Women & Finance: 3 Costly Errors To Avoid

Table of Contents

Underestimating the Power of Long-Term Investing

Many women delay or underinvest in long-term strategies like retirement accounts (401k, IRA) due to various factors. These can include career breaks to raise children, lower salaries compared to male counterparts, or a simple lack of confidence in their investment abilities. However, underestimating the power of long-term investing is a costly mistake that can severely impact your financial well-being in the long run. For women, long-term investment strategies are particularly crucial given the potential for longer lifespans and the realities of gender-based pay gaps.

-

The Magic of Compound Interest: Compound interest is the interest earned on both the principal amount and accumulated interest. The earlier you start investing, the more time your money has to grow exponentially. Even small, consistent contributions can yield significant returns over decades. This is a crucial concept for effective retirement planning for women.

-

Setting Realistic Financial Goals: Before diving into investments, define your financial goals. What kind of retirement lifestyle do you envision? Do you plan to travel? Buy a vacation home? Setting clear, measurable goals provides a roadmap for your investment strategy. Creating a personalized investment plan is essential for women's investment strategies.

-

Diversification is Key: A diversified investment portfolio, including stocks, bonds, and mutual funds, helps manage risk. Don't put all your eggs in one basket! Spread your investments across different asset classes to reduce the impact of potential losses in any single area. This is vital for mitigating risk in women's investment strategies.

-

Addressing Risk Tolerance: Investing involves risk, but your risk tolerance is personal. Consider your age, financial situation, and comfort level with potential losses when selecting investments. There are resources available to help you assess your risk tolerance and build a portfolio aligned with it.

-

Seek Professional Guidance: Don't hesitate to seek help from financial advisors specializing in women's financial planning. They can provide personalized guidance, create a customized investment plan, and address specific concerns you may have.

Ignoring the Importance of Financial Education and Planning

A lack of financial knowledge can lead to poor financial decisions and ultimately hinder women's financial independence. This includes everything from budgeting and debt management to understanding investment options and estate planning. Prioritizing financial education and creating a comprehensive financial plan are essential steps towards a secure financial future.

-

Access Reputable Resources: Numerous resources are available to improve your financial literacy. Explore websites like the National Foundation for Credit Counseling, online courses, financial literacy books, and workshops specifically designed for women. These resources for financial education are invaluable.

-

Budgeting and Expense Tracking: Creating a realistic budget is crucial for managing your finances effectively. Track your income and expenses to identify areas where you can save and allocate funds towards your financial goals. Budgeting for women needs to account for unique circumstances such as childcare or eldercare responsibilities.

-

Debt Management Strategies: High levels of debt can significantly impact your financial health. Explore strategies like the debt snowball or debt avalanche methods to pay down your debts efficiently. Effective debt management is key for women's financial well-being.

-

Setting SMART Financial Goals: Set Specific, Measurable, Achievable, Relevant, and Time-bound (SMART) financial goals. Whether it’s saving for a down payment, paying off student loans, or building a retirement nest egg, having clear goals motivates you to stay on track.

-

Professional Financial Advice: Consulting a financial advisor can provide invaluable insights and personalized guidance. They can help you create a comprehensive financial plan that addresses your unique circumstances and goals. This is particularly important for navigating complex financial topics.

Failing to Plan for Life's Unexpected Events

Life is unpredictable. Unexpected events like job loss, illness, or accidents can significantly impact your finances. Failing to plan for these unforeseen circumstances can leave you vulnerable and financially insecure.

-

Building an Emergency Fund: An emergency fund, ideally covering 3-6 months of living expenses, is crucial. This fund provides a safety net during unexpected job losses or medical emergencies. This is essential for women's financial security.

-

Comprehensive Insurance Coverage: Adequate insurance coverage is paramount. This includes health insurance, life insurance, and disability insurance. Consider the unique insurance needs of women, such as maternity coverage and long-term care insurance. Insurance planning for women should address these specific needs.

-

Assessing Your Insurance Needs: Regularly review your insurance policies to ensure they meet your current needs and circumstances. Adjust coverage as your life changes and be aware of any gaps in your protection.

-

Finding Affordable Coverage: Shop around for affordable insurance options, compare quotes, and don't be afraid to negotiate. Many resources are available to help you find suitable and affordable coverage.

-

Regular Policy Review: Life changes, and your insurance needs will evolve with them. Review your policies annually to ensure they continue to provide adequate coverage.

Conclusion

Avoiding these three common financial mistakes—underestimating long-term investing, neglecting financial education and planning, and failing to plan for unexpected events—is crucial for women seeking financial security and independence. Taking proactive steps towards financial literacy and planning empowers you to take control of your financial future. Start building a strong financial foundation today! Learn more about smart investment strategies for women and effective financial planning tailored to your needs. Take control of your women & finance journey now!

Featured Posts

-

Love Monster Exploring The Psychology Behind The Character

May 22, 2025

Love Monster Exploring The Psychology Behind The Character

May 22, 2025 -

Decouvrez Hell City La Brasserie Incontournable Pres Du Hellfest

May 22, 2025

Decouvrez Hell City La Brasserie Incontournable Pres Du Hellfest

May 22, 2025 -

Canada Post Workers Strike What Businesses Need To Know

May 22, 2025

Canada Post Workers Strike What Businesses Need To Know

May 22, 2025 -

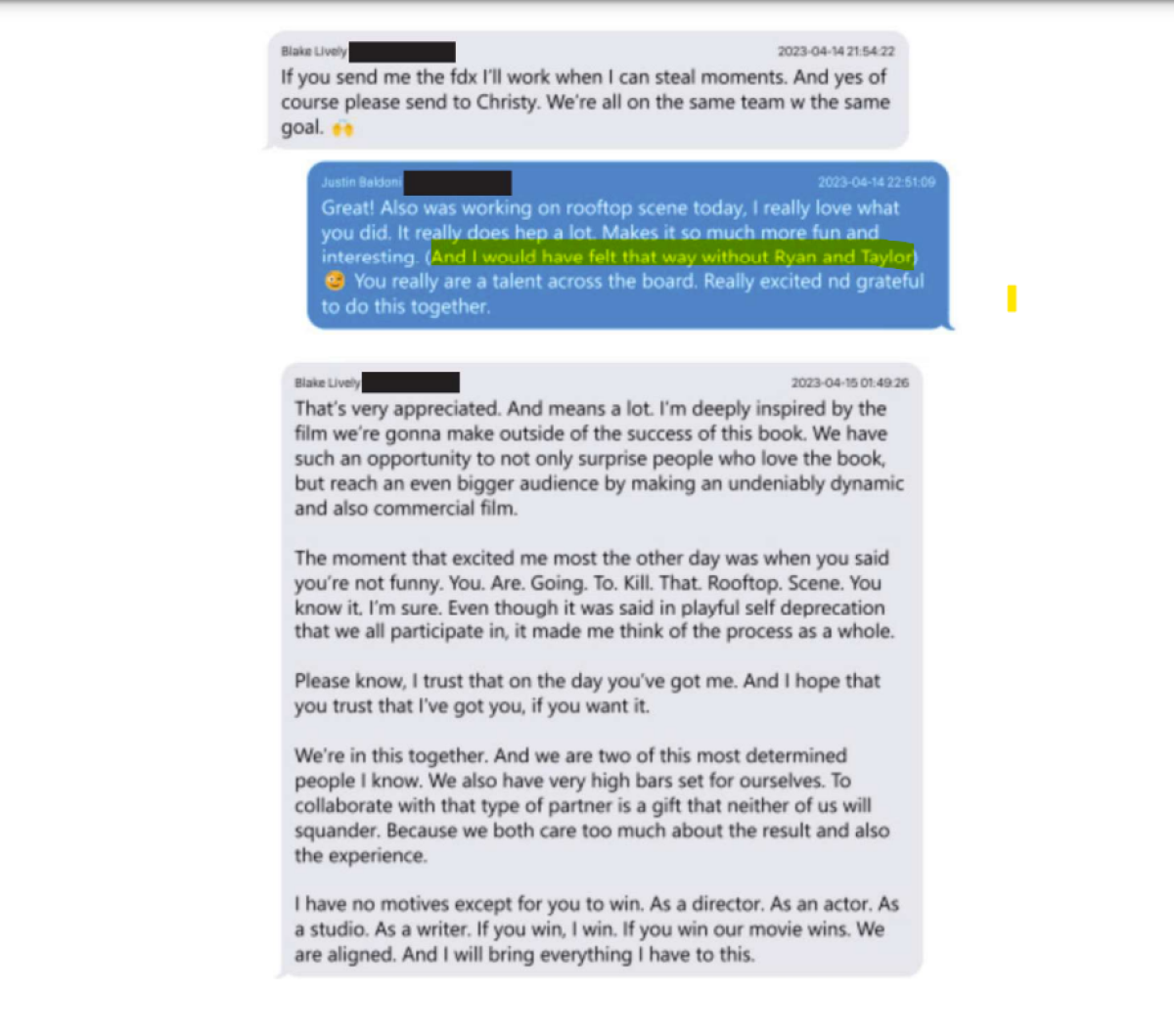

Dissecting The Alleged Incidents Involving Blake Lively

May 22, 2025

Dissecting The Alleged Incidents Involving Blake Lively

May 22, 2025 -

Man Breaks Australian Foot Crossing Record

May 22, 2025

Man Breaks Australian Foot Crossing Record

May 22, 2025

Latest Posts

-

The Blake Lively Taylor Swift Feud Leaked Texts And Blackmail Allegations Investigated

May 22, 2025

The Blake Lively Taylor Swift Feud Leaked Texts And Blackmail Allegations Investigated

May 22, 2025 -

Blake Livelys Alleged Blackmail Of Taylor Swift Explored The Baldoni Dispute And Leaked Texts

May 22, 2025

Blake Livelys Alleged Blackmail Of Taylor Swift Explored The Baldoni Dispute And Leaked Texts

May 22, 2025 -

Taylor Swift And Blake Lively Feud Allegations Of Blackmail And Leaked Texts

May 22, 2025

Taylor Swift And Blake Lively Feud Allegations Of Blackmail And Leaked Texts

May 22, 2025 -

Blake Lively And Taylor Swift Alleged Blackmail And Leaked Texts Amid Baldoni Feud

May 22, 2025

Blake Lively And Taylor Swift Alleged Blackmail And Leaked Texts Amid Baldoni Feud

May 22, 2025 -

Blake Lively Faces A List Backlash The Power Of Family Support

May 22, 2025

Blake Lively Faces A List Backlash The Power Of Family Support

May 22, 2025