Will Canadian Tire Thrive Under Hudson's Bay Ownership? A Cautious Analysis

Table of Contents

Synergies and Potential Benefits of the Merger

The potential union of Canadian Tire and Hudson's Bay presents several compelling synergies, particularly in terms of operational efficiency and market reach.

Shared Retail Infrastructure and Logistics

A combined Canadian Tire and Hudson's Bay could significantly streamline operations by leveraging shared infrastructure and logistics.

- Reduced transportation costs: Consolidating distribution networks and optimizing delivery routes could lead to substantial savings in transportation expenses. This is especially pertinent given the rising costs of fuel and logistics in Canada.

- Increased efficiency in warehousing and inventory management: Sharing warehousing space and implementing unified inventory management systems could reduce storage costs and minimize stockouts. Improved forecasting and demand planning would further enhance efficiency.

- Potential for shared retail spaces: Co-locating stores in strategic locations could offer increased customer convenience and reduced overhead costs for both brands. Imagine a combined store offering both home goods and sporting equipment under one roof.

Expanded Customer Base and Market Reach

The merger could broaden the customer base for both Canadian Tire and Hudson's Bay.

- Access to Hudson's Bay's upscale customer base: Canadian Tire could tap into a more affluent demographic through access to HBC's customer data and established relationships.

- Cross-promotion opportunities between the two brands: Joint marketing campaigns and loyalty programs could create significant cross-selling opportunities, driving revenue growth for both entities. This could involve targeted promotions and bundled offers.

- Enhanced loyalty programs and benefits for combined customer base: A unified loyalty program could offer enhanced rewards and benefits, fostering stronger customer engagement and loyalty. This could involve tiered rewards based on spending across both brands.

Financial Benefits and Increased Investment Capacity

The combined entity could benefit from significant financial advantages.

- Reduced operating costs: Synergies across various operational areas could significantly reduce overall operating costs, increasing profitability.

- Increased profitability through enhanced pricing power: A larger combined entity may have greater negotiating power with suppliers, leading to improved margins.

- Opportunities for strategic acquisitions and expansion: The combined financial strength could facilitate strategic acquisitions and expansion into new markets or product categories.

Potential Challenges and Risks of the Merger

Despite the potential upsides, the Canadian Tire Hudson's Bay merger presents several substantial challenges.

Brand Identity and Customer Overlap

Integrating two distinct brands with potentially overlapping customer bases could present significant challenges.

- Risk of alienating existing Canadian Tire customer base: Changes to the brand's image or product offerings could alienate loyal customers accustomed to Canadian Tire's current identity.

- Challenges in integrating disparate brand identities and marketing strategies: Successfully merging two distinct brand identities and marketing strategies will require careful planning and execution.

- Potential for cannibalization of sales between the two brands: If the product offerings overlap significantly, the merger could lead to internal competition and cannibalization of sales.

Integration Difficulties and Operational Challenges

Merging two large and complex organizations will present substantial operational hurdles.

- Challenges in merging IT systems and data management: Integrating different IT systems and data management practices could be costly and time-consuming.

- Potential for disruptions in supply chain and operations during integration: The integration process could temporarily disrupt supply chains and operations, potentially impacting sales and customer satisfaction.

- Resistance from employees and potential job losses: Mergers often lead to restructuring and potential job losses, which could cause employee morale issues and resistance to change.

Regulatory Scrutiny and Antitrust Concerns

The merger could face regulatory scrutiny and antitrust investigations.

- Potential for investigation by the Competition Bureau of Canada: The Competition Bureau could investigate the merger to ensure it doesn't create anti-competitive practices.

- Need to address potential anti-competitive concerns: The companies will need to demonstrate that the merger will not harm competition in the Canadian retail market.

- Potential for mandated divestitures to address antitrust issues: To address antitrust concerns, regulators could require the companies to divest certain assets or business units.

Analysis of Market Conditions and Competitor Landscape

The success of the Canadian Tire Hudson's Bay merger will also depend on navigating the evolving retail landscape.

Impact of E-commerce and Shifting Consumer Preferences

The rise of e-commerce and shifting consumer preferences present significant challenges.

- Need to enhance e-commerce capabilities to remain competitive: Both Canadian Tire and Hudson's Bay need to invest in their e-commerce platforms and enhance online shopping experiences to compete effectively.

- Adaptation to changing consumer shopping habits and preferences: The companies must adapt their strategies to cater to changing consumer preferences, including a greater emphasis on omnichannel experiences.

- Investment in technology and digital marketing strategies: Investment in technology and innovative digital marketing strategies will be essential for attracting and retaining customers in the digital age.

Competitive Threats from Major Retailers

The Canadian retail sector is highly competitive.

- Competition from Walmart, Amazon, and other major players: The merged entity will face intense competition from major retailers like Walmart, Amazon, and other established players.

- Strategies to maintain market share and compete effectively: The companies need to develop effective strategies to maintain market share and compete effectively against these rivals.

- Differentiation and value proposition to attract and retain customers: A clear differentiation strategy and strong value proposition will be critical for attracting and retaining customers in a crowded marketplace.

Conclusion

The future success of the Canadian Tire Hudson's Bay merger remains uncertain. While potential synergies exist, the integration process will be complex and fraught with potential challenges. Careful management of brand identity, operational integration, regulatory scrutiny, and intense competition will be paramount. The impact of this Canadian Tire Hudson's Bay merger on the Canadian retail landscape warrants close monitoring. Further analysis and ongoing observation of the integration process are crucial to determine the ultimate success or failure of this high-stakes business combination. Stay informed on this evolving story; the future of these retail giants is yet to be written.

Featured Posts

-

Hamilton Ferrari Clash Tensions Boil Over During Miami Gp Tea Break

May 20, 2025

Hamilton Ferrari Clash Tensions Boil Over During Miami Gp Tea Break

May 20, 2025 -

Hmrc Tax Return Changes Whos Affected And What You Need To Know

May 20, 2025

Hmrc Tax Return Changes Whos Affected And What You Need To Know

May 20, 2025 -

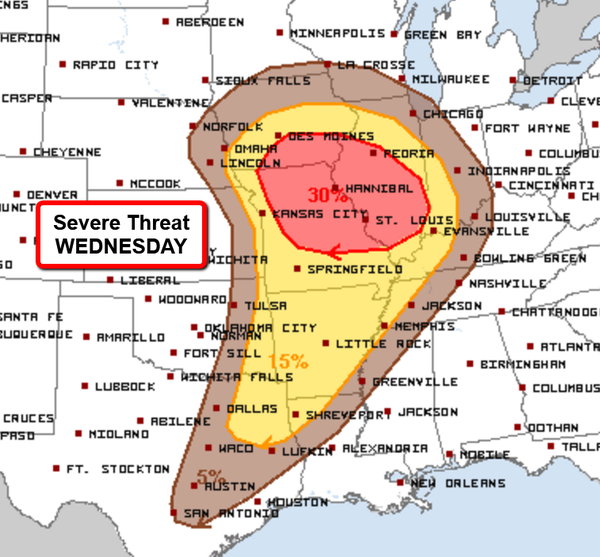

Enjoying Mild Temperatures And Low Rain Chances This Week

May 20, 2025

Enjoying Mild Temperatures And Low Rain Chances This Week

May 20, 2025 -

Gmas 50th Anniversary A Paley Center Celebration

May 20, 2025

Gmas 50th Anniversary A Paley Center Celebration

May 20, 2025 -

Pro D2 L Impact Du Mental Sur Le Match Asbh A Biarritz

May 20, 2025

Pro D2 L Impact Du Mental Sur Le Match Asbh A Biarritz

May 20, 2025

Latest Posts

-

Damaging Winds How Fast Moving Storms Impact Your Area

May 20, 2025

Damaging Winds How Fast Moving Storms Impact Your Area

May 20, 2025 -

Ftv Lives A Hell Of A Run A Deep Dive Into The Story

May 20, 2025

Ftv Lives A Hell Of A Run A Deep Dive Into The Story

May 20, 2025 -

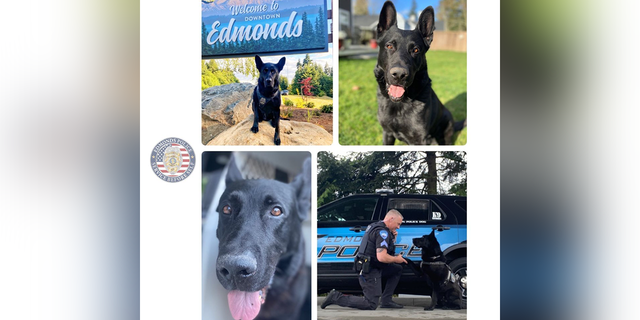

Investigation Into Washington County Breeder Following 49 Dog Removal

May 20, 2025

Investigation Into Washington County Breeder Following 49 Dog Removal

May 20, 2025 -

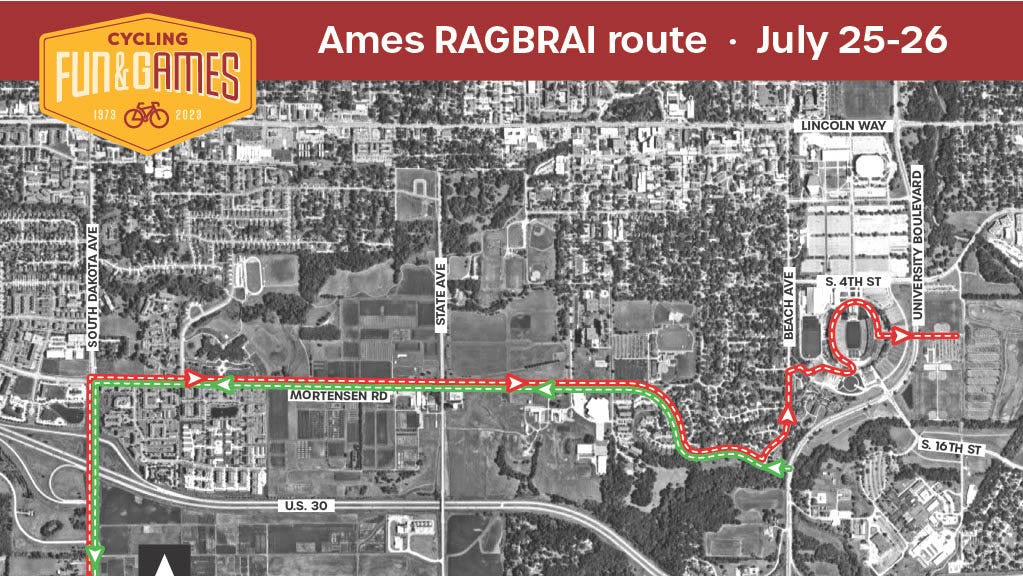

A Cyclists Dedication Scott Savilles Ragbrai And Commute Experiences

May 20, 2025

A Cyclists Dedication Scott Savilles Ragbrai And Commute Experiences

May 20, 2025 -

The Power Of Resilience Protecting Your Mental Health

May 20, 2025

The Power Of Resilience Protecting Your Mental Health

May 20, 2025