Will Big Oil Increase Production? OPEC+ Meeting In Focus

Table of Contents

The global energy market hangs precariously in the balance, with fluctuating oil prices impacting consumers and the global economy alike. The question on everyone's mind is: Will Big Oil Increase Production? The answer, largely dependent on the upcoming OPEC+ meeting, holds significant weight for the future of energy markets worldwide. This article will analyze the factors influencing the OPEC+ decision and explore the potential outcomes, including their impact on oil prices and the global economy.

<h2>OPEC+'s Current Production Levels and Market Share</h2>

OPEC+, a powerful alliance of oil-producing nations, plays a pivotal role in shaping the global oil landscape. Understanding their current production levels and market share is crucial to predicting future trends. OPEC+ currently controls a significant portion of the global oil supply, wielding considerable influence over prices.

- Current OPEC+ production quotas: These quotas, regularly reviewed and adjusted, determine the amount of oil each member country is allowed to produce.

- Major players: Saudi Arabia and Russia are key players within OPEC+, boasting substantial production capacities and significant influence over the group's decisions. Other major players include the UAE, Kuwait, and Iraq.

- Market share: OPEC+ collectively holds a substantial share of the global oil market, making their decisions critical to price stability and global energy security.

- Recent production adjustments: Recent months have seen production cuts by some OPEC+ members, often cited as a means of stabilizing prices in the face of global economic uncertainty.

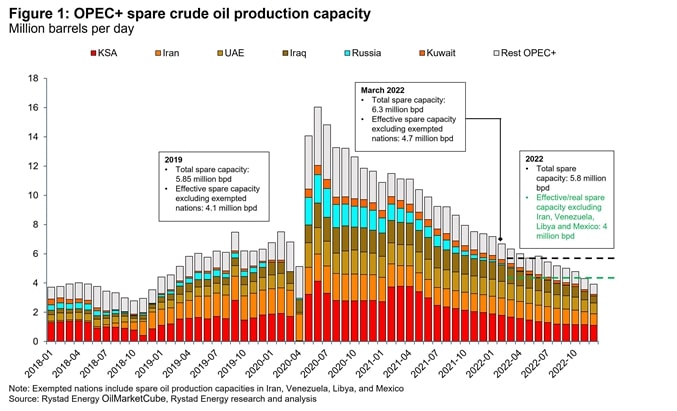

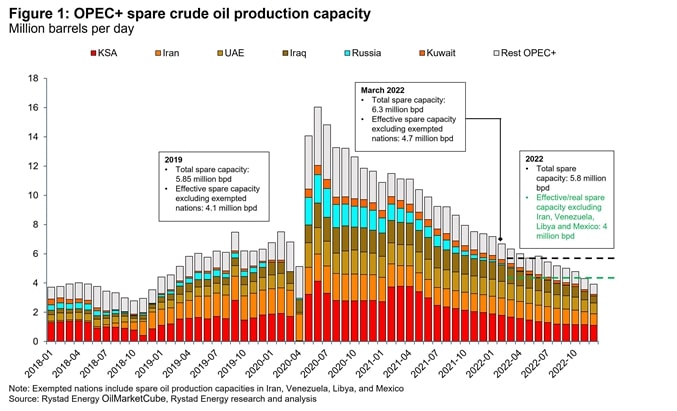

The impact of sanctions on Russian oil production is a major factor influencing OPEC+ decisions. These sanctions have disrupted global supply chains and created uncertainty within the market, pushing prices higher and forcing OPEC+ to carefully consider its response. The following chart illustrates OPEC+'s market share over the last five years:

[Insert Chart/Graph showing OPEC+ market share over time]

<h2>Factors Influencing OPEC+'s Decision on Production</h2>

Several key factors will likely influence the OPEC+ decision on whether to increase oil production:

- Global oil demand: Current and projected global demand for oil is a significant driver. Strong economic growth in certain regions increases demand, potentially pushing OPEC+ towards higher production. Conversely, weaker economic performance might lead to a more cautious approach.

- Geopolitical factors: The ongoing war in Ukraine and the resulting geopolitical tensions significantly impact the oil market. These tensions often lead to price volatility and uncertainty, influencing OPEC+'s decisions. Relations between OPEC+ member states also play a crucial role.

- Oil price volatility: The price of oil itself is a major factor. If prices are significantly higher than desired, OPEC+ may opt to increase production to prevent further inflation. Conversely, low prices might encourage production cuts to maintain profitability.

- Inventory levels: Global oil inventories and storage capacities influence OPEC+'s strategy. High inventory levels may lead to production cuts to prevent a price crash. Low inventories might justify increasing production.

- Pressure from consuming nations: Major oil-consuming nations often exert pressure on OPEC+ to increase production to alleviate price pressures and stabilize their own economies. This external pressure can sway the OPEC+ decision.

Expert analysis suggests that the geopolitical climate is a primary concern for OPEC+ members, potentially overshadowing immediate price signals. "The uncertainty surrounding geopolitical events makes it difficult to accurately predict future oil demand," states Dr. Anya Petrova, energy analyst at the Global Energy Institute.

<h2>Potential Outcomes of the OPEC+ Meeting</h2>

Several scenarios could emerge from the OPEC+ meeting:

- Scenario 1: Increased Production: To meet rising global demand and potentially ease price pressures, OPEC+ might decide to increase production. This could lead to lower oil prices, benefiting consumers but potentially reducing the profitability for producers.

- Scenario 2: Maintaining Current Production Levels: OPEC+ might decide to maintain current production levels, keeping prices relatively stable. This strategy balances the interests of producers and consumers, offering a middle ground.

- Scenario 3: Further Production Cuts: If prices remain low or geopolitical uncertainties escalate, OPEC+ might choose to further cut production to support prices, potentially leading to higher oil prices and increased inflation.

<h3>The Impact on Oil Prices</h3>

The OPEC+ decision will have a direct and significant impact on oil prices. An increase in production is likely to decrease prices, whereas maintaining or reducing production will likely lead to price increases. These price fluctuations will have ripple effects across various sectors: higher prices can dampen economic growth and fuel inflation, particularly in transportation and manufacturing sectors. Reputable economic forecasters predict a range of price outcomes depending on the OPEC+ decision.

<h2>Conclusion</h2>

Determining whether big oil will increase production hinges on several interconnected factors: global oil demand, geopolitical stability, current oil prices, inventory levels, and external pressures from consuming nations. The upcoming OPEC+ meeting will be crucial in shaping the global energy landscape for the coming months. The potential outcomes – increased production leading to lower prices, maintaining current levels for stability, or production cuts resulting in higher prices – all carry significant implications for the global economy and energy markets. Stay tuned for updates on whether big oil will increase production, and keep checking back for analysis of the OPEC+ meeting's impact on oil prices. Understanding OPEC+'s role in shaping the global energy landscape is paramount in navigating these uncertain times.

Featured Posts

-

Getting To Know Myke Wright Lizzos Boyfriend His Career And Wealth

May 05, 2025

Getting To Know Myke Wright Lizzos Boyfriend His Career And Wealth

May 05, 2025 -

Ranking Fleetwood Macs Top Songs From Classics To Hidden Gems

May 05, 2025

Ranking Fleetwood Macs Top Songs From Classics To Hidden Gems

May 05, 2025 -

Three Word Commentary On Blake Lively By Anna Kendrick Causes Stir

May 05, 2025

Three Word Commentary On Blake Lively By Anna Kendrick Causes Stir

May 05, 2025 -

Police Investigating Fatal Collision Near Yellowstone Seven Dead

May 05, 2025

Police Investigating Fatal Collision Near Yellowstone Seven Dead

May 05, 2025 -

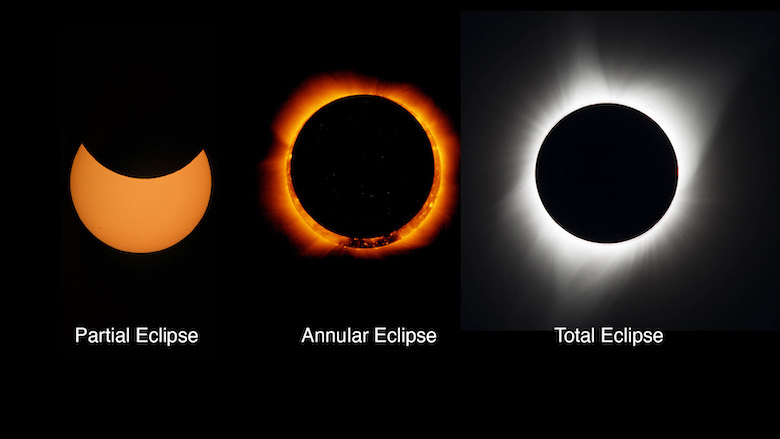

Partial Solar Eclipse Saturday In Nyc Time And Viewing Guide

May 05, 2025

Partial Solar Eclipse Saturday In Nyc Time And Viewing Guide

May 05, 2025

Latest Posts

-

Bianca Censoris Italian Rollerblading Outing Lingerie And Kanye Free

May 05, 2025

Bianca Censoris Italian Rollerblading Outing Lingerie And Kanye Free

May 05, 2025 -

Exploring The Concerns Surrounding Kanye Wests Relationship With Bianca Censori

May 05, 2025

Exploring The Concerns Surrounding Kanye Wests Relationship With Bianca Censori

May 05, 2025 -

Angelina Censori Facts And Photos Of Bianca Censoris Sister

May 05, 2025

Angelina Censori Facts And Photos Of Bianca Censoris Sister

May 05, 2025 -

The Kanye West Bianca Censori Dynamic An Examination Of Reported Power Imbalances

May 05, 2025

The Kanye West Bianca Censori Dynamic An Examination Of Reported Power Imbalances

May 05, 2025 -

Kanye West And Bianca Censori Public Perception And Concerns About Control

May 05, 2025

Kanye West And Bianca Censori Public Perception And Concerns About Control

May 05, 2025