Will The SEC Declare XRP A Commodity? Ripple Settlement Update

Table of Contents

The Ripple-SEC Lawsuit: A Summary

The lawsuit, filed in December 2020, centers on the SEC's claim that Ripple illegally sold XRP as an unregistered security. The SEC argues that XRP sales constituted an investment contract, offering investors the expectation of profit based on Ripple's efforts. This directly challenges Ripple's assertion that XRP is a decentralized digital asset, operating similarly to other cryptocurrencies like Bitcoin and Ethereum.

-

SEC's Claim: The SEC contends that XRP sales, particularly those to institutional investors, were investment contracts, violating federal securities laws. They point to Ripple's involvement in promoting XRP and its potential profits as central arguments.

-

Ripple's Counter-Arguments: Ripple maintains that XRP is a functional cryptocurrency, used for payments and transactions on its network, not an investment contract. They highlight XRP's decentralized nature and its independent market operation.

-

Key Legal Precedents: Both sides have cited various legal precedents related to the Howey Test, a Supreme Court decision defining investment contracts, aiming to strengthen their respective positions.

-

Timeline of Major Events: The lawsuit has seen numerous filings, motions, and expert witness testimonies, leading to significant delays. Key events include the SEC's initial complaint, Ripple's response, various court hearings, and the ongoing discovery process.

Potential Outcomes of the Ripple Settlement

Several potential outcomes exist, each with significant implications for XRP and the cryptocurrency market:

XRP Classified as a Commodity

If the SEC classifies XRP as a commodity, this would significantly alter its regulatory landscape.

-

Reduced Regulatory Oversight: XRP would likely fall under the purview of the Commodity Futures Trading Commission (CFTC), subject to less stringent regulations than securities.

-

Potential for Increased Market Adoption and Price Appreciation: Reduced regulatory uncertainty could boost investor confidence, potentially driving increased adoption and price appreciation.

-

Impact on Exchanges and Trading Platforms: Exchanges would likely face less regulatory pressure to delist XRP, potentially increasing trading volume and liquidity.

-

Comparison to Other Commodities: This classification would align XRP more closely with other commodities like gold or oil, subject to market forces and supply and demand dynamics.

XRP Classified as a Security (Partial or Full)

Conversely, a partial or full classification of XRP as a security would have far-reaching consequences.

-

Stricter Regulatory Compliance Requirements for Ripple: Ripple would face significant regulatory burdens, potentially impacting its operations and future fundraising efforts.

-

Potential Limitations on Trading and Investment: Trading platforms might face pressure to delist XRP, restricting investor access and reducing liquidity.

-

Legal Ramifications for Past XRP Sales: Ripple could face significant financial penalties and legal repercussions related to past XRP sales deemed to be unregistered securities offerings.

-

Impact on Investor Confidence and Market Volatility: A security classification could significantly dampen investor confidence, leading to increased market volatility and price fluctuations.

Implications of a Negotiated Settlement

A negotiated settlement between Ripple and the SEC remains a possibility. However, the outcome of such a settlement is highly uncertain.

-

Potential for a Consent Decree with Specific Conditions: A consent decree might involve Ripple agreeing to specific conditions, potentially including restrictions on future XRP sales or other compliance measures.

-

Impact on Ripple's Future Operations and Fundraising Activities: The terms of any settlement could substantially influence Ripple's future operations and ability to raise capital.

-

Uncertainty Surrounding the Ultimate Legal Classification of XRP: Even with a settlement, the ultimate legal classification of XRP might remain ambiguous, prolonging regulatory uncertainty.

Market Analysis and Investor Sentiment

The XRP market closely tracks developments in the Ripple-SEC lawsuit. Price fluctuations often reflect shifts in investor sentiment.

-

Current XRP Price and Market Capitalization: The current market cap and price of XRP are highly dependent on the ongoing legal proceedings and any news related to the case.

-

Investor Reaction to Recent Developments in the Lawsuit: Positive news tends to drive price increases, while negative developments often result in price declines.

-

Predictions and Forecasts from Cryptocurrency Analysts: Analysts provide various predictions, highlighting the wide range of potential outcomes and their impact on XRP's price.

-

Impact of the Potential Outcome on Overall Market Stability: The resolution of this case could significantly impact overall cryptocurrency market stability and investor confidence.

Future Regulatory Landscape for Cryptocurrencies

The Ripple case is setting a significant precedent for future cryptocurrency regulation.

-

The SEC's Approach to Other Cryptocurrencies: The outcome of the Ripple case will inform the SEC's approach to regulating other cryptocurrencies, potentially setting a standard for future enforcement actions.

-

Potential Changes in Regulatory Frameworks Worldwide: The case could influence regulatory developments in other jurisdictions, impacting the global cryptocurrency regulatory landscape.

-

Impact on Innovation and Development in the Cryptocurrency Space: Clearer regulatory guidelines could foster innovation, while prolonged uncertainty could hinder development.

-

Calls for Clearer Regulatory Guidelines: The case highlights the urgent need for clearer and more comprehensive regulatory frameworks for the cryptocurrency industry.

Conclusion

The Ripple-SEC lawsuit holds significant implications for the future of cryptocurrency regulation. The classification of XRP as a commodity or a security will have profound effects on the market, investor confidence, and the broader regulatory landscape. A negotiated settlement could provide some clarity, but uncertainties remain.

Call to Action: Stay informed about the latest developments in the Ripple-SEC case and the potential classification of XRP as a commodity. Continue researching the XRP and cryptocurrency markets to make informed investment decisions. Understanding the potential implications of this ongoing legal battle is crucial for navigating the evolving world of cryptocurrencies.

Featured Posts

-

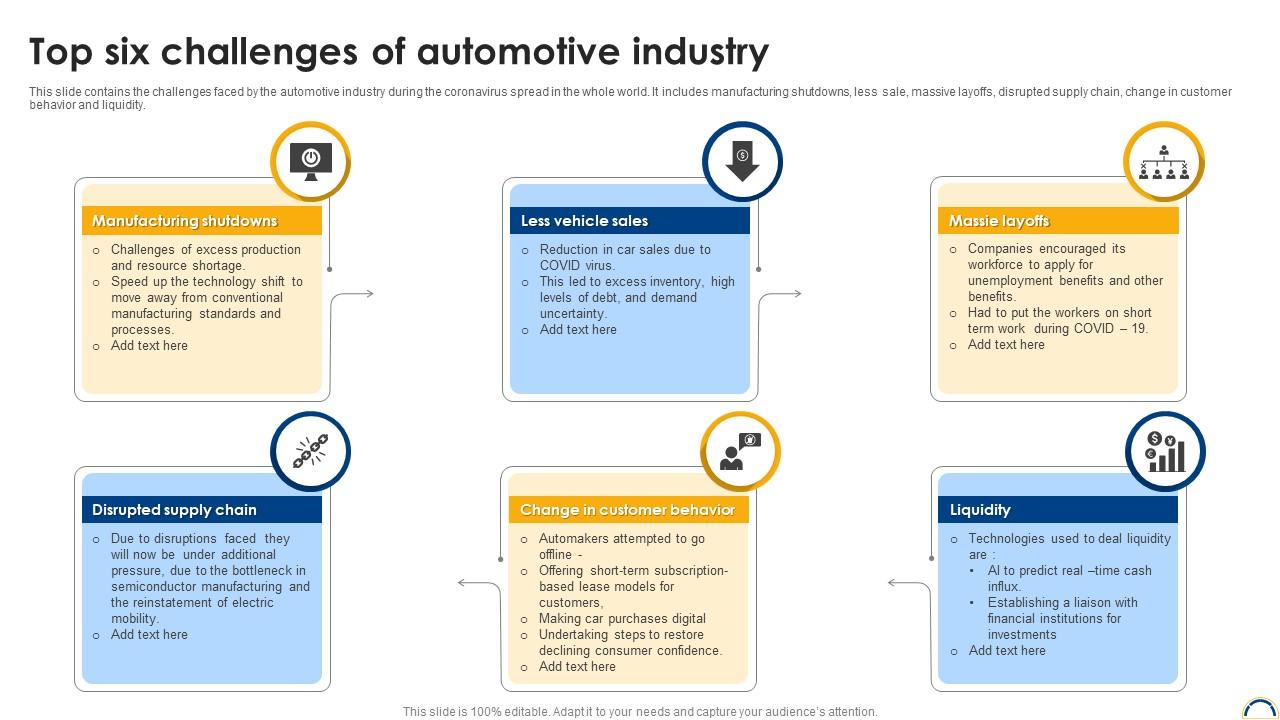

Bmw And Porsches China Challenges A Growing Trend In The Automotive Industry

May 02, 2025

Bmw And Porsches China Challenges A Growing Trend In The Automotive Industry

May 02, 2025 -

Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 02, 2025

Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 02, 2025 -

The Strategic Importance Of Effective Middle Management For Organizational Success

May 02, 2025

The Strategic Importance Of Effective Middle Management For Organizational Success

May 02, 2025 -

School Desegregation Order Terminated The Future Of Integrated Schools

May 02, 2025

School Desegregation Order Terminated The Future Of Integrated Schools

May 02, 2025 -

Solidarnosc I Republika Czy To Te Same Wartosci Wyjatkowe Spojrzenie Sakiewicza

May 02, 2025

Solidarnosc I Republika Czy To Te Same Wartosci Wyjatkowe Spojrzenie Sakiewicza

May 02, 2025

Latest Posts

-

Macron Promet Une Pression Renforcee Sur Moscou

May 03, 2025

Macron Promet Une Pression Renforcee Sur Moscou

May 03, 2025 -

Macron Intensifie La Pression Sur La Russie Les Prochains Jours Decisifs

May 03, 2025

Macron Intensifie La Pression Sur La Russie Les Prochains Jours Decisifs

May 03, 2025 -

Emmanuel Macron Pression Accrue Sur Moscou A Venir

May 03, 2025

Emmanuel Macron Pression Accrue Sur Moscou A Venir

May 03, 2025 -

Situatsiya Vokrug Makronov Kommentariy Marii Zakharovoy

May 03, 2025

Situatsiya Vokrug Makronov Kommentariy Marii Zakharovoy

May 03, 2025 -

Ofitsialnoe Zayavlenie Zakharovoy O Seme Makron

May 03, 2025

Ofitsialnoe Zayavlenie Zakharovoy O Seme Makron

May 03, 2025