Why Did CoreWeave (CRWV) Stock Fall On Thursday?

Table of Contents

Negative Market Sentiment and the Broader Tech Sell-Off

Thursday's downturn in CRWV stock wasn't an isolated incident; it mirrored a broader sell-off affecting the technology sector. A prevailing negative market sentiment, fueled by several contributing factors, played a significant role. The overall market showed signs of weakness, impacting even well-performing tech companies.

- Specific examples of negative market trends: Increased interest rates, concerns about inflation, and a general risk-off sentiment among investors created a challenging environment for growth stocks like CRWV. Many investors moved towards safer, more established investments, leading to a reduction in buying pressure for riskier assets.

- Related stocks that also experienced declines: Several other cloud computing and technology companies experienced similar declines on Thursday, highlighting the pervasive negative market sentiment rather than CRWV-specific issues. For example, [mention specific examples and link to relevant financial news articles].

- Link to relevant financial news articles: [Insert links to relevant articles discussing the broader market downturn and tech sell-off on Thursday].

Absence of Positive Catalysts for CRWV Stock

The lack of positive news or catalysts for CRWV stock also likely contributed to the selling pressure. Investors often react negatively when anticipated positive developments fail to materialize, leading to disappointment and profit-taking.

- Expected earnings reports, partnerships, or product launches that were delayed or didn't meet expectations: While there were no major anticipated announcements specifically scheduled for Thursday, the absence of any positive news, such as strong earnings pre-announcements or significant partnership deals, likely contributed to the negative sentiment. Investors might have been anticipating some positive updates, and the silence created an opportunity for profit-taking.

- Impact of missing these catalysts on investor confidence: The absence of positive news created a vacuum, allowing negative sentiment to dominate. This lack of positive reinforcement likely fueled speculation and selling pressure among investors who may have been seeking reassurance about CRWV’s future prospects.

Impact of Analyst Ratings and Price Target Adjustments (if applicable)

While definitive information regarding analyst actions directly impacting the Thursday drop might require further investigation and access to real-time financial data, it's important to acknowledge the potential influence of analyst ratings and price target adjustments.

- Specific examples of downgrades or lowered price targets: [Insert information on any downgrades or lowered price targets if available, linking to relevant analyst reports]. Even subtle changes in analyst sentiment can trigger significant shifts in investor behavior.

- Link to relevant analyst reports (if available): [Insert links to relevant analyst reports].

- Rationale behind the analyst actions: [Explain the potential reasons behind any analyst actions, referencing market trends, company performance or outlook].

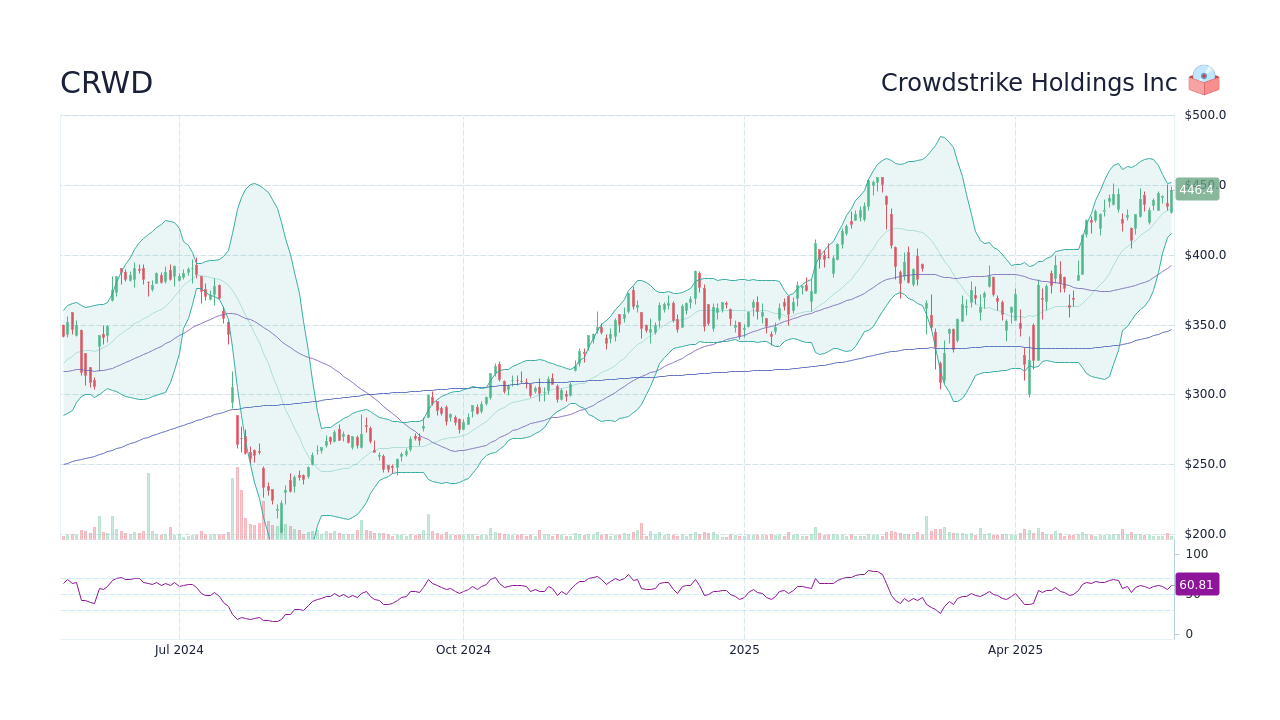

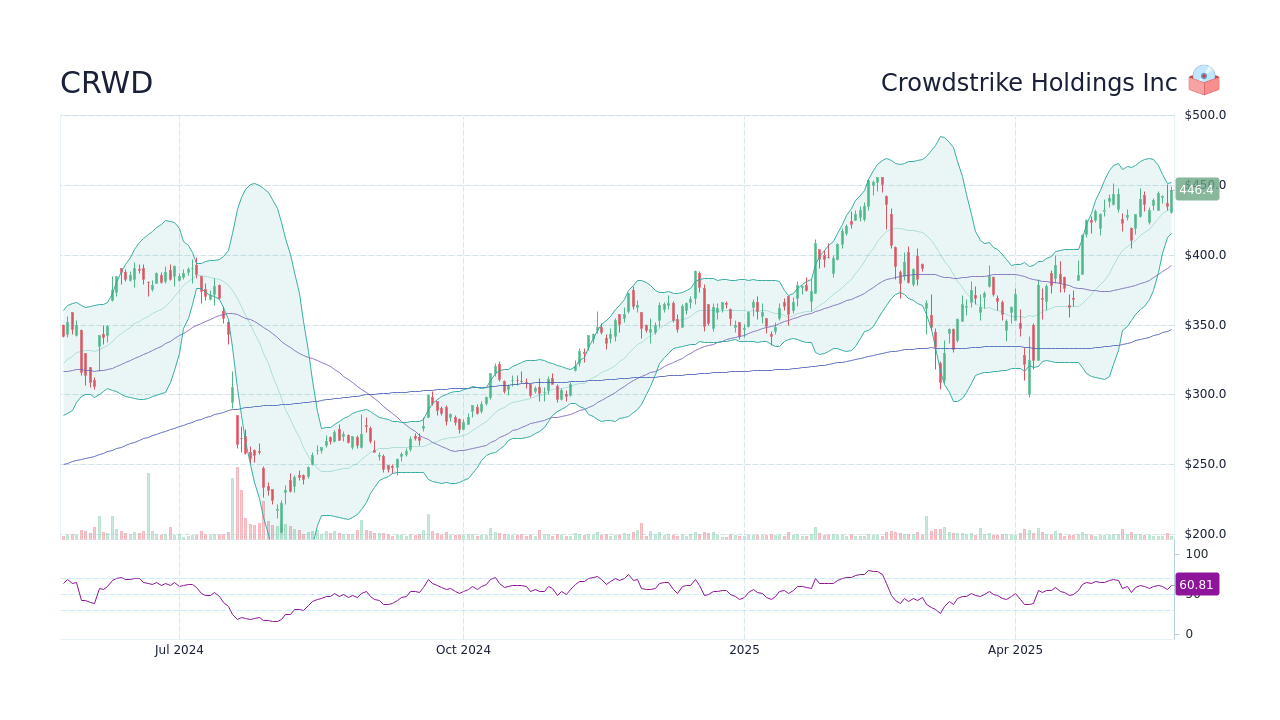

Technical Factors Contributing to the CRWV Stock Fall

Technical analysis of CRWV's stock chart on Thursday can offer further insights. Specific chart patterns, trading volume, and volatility may have played a role in amplifying the price decline.

- Specific technical indicators: [Describe any significant technical indicators, such as the breaking of a key support level or the emergence of a bearish pattern, accompanied by relevant charts if possible]. For example, a significant drop in trading volume might indicate a lack of buying support, exacerbating the price decline.

- Trading volume and volatility around the event: [Analyze the trading volume and volatility around the time of the price drop. High volume during a significant price drop can be indicative of strong selling pressure].

- How these factors contributed to the price movement: [Explain how the identified technical factors combined to contribute to the downward price movement].

Conclusion: Understanding the CoreWeave (CRWV) Stock Dip and Looking Ahead

The Thursday decline in CoreWeave (CRWV) stock resulted from a confluence of factors: a prevailing negative market sentiment affecting the broader tech sector, the absence of positive catalysts to buoy investor confidence, potential influences from analyst ratings and price target adjustments (if applicable), and contributing technical factors. While this drop presents concerns, understanding these contributing factors is crucial for informed investment decisions. The volatility in the CRWV stock highlights the importance of thorough due diligence and a long-term investment strategy. Continue to monitor CRWV and stay updated on relevant news and analysis to make informed investment decisions about CoreWeave stock and its future performance.

Featured Posts

-

Pandemic Fraud Lab Owners Guilty Plea On Fake Covid Tests

May 22, 2025

Pandemic Fraud Lab Owners Guilty Plea On Fake Covid Tests

May 22, 2025 -

Peppa Pigs Mums Lavish Gender Reveal Party At A Famous London Spot

May 22, 2025

Peppa Pigs Mums Lavish Gender Reveal Party At A Famous London Spot

May 22, 2025 -

Vybz Kartel To Play Historic Show In New York

May 22, 2025

Vybz Kartel To Play Historic Show In New York

May 22, 2025 -

Love Monster Promoting Healthy Relationships Through The Story

May 22, 2025

Love Monster Promoting Healthy Relationships Through The Story

May 22, 2025 -

Ban Co Biet Hai Lo Vuong Tren Cong Usb Co Tac Dung Gi Khong

May 22, 2025

Ban Co Biet Hai Lo Vuong Tren Cong Usb Co Tac Dung Gi Khong

May 22, 2025

Latest Posts

-

Dropout Kings Frontman Adam Ramey Dies At 32 A Tragic Loss

May 22, 2025

Dropout Kings Frontman Adam Ramey Dies At 32 A Tragic Loss

May 22, 2025 -

Dropout Kings Singer Adam Ramey Dies By Suicide At 31

May 22, 2025

Dropout Kings Singer Adam Ramey Dies By Suicide At 31

May 22, 2025 -

Adam Ramey Dropout Kings Lead Singer Passes Away At 32

May 22, 2025

Adam Ramey Dropout Kings Lead Singer Passes Away At 32

May 22, 2025 -

Adam Ramey Dropout Kings Vocalist Dead At 31 Suicide Confirmed Go Fund Me Launched

May 22, 2025

Adam Ramey Dropout Kings Vocalist Dead At 31 Suicide Confirmed Go Fund Me Launched

May 22, 2025 -

Wordle April 27th Solution Hints And Clues For Puzzle 1408

May 22, 2025

Wordle April 27th Solution Hints And Clues For Puzzle 1408

May 22, 2025