XRP ETF Approval: Analyzing The Potential For $800 Million In Initial Investment

Table of Contents

H2: The Case for $800 Million in Initial Investment

H3: Analyzing Market Demand and Investor Sentiment

The projected $800 million in initial investment upon XRP ETF approval isn't arbitrary. It stems from a confluence of factors, including substantial pent-up demand and positive investor sentiment.

- High Existing Market Cap: XRP already boasts a significant market capitalization, demonstrating existing investor interest and a solid foundation for further growth. An ETF would significantly increase accessibility, attracting new investors.

- Proven Utility: XRP's established use cases in cross-border payments and within the RippleNet network contribute to its appeal. This demonstrable utility differentiates it from many other cryptocurrencies solely focused on speculation.

- Price History and Potential: XRP's price history, while volatile, shows periods of significant growth. The potential for future price appreciation, coupled with the ease of access via an ETF, makes it attractive to both retail and institutional investors.

- Institutional Investor Participation: The approval of an XRP ETF would open the doors for institutional investors, who often require the regulated structure of an ETF before investing in cryptocurrencies. This influx of institutional capital could significantly contribute to the $800 million figure.

The pent-up demand from investors who have been hesitant to invest directly in XRP due to regulatory uncertainty and the complexity of accessing the cryptocurrency market could translate into a massive influx of funds the moment an ETF is approved. Several financial analysts predict significant upward price movement, bolstering this $800 million estimate.

H3: The Role of SEC Approval and Regulatory Clarity

SEC approval is paramount. It would legitimize XRP in the eyes of many investors, significantly reducing perceived investment risk.

- Increased Investor Confidence: SEC approval would signal regulatory acceptance, leading to a surge in investor confidence and, consequently, investment.

- Global Impact: The approval by the SEC could potentially trigger similar approvals in other countries, further accelerating adoption and investment.

- Reduced Regulatory Hurdles: The approval process itself would remove a major hurdle for institutional investors, many of whom are restricted from directly investing in unregulated cryptocurrencies.

- Challenges Remain: It's important to acknowledge that challenges remain, including the ongoing legal battles facing Ripple Labs. While the SEC's decision would significantly influence investor sentiment, there are still potential hurdles to overcome.

H2: Potential Impact of XRP ETF Approval on the Market

H3: Price Volatility and Market Capitalization

The approval of an XRP ETF is expected to significantly impact XRP's price and market capitalization.

- Increased Liquidity: An ETF would dramatically increase the liquidity of XRP, making it easier to buy and sell. This increased liquidity could lead to more stable price action, although short-term volatility is still likely.

- Trading Volume Surge: Expect a considerable surge in trading volume as more investors gain access to XRP through the ETF.

- Market Cap Growth: The influx of capital, potentially exceeding $800 million initially, could significantly boost XRP's market capitalization. Projections vary, but substantial growth is anticipated.

- Ripple Effects: The impact on XRP could extend to other cryptocurrencies, possibly increasing overall market interest and potentially influencing the price of other altcoins.

H3: Increased Adoption and Mainstream Acceptance

ETF approval could be a catalyst for wider adoption and mainstream acceptance of XRP.

- Enhanced Accessibility: ETFs make investing in XRP considerably easier for the average investor, removing many of the technical barriers associated with directly purchasing cryptocurrencies.

- Legitimacy and Trust: The regulatory approval would greatly enhance XRP's legitimacy and build trust among investors who may have previously been hesitant.

- Wider Applications: Increased adoption could stimulate further development and implementation of XRP in payment systems and other applications, increasing its utility and value.

- Mainstream Integration: With greater accessibility and legitimacy, XRP could become a more widely accepted digital asset, potentially bridging the gap between traditional finance and the cryptocurrency world.

H2: Risks and Considerations Associated with XRP ETF Investment

H3: Regulatory Uncertainty and Legal Challenges

Despite the potential upside, it is crucial to acknowledge the inherent risks.

- Ongoing Legal Battles: The ongoing legal proceedings involving Ripple Labs still present a level of regulatory uncertainty. The outcome could significantly impact XRP's price and future prospects.

- Future Regulatory Changes: The regulatory landscape for cryptocurrencies is constantly evolving. Future changes in regulations could negatively impact XRP's price and the value of an XRP ETF.

- SEC Decisions: The SEC's decision, while crucial, is not a guarantee of long-term success. Future actions by regulators in other jurisdictions could also affect the market.

H3: Market Volatility and Investment Risk

Cryptocurrency investments are inherently volatile.

- Price Fluctuations: Even with ETF approval, XRP's price is likely to fluctuate significantly. Investors should be prepared for periods of both significant gains and potential losses.

- Diversification: It's essential to diversify your investment portfolio. Don't put all your eggs in one basket, especially in the volatile cryptocurrency market.

- Market Sentiment: Investor sentiment plays a crucial role in cryptocurrency pricing. Negative news or market trends could impact XRP's price regardless of ETF approval.

3. Conclusion: Investing in the Future of XRP with ETF Approval

The potential for an XRP ETF approval to unlock an initial $800 million investment is significant, offering the promise of increased liquidity, wider adoption, and potential price appreciation. However, it's crucial to acknowledge the associated risks, including regulatory uncertainty and inherent market volatility. The ongoing legal battles facing Ripple and the ever-changing regulatory landscape add layers of complexity.

The potential benefits of XRP ETF approval are undeniable, but thorough research and a cautious approach are essential. Stay informed about the latest developments regarding XRP ETF approval and make informed investment decisions regarding XRP ETFs. The future of XRP, and the broader cryptocurrency market, could be significantly shaped by this landmark decision. Stay informed and invest wisely in this rapidly evolving sector.

Featured Posts

-

Etf

May 08, 2025

Etf

May 08, 2025 -

Universal Credit Key Changes And Potential Financial Implications

May 08, 2025

Universal Credit Key Changes And Potential Financial Implications

May 08, 2025 -

Boston Celtics Gear Shop The Latest Collection At Fanatics

May 08, 2025

Boston Celtics Gear Shop The Latest Collection At Fanatics

May 08, 2025 -

Andor Season 2 Will It Surpass The First Season Diego Luna Weighs In

May 08, 2025

Andor Season 2 Will It Surpass The First Season Diego Luna Weighs In

May 08, 2025 -

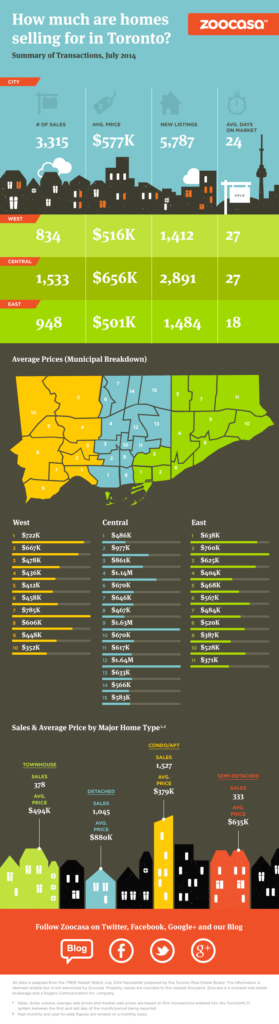

Significant Drop In Toronto Home Sales And Prices 23 And 4 Respectively

May 08, 2025

Significant Drop In Toronto Home Sales And Prices 23 And 4 Respectively

May 08, 2025