XRP Breaks Key Resistance: Fueling Speculation Of A $10 Price Prediction

Table of Contents

Technical Analysis: The XRP Breakout and its Implications

The recent XRP price surge is supported by compelling technical indicators. The breakout signifies a potential shift in market sentiment, moving from bearish to bullish.

Chart Patterns and Indicators

- Head and Shoulders Pattern Breakout: Many analysts point to a successful breakout from a head and shoulders pattern on various XRP/USD trading charts. This classic bullish reversal pattern suggests a significant price increase is likely.

- RSI (Relative Strength Index) Above 70: The RSI, a momentum indicator, has climbed above the 70 mark, indicating overbought conditions. While this could suggest a potential short-term correction, it also confirms the strength of the recent upward trend.

- MACD (Moving Average Convergence Divergence) Bullish Crossover: The MACD indicator has shown a bullish crossover, further reinforcing the positive momentum and supporting the potential for continued XRP price growth.

- Increased Trading Volume: The breakout was accompanied by a significant increase in trading volume, indicating strong buyer conviction and reducing the likelihood of a false breakout.

- Support and Resistance Levels: Previous resistance levels have now become support levels, providing further confirmation of the bullish trend. Key support levels to watch are [insert specific price levels based on current market data].

Historical Price Action

Comparing the current XRP price action to previous movements reveals potential parallels to past bull runs.

- 2017 Bull Run Similarities: While not a perfect mirror image, the current momentum shares similarities with the 2017 bull run, characterized by significant price increases followed by periods of consolidation.

- Previous Resistance Levels: The recent breakout surpasses several key resistance levels that previously hindered XRP's price growth, suggesting a potential for further upward movement.

- Market Sentiment Shift: The overall market sentiment towards XRP has shifted noticeably, with increasing positive news and reduced uncertainty contributing to the price surge.

Fundamental Factors Supporting the $10 XRP Price Prediction

Beyond the technical analysis, several fundamental factors contribute to the optimistic $10 XRP price prediction.

Ripple's Legal Battle Progress

The ongoing legal battle between Ripple and the SEC remains a crucial factor influencing XRP's price.

- Recent Court Filings: Recent court decisions and filings have been viewed favorably by the XRP community, potentially reducing the legal uncertainty surrounding the cryptocurrency. [Cite specific examples and their interpretations].

- Positive Outcomes: A positive resolution to the lawsuit could unlock significant gains for XRP, as it removes a major obstacle to its wider adoption.

- Regulatory Clarity: A clear regulatory framework for XRP in the US could significantly boost investor confidence and fuel further price increases.

Increasing Adoption and Partnerships

The expanding use of XRP by financial institutions and payment processors is a strong positive indicator.

- RippleNet Expansion: RippleNet, Ripple's global payments network, continues to expand, onboarding new financial institutions and facilitating cross-border payments using XRP. [Provide specific examples of recent partnerships and their impact].

- Strategic Partnerships: Ripple is actively forging strategic partnerships with various companies in the finance and technology sectors, further boosting XRP's utility and potential for growth.

- Increased Transaction Volume: A rising number of transactions processed using XRP demonstrates its growing adoption in real-world applications.

XRP's Utility and Scalability

XRP's technological advantages contribute to its appeal as a payment solution.

- Fast Transaction Speeds: XRP boasts significantly faster transaction speeds compared to traditional payment systems like SWIFT, making it an attractive option for cross-border payments.

- Low Transaction Fees: The low transaction fees associated with XRP make it a cost-effective solution for various payment applications.

- Energy Efficiency: XRP’s consensus mechanism is significantly more energy-efficient than many other cryptocurrencies, addressing environmental concerns often raised in the crypto space.

Challenges and Risks Associated with the $10 XRP Price Prediction

While the outlook appears bullish, it's essential to acknowledge the potential challenges and risks.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain, posing a significant risk to XRP's price.

- Global Regulatory Scrutiny: Regulatory bodies worldwide are scrutinizing cryptocurrencies, and any adverse regulations could negatively impact XRP's price.

- Jurisdictional Differences: Regulatory frameworks differ significantly between jurisdictions, creating uncertainty and potential obstacles for XRP's global adoption.

- SEC Actions: Future actions by the SEC could further impact the price and trading of XRP.

Market Volatility

The cryptocurrency market is inherently volatile, and price corrections or downturns are possible.

- Market Sentiment Shifts: Changes in overall market sentiment can significantly influence XRP's price.

- External Factors: Geopolitical events and macroeconomic factors can also affect the crypto market and XRP's price.

- Speculative Nature: The $10 prediction is speculative and not guaranteed; investors should manage their risk accordingly.

Competition from other Cryptocurrencies

XRP faces competition from other cryptocurrencies vying for market share.

- Ethereum and other Altcoins: Ethereum and other altcoins offer competing solutions in the decentralized finance (DeFi) and payment processing sectors.

- Market Share: XRP's market capitalization and market share relative to its competitors need to be considered when assessing its future price potential.

- Technological Advancements: Continuous innovation in the cryptocurrency space means XRP must maintain its competitive edge.

Conclusion

The recent XRP price surge, fueled by a decisive break through key resistance, has led to optimistic $10 XRP price predictions. While the technical analysis and increasing adoption create a positive outlook, significant challenges remain, including regulatory uncertainty and market volatility. Investors should conduct their own thorough research and carefully consider the inherent risks before investing in XRP. Don't miss out on this potentially exciting opportunity; stay informed on the latest developments regarding XRP price predictions and market analysis to make well-informed investment decisions. Keep monitoring the XRP market and stay updated on the latest news to capitalize on potential growth. Remember to always conduct thorough due diligence before investing in any cryptocurrency, including XRP.

Featured Posts

-

Cau Chuyen Cam Dong Cua Tien Linh Dai Su Tinh Nguyen Cua Tinh Binh Duong

May 01, 2025

Cau Chuyen Cam Dong Cua Tien Linh Dai Su Tinh Nguyen Cua Tinh Binh Duong

May 01, 2025 -

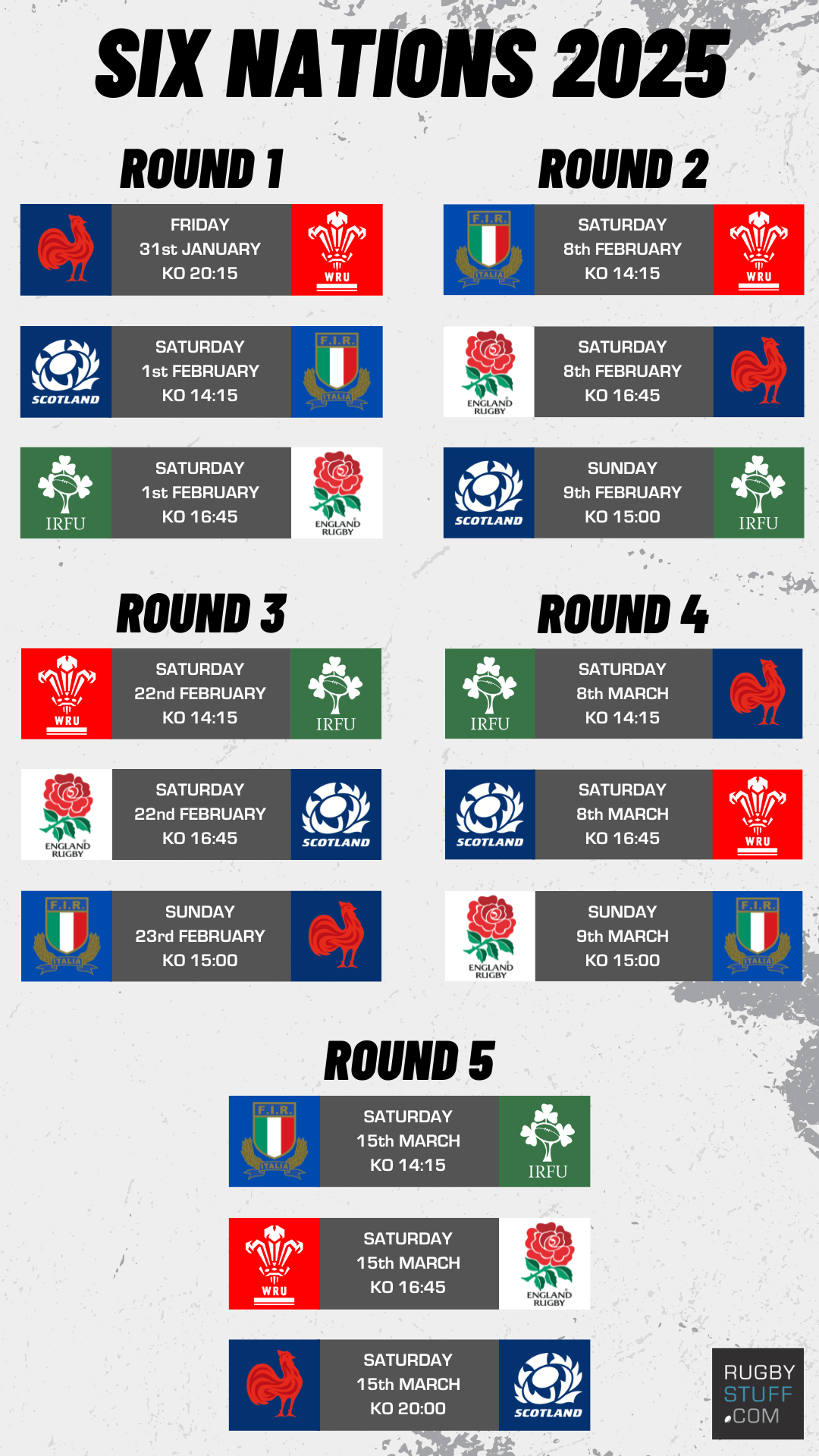

Six Nations 2024 France Triumphant England Dominant Scotland And Ireland Struggle

May 01, 2025

Six Nations 2024 France Triumphant England Dominant Scotland And Ireland Struggle

May 01, 2025 -

How To Make Crab Stuffed Shrimp With Lobster Sauce

May 01, 2025

How To Make Crab Stuffed Shrimp With Lobster Sauce

May 01, 2025 -

Xrp Price Prediction Could Xrp Hit 10 Ripples Dubai License And Resistance Break

May 01, 2025

Xrp Price Prediction Could Xrp Hit 10 Ripples Dubai License And Resistance Break

May 01, 2025 -

Ely Rda Syd Ka Mwqf Kshmyrywn Ke Lye Ansaf Awr Khte Ka Amn

May 01, 2025

Ely Rda Syd Ka Mwqf Kshmyrywn Ke Lye Ansaf Awr Khte Ka Amn

May 01, 2025

Latest Posts

-

Kamala Harris Political Future When Will She Return

May 01, 2025

Kamala Harris Political Future When Will She Return

May 01, 2025 -

Severe Flooding Cancels Thunder Over Louisville Fireworks Show

May 01, 2025

Severe Flooding Cancels Thunder Over Louisville Fireworks Show

May 01, 2025 -

Louisville Launches Debris Removal Program After Recent Storms

May 01, 2025

Louisville Launches Debris Removal Program After Recent Storms

May 01, 2025 -

Thunder Over Louisville 2024 Fireworks Show Cancellation Due To Flooding

May 01, 2025

Thunder Over Louisville 2024 Fireworks Show Cancellation Due To Flooding

May 01, 2025 -

Submit Your Debris Removal Request Louisvilles Post Storm Cleanup

May 01, 2025

Submit Your Debris Removal Request Louisvilles Post Storm Cleanup

May 01, 2025