Will The Bank Of Canada Cut Rates Again? Economists Weigh In On Tariff Impact

Table of Contents

Current Economic Indicators and their Implications for Interest Rates

The Bank of Canada's interest rate decisions are heavily influenced by key economic indicators. Analyzing these indicators provides crucial insight into the potential for future rate cuts or hikes. Understanding the interplay between inflation, GDP growth, and unemployment is paramount to predicting future monetary policy.

-

Inflation Rate: The current inflation rate is a critical factor. A rate consistently below the Bank of Canada's target range (typically 1-3%) might signal a need for stimulative measures, such as an interest rate cut. Conversely, inflation significantly above the target range could lead to rate hikes to cool down the economy. Analyzing the underlying drivers of inflation – whether it's demand-pull or cost-push – is equally important in assessing the need for intervention in Bank of Canada interest rates.

-

GDP Growth: Sustained strong GDP growth indicates a healthy economy, potentially lessening the need for interest rate cuts. However, slowing GDP growth or signs of a recession might prompt the Bank of Canada to lower interest rates to stimulate economic activity. Analyzing the composition of GDP growth (e.g., consumer spending, investment, government spending, net exports) provides a more nuanced picture.

-

Unemployment Rate: A low unemployment rate often indicates a tight labor market, potentially leading to upward pressure on wages and inflation. The Bank of Canada might respond to this by raising interest rates to prevent overheating. Conversely, a rising unemployment rate may signal the need for lower interest rates to boost employment. The natural rate of unemployment, and its deviation from the current rate, is an important metric to consider.

These indicators are intertwined and their combined effect informs the Bank of Canada's monetary policy decisions regarding Bank of Canada interest rates. Predicting future economic growth requires analyzing the trajectory of each indicator and their potential impact on each other. A decline in consumer confidence, for example, could impact GDP growth and potentially lead to a need for interest rate cuts.

The Impact of Tariffs on the Canadian Economy

Tariffs, while intended to protect domestic industries, can have significant ripple effects throughout the Canadian economy, ultimately influencing Bank of Canada interest rates.

-

Increased Input Costs: Tariffs directly increase the cost of imported goods, raising input costs for businesses across various sectors. This can lead to reduced profitability, decreased investment, and potentially slower economic growth. This is particularly true for industries heavily reliant on imported components, like manufacturing.

-

Impact on Consumer Prices and Inflation: Higher input costs are often passed on to consumers in the form of higher prices, contributing to inflationary pressures. This might force the Bank of Canada to consider raising interest rates to control inflation, even if overall economic growth remains sluggish. The impact of tariffs on inflation needs to be carefully assessed.

-

Negative Impact on Canadian Exports: Retaliatory tariffs from other countries can significantly harm Canadian exports, leading to reduced economic activity and job losses. This negative effect on exports could push the Bank of Canada toward a more accommodative monetary policy, potentially including cuts to Bank of Canada interest rates. Specific examples include the impact of tariffs on Canadian agricultural products or manufactured goods exported to the US. The impact of tariffs on specific industries needs to be closely monitored by the Bank of Canada.

Economists' Predictions and Divergent Views on Future Interest Rates

Economists hold varying views on the likelihood of further Bank of Canada interest rate cuts.

-

Arguments for a Rate Cut: Some economists argue that the current economic climate warrants a rate cut. They point to slowing GDP growth, persistent trade tensions, and the potential for a global economic slowdown. For example, [Economist's Name], chief economist at [Institution], believes that “the current uncertainty necessitates a proactive approach from the Bank of Canada.”

-

Arguments Against a Rate Cut: Other economists contend that a rate cut is unnecessary or even premature. They emphasize the relatively low unemployment rate and argue that a rate cut might fuel excessive inflation without meaningfully boosting economic growth. [Another Economist's Name] from [Institution] stated, "A rate cut at this juncture would risk stoking inflation without addressing the underlying structural issues.”

-

The Role of Global Economic Uncertainty: The global economic landscape adds significant complexity to the Bank of Canada's decision-making process. Global trade wars, geopolitical instability, and the potential for a global recession all contribute to uncertainty. The interconnectedness of the global economy means that external shocks can quickly impact the Canadian economy.

The Role of Global Economic Uncertainty

The Bank of Canada operates within a global context. Global economic uncertainty, such as trade wars or a global slowdown, significantly impacts its decision-making regarding Bank of Canada interest rates.

-

Influence on Canadian Economic Growth: Global uncertainty can dampen investor confidence and reduce business investment, negatively impacting Canadian economic growth. This can lead to a higher chance of a Bank of Canada interest rate cut.

-

Contagion Effects: Economic problems in other major economies can quickly spread to Canada, creating further challenges for the Bank of Canada. This could increase the likelihood of rate adjustments.

-

Interplay of Domestic and Global Factors: The Bank of Canada must carefully weigh domestic economic conditions with global trends to make informed decisions about its monetary policy. The decision on Bank of Canada interest rates involves a complex calculation of domestic and global factors.

Navigating this complex global environment presents significant challenges for the Bank of Canada.

Conclusion

The question of whether the Bank of Canada will cut interest rates again remains uncertain. The decision hinges on a complex interplay of economic indicators, the impact of tariffs on the Canadian economy, and prevailing global economic uncertainty. Analyzing inflation, GDP growth, and unemployment figures provides valuable insight. However, the unpredictable effects of tariffs and global economic events create significant challenges. Economists hold differing views, highlighting the uncertainty surrounding future Bank of Canada interest rate adjustments. Staying abreast of these developments is vital for informed financial planning. Stay informed on the latest developments regarding Bank of Canada interest rates. Regularly check our website for updates and in-depth analysis of the Canadian economy and the Bank of Canada's monetary policy decisions. Understanding the complexities of Bank of Canada interest rate adjustments is crucial for informed financial planning.

Featured Posts

-

Farq Alsn 26 Eama Hl Yjme Twm Krwz Wana Dy Armas Qst Hb

May 11, 2025

Farq Alsn 26 Eama Hl Yjme Twm Krwz Wana Dy Armas Qst Hb

May 11, 2025 -

Blowout Win Sends Celtics To Division Title

May 11, 2025

Blowout Win Sends Celtics To Division Title

May 11, 2025 -

Pentagon Mulls Greenland Shift To Northern Command Concerns Rise Over Us Ambitions

May 11, 2025

Pentagon Mulls Greenland Shift To Northern Command Concerns Rise Over Us Ambitions

May 11, 2025 -

Vols Cruise To 12 1 Win Over Sycamores

May 11, 2025

Vols Cruise To 12 1 Win Over Sycamores

May 11, 2025 -

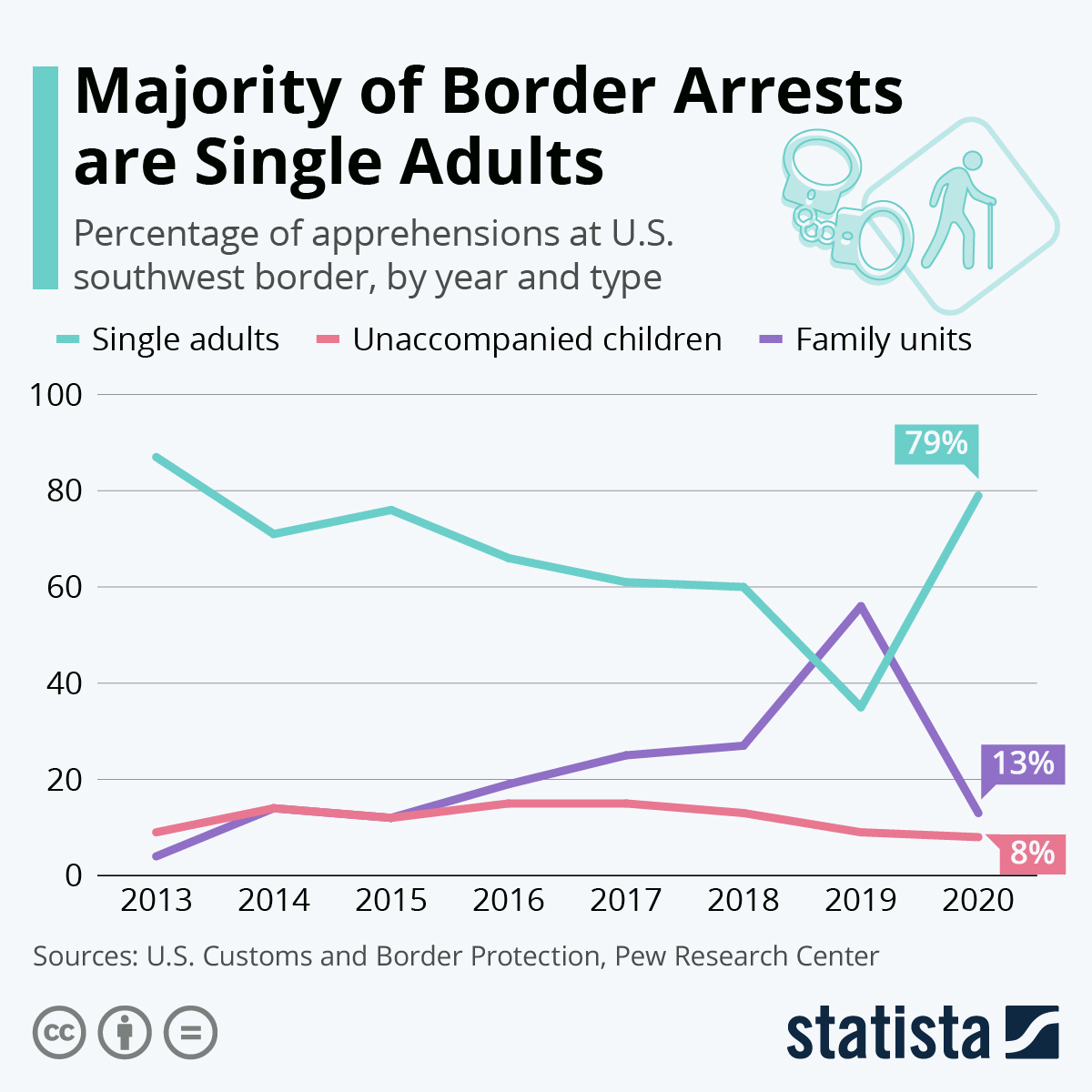

Increased Border Security Fewer Arrests More Detentions

May 11, 2025

Increased Border Security Fewer Arrests More Detentions

May 11, 2025

Latest Posts

-

Examining Juan Sotos Performance Following Michael Kays Comments On Aaron Judge Loyalty

May 12, 2025

Examining Juan Sotos Performance Following Michael Kays Comments On Aaron Judge Loyalty

May 12, 2025 -

Aaron Judge On Juan Sotos Lineup Comments A New York Yankees Perspective

May 12, 2025

Aaron Judge On Juan Sotos Lineup Comments A New York Yankees Perspective

May 12, 2025 -

Aaron Judge At 1 000 Games Hall Of Fame Candidacy Examined

May 12, 2025

Aaron Judge At 1 000 Games Hall Of Fame Candidacy Examined

May 12, 2025 -

Juan Sotos Offensive Surge A Consequence Of Kays Inquiry

May 12, 2025

Juan Sotos Offensive Surge A Consequence Of Kays Inquiry

May 12, 2025 -

Judge Addresses Sotos Remarks The Effect Of Absence On The Lineup

May 12, 2025

Judge Addresses Sotos Remarks The Effect Of Absence On The Lineup

May 12, 2025