WiseTech's $2.1 Billion Acquisition Of E2open: A Debt-Funded Deal

Table of Contents

Deal Structure and Financing

The WiseTech E2open acquisition was primarily funded through debt, marking a significant financial undertaking for the acquiring company. While the precise breakdown of financing sources wasn't fully disclosed, it's clear that a substantial portion came from borrowed funds, likely a combination of bank loans and potentially high-yield bonds given the deal's size. This debt-heavy approach significantly increases WiseTech's leverage, impacting its financial risk profile.

- Breakdown of Financing Sources: While the exact proportions remain undisclosed, industry experts suggest a mix of syndicated bank loans and possibly private debt placements. Further details will likely emerge in subsequent financial reports.

- Credit Rating Agency Outlook: Post-acquisition, credit rating agencies will closely scrutinize WiseTech's debt-to-equity ratio and its ability to service this increased debt load. A downgrade is a possibility if the integration process proves more challenging or less lucrative than projected.

- Impact on Dividend Policy: The substantial debt incurred to finance the acquisition might necessitate a reassessment of WiseTech's dividend policy. Maintaining or increasing dividend payouts could strain the company's cash flow, particularly during the integration phase.

Strategic Rationale Behind the Acquisition

WiseTech's acquisition of E2open isn't merely an expansion; it's a strategic move to solidify its position as a leading player in the global supply chain software market. E2open's robust platform complements WiseTech's existing offerings, creating potential synergies in multiple areas.

- Expanded Product Offerings and Market Reach: The combined entity boasts a significantly wider range of software solutions catering to a larger customer base across various industries and geographical regions. This acquisition strengthens WiseTech's position in the global market.

- Elimination of a Competitor: The acquisition removes a direct competitor, reducing competition and potentially paving the way for increased market share and pricing power. This reduces future competitive pressure.

- Synergies in Technology and Customer Base: Integrating E2open's technology with WiseTech's existing systems can lead to efficiency improvements, streamlined operations, and cost reductions. The combined customer base offers significant cross-selling opportunities.

- Economies of Scale: The larger scale operation after the WiseTech E2open Acquisition allows for potential cost savings through economies of scale in areas like research and development, sales, and marketing.

Impact on the Supply Chain Software Market

The WiseTech E2open Acquisition has profound implications for the broader supply chain software market, triggering a ripple effect across the industry.

- Increased Consolidation: This acquisition signifies an ongoing trend of consolidation within the supply chain software sector, with larger players acquiring smaller ones to gain a competitive edge.

- Potential for Higher Prices: With reduced competition, there's a potential for price increases for customers, although the actual outcome will depend on market dynamics and WiseTech's pricing strategy.

- Increased Competition from Other Providers: The acquisition will intensify competition from other major supply chain management software providers like SAP, Oracle, and Infor, who will likely seek to capitalize on the market disruption.

- Impact on Innovation: While the short-term focus may be on integration, the long-term impact on innovation remains to be seen. The combined resources could fuel innovation, but it could also lead to a focus on consolidating existing products rather than developing new ones.

Potential Risks and Challenges

Despite the strategic advantages, the WiseTech E2open acquisition presents several potential risks and challenges.

- Integration Challenges and Costs: Integrating two large organizations with different cultures, technologies, and operational processes can be complex and costly, potentially delaying the realization of synergies.

- Risks Related to Debt Servicing: The significant debt burden could pose a challenge, especially if the integration process experiences setbacks or if economic conditions deteriorate.

- Potential for Customer Loss: Integration issues could lead to disruptions and dissatisfaction among customers, potentially resulting in churn and lost revenue.

- Regulatory Hurdles and Antitrust Concerns: Regulatory scrutiny and potential antitrust concerns are another significant risk. Antitrust authorities might investigate the deal for potential anti-competitive practices.

Conclusion

The WiseTech E2open Acquisition, a substantial debt-funded deal, represents a bold strategic move with the potential to reshape the supply chain software landscape. While offering significant advantages through expanded market reach and enhanced product offerings, it also carries substantial financial risks and integration challenges. The success of this acquisition hinges on effectively managing the debt, seamlessly integrating the two companies, and navigating potential regulatory hurdles. To understand the long-term effects, it's crucial to closely follow WiseTech and E2open's financial reports and monitor the integration process. Further research into the impact on competing supply chain management software solutions will also provide valuable insights into the evolving dynamics of this crucial sector. Stay informed about the unfolding consequences of this significant WiseTech E2open Acquisition.

Featured Posts

-

Trumps Comments On Iran Deal Following Talks Indicate Potential Breakthrough

May 27, 2025

Trumps Comments On Iran Deal Following Talks Indicate Potential Breakthrough

May 27, 2025 -

The Studio Apple Tv Episode Release Schedule And Dates

May 27, 2025

The Studio Apple Tv Episode Release Schedule And Dates

May 27, 2025 -

Mirel Curea Despre Manipularea Opiniei Publice Prin Interes Politic

May 27, 2025

Mirel Curea Despre Manipularea Opiniei Publice Prin Interes Politic

May 27, 2025 -

Trump Declares Taylor Swift Not Hot Ignites Maga Celebration

May 27, 2025

Trump Declares Taylor Swift Not Hot Ignites Maga Celebration

May 27, 2025 -

Fire Country Season 3 Episode 16 Release Date Time And Streaming Options

May 27, 2025

Fire Country Season 3 Episode 16 Release Date Time And Streaming Options

May 27, 2025

Latest Posts

-

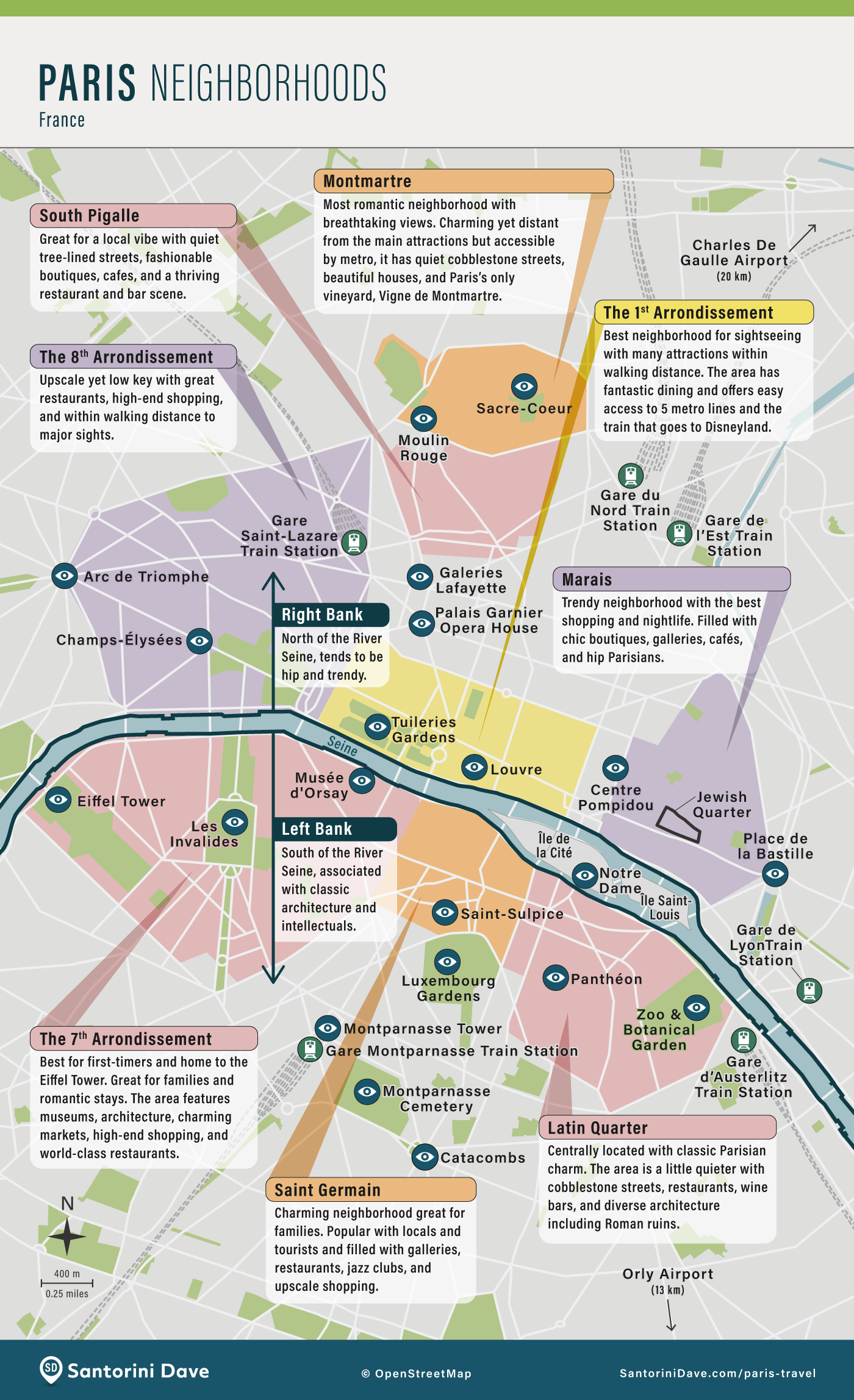

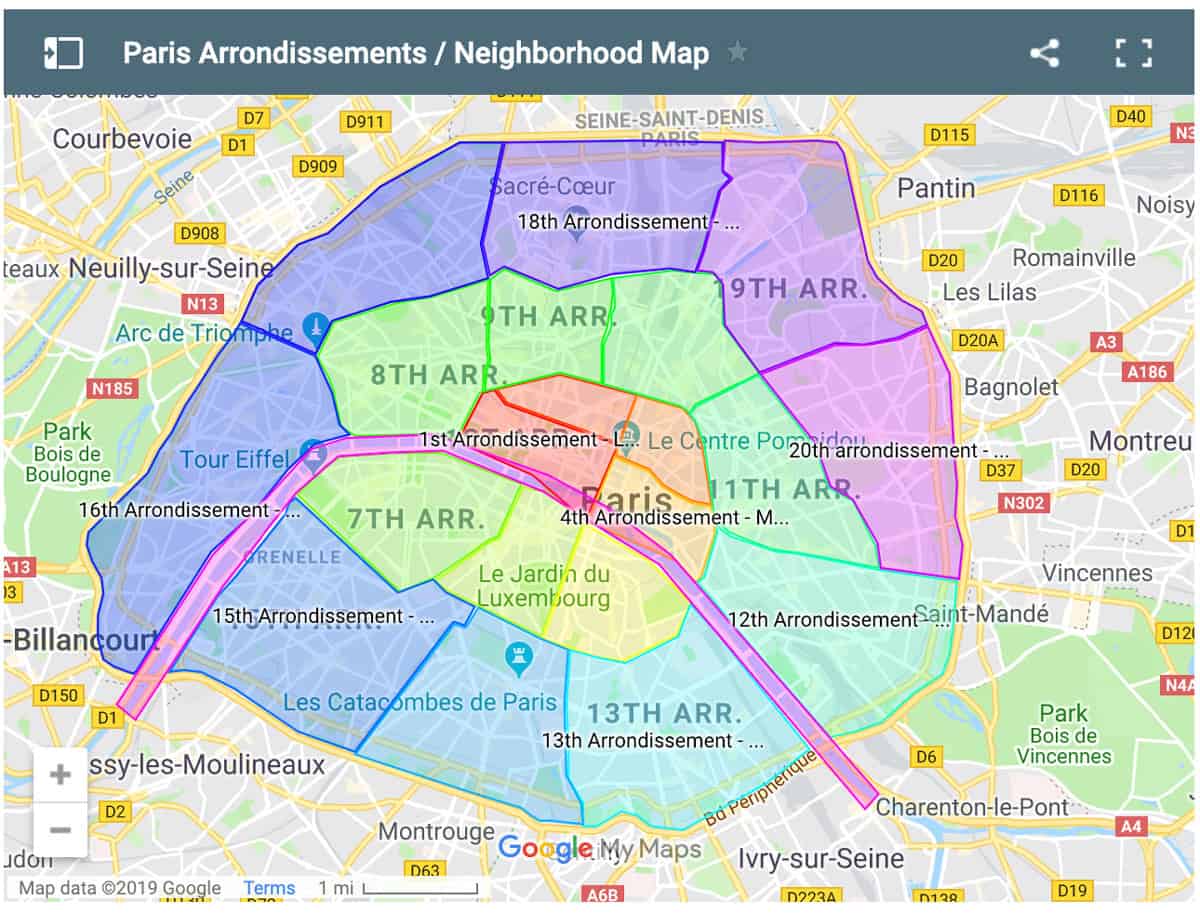

Paris Neighborhoods Choosing The Right Area For Your Trip

May 30, 2025

Paris Neighborhoods Choosing The Right Area For Your Trip

May 30, 2025 -

Finding The Perfect Parisian Neighborhood An Insiders Guide

May 30, 2025

Finding The Perfect Parisian Neighborhood An Insiders Guide

May 30, 2025 -

Tunnel De Tende Ouverture Prevue En Juin Selon Le Ministre Tabarot

May 30, 2025

Tunnel De Tende Ouverture Prevue En Juin Selon Le Ministre Tabarot

May 30, 2025 -

Ouverture Du Tunnel De Tende En Juin Confirmation Du Ministre Tabarot

May 30, 2025

Ouverture Du Tunnel De Tende En Juin Confirmation Du Ministre Tabarot

May 30, 2025 -

Where To Stay In Paris A Guide To The Citys Best Neighborhoods

May 30, 2025

Where To Stay In Paris A Guide To The Citys Best Neighborhoods

May 30, 2025