Will Palantir Be A Trillion-Dollar Company By 2030? An In-Depth Analysis

Table of Contents

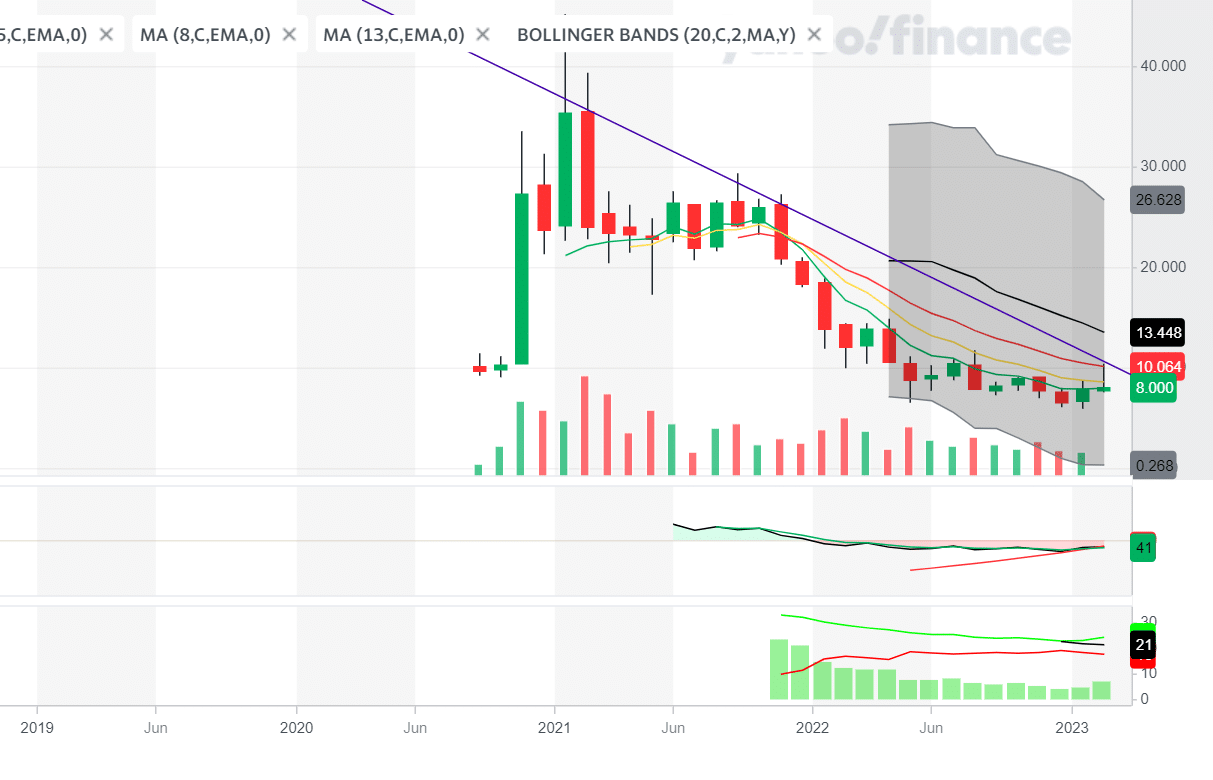

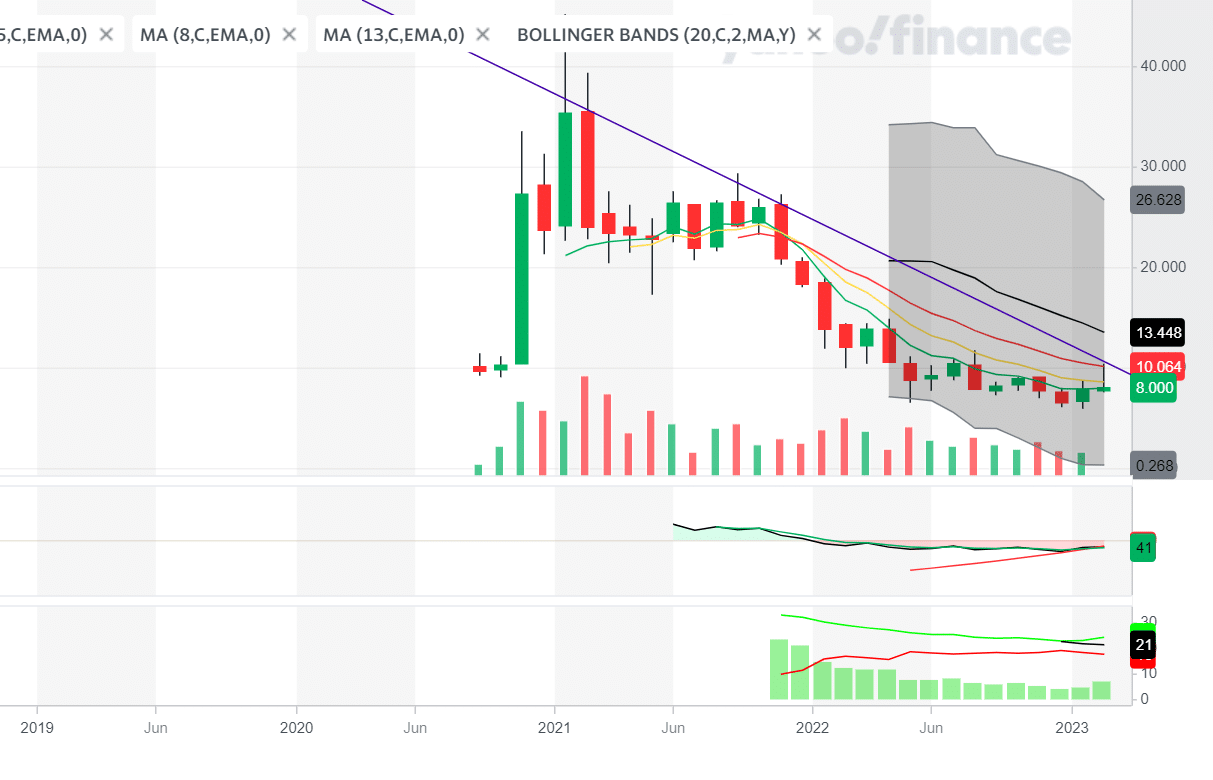

Palantir's Current Market Position and Financial Performance

Understanding Palantir's current standing is crucial to predicting its future. The company’s proprietary technology, particularly its Gotham platform for government clients and Foundry for commercial clients, forms the bedrock of its success. Strong government contracts have historically been a major revenue driver, providing a stable foundation for growth. However, Palantir is actively expanding its presence in the commercial market, aiming for diversification and accelerated growth.

- Current stock price and market cap: As of [Insert Current Date], Palantir's stock price is [Insert Current Stock Price], resulting in a market capitalization of approximately [Insert Current Market Cap]. This figure serves as our baseline for evaluating potential future growth.

- Recent financial reports and key performance indicators (KPIs): Analysis of Palantir's recent financial reports reveals [Insert Key Data Points from Recent Reports, e.g., revenue growth, profit margins, customer acquisition costs]. These KPIs are vital indicators of the company's financial health and future prospects.

- Growth rate analysis: Palantir's historical growth rate has been [Insert Growth Rate Data]. Sustaining, or even exceeding, this growth rate will be critical to achieving a trillion-dollar valuation.

- Comparison to competitors in the data analytics market: Palantir competes with established players like Microsoft, Amazon, and Google Cloud, each with significant resources and market share. However, Palantir’s niche focus on complex data analysis for both government and commercial clients provides a degree of differentiation.

Growth Projections and Key Drivers for Palantir's Future Success

Reaching a trillion-dollar valuation requires sustained, exponential growth. Several factors could propel Palantir towards this ambitious goal:

-

Expansion into new markets: Palantir's expansion into sectors like healthcare, finance, and supply chain management offers significant growth potential. These industries are ripe for data-driven transformation, and Palantir's platforms are well-suited to meet their analytical needs.

-

Technological advancements and innovation: Continued investment in R&D, including advancements in artificial intelligence (AI), machine learning (ML), and big data analytics, will be crucial for staying ahead of the competition and attracting new clients.

-

Government contracts and their long-term sustainability: While government contracts have been a cornerstone of Palantir's revenue, their long-term sustainability is a key consideration. Securing new contracts and diversifying revenue streams is vital to mitigate risk.

-

Market size projections for data analytics: The global data analytics market is projected to reach [Insert Market Size Projection] by [Insert Year]. Capturing a significant share of this rapidly expanding market is essential for Palantir's ambitious growth plan.

-

Palantir's strategic initiatives and partnerships: Strategic partnerships and acquisitions could accelerate growth by expanding market reach and technological capabilities.

-

Technological breakthroughs and their potential impact on revenue: Major technological breakthroughs could significantly disrupt the market and potentially increase Palantir’s revenue exponentially.

-

Risks and challenges to future growth (competition, regulation, etc.): Increased competition, regulatory hurdles, and economic downturns pose significant challenges to Palantir's growth trajectory.

Factors that Could Hinder Palantir Reaching a Trillion-Dollar Valuation

Despite its potential, several factors could hinder Palantir's progress towards a trillion-dollar valuation:

-

Competitive landscape: The data analytics market is fiercely competitive, with established tech giants possessing significant resources and market share.

-

Regulatory hurdles: Government regulations and data privacy concerns could impact Palantir's operations and limit its market reach.

-

Economic downturns: Economic instability and reduced government spending could negatively affect Palantir’s revenue, especially its government contracts.

-

Competitive analysis of major players in the data analytics space: [Insert Analysis comparing Palantir to competitors like Microsoft Azure, AWS, Google Cloud, etc.]

-

Potential regulatory hurdles and their impact on Palantir's business: [Discuss specific regulations, such as GDPR or CCPA, and their potential impact on Palantir.]

-

Economic factors that could affect future growth: [Discuss potential economic downturns and their impact on Palantir's customer base and spending.]

-

Risks associated with over-reliance on government contracts: [Highlight the vulnerability of relying heavily on a single revenue source.]

Valuation Analysis and Probability of Reaching a Trillion-Dollar Market Cap by 2030

Determining the likelihood of Palantir achieving a trillion-dollar valuation requires a thorough valuation analysis. While precise prediction is impossible, various methods can provide insights:

-

Discounted Cash Flow (DCF) analysis: [Insert DCF analysis results and assumptions.]

-

Comparable company analysis: [Insert analysis comparing Palantir's valuation multiples to similar companies.]

-

Results of different valuation models: [Summarize the findings from different valuation methods, highlighting the range of potential outcomes.]

-

Sensitivity analysis to highlight key assumptions: [Analyze how changes in key assumptions (e.g., growth rate, discount rate) affect the valuation.]

-

Probability assessment based on the analysis: [Provide a reasoned estimate of the probability of Palantir reaching a trillion-dollar market cap by 2030.]

-

Comparison with other companies that achieved similar valuations: [Compare Palantir's trajectory to other companies that have achieved similar market capitalization.]

Conclusion: Will Palantir Reach a Trillion-Dollar Valuation? Final Thoughts and Call to Action

Determining whether Palantir will reach a trillion-dollar valuation by 2030 is a complex question with no definitive answer. While the company possesses significant potential fueled by its innovative technology and expanding market reach, considerable challenges remain, including intense competition and economic uncertainties. Our analysis suggests that achieving this ambitious goal depends on sustained high growth rates, successful diversification into the commercial market, and navigating potential regulatory hurdles.

This analysis aims to provide a comprehensive overview, but it's crucial to conduct your own research and consider all factors before forming your own opinion. Investigate Palantir’s financial reports, understand its competitive landscape, and assess its long-term growth potential. Consider the risks involved in investing in Palantir and whether its trillion-dollar potential aligns with your risk tolerance. Ultimately, the question of Palantir's trillion-dollar potential is one that only time will answer. Start your own research now and decide for yourself on Palantir's future prospects.

Featured Posts

-

Firstpost Imfs Decision On Pakistans 1 3 Billion Loan Package

May 10, 2025

Firstpost Imfs Decision On Pakistans 1 3 Billion Loan Package

May 10, 2025 -

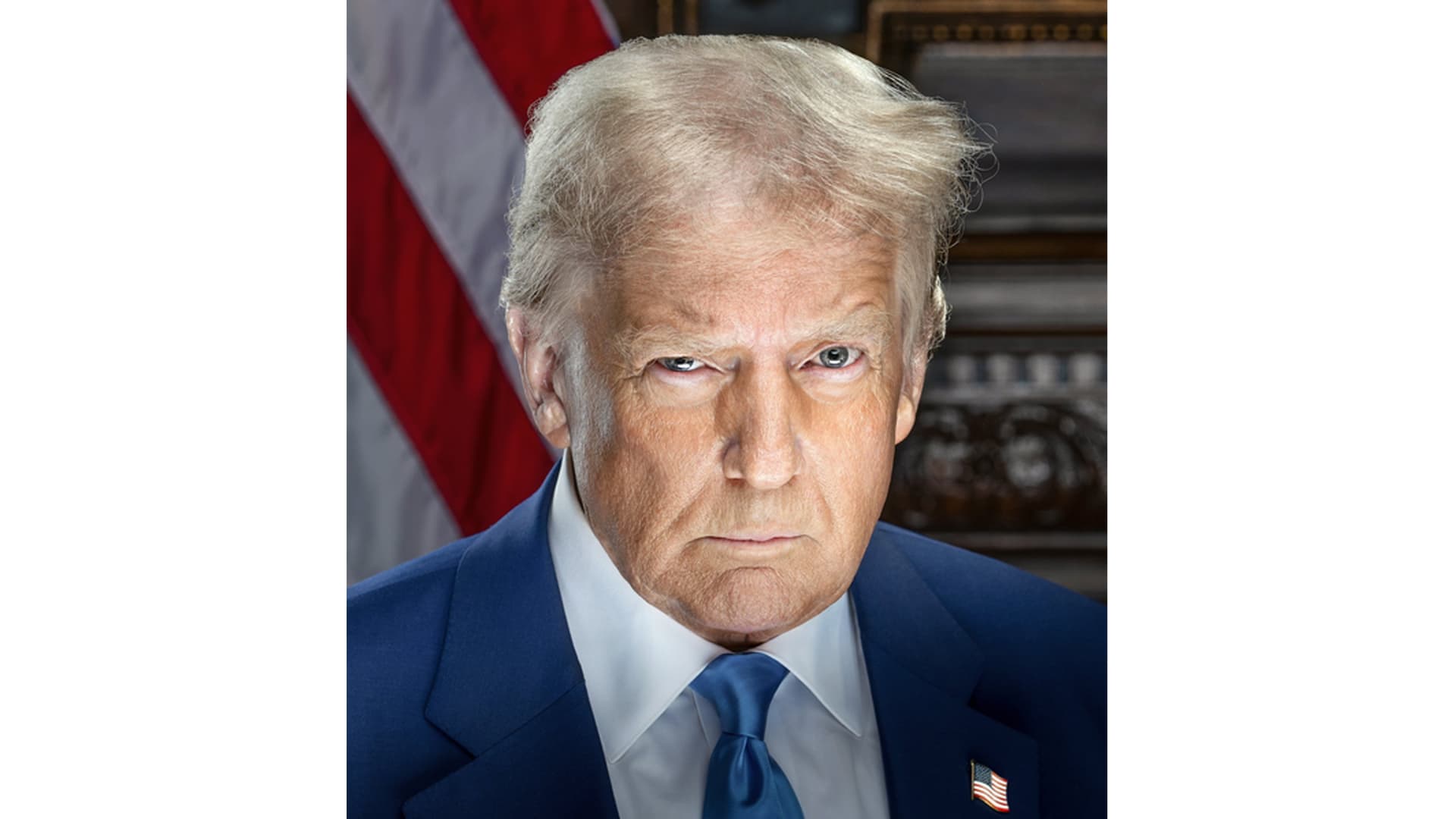

2025 Presidential Politics Retrospective On Trumps Day 109 May 8th

May 10, 2025

2025 Presidential Politics Retrospective On Trumps Day 109 May 8th

May 10, 2025 -

Hkayat Almdkhnyn Fy Ealm Krt Alqdm Mn Njwm Ila Asatyr

May 10, 2025

Hkayat Almdkhnyn Fy Ealm Krt Alqdm Mn Njwm Ila Asatyr

May 10, 2025 -

Difficultes D Epicure A La Cite De La Gastronomie De Dijon Intervention Municipale

May 10, 2025

Difficultes D Epicure A La Cite De La Gastronomie De Dijon Intervention Municipale

May 10, 2025 -

The Trump Administration On May 8th 2025 Day 109 In Review

May 10, 2025

The Trump Administration On May 8th 2025 Day 109 In Review

May 10, 2025