XRP Gains Momentum: Analyzing The Ripple Case, ETF Possibilities, And Future Price Trends

Table of Contents

The Ripple Case and its Impact on XRP Price

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) has significantly impacted XRP's price. Understanding this case is crucial for anyone invested in or considering investing in XRP.

Understanding the SEC vs. Ripple Lawsuit

The core of the SEC's argument is that XRP is an unregistered security, violating federal laws. Ripple, conversely, maintains that XRP is a currency and not a security.

- Key Events and Rulings: The case has seen several significant rulings, including [insert link to relevant court document or news article], which [briefly explain the ruling's impact]. [Insert another bullet point with another key event and link].

- Implications of a Favorable Ruling for Ripple: A victory for Ripple could lead to a significant surge in XRP's price, as the uncertainty surrounding its legal status would be removed. Increased institutional investment and broader adoption would likely follow.

- Impact of the Case's Uncertainty on XRP's Price Volatility: The ongoing uncertainty has contributed to XRP's price volatility. Positive developments tend to boost the price, while negative news can lead to sharp declines. This volatility presents both risks and opportunities for investors.

Recent Developments and Legal Analysis

Recent expert opinions and legal analyses suggest a growing possibility of a favorable outcome for Ripple. [Insert link to relevant legal analysis or expert opinion]. This positive shift in narrative has contributed to the recent momentum behind XRP.

- Potential for Settlement and its Effects on XRP: While a settlement is possible, its terms could significantly impact XRP's price. A favorable settlement could lead to a price increase, while an unfavorable one might further depress the price.

- Long-Term Implications of the Case's Outcome: Regardless of the outcome, the Ripple case will likely have long-term implications for the entire cryptocurrency regulatory landscape, potentially setting precedents for future cases involving other digital assets.

The Potential for XRP ETFs and Their Market Impact

The emergence of Exchange-Traded Funds (ETFs) for cryptocurrencies could be a game-changer for XRP.

What are ETFs and Why are they Important?

ETFs are investment funds traded on stock exchanges, offering investors easy access to diversified portfolios. An XRP ETF would allow investors to buy and sell XRP shares through traditional brokerage accounts, significantly increasing accessibility.

- How an XRP ETF Would Work: An XRP ETF would hold XRP in its portfolio, and investors would buy and sell shares of the ETF, mirroring the price movements of XRP.

- Benefits of ETFs for Investors: ETFs offer diversification, ease of trading, and regulatory oversight, making them an attractive investment option for both individual and institutional investors.

Regulatory Hurdles and the Path to XRP ETF Approval

The regulatory landscape for crypto ETFs is complex. The SEC, for example, has stringent requirements before approving a crypto ETF. Specific challenges for an XRP ETF include the ongoing Ripple lawsuit and the general regulatory uncertainty surrounding cryptocurrencies.

- Regulatory Bodies Involved: The SEC is the primary regulatory body in the US that would need to approve an XRP ETF. Other international regulatory bodies might also play a role.

- Likelihood of Approval: The likelihood of XRP ETF approval depends on several factors, including the outcome of the Ripple case, overall market conditions, and evolving regulatory frameworks.

- Potential Timing of an XRP ETF Launch: Predicting the exact timing is difficult, but if the Ripple case is resolved favorably, we could see an XRP ETF launch within [mention a timeframe, e.g., the next 1-2 years].

The Market Impact of an XRP ETF Listing

The listing of an XRP ETF would likely have a significant impact on the XRP market.

- Potential Price Increases: Increased demand driven by ETF listing would likely result in price increases for XRP.

- Increased Institutional Investment: ETFs make it easier for institutional investors to participate in the XRP market, potentially leading to a substantial influx of capital.

- Effect on XRP's Market Capitalization: A successful XRP ETF launch could significantly increase XRP's market capitalization, solidifying its position in the crypto market.

Predicting Future XRP Price Trends: Technical and Fundamental Analysis

Forecasting future XRP price trends requires a combination of technical and fundamental analysis.

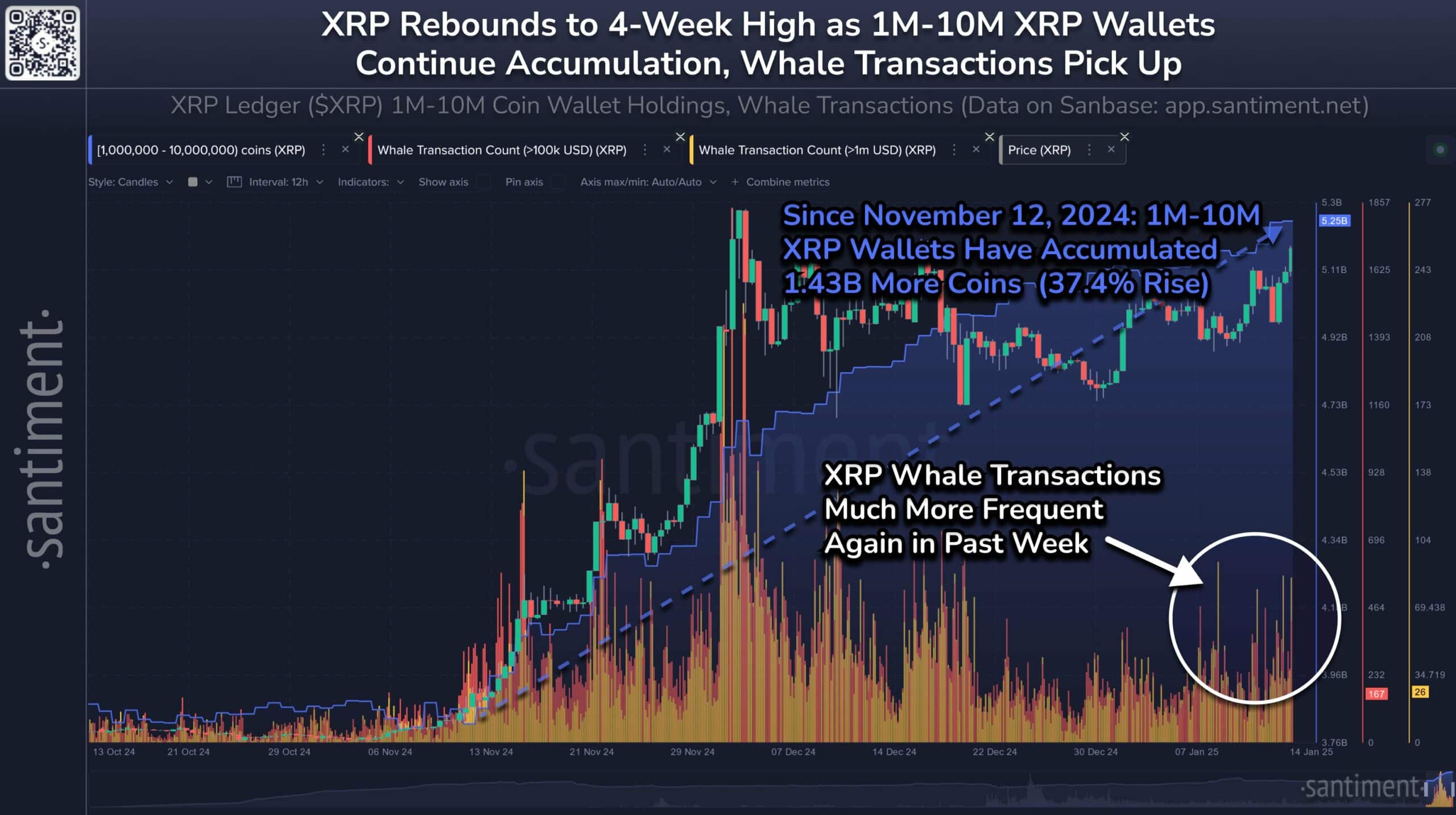

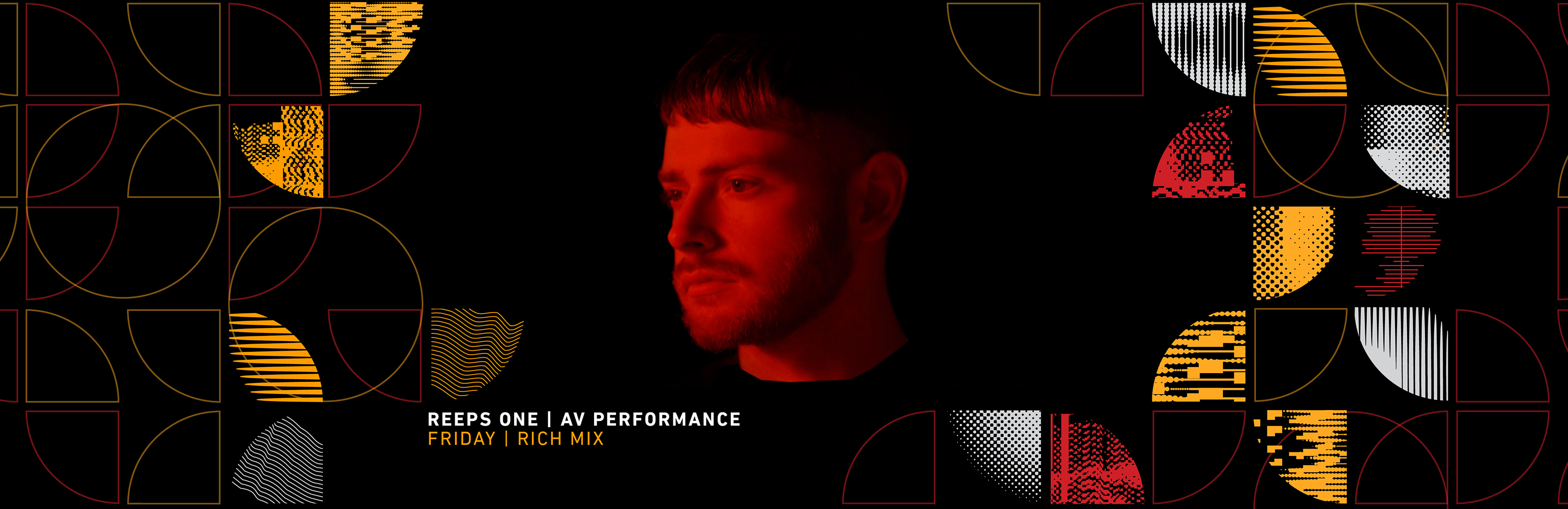

Technical Analysis of XRP Charts

Technical analysis involves studying historical price charts, identifying patterns, and using indicators to predict future price movements.

- Support and Resistance Levels: Analyzing historical data reveals key support and resistance levels that could influence future price action. [Include relevant charts and graphs].

- Price Targets: Based on technical analysis, potential price targets for XRP can be estimated, but these are subject to change based on market dynamics.

- Limitations of Technical Analysis: Technical analysis is not foolproof and should be used in conjunction with fundamental analysis.

Fundamental Analysis of XRP and the Ripple Ecosystem

Fundamental analysis focuses on the underlying value of XRP and the Ripple ecosystem.

- XRP's Utility: XRP's utility in cross-border payments and other applications is a key factor in its long-term potential. Its efficiency and low transaction costs are significant advantages.

- Strength of Ripple's Partnerships: Ripple's partnerships with financial institutions around the world are crucial for XRP adoption and growth. Strong partnerships suggest a healthy and growing ecosystem.

- Overall Health of the XRP Ecosystem: The overall health and activity within the XRP ecosystem, including development efforts and community engagement, are important indicators of its long-term prospects.

XRP Gains Momentum – A Look Ahead

In conclusion, XRP's future is intertwined with the outcome of the Ripple case, the potential for ETF approval, and the overall health of the XRP ecosystem. The recent positive developments suggest that XRP gains momentum, but the road ahead remains uncertain. A favorable ruling in the Ripple case, coupled with the launch of an XRP ETF, could trigger significant price increases and increased market adoption. However, investors should always conduct thorough research and invest responsibly.

To stay informed on the latest developments and capitalize on the potential of XRP, continue your research, consider responsible investing strategies, and stay updated on all news surrounding XRP gains momentum and the Ripple case.

Featured Posts

-

Fortnite New Shop Update Faces Player Backlash

May 02, 2025

Fortnite New Shop Update Faces Player Backlash

May 02, 2025 -

Laukiamas Hario Poterio Parkas Sanchajuje 2027 Metu Atidarymas

May 02, 2025

Laukiamas Hario Poterio Parkas Sanchajuje 2027 Metu Atidarymas

May 02, 2025 -

Supreme Court Decision Could Bar Lee From South Korean Presidential Race

May 02, 2025

Supreme Court Decision Could Bar Lee From South Korean Presidential Race

May 02, 2025 -

Spotlight On Splice At The Cay Fest Film Festival

May 02, 2025

Spotlight On Splice At The Cay Fest Film Festival

May 02, 2025 -

Arizonas Upset Victory Over Texas Tech In Big 12 Semifinals

May 02, 2025

Arizonas Upset Victory Over Texas Tech In Big 12 Semifinals

May 02, 2025

Latest Posts

-

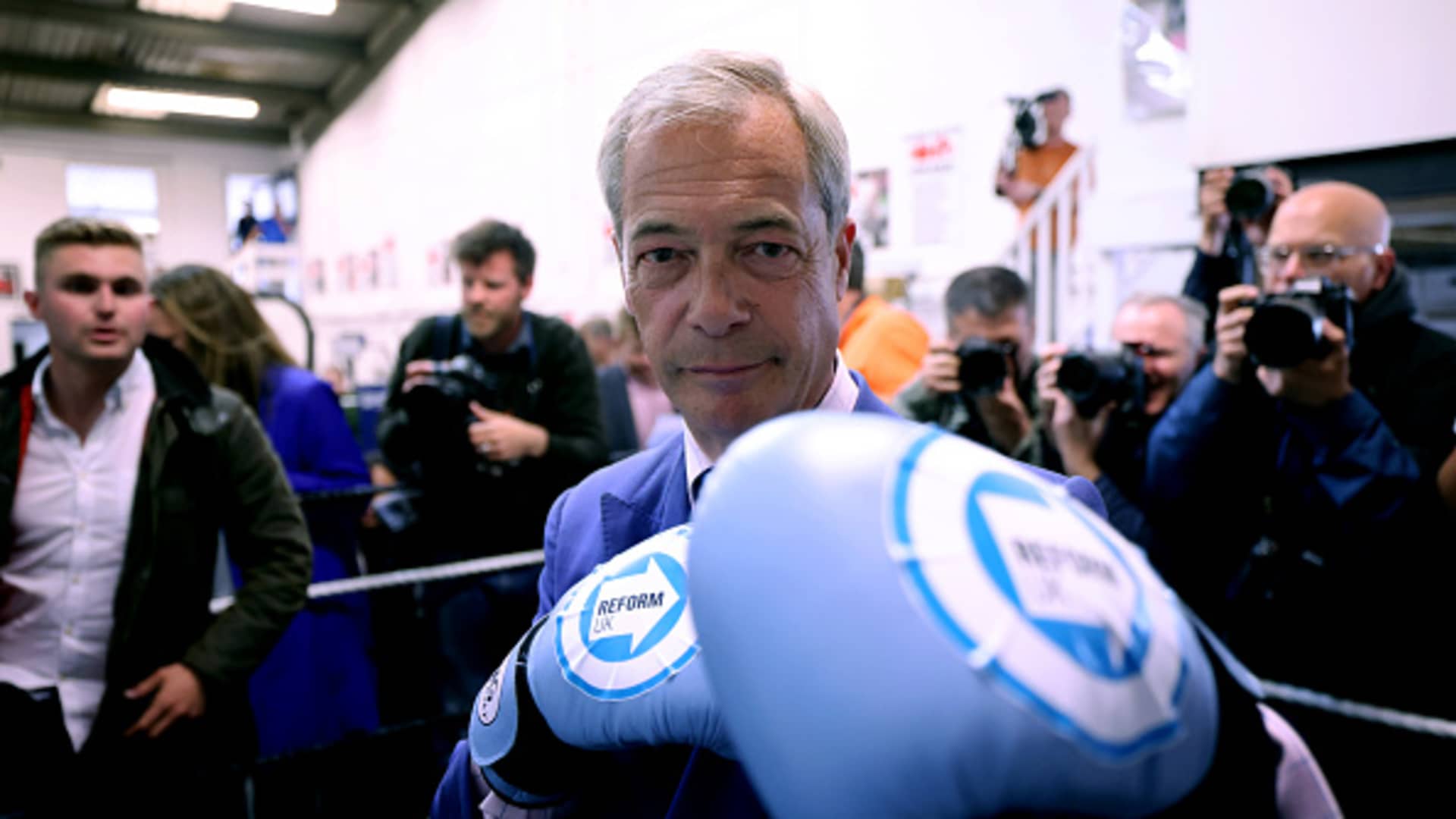

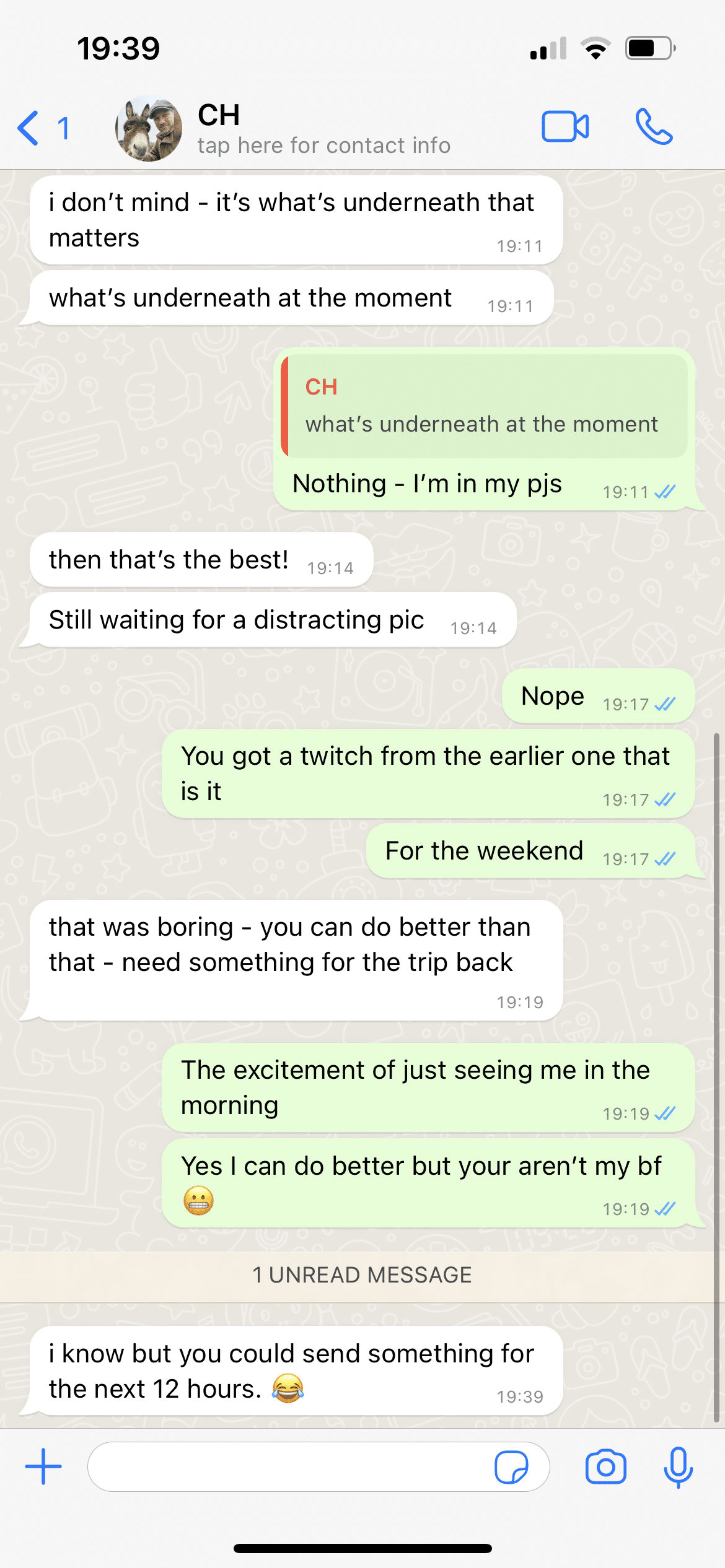

Farages Whats App Leaks Ignite Reform Party Internal Conflict

May 02, 2025

Farages Whats App Leaks Ignite Reform Party Internal Conflict

May 02, 2025 -

Ex Mp Rupert Lowe And Reform Shares Report Details Unlawful Harassment Claims

May 02, 2025

Ex Mp Rupert Lowe And Reform Shares Report Details Unlawful Harassment Claims

May 02, 2025 -

Leaked Whats App Messages Reform Party Civil War Erupts Over Farages Integrity

May 02, 2025

Leaked Whats App Messages Reform Party Civil War Erupts Over Farages Integrity

May 02, 2025 -

Reform Shares Ex Mp Rupert Lowe Faces Harassment Allegations Credible Evidence Emerges

May 02, 2025

Reform Shares Ex Mp Rupert Lowe Faces Harassment Allegations Credible Evidence Emerges

May 02, 2025 -

Great Yarmouth Responds Public Sentiment On The Rupert Lowe Issue

May 02, 2025

Great Yarmouth Responds Public Sentiment On The Rupert Lowe Issue

May 02, 2025