Will Trump's China Tariffs Remain At 30% Until 2025? Analysis And Implications

Table of Contents

The Current State of Trump-Era Tariffs on Chinese Goods

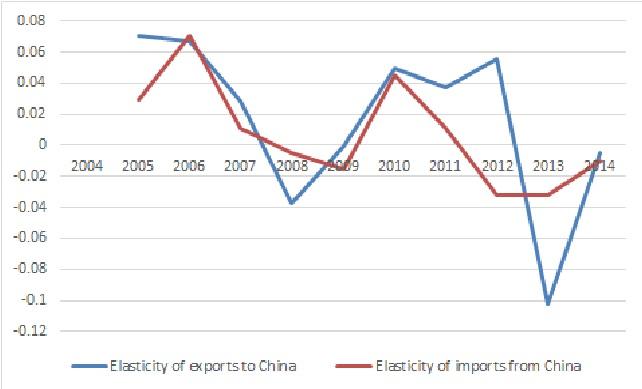

The 30% tariffs imposed during the Trump era targeted a broad spectrum of Chinese goods, significantly impacting various sectors of the US economy. Understanding the current state of these tariffs is crucial to predicting their future.

Specific Tariffs Affected

The 30% tariffs primarily affected goods categorized under Section 301 of the Trade Act of 1974. These include, but are not limited to:

- Consumer electronics: This encompasses a wide range of products, from smartphones and laptops to televisions and home appliances.

- Textiles and apparel: Garments, fabrics, and related products were heavily impacted by these tariffs.

- Machinery and equipment: Various industrial machinery and equipment imported from China faced increased costs.

- Chemicals and plastics: A significant portion of chemical and plastic imports from China were subject to the 30% tariffs.

The precise list of products is extensive and available on the official US Trade Representative website.

Existing Exemptions and Waivers

While the 30% tariff was broadly applied, some exemptions and waivers were granted to specific industries or products based on demonstrated hardship. The process for obtaining these exemptions was complex and involved demonstrating significant economic harm. However, many of these exemptions have expired or been modified, leaving many products still subject to the full tariff rate.

-

Examples of products with expired exemptions: Certain types of steel and aluminum products initially received exemptions but later faced the full 30% tariff.

-

The process for seeking tariff exemptions: This involves submitting a detailed application to the USTR, providing evidence of economic hardship.

-

Recent changes to the tariff structure: Some tariffs have been reduced or eliminated through bilateral agreements or unilateral decisions by the administration, but the majority of the 30% tariffs remain in effect.

Political and Economic Factors Influencing Tariff Decisions

Several interconnected political and economic factors will significantly influence the Biden administration's decision regarding the future of these tariffs.

Biden Administration's Trade Policy

The Biden administration has expressed a desire to recalibrate the US-China relationship, moving away from the confrontational trade policies of the previous administration. However, a complete removal of the 30% tariffs could be seen as a concession to China, potentially facing political backlash within the US. The administration is likely to consider a more nuanced approach, balancing economic concerns with strategic geopolitical considerations.

Domestic Political Pressures

Powerful lobbying groups representing various US industries exert significant influence on trade policy. Industries that benefited from the protection provided by the tariffs will likely oppose their removal, while others may lobby for their reduction or elimination. Public opinion, particularly regarding inflation and the cost of goods, also plays a significant role.

Global Economic Conditions

The current global economic climate, characterized by inflation and potential recessionary pressures, significantly impacts the feasibility of maintaining high tariffs. Increased costs due to tariffs can exacerbate inflation, hurting consumers and potentially undermining economic growth. A global recession could also make maintaining these tariffs politically untenable.

-

Key statements by government officials: Statements made by high-ranking officials, including the President and the US Trade Representative, should be carefully analyzed for indications of future policy.

-

Potential economic consequences: Maintaining the tariffs may lead to higher prices for consumers and reduced competitiveness for US businesses. Removing them could lead to increased competition and potentially lower prices, but may also lead to job losses in certain sectors.

-

Role of international trade agreements: Existing and future trade agreements will play a critical role in shaping future US-China trade relations and the potential for modifying or eliminating the 30% tariffs.

Potential Scenarios and Their Implications

Several plausible scenarios could unfold regarding the future of the 30% Trump-era tariffs on Chinese goods. Each scenario carries significant implications for various stakeholders.

Scenario 1: Maintaining the 30% Tariffs

Maintaining the 30% tariffs would likely perpetuate higher prices for consumers, potentially exacerbating inflation and slowing economic growth. Specific industries heavily reliant on imported Chinese goods would face significant challenges. This scenario is less likely given the economic pressures.

Scenario 2: Partial Reduction or Removal of Tariffs

A partial reduction or complete removal of the tariffs would offer immediate relief to consumers and businesses. However, this could lead to increased competition from Chinese goods, potentially resulting in job losses in some US industries. This scenario requires a careful assessment of the impact on various sectors.

Scenario 3: Negotiated Trade Agreement

A negotiated trade agreement with China could lead to a phased reduction or elimination of the tariffs in exchange for concessions from China on issues like intellectual property protection and market access. This scenario represents a compromise and is possibly the most likely long-term solution.

-

Quantitative economic impact: Economic modeling and analysis are needed to accurately quantify the potential impact of each scenario on GDP growth, inflation, and employment.

-

Industries most affected: Sectors heavily reliant on Chinese imports, such as consumer electronics and textiles, would be disproportionately affected.

-

Likelihood of each scenario: The current global economic situation and the Biden administration's evolving trade policy will determine the likelihood of each of these scenarios.

Conclusion

The future of the 30% Trump-era tariffs on Chinese goods remains uncertain, contingent on evolving political and economic factors. Maintaining these tariffs carries the risk of persistent inflation and reduced economic growth, while their removal or reduction could lead to increased competition and potential job losses in certain sectors. A negotiated trade agreement offers a potential compromise, but its feasibility and terms remain uncertain.

The uncertainty surrounding the future of these tariffs necessitates continuous monitoring of trade policy updates. Stay informed on developments regarding Trump's China tariffs and their potential impact on your business or investments. Regularly review reliable news sources and official government announcements to understand the evolving landscape of US-China trade relations and the implications of the 30% tariff policy. Understanding these nuances is critical for making informed business decisions in this dynamic environment.

Featured Posts

-

350 Te Burgosur Shkembehen Midis Rusise Dhe Ukraines Fale Emirateve Te Bashkuara Arabe

May 17, 2025

350 Te Burgosur Shkembehen Midis Rusise Dhe Ukraines Fale Emirateve Te Bashkuara Arabe

May 17, 2025 -

Talleres Vs Alianza Lima Goles Resumen Y Resultado Final 2 0

May 17, 2025

Talleres Vs Alianza Lima Goles Resumen Y Resultado Final 2 0

May 17, 2025 -

Srochno Rossiya Atakovala Ukrainu Bolee Chem 200 Raketami I Dronami

May 17, 2025

Srochno Rossiya Atakovala Ukrainu Bolee Chem 200 Raketami I Dronami

May 17, 2025 -

Why Uber Stock Might Weather An Economic Downturn

May 17, 2025

Why Uber Stock Might Weather An Economic Downturn

May 17, 2025 -

Successfully Buying A Home Despite Student Loan Debt

May 17, 2025

Successfully Buying A Home Despite Student Loan Debt

May 17, 2025