Why Investors Shouldn't Panic Over High Stock Market Valuations: A BofA Analysis

Table of Contents

BofA's Key Findings on Current Market Valuations

BofA's recent reports on high stock market valuations offer a nuanced perspective, arguing against immediate alarm. Their analysis suggests that while valuations are indeed high by historical standards, several mitigating factors counterbalance the risks.

- Strong Earnings Growth: BofA points to robust corporate earnings growth as a key justification for current valuations. Many companies are exceeding expectations, demonstrating the underlying strength of the economy and justifying higher price-to-earnings ratios (P/E).

- Low Interest Rates: The persistently low interest rate environment continues to fuel investment in equities, pushing up valuations. This makes bonds less attractive compared to the potential returns offered by stocks.

- Valuation Metrics: BofA acknowledges the elevated levels of common valuation metrics like the Price-to-Earnings (P/E) ratio and the cyclically adjusted price-to-earnings ratio (Shiller PE), but argues that these need to be considered within the context of strong earnings growth and low interest rates.

- Addressing Counterarguments: BofA acknowledges concerns about potential bubbles and overvaluation. However, they argue that the current market strength is underpinned by sustainable economic fundamentals, differentiating it from previous bubbles fueled by speculative fervor.

Understanding the Factors Driving High Valuations

Several significant economic factors contribute to the current high stock market valuations. Understanding these factors is crucial for developing a reasoned investment strategy.

- Low Interest Rates: The prolonged period of low interest rates, a result of central bank policies, makes equity investments more attractive compared to bonds and other fixed-income instruments. This increased demand drives up stock prices.

- Strong Corporate Earnings and Growth Projections: Healthy corporate profits and optimistic future earnings projections support higher valuations. Investors are willing to pay a premium for companies expected to deliver strong returns.

- Increased Investor Confidence: A combination of factors, including economic growth in certain sectors and technological advancements, has boosted investor confidence, driving demand for equities.

- Technological Advancements: Rapid technological advancements, particularly in areas like artificial intelligence and cloud computing, have created new growth opportunities, increasing the perceived value of technology stocks and influencing overall market valuations.

Why a Panic Sell-Off is Unlikely (According to BofA)

BofA's analysis suggests that a sudden, sharp market correction – a panic sell-off – is unlikely, despite the elevated valuations. Their reasoning rests on several key points.

- Historical Parallels: BofA draws parallels to past periods of high valuations, highlighting instances where markets continued to grow despite seemingly overextended valuations. They emphasize that historical context is crucial and that blanket comparisons can be misleading.

- Potential for Continued Growth: Despite high valuations, BofA anticipates continued economic growth and strong corporate earnings, supporting the sustained upward trend in the market.

- Mitigating Factors: Several factors could prevent a sharp downturn, including ongoing central bank support, robust consumer spending in certain regions, and the continued innovation driving many sectors.

A More Measured Approach to Investing

While BofA's analysis suggests a relatively optimistic outlook, a measured approach to investing remains prudent, even with high stock market valuations.

- Diversification: Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk. Don't put all your eggs in one basket.

- Long-Term Investment Strategy: Focus on a long-term investment strategy based on fundamental analysis rather than short-term market fluctuations. High stock market valuations are not a reason to abandon your long-term plan.

- Dollar-Cost Averaging: Dollar-cost averaging, a strategy of investing a fixed amount of money at regular intervals, helps reduce the impact of market volatility.

- Professional Financial Advice: Consider seeking professional financial advice tailored to your individual circumstances and risk tolerance. A financial advisor can help you navigate the complexities of the market and develop a personalized strategy.

Navigating High Stock Market Valuations with Confidence

In conclusion, BofA's analysis suggests that while high stock market valuations are a legitimate concern, they don't automatically predict an imminent market crash. Strong earnings growth, low interest rates, and other mitigating factors suggest a more nuanced picture than one of impending doom. Remember, high stock market valuations don’t automatically equate to immediate risk. Don't let concerns over elevated market valuations lead to rash decisions. Review BofA's analysis and consider a more strategic, long-term investment plan, incorporating diversification and risk mitigation techniques. By understanding the factors driving current valuations and adopting a measured approach, you can navigate stock market valuation concerns with greater confidence.

Featured Posts

-

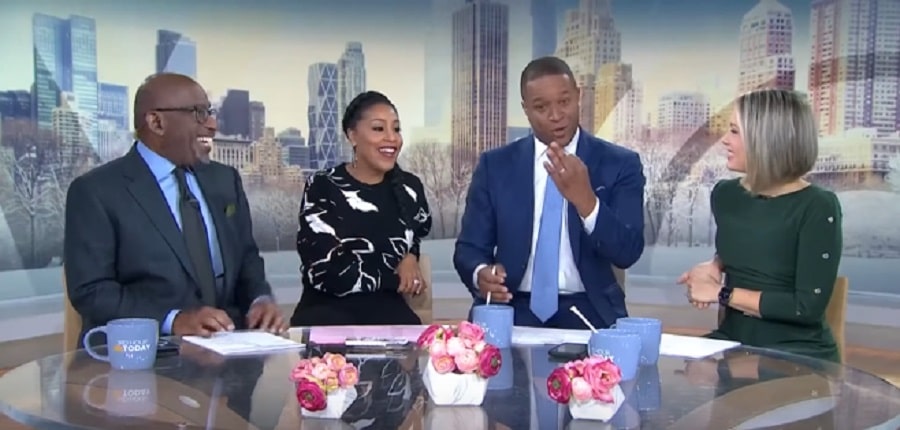

Celebrating Milestones Dylan Dreyer And Familys Latest Update

May 24, 2025

Celebrating Milestones Dylan Dreyer And Familys Latest Update

May 24, 2025 -

G 7 De Minimis Tariff Talks Implications For Trade With China

May 24, 2025

G 7 De Minimis Tariff Talks Implications For Trade With China

May 24, 2025 -

10 Let Pobediteley Evrovideniya Tvorcheskie Puti I Nyneshnyaya Zhizn

May 24, 2025

10 Let Pobediteley Evrovideniya Tvorcheskie Puti I Nyneshnyaya Zhizn

May 24, 2025 -

A Relaxing Escape To The Country Choosing The Right Location

May 24, 2025

A Relaxing Escape To The Country Choosing The Right Location

May 24, 2025 -

Lauryn Goodman And Kyle Walker Unpacking The Italy Relocation

May 24, 2025

Lauryn Goodman And Kyle Walker Unpacking The Italy Relocation

May 24, 2025

Latest Posts

-

Today Shows Dylan Dreyer Shares Difficult Personal Situation

May 24, 2025

Today Shows Dylan Dreyer Shares Difficult Personal Situation

May 24, 2025 -

Dylan Dreyer And Brian Ficheras Instagram Post A Closer Look At Fan Reactions

May 24, 2025

Dylan Dreyer And Brian Ficheras Instagram Post A Closer Look At Fan Reactions

May 24, 2025 -

Family Joy Dylan Dreyer And Brian Fichera Share Updates

May 24, 2025

Family Joy Dylan Dreyer And Brian Fichera Share Updates

May 24, 2025 -

Dylan Dreyer Challenges Today Show Colleagues With Unexpected News

May 24, 2025

Dylan Dreyer Challenges Today Show Colleagues With Unexpected News

May 24, 2025 -

Whats Got Fans Talking Dylan Dreyers Latest Post With Brian Fichera

May 24, 2025

Whats Got Fans Talking Dylan Dreyers Latest Post With Brian Fichera

May 24, 2025