XRP Classification Update: Ripple Lawsuit Settlement Talks And Commodity Status

Table of Contents

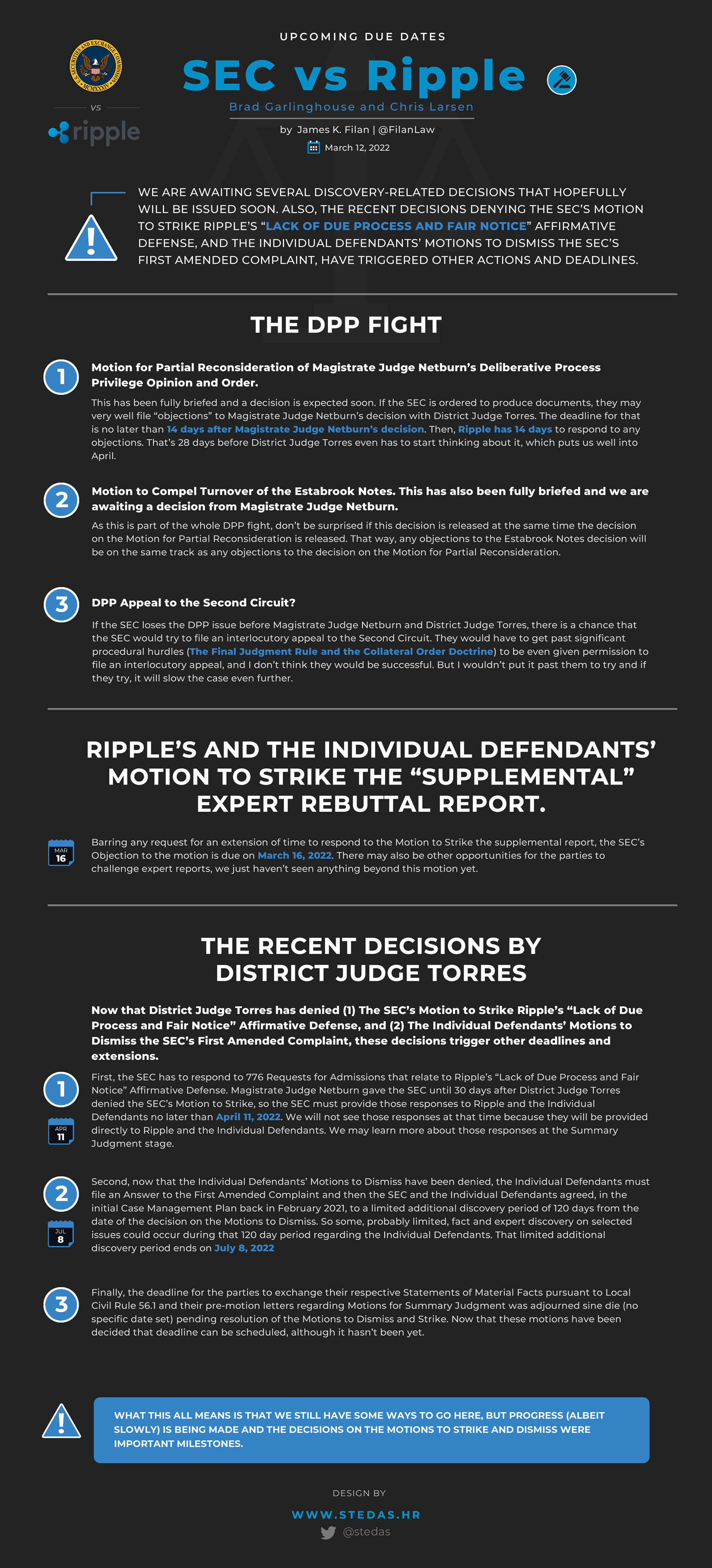

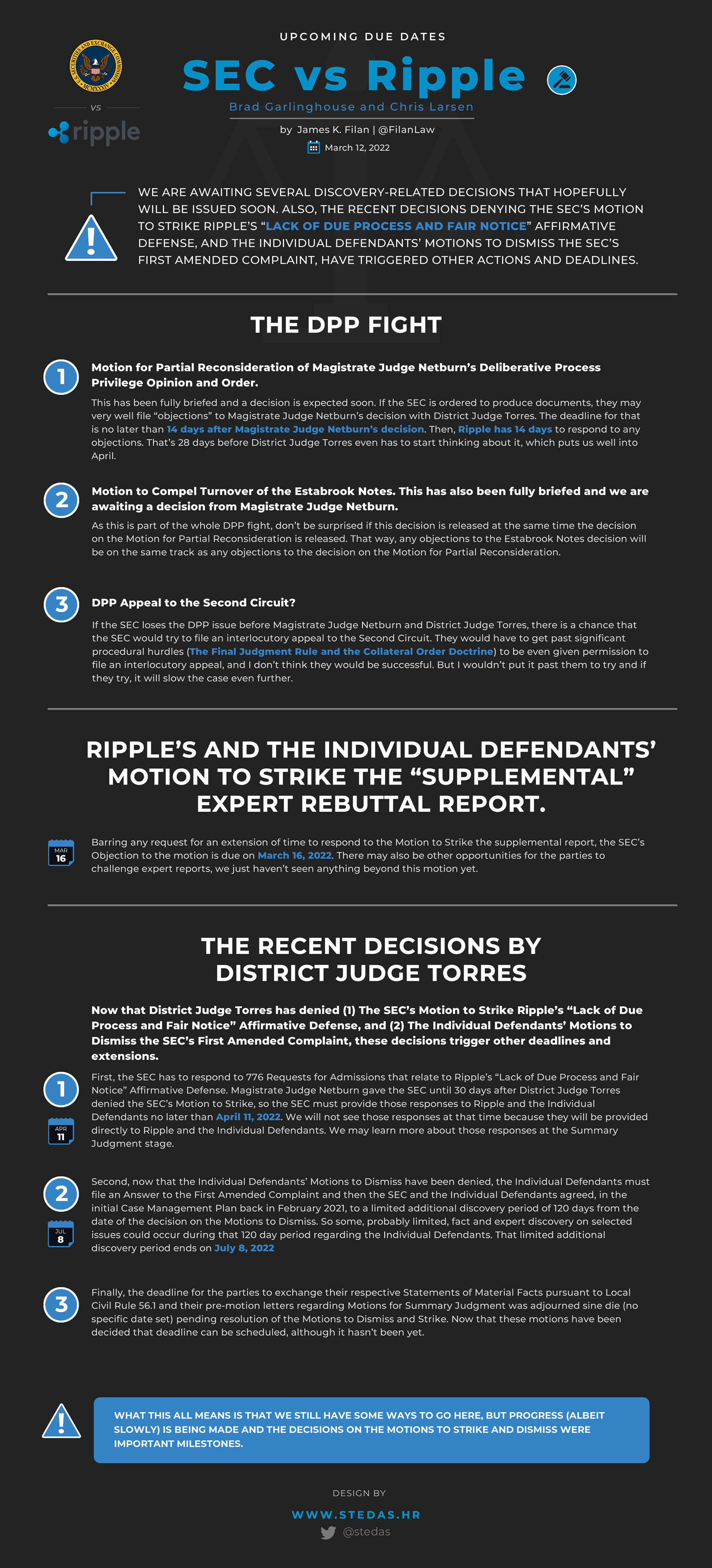

The Ripple Lawsuit: A Summary and Recent Developments

The core of the SEC's case against Ripple Labs hinges on the allegation that Ripple's sales of XRP constituted unregistered securities offerings, violating federal securities laws. The SEC argues that XRP sales met the criteria of an "investment contract" under the Howey Test, a legal framework used to determine whether an asset qualifies as a security.

-

Key arguments from the SEC: The SEC claims Ripple knowingly sold XRP as an unregistered security, profiting from the sale while misleading investors about its regulatory status. They point to Ripple's control over XRP's distribution and its perceived promise of future profits to investors.

-

Key arguments from Ripple: Ripple counters that XRP is a decentralized, freely traded digital asset, akin to other cryptocurrencies like Bitcoin and Ethereum. They argue that XRP sales did not constitute investment contracts, as purchasers lacked the expectation of profit derived solely from Ripple's efforts. They highlight XRP's utility in facilitating cross-border payments on their RippleNet platform.

-

Significant court rulings and their impact: The court's rulings have seen significant swings affecting XRP's price. Positive rulings for Ripple have generally resulted in price increases, while negative news has caused sharp drops. Recent developments, including [insert specific recent court rulings or motions here, citing sources], have [describe impact on XRP price and market sentiment].

-

Settlement negotiations: While both parties have expressed openness to settlement, progress has been [describe the pace and apparent success of settlement talks - slow, stalled, or showing progress. Cite sources if possible]. Public statements from Ripple and the SEC regarding settlement remain [describe tone - vague, optimistic, pessimistic, etc.].

-

Potential outcomes: The case could result in a win for Ripple, validating XRP as a non-security; a win for the SEC, establishing XRP as a security with significant implications; or a negotiated settlement, potentially leading to a compromise on XRP's classification or future sales practices. Each scenario carries vastly different consequences for XRP and the cryptocurrency market as a whole.

The Commodity vs. Security Debate: What's at Stake for XRP?

The distinction between a security and a commodity is pivotal for XRP's future. A security is typically an investment contract offering profit based on the efforts of others, while a commodity is a raw material or primary agricultural product.

-

Security vs. Commodity: Bitcoin, for example, is often considered a decentralized commodity due to its inherent properties and lack of a central issuer promising returns. A stock, conversely, is a clear example of a security.

-

The Howey Test: This test evaluates whether an investment involves an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others. The SEC's application of the Howey Test to XRP is a central point of contention in the lawsuit.

-

Arguments for and against XRP as a security: Proponents of XRP as a security point to Ripple's control over XRP distribution and its marketing efforts, suggesting an expectation of profit based on Ripple's actions. Conversely, opponents highlight XRP's decentralized nature, its use in cross-border payments, and its independent trading outside of Ripple's direct control.

-

Impact of commodity classification: If classified as a commodity, XRP might experience increased regulatory clarity, potentially boosting investor confidence and facilitating wider adoption. However, this classification may not prevent future regulatory scrutiny, particularly regarding anti-money laundering (AML) and know-your-customer (KYC) compliance.

-

Broader implications: The outcome significantly impacts not only XRP but also shapes the future regulatory landscape for cryptocurrencies. A broad definition of "security" could stifle innovation, while a narrower definition might create regulatory gaps.

International Regulatory Perspectives on XRP

The regulatory landscape for XRP varies considerably across jurisdictions.

-

Different views: Some countries have taken a relatively hands-off approach, while others have implemented stricter regulations. For instance, [insert examples of different regulatory approaches in specific countries, citing sources].

-

International regulatory actions: International bodies like the Financial Action Task Force (FATF) are increasingly focusing on cryptocurrency regulation, though specific actions concerning XRP remain limited. [Insert examples of relevant actions and their impact, citing sources.]

-

Regulatory arbitrage: The disparity in regulatory approaches creates opportunities for regulatory arbitrage, where traders might move XRP to jurisdictions with more favorable regulatory environments. This can impact price stability and the overall global market for XRP.

Impact of the Ripple Lawsuit on XRP Price and Market Sentiment

The Ripple lawsuit has significantly influenced XRP's price and market sentiment.

-

Correlation between lawsuit progress and price: Positive developments in the case generally lead to price increases, reflecting growing investor confidence. Conversely, negative news often triggers price drops and increased market volatility.

-

Investor sentiment: News related to the lawsuit significantly shapes investor sentiment, impacting trading volume and market capitalization. [Describe the impact of positive/negative news on market sentiment, citing examples.]

-

Trading volume and market capitalization: Examine the correlation between court decisions, media coverage, and the trading volume and market cap of XRP. [Provide data illustrating this correlation, if available. Cite sources.]

-

Cautious outlook on price prediction: Predicting XRP's future price remains highly speculative. The outcome of the Ripple lawsuit is a primary driver of uncertainty, making accurate predictions extremely challenging.

Conclusion

The Ripple lawsuit and the ongoing debate surrounding XRP's classification as a security or commodity remain highly significant events impacting the cryptocurrency market. While the outcome of the case remains uncertain, understanding the latest developments and the arguments presented by both sides is essential for navigating the complexities of the XRP landscape. The potential implications for regulatory clarity and global adoption are profound.

Call to Action: Stay informed about the latest updates on the XRP classification by following reputable news sources and legal analyses. Continue to monitor the Ripple lawsuit and the evolving regulatory landscape to make informed decisions about your XRP investments. Understanding the commodity status debate is crucial for navigating the future of this digital asset.

Featured Posts

-

Stroomstoring Blokkeert Duurzaam Schoolgebouw Kampen Kort Geding Tegen Enexis

May 01, 2025

Stroomstoring Blokkeert Duurzaam Schoolgebouw Kampen Kort Geding Tegen Enexis

May 01, 2025 -

Simple Shrimp Ramen Stir Fry Recipe For Beginners

May 01, 2025

Simple Shrimp Ramen Stir Fry Recipe For Beginners

May 01, 2025 -

Dragons Den A Guide To Success

May 01, 2025

Dragons Den A Guide To Success

May 01, 2025 -

Legal Battle Erupts Documentary Copyright Claim Against Michael Sheen And Channel 4

May 01, 2025

Legal Battle Erupts Documentary Copyright Claim Against Michael Sheen And Channel 4

May 01, 2025 -

Invest Smart A Map Of The Countrys Promising Business Hotspots

May 01, 2025

Invest Smart A Map Of The Countrys Promising Business Hotspots

May 01, 2025

Latest Posts

-

Noa Argamani Rescued Hostage Honored Among Times 100 Most Influential

May 01, 2025

Noa Argamani Rescued Hostage Honored Among Times 100 Most Influential

May 01, 2025 -

Noa Argamani Named To Times 100 Most Influential People List 2025

May 01, 2025

Noa Argamani Named To Times 100 Most Influential People List 2025

May 01, 2025 -

Israeli Hostage Noa Argamani Named To Times 100 Most Influential People

May 01, 2025

Israeli Hostage Noa Argamani Named To Times 100 Most Influential People

May 01, 2025 -

Time Recognizes Noa Argamani Among The 100 Most Influential In 2025

May 01, 2025

Time Recognizes Noa Argamani Among The 100 Most Influential In 2025

May 01, 2025 -

Kamala Harris Political Comeback What We Know So Far

May 01, 2025

Kamala Harris Political Comeback What We Know So Far

May 01, 2025