Will Tax Credits Revitalize Minnesota's Film And Television Scene?

Table of Contents

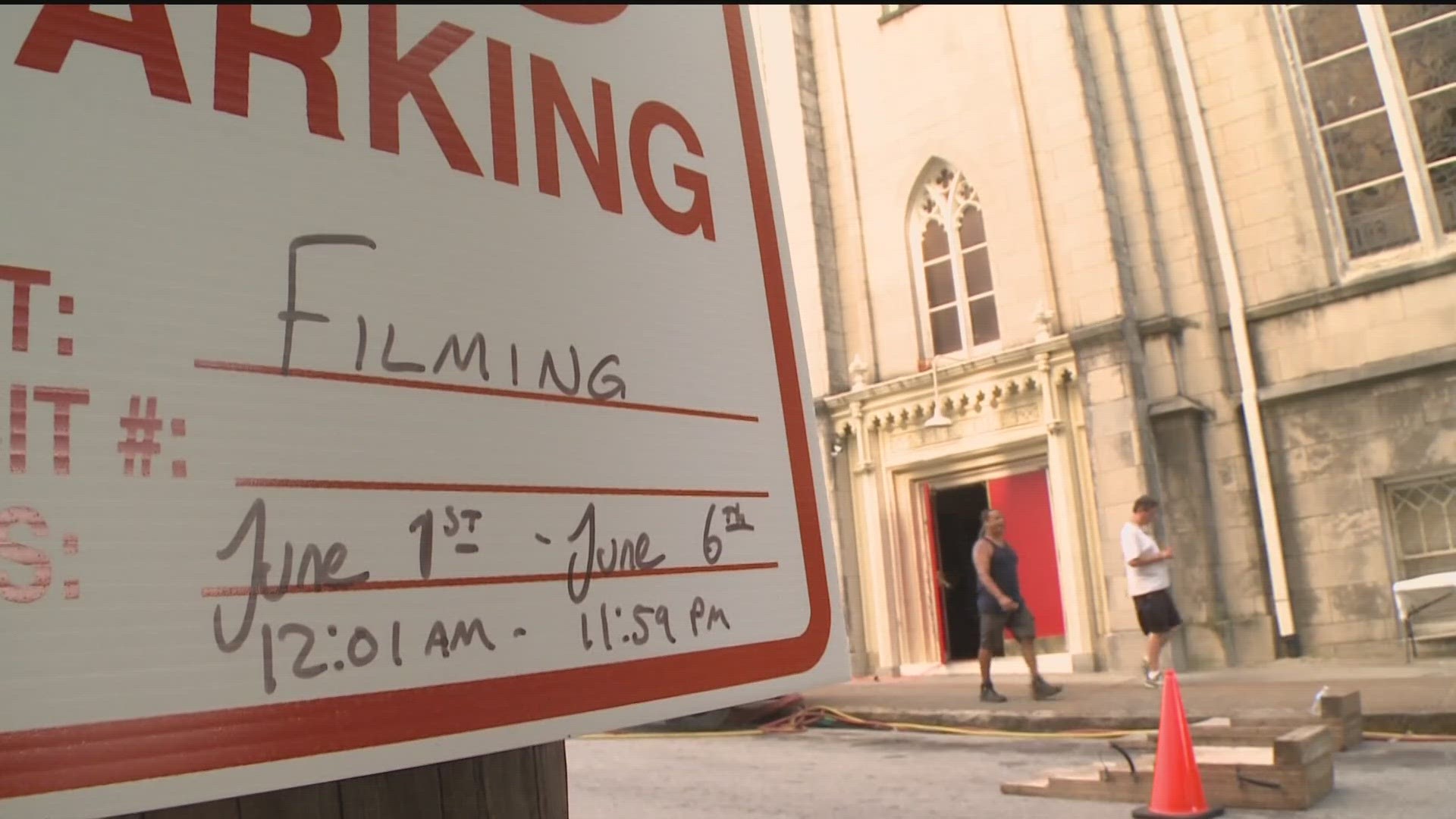

The Current State of Minnesota's Film Industry

Minnesota's film history is rich, featuring independent productions and contributions to larger projects. While the state has produced notable films and TV shows like Fargo (inspired by the Coen brothers' film) and the Hulu series The Dropout, showcasing its talent and locations, the industry faces significant hurdles. Competition from states offering more generous incentives, a lack of substantial studio infrastructure, and shortages of skilled labor hinder growth. Existing incentives, while helpful, haven't proven sufficient to attract major productions consistently.

- Successful Minnesota Productions: Fargo, The Leftovers, Lake of Fire, and numerous independent films have showcased Minnesota's potential.

- Economic Impact: While precise figures are difficult to obtain, the current film industry contributes a measurable, though relatively small, amount to the state's economy through jobs and spending.

- Challenges: Filmmakers often struggle to secure sufficient funding and face challenges in attracting and retaining experienced crew members.

The Potential Impact of Increased Film Tax Credits

Film tax credits incentivize production companies to film in a specific state by offering a percentage reduction in their tax liability. For Minnesota, this could mean:

- Attracting Productions: Increased tax credits make Minnesota a more financially attractive filming location compared to competitors.

- Job Creation: Film productions create a ripple effect, generating jobs not only for on-screen talent and crew but also for support industries like catering, transportation, and hospitality.

- Economic Boost: Increased spending by production companies injects capital into the local economy, benefiting businesses and communities.

- Tourism: Filming in Minnesota could boost tourism as fans seek out locations featured in popular shows and movies.

However, potential drawbacks include the cost to taxpayers and the possibility of abuse if the program isn't carefully designed and monitored.

- Examples of Successful Programs: Georgia's generous film tax credit program has significantly boosted its film industry, demonstrating the potential impact of such incentives.

- Projected Job Creation: Based on models from other states, a robust tax credit program in Minnesota could potentially create thousands of jobs across various sectors.

- Tourism Revenue: Increased film production could attract tourists interested in film tourism, generating additional revenue for the state.

Comparative Analysis of Other States' Film Incentive Programs

To understand the potential of tax credits in Minnesota, it’s crucial to compare its current incentives (if any) with those of successful film production states like Georgia, New York, and California. Georgia's expansive program, for instance, has lured many major productions. Analyzing the structures, success rates, and limitations of these programs can inform the design of an effective Minnesota program.

- Successful Programs: Examining the structures and results of successful programs in other states can help shape a more effective approach for Minnesota.

- Key Differences: A clear comparison reveals the gaps between Minnesota's offerings and those of its competitors.

- Effectiveness of Incentive Structures: Analyzing different incentive models—refundable vs. non-refundable credits, for example—can guide the selection of the most impactful structure for Minnesota.

Addressing Concerns and Potential Challenges

Implementing a film tax credit program requires careful consideration of potential concerns. Critics often raise the issue of taxpayer cost and the possibility of fraud. To mitigate these risks:

-

Accountability and Transparency: Strict guidelines, robust auditing processes, and transparent reporting mechanisms are crucial to prevent abuse.

-

Workforce Development: Investing in film training programs ensures a skilled workforce capable of supporting increased production.

-

Infrastructure Improvements: Expanding studio space, providing better soundstages, and improving logistical support are necessary to attract larger productions.

-

Strategies for Accountability: Regular audits, independent oversight, and clear eligibility criteria are essential components of a successful program.

-

Workforce Training Initiatives: Collaborations with educational institutions and industry professionals can address skill gaps.

-

Infrastructure Investments: Public-private partnerships and strategic investments can facilitate the development of necessary infrastructure.

Conclusion: The Future of Film in Minnesota and the Role of Tax Credits

The revitalization of Minnesota's film and television industry hinges on a multifaceted approach. While increased film tax credits offer significant potential for attracting productions, creating jobs, and boosting the economy, concerns regarding cost and potential abuse must be addressed proactively through careful planning and implementation. A comprehensive strategy encompassing infrastructure development, workforce training, and a well-designed tax credit program is essential. Will tax credits be the catalyst Minnesota needs? Learn more about the debate and support policies that will help revitalize our state's film and television scene.

Featured Posts

-

Iva I Siyana Novi Tseli Novi Pobedi

Apr 29, 2025

Iva I Siyana Novi Tseli Novi Pobedi

Apr 29, 2025 -

Transparency Concerns Raised By Louisville Congressman Over Usps Mail Delays

Apr 29, 2025

Transparency Concerns Raised By Louisville Congressman Over Usps Mail Delays

Apr 29, 2025 -

Urgent Evacuation Israeli Airstrike Strikes Southern Beirut

Apr 29, 2025

Urgent Evacuation Israeli Airstrike Strikes Southern Beirut

Apr 29, 2025 -

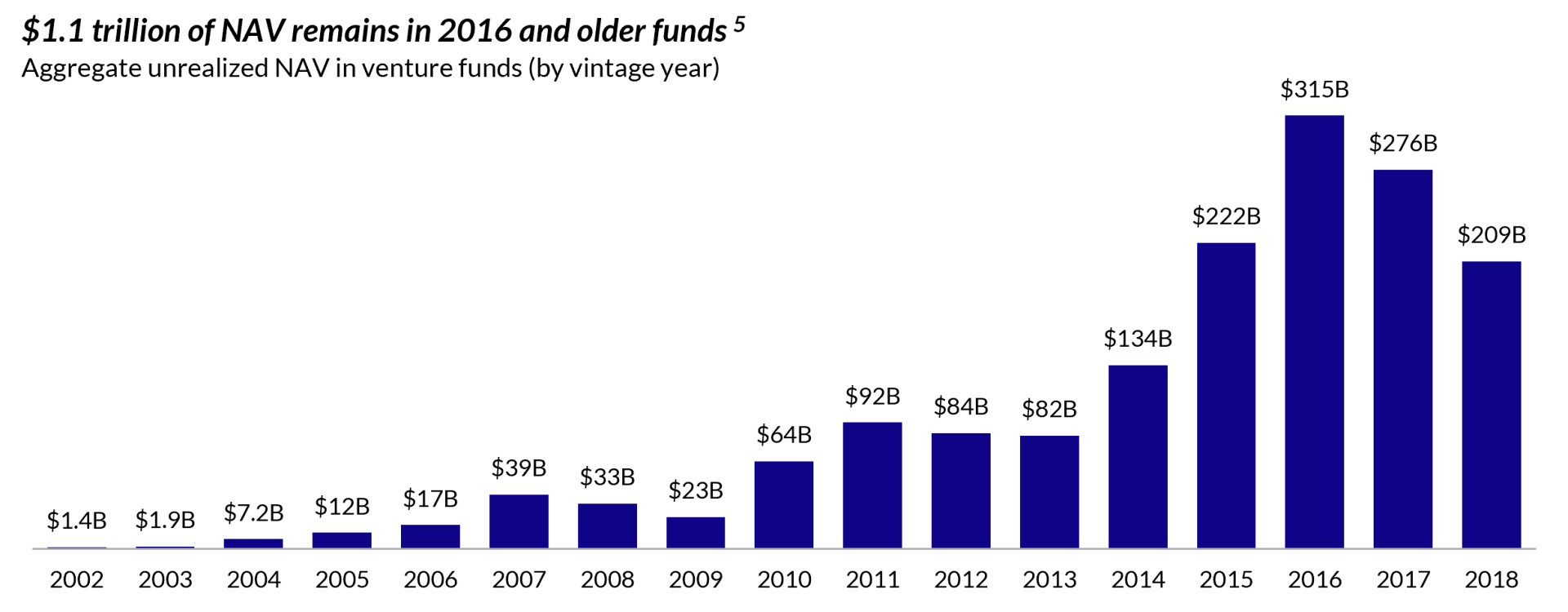

Venture Capital Secondary Market A Hot Investment Opportunity

Apr 29, 2025

Venture Capital Secondary Market A Hot Investment Opportunity

Apr 29, 2025 -

The Price Of Touring Willie Nelsons Health And The Challenges Of Age

Apr 29, 2025

The Price Of Touring Willie Nelsons Health And The Challenges Of Age

Apr 29, 2025