Why Is Gold Soaring? Trade Wars And The Bullion Market Explained

Table of Contents

Gold as a Safe-Haven Asset During Trade Wars

Gold has long held a reputation as a safe-haven asset, a reliable store of value during times of economic and political turmoil. When global markets become volatile and investor confidence wanes, gold's inherent stability makes it an attractive investment. Trade wars, with their inherent uncertainty and disruptive impact on global trade, amplify this effect. The escalating tensions and unpredictable policies create a climate of fear, driving investors to seek refuge in assets perceived as less risky.

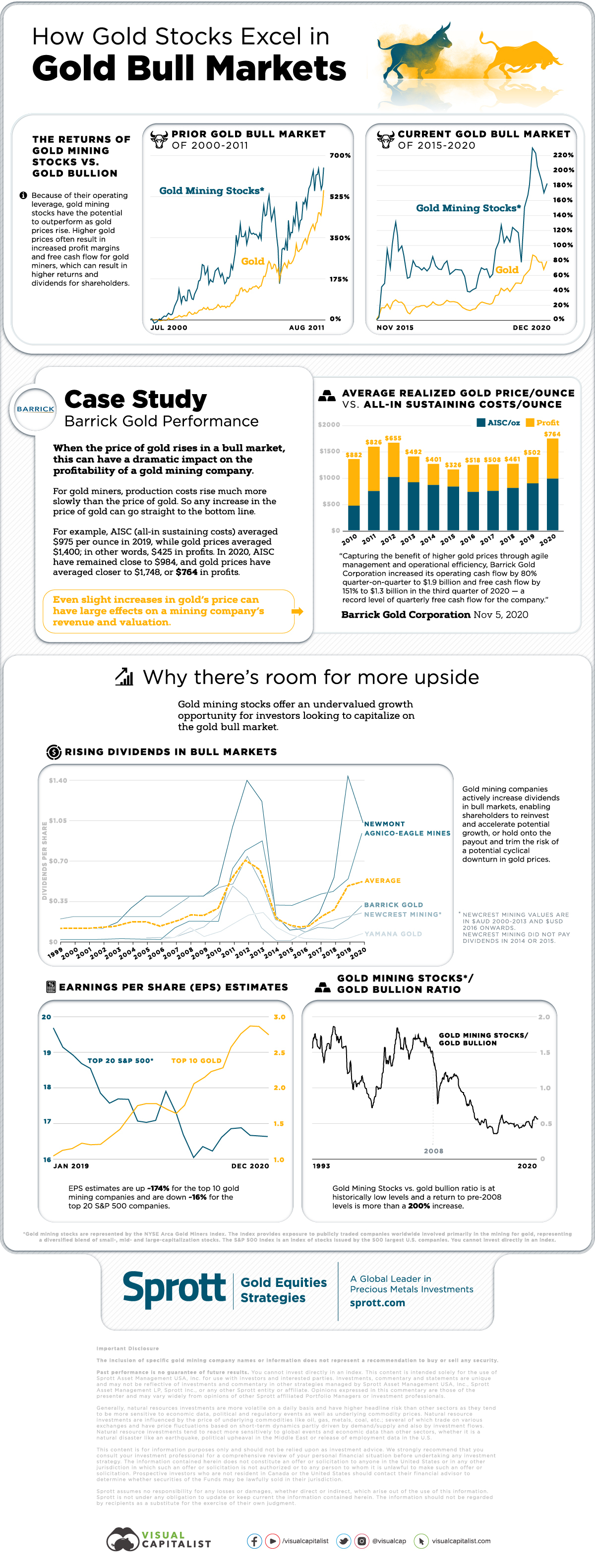

Historically, periods of geopolitical instability have often seen a significant rise in gold prices. The increased uncertainty surrounding global trade creates a flight to safety, where investors shift their portfolios away from riskier assets like stocks and bonds, and into the perceived security of gold.

- Reduced confidence in global markets: Trade wars erode investor trust in market stability.

- Increased demand for a non-correlated asset: Gold's price typically moves independently of stocks and bonds, providing diversification.

- Portfolio diversification strategy: Gold acts as a crucial element in a well-diversified investment portfolio to mitigate risk.

- Protection against currency devaluation: During inflationary periods often associated with trade disputes, gold can retain its value better than fiat currencies.

Inflationary Pressures and the Gold Price

Trade wars often trigger inflationary pressures. Tariffs imposed on imported goods increase consumer prices, while disruptions to global supply chains lead to production bottlenecks and increased costs. This erosion of purchasing power makes fiat currencies less attractive, increasing the allure of gold as a hedge against inflation.

Historically, there's a strong correlation between inflation rates and gold prices. When inflation rises, the real value of fiat currencies falls, pushing investors towards assets that hold their value, like gold.

- Impact of tariffs on consumer prices: Increased tariffs directly translate to higher prices for consumers.

- Supply chain bottlenecks and increased production costs: Trade disruptions increase manufacturing costs, leading to higher prices.

- Weakening of currency values: Inflation can cause a currency's purchasing power to decline.

- Gold's historical performance during inflationary periods: Data consistently shows gold's value increasing during periods of high inflation.

The Impact of Geopolitical Uncertainty on the Bullion Market

Geopolitical uncertainty, largely fueled by trade disputes and their unpredictable consequences, significantly impacts investor sentiment. The fear of further escalation and the unknown long-term effects on the global economy increase market volatility and drive investors towards safer assets like gold.

Specific examples of trade tensions, like the ongoing US-China trade war, have demonstrably affected gold prices. Negative news and heightened uncertainty create a "flight to safety," boosting demand for gold.

- Increased market volatility: Trade disputes generate unpredictable market swings.

- Flight to safety by investors: Investors seek security in stable assets during times of uncertainty.

- Impact of negative news on market sentiment: Negative headlines surrounding trade wars drive increased demand for gold.

- Influence of central bank actions: Central bank responses to economic uncertainty can also influence gold prices.

Analyzing the Bullion Market: Supply and Demand Dynamics

The gold market, like any other market, is governed by the interplay of supply and demand. Understanding these dynamics is key to comprehending price fluctuations. Gold supply is primarily influenced by mining production and recycling efforts, while demand comes from various sources, including investment, jewelry manufacturing, and industrial applications.

- Changes in gold mining output: Fluctuations in mining production impact the overall gold supply.

- Investment demand from ETFs and central banks: Large-scale investment from ETFs and central banks can significantly influence prices.

- Jewelry demand in key markets: Consumer demand for gold jewelry in major markets plays a role in price movements.

- Industrial applications of gold: Gold's use in electronics and other industries contributes to demand.

Conclusion: The Future of Gold and Trade Wars

The surge in gold prices is undeniably linked to ongoing trade wars and the resulting economic uncertainty. Gold's role as a safe-haven asset, a hedge against inflation, and its inherent stability make it an attractive investment during times of global instability. The future relationship between gold prices and the global trade landscape remains uncertain, but the current climate suggests that gold will continue to be a crucial element in diversified investment strategies.

As trade wars continue to impact the global economy, understanding the factors that contribute to "Gold Soaring" is vital for investors. To learn more about protecting your portfolio during periods of economic uncertainty, explore resources on gold investment and portfolio diversification. Consider including gold as a key component of your strategy for navigating the complexities of the current global market.

Featured Posts

-

White House Cocaine Incident Secret Service Concludes Investigation

Apr 26, 2025

White House Cocaine Incident Secret Service Concludes Investigation

Apr 26, 2025 -

La Palisades Fire Impact On Celebrity Homes Full List

Apr 26, 2025

La Palisades Fire Impact On Celebrity Homes Full List

Apr 26, 2025 -

Navigating The Geopolitical Landscape Of Ai The Us Eu Standoff

Apr 26, 2025

Navigating The Geopolitical Landscape Of Ai The Us Eu Standoff

Apr 26, 2025 -

La Rental Market Exploits Price Gouging After Wildfires

Apr 26, 2025

La Rental Market Exploits Price Gouging After Wildfires

Apr 26, 2025 -

Evaluating The Potential Of Chinese Made Vehicles For Global Consumers

Apr 26, 2025

Evaluating The Potential Of Chinese Made Vehicles For Global Consumers

Apr 26, 2025

Latest Posts

-

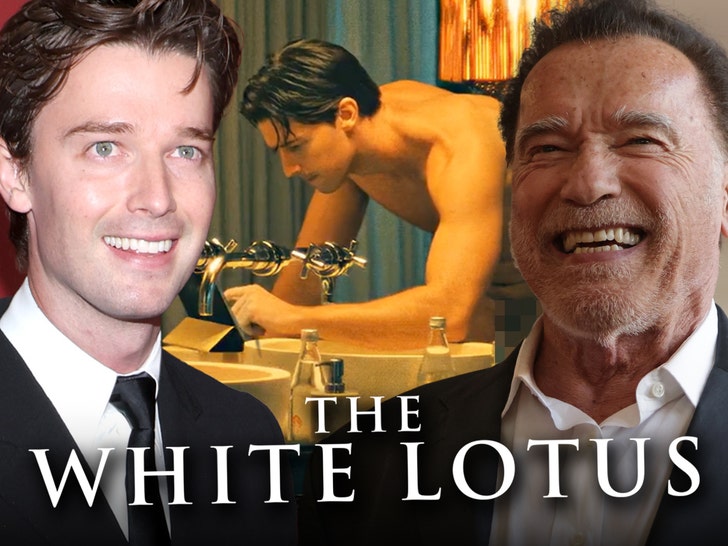

Patrick Schwarzeneggers White Lotus Role A Surprise Ariana Grande Music Video Appearance

Apr 27, 2025

Patrick Schwarzeneggers White Lotus Role A Surprise Ariana Grande Music Video Appearance

Apr 27, 2025 -

Forgotten Cameo Patrick Schwarzenegger In Ariana Grandes Video And White Lotus

Apr 27, 2025

Forgotten Cameo Patrick Schwarzenegger In Ariana Grandes Video And White Lotus

Apr 27, 2025 -

Ariana Grande Music Video Features Unexpected White Lotus Star Patrick Schwarzenegger

Apr 27, 2025

Ariana Grande Music Video Features Unexpected White Lotus Star Patrick Schwarzenegger

Apr 27, 2025 -

Patrick Schwarzeneggers Unseen Appearance In Ariana Grandes Music Video A White Lotus Connection

Apr 27, 2025

Patrick Schwarzeneggers Unseen Appearance In Ariana Grandes Music Video A White Lotus Connection

Apr 27, 2025 -

Patrick Schwarzeneggers Forgotten White Lotus Role In Ariana Grande Music Video

Apr 27, 2025

Patrick Schwarzeneggers Forgotten White Lotus Role In Ariana Grande Music Video

Apr 27, 2025