XRP Momentum Builds: Analyzing The Ripple Lawsuit And US ETF Prospects

Table of Contents

The Ripple Lawsuit: A Turning Point for XRP?

Recent Developments and Judge's Rulings:

The Ripple lawsuit against the Securities and Exchange Commission (SEC) has been a rollercoaster ride for XRP investors. However, recent rulings have injected a dose of optimism.

- Partial Summary Judgment: Judge Analisa Torres ruled that XRP sales on public exchanges did not constitute the sale of unregistered securities. This was a significant victory for Ripple and XRP holders. [Link to relevant news article]

- Programmatic Sales: The court's distinction between programmatic sales and institutional sales has clarified the regulatory landscape for XRP. [Link to legal document]

- Ongoing Litigation: While the case isn't entirely resolved, the partial victory has significantly improved the outlook for XRP.

Impact on XRP Price and Market Sentiment:

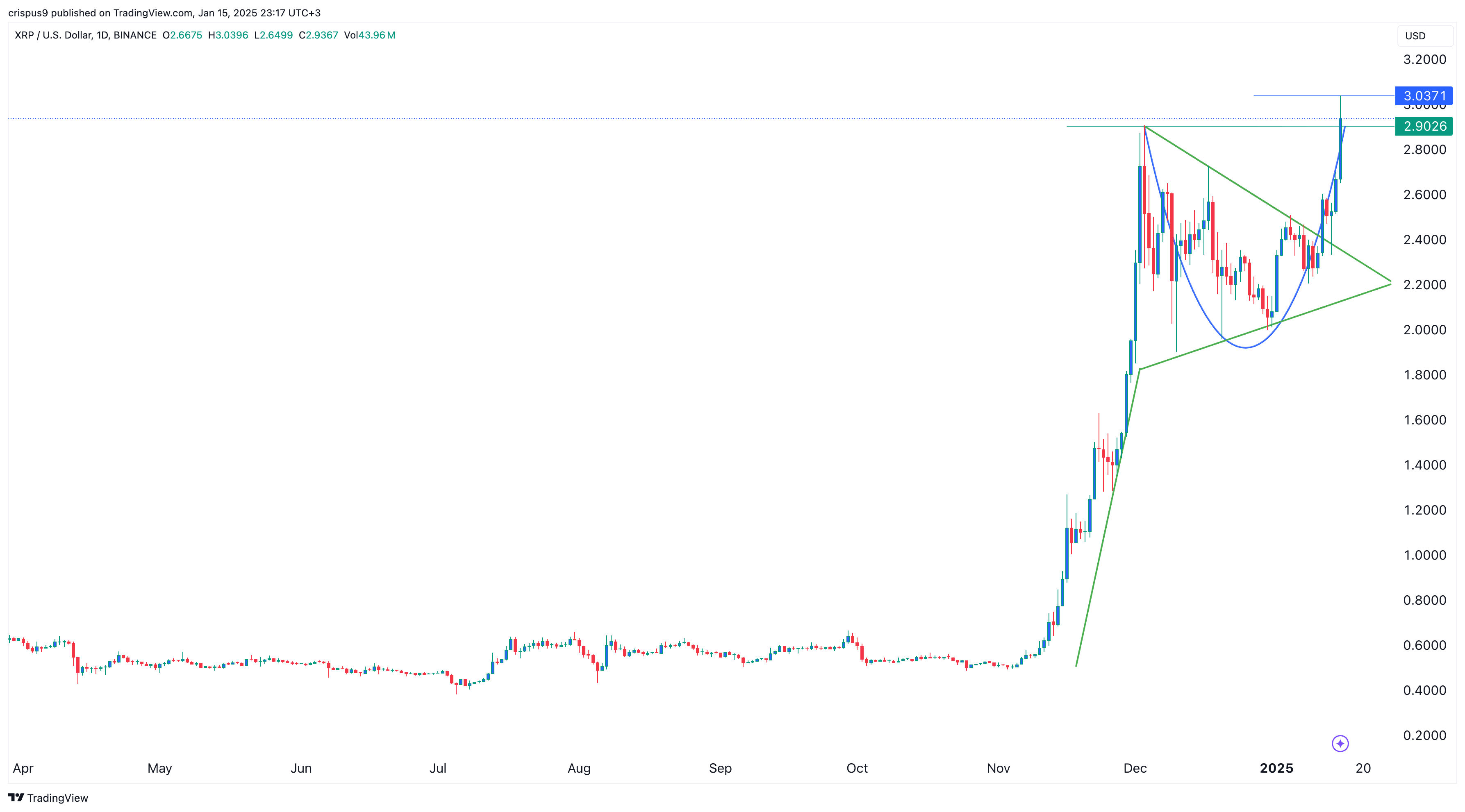

The correlation between court rulings and XRP's price is undeniable. Positive developments have generally led to price increases, while negative news has resulted in dips.

- Price Volatility: XRP price has shown significant volatility throughout the lawsuit, reflecting the fluctuating market sentiment. [Insert chart showing XRP price fluctuations correlated with key rulings]

- Investor Confidence: The partial summary judgment has boosted investor confidence, attracting new buyers and encouraging long-term holders to maintain their positions.

- Market Sentiment Analysis: Social media sentiment analysis tools show a significant shift towards positivity following key positive rulings.

Potential Future Outcomes and their Effects on XRP:

Several scenarios remain possible:

- Complete Victory for Ripple: A full dismissal of the SEC's case would likely lead to a substantial surge in XRP's price and adoption.

- Settlement: A negotiated settlement could have a less dramatic, but still positive, impact on XRP's price.

- Partial Loss for Ripple: While less favorable, a partial loss may still leave XRP with a clearer regulatory path forward.

The long-term consequences hinge on the final outcome, but the current trajectory suggests a positive outlook for XRP.

The Rise of XRP ETFs: A Catalyst for Growth?

The Appeal of XRP ETFs for Investors:

XRP ETFs offer several advantages:

- Increased Accessibility: ETFs provide easier access to XRP for institutional and retail investors compared to directly purchasing the cryptocurrency.

- Diversification: They allow investors to diversify their portfolios with exposure to the cryptocurrency market.

- Regulatory Compliance: Investing through an ETF offers a degree of regulatory compliance and oversight.

SEC's Stance and the Path to Approval:

The SEC's stance on crypto ETFs has been cautious, but the landscape is evolving.

- Gradual Acceptance: The SEC's approval of Bitcoin futures ETFs signals a growing acceptance of crypto-related investments.

- Regulatory Hurdles: The SEC will likely scrutinize any XRP ETF application carefully, particularly in light of the past regulatory uncertainty surrounding XRP.

- Potential Timeline: The approval process for an XRP ETF could take several months or even years, depending on the SEC's review.

Impact of ETF Approval on XRP Liquidity and Adoption:

ETF approval would likely have a significant impact:

- Increased Liquidity: A surge in trading volume is expected, making XRP more liquid and accessible.

- Mainstream Adoption: An ETF would increase XRP's visibility and attract mainstream investors.

- Wider Use Cases: Increased adoption could unlock new use cases for XRP, furthering its growth potential.

Technical Analysis of XRP: Identifying Key Trends

Price Charts and Indicators:

[Insert XRP price chart with key support and resistance levels marked. Include analysis of moving averages and RSI.]

XRP's price has shown considerable resilience in the face of regulatory uncertainty. The chart indicates key support levels and potential future price targets based on technical indicators.

Trading Volume and Market Capitalization:

[Insert chart showing XRP trading volume and market capitalization trends.]

Increased trading volume correlated with positive news regarding the lawsuit and ETF prospects indicates a growing interest in XRP.

Comparison to other Cryptocurrencies:

[Insert comparative chart of XRP vs. Bitcoin and Ethereum.]

While Bitcoin and Ethereum remain dominant, XRP's performance has shown relative strength, particularly in the context of the recent positive developments.

Conclusion:

The combination of positive developments in the Ripple lawsuit and the increasing likelihood of XRP ETF approval presents a compelling case for continued XRP momentum. While uncertainty remains, the potential rewards are significant. Staying informed about the unfolding legal proceedings and regulatory developments is crucial for navigating this exciting phase for XRP. Further research into XRP and its potential is highly recommended before making any investment decisions. Keep your eye on the ongoing developments surrounding XRP, as its future looks brighter than ever.

Featured Posts

-

Verdeelstation Oostwold Bewoners Teleurgesteld Over Onafwendbare Komst

May 01, 2025

Verdeelstation Oostwold Bewoners Teleurgesteld Over Onafwendbare Komst

May 01, 2025 -

Beyond China Examining The Wider Geopolitical Challenges Facing Nvidia

May 01, 2025

Beyond China Examining The Wider Geopolitical Challenges Facing Nvidia

May 01, 2025 -

Ripple Xrp Investment Weighing The Risks And Rewards For Potential Millionaires

May 01, 2025

Ripple Xrp Investment Weighing The Risks And Rewards For Potential Millionaires

May 01, 2025 -

Workboat Automation Tbs Safety And Nebofleet Collaboration

May 01, 2025

Workboat Automation Tbs Safety And Nebofleet Collaboration

May 01, 2025 -

Xrp Price Surge 400 In 3 Months Should You Buy Now

May 01, 2025

Xrp Price Surge 400 In 3 Months Should You Buy Now

May 01, 2025

Latest Posts

-

Pandemic Fraud Lab Owner Convicted Of Falsifying Covid Test Results

May 01, 2025

Pandemic Fraud Lab Owner Convicted Of Falsifying Covid Test Results

May 01, 2025 -

Guilty Plea Lab Owner Admits To Fraudulent Covid 19 Testing

May 01, 2025

Guilty Plea Lab Owner Admits To Fraudulent Covid 19 Testing

May 01, 2025 -

Covid 19 Pandemic Lab Owner Admits To Faking Test Results

May 01, 2025

Covid 19 Pandemic Lab Owner Admits To Faking Test Results

May 01, 2025 -

Ryujinx Emulator Project Termination A Nintendo Intervention

May 01, 2025

Ryujinx Emulator Project Termination A Nintendo Intervention

May 01, 2025 -

The End Of Ryujinx Nintendo Contact Leads To Development Halt

May 01, 2025

The End Of Ryujinx Nintendo Contact Leads To Development Halt

May 01, 2025