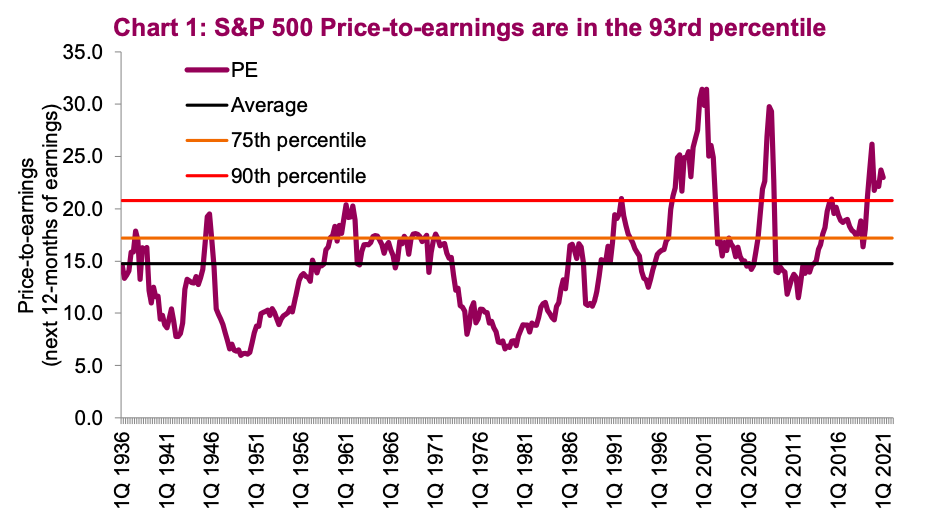

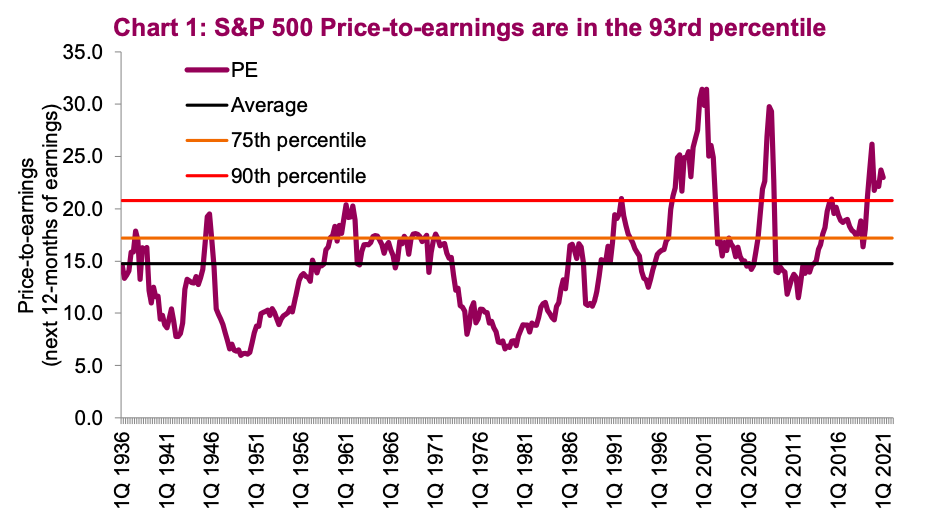

Why Stretched Stock Market Valuations Aren't A Worry: A BofA Analysis

Table of Contents

BofA's Key Arguments Against Valuation Concerns

BofA's analysis counters prevailing anxieties about high stock market valuations by focusing on several key factors. Their perspective suggests that the current "stretched" valuations are not necessarily indicative of an impending market crash, but rather a reflection of specific economic and technological trends.

The Role of Low Interest Rates

Historically low interest rates play a significant role in justifying higher Price-to-Earnings (P/E) ratios. When interest rates are low, the opportunity cost of investing in equities is reduced. This means investors are willing to pay more for future earnings because the alternative – investing in low-yield bonds – is less attractive.

- BofA cites a strong correlation between low interest rates and higher equity valuations throughout history.

- The report details specific interest rate scenarios and their impact on discounted cash flow models, which are used to determine the intrinsic value of stocks. Lower discount rates, driven by lower interest rates, lead to higher valuations.

- BofA's models suggest that current P/E ratios are largely consistent with the prevailing low-interest-rate environment.

Strong Corporate Earnings Growth

BofA's analysis highlights robust corporate earnings growth as a key factor supporting current valuations. Their projections indicate continued, albeit potentially moderating, earnings expansion across various sectors.

- Technology sector outperformance continues to drive significant earnings growth.

- Strong consumer spending is fueling robust retail growth.

- The industrial sector is benefiting from increased infrastructure investment and global trade.

Technological Advancements and Innovation

Technological innovation is a major driver of higher valuations, as it fuels future growth potential. Companies investing heavily in and benefiting from disruptive technologies often command higher valuations reflecting their expected long-term growth trajectories.

- Artificial Intelligence (AI) is transforming numerous industries, leading to increased efficiency and new revenue streams.

- Cloud computing continues its rapid expansion, creating significant opportunities for software and infrastructure companies.

- These and other transformative technologies justify higher valuations by promising substantial future earnings and market share dominance.

Addressing Counterarguments and Potential Risks

While BofA presents a positive outlook, it acknowledges potential risks that could impact market valuations. Their analysis, however, suggests these risks are manageable within the broader context.

Inflationary Pressures

Inflationary pressures represent a significant concern for many investors. High inflation can erode corporate profits and increase borrowing costs, potentially negatively impacting valuations.

- BofA anticipates controlled inflation, moderated by the actions of central banks.

- The report discusses the Federal Reserve's (Fed) monetary policy response to inflation, highlighting their commitment to price stability.

- BofA's models incorporate various inflation scenarios, suggesting that the impact on valuations is likely to be less dramatic than many fear.

Geopolitical Uncertainty

Geopolitical uncertainty, including trade tensions and conflicts, presents another potential risk. These events can create volatility and negatively influence investor sentiment.

- BofA highlights the resilience of the market to geopolitical shocks in recent years. Markets tend to recover after initial negative reactions.

- The report emphasizes the importance of diversification strategies to mitigate these risks.

- BofA encourages investors to consider long-term investment horizons to weather short-term geopolitical turbulence.

Conclusion

BofA's analysis suggests that while stock market valuations may appear stretched, they are largely supported by several key factors. Low interest rates, strong corporate earnings growth, and technological advancements all contribute to a positive outlook, even accounting for inflationary pressures and geopolitical uncertainty. The report emphasizes the importance of considering these factors holistically rather than focusing solely on P/E ratios in isolation. To gain a comprehensive perspective on the current market outlook and why stretched stock market valuations may not be the cause for concern many believe, we encourage you to review BofA's full report.

Featured Posts

-

Edenred Document Amf Cp 2025 E1029244 Rapport Complet

Apr 30, 2025

Edenred Document Amf Cp 2025 E1029244 Rapport Complet

Apr 30, 2025 -

Harris Criticized For Rambling Speech At Louis Armstrong Musical

Apr 30, 2025

Harris Criticized For Rambling Speech At Louis Armstrong Musical

Apr 30, 2025 -

Police Watchdogs Ofcom Complaint The Chris Kaba Panorama Episode

Apr 30, 2025

Police Watchdogs Ofcom Complaint The Chris Kaba Panorama Episode

Apr 30, 2025 -

Processo Becciu Rinvio Per I Fondi 8xmille

Apr 30, 2025

Processo Becciu Rinvio Per I Fondi 8xmille

Apr 30, 2025 -

Chat Pubblicate Da Domani Becciu Complotto E Accuse Ai Miei Danni

Apr 30, 2025

Chat Pubblicate Da Domani Becciu Complotto E Accuse Ai Miei Danni

Apr 30, 2025