Why The Fed Lags Behind On Interest Rate Cuts: A Deep Dive

Table of Contents

Data Dependency and the Lagging Indicators Problem

The Fed relies heavily on economic data to inform its decisions regarding monetary policy. This data-driven approach, while seemingly logical, presents a significant challenge: much of the economic data used is lagging. This means it reflects past performance rather than providing a real-time snapshot of the current economic situation. The time lag between economic activity and the availability of data creates a significant hurdle for the Fed's ability to respond swiftly to economic slowdowns.

- GDP growth figures: These crucial indicators of overall economic health are often released with a delay of several weeks or even months after the period they cover. By the time the data is available, the economic situation might have already shifted.

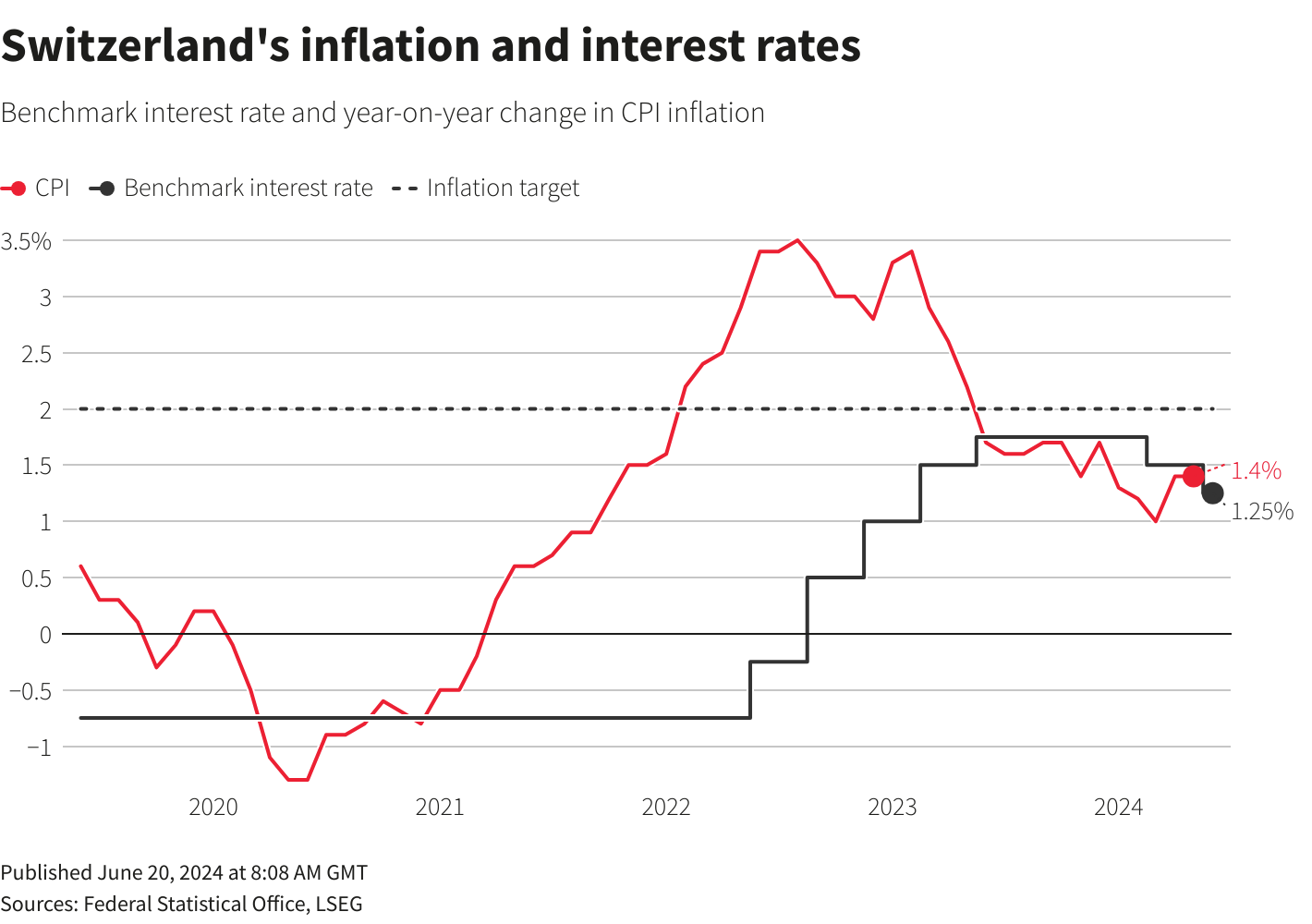

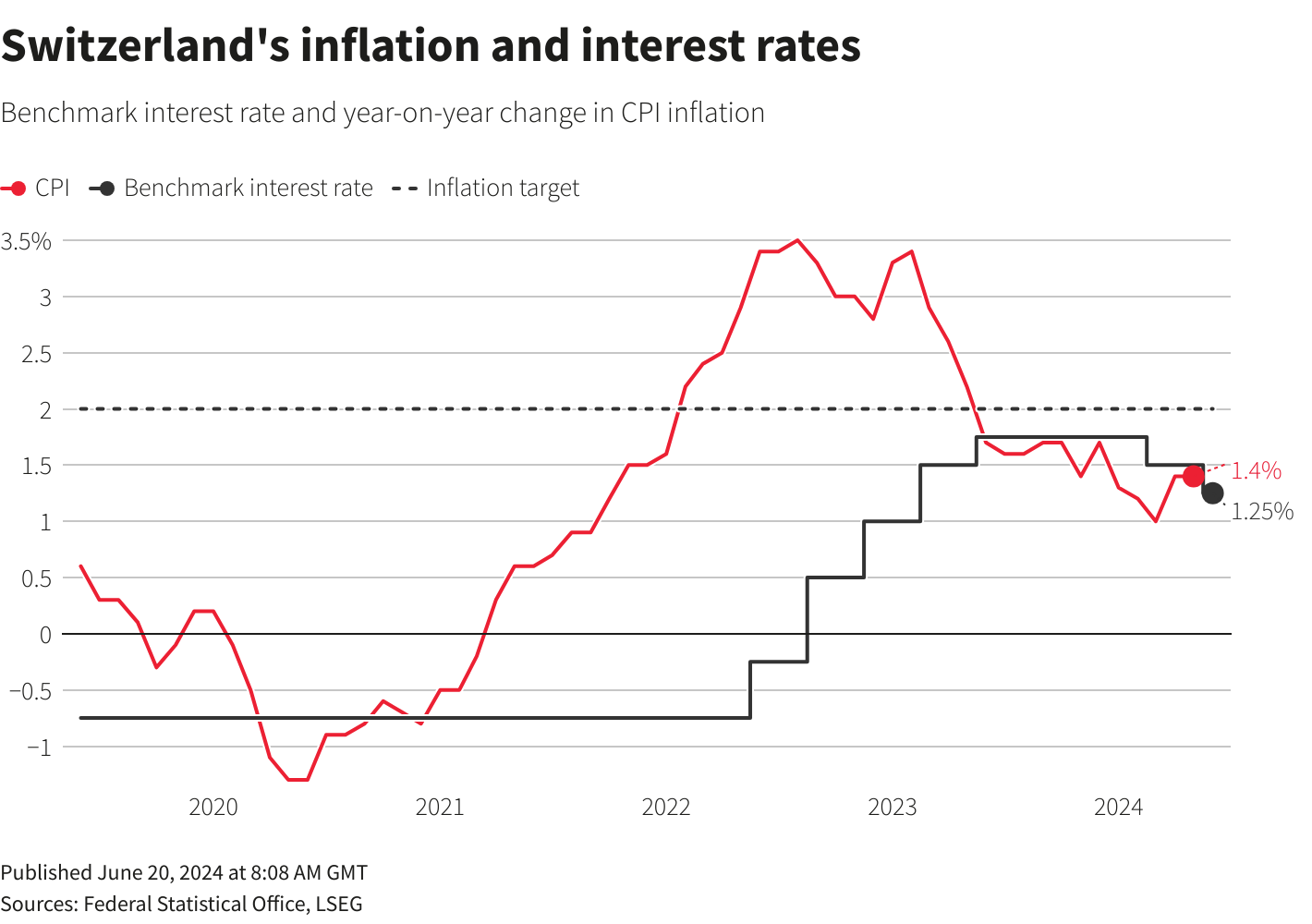

- Inflation data: Inflation measurements, such as the Consumer Price Index (CPI) and the Producer Price Index (PPI), can be volatile and subject to revisions. These revisions further complicate the Fed's ability to accurately assess inflationary pressures.

- Employment numbers: While employment reports, like the Nonfarm Payroll report, offer relatively timely insights into the labor market, they don't always capture the nuances of the economic situation. For instance, a decrease in unemployment might mask underemployment or a decline in real wages.

This lag in data availability means the Fed might not fully grasp the severity of an economic slowdown—or the need for interest rate cuts—until it's already underway. This inherent delay contributes significantly to the perception that the Fed is lagging behind on interest rate cuts. The challenge lies in effectively balancing the need for accurate data with the urgency of timely intervention in a dynamic economic environment. Keywords: lagging economic indicators, data-driven monetary policy, Fed reaction time, real-time economic data.

The Risk of Premature Rate Cuts

Cutting interest rates prematurely carries significant risks, primarily the risk of exacerbating inflation. If the economy is merely experiencing a temporary slowdown rather than a full-blown recession, reducing interest rates too soon could fuel unsustainable economic growth and inflationary pressures.

- Maintaining price stability: One of the Fed's primary mandates is to maintain price stability. Premature rate cuts risk undermining this goal by increasing aggregate demand without a corresponding increase in aggregate supply.

- Asset bubbles: Lower interest rates can inflate asset bubbles in the stock market and real estate, leading to potential financial instability in the future.

- Unsustainable growth: Stimulating a weak economy with rate cuts when the economy is not truly weak can lead to overheating and unsustainable growth, ultimately followed by a sharper downturn.

The Fed faces a delicate balancing act: weighing the risks of acting too slowly against the risks of acting too quickly. This cautious approach, necessary to avoid fueling inflation, can lead to delays in interest rate cuts, even when the economy appears to be slowing. Keywords: inflationary pressures, monetary policy risks, Fed cautiousness, premature rate cuts, economic overheating.

Internal Fed Dynamics and Political Considerations

Internal disagreements within the Federal Open Market Committee (FOMC), the body responsible for setting interest rates, can further delay decision-making. The FOMC comprises various members with diverse economic perspectives and potential political considerations.

- Differing economic perspectives: FOMC members may hold varying views on the severity of an economic slowdown and the appropriate policy response. Reaching a consensus can take time and involve extensive deliberation.

- Political pressures: The Fed is not entirely immune to political pressures. Public opinion and political considerations can subtly influence decision-making, leading to delays or modifications in policy.

- Reaching a consensus: The FOMC's decision-making process is complex and requires careful consideration of numerous factors. This deliberative process, while crucial for responsible policymaking, can contribute to delays in implementing rate cuts.

The internal workings of the Fed, combined with external political pressures, add another layer of complexity to the rate-setting process, potentially causing delays in implementing necessary interest rate cuts. Keywords: FOMC decision-making, political influence on monetary policy, interest rate consensus, monetary policy transparency.

The Impact of Unforeseen Economic Shocks

Sudden and unexpected economic events—such as a global pandemic, a major financial crisis, or a significant geopolitical event—can significantly complicate the situation and necessitate a more cautious approach, delaying response times.

The Fed's ability to react promptly depends heavily on the predictability of the economic landscape. Unexpected shocks introduce uncertainty and necessitate a more thorough analysis before implementing interest rate cuts. The need to fully assess the implications of such events before making critical decisions can lead to delays. Keywords: economic shocks, unexpected recession, monetary policy response time, global economic uncertainty.

Conclusion

The reasons why the Fed lags behind on interest rate cuts are multifaceted. They stem from inherent limitations in data availability, the inherent risks of premature action, the complexities of internal decision-making processes within the FOMC, and the disruptive impact of unforeseen economic shocks. Understanding these complexities highlights the challenge the Fed faces in balancing economic stability and mitigating the potential negative consequences of both inaction and premature intervention. To stay informed about the Fed's decisions and their impact on your investments and financial planning, continue researching the intricacies of interest rate cuts and follow relevant economic news. Staying updated on interest rate cuts and their implications is crucial for navigating economic uncertainty.

Featured Posts

-

Tien Giang Xu Ly Nghiem Vu Bao Mau Bao Hanh Tre

May 09, 2025

Tien Giang Xu Ly Nghiem Vu Bao Mau Bao Hanh Tre

May 09, 2025 -

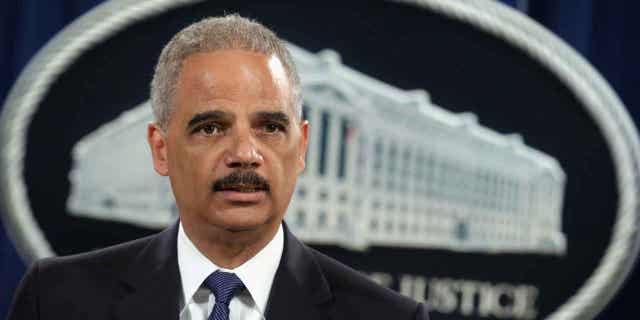

The Us Attorney General And Fox News Context And Concerns

May 09, 2025

The Us Attorney General And Fox News Context And Concerns

May 09, 2025 -

Impact Of Warming Weather On Recovering Fin Whale Carcass In Anchorage

May 09, 2025

Impact Of Warming Weather On Recovering Fin Whale Carcass In Anchorage

May 09, 2025 -

Is The Great Decoupling Inevitable Exploring Potential Outcomes

May 09, 2025

Is The Great Decoupling Inevitable Exploring Potential Outcomes

May 09, 2025 -

Phan No Vu Bao Mau Tat Tre Em Tien Giang Phai Bao Ve Tre Em

May 09, 2025

Phan No Vu Bao Mau Tat Tre Em Tien Giang Phai Bao Ve Tre Em

May 09, 2025