XRP Price Below $3: Should You Invest In Ripple Right Now?

Table of Contents

Current Market Conditions and XRP's Performance

The cryptocurrency market is notoriously volatile. Recent macroeconomic factors, alongside regulatory uncertainty, have impacted the overall market sentiment, directly affecting XRP's price. While Bitcoin and Ethereum often set the tone for the broader market, XRP’s price tends to react uniquely to legal developments and adoption rates. Analyzing recent price charts reveals periods of both significant gains and losses, highlighting XRP's susceptibility to market swings.

[Insert Chart/Graph showing XRP price movement over the last 3-6 months]

Key market indicators significantly influencing XRP's price include:

- Overall crypto market sentiment: A positive market generally boosts XRP, while negative sentiment can trigger price drops.

- Regulatory developments (SEC lawsuit updates): The ongoing SEC lawsuit is a major factor, with positive rulings potentially driving price increases.

- Adoption rate of XRP by financial institutions: Increased adoption by banks and payment processors often leads to price appreciation.

- Technological advancements in the Ripple ecosystem: Improvements to RippleNet and the XRP Ledger can attract more users and boost the price.

Ripple's Legal Battle with the SEC

The legal dispute between Ripple Labs and the SEC is a pivotal factor impacting XRP's price. The SEC alleges that XRP is an unregistered security, while Ripple maintains it's a currency. The outcome of this case could significantly impact XRP's future. A favorable ruling for Ripple could lead to a substantial price surge, whereas an unfavorable outcome could result in a significant decline.

[Insert a brief summary of recent court rulings and their implications on XRP price]

Key aspects of the legal battle:

- Recent court rulings and their significance: Each ruling, whether positive or negative, directly impacts investor sentiment and XRP's price.

- Expert opinions and market analysis on the case: Analysts' predictions and interpretations of the legal proceedings significantly influence market perception.

- Potential scenarios and their effect on XRP's future: Various potential outcomes, ranging from a complete SEC victory to a full dismissal of the case, create considerable uncertainty.

Ripple's Technology and Use Cases

Ripple's technology, primarily RippleNet and the XRP Ledger, offers a fast, efficient, and cost-effective solution for cross-border payments. Unlike many cryptocurrencies, XRP has a clear, defined use case within the financial industry. Its speed and low transaction costs make it an attractive alternative to traditional SWIFT payments. Moreover, Ripple actively collaborates with various financial institutions, enhancing its adoption and credibility.

Examples of XRP's practical applications:

- Cross-border payments efficiency: XRP enables near-instantaneous international transfers.

- Reduced transaction fees: Compared to traditional methods, XRP transactions are significantly cheaper.

- Increased transparency and security: The XRP Ledger provides a transparent and secure platform for transactions.

Risk Assessment and Investment Strategies

Investing in XRP carries inherent risks. Its volatility, coupled with the ongoing legal uncertainty, makes it a high-risk investment. However, careful risk management can mitigate potential losses.

Strategies to consider include:

- Diversifying your investment portfolio: Don't put all your eggs in one basket. Diversify across different assets to reduce overall risk.

- Only investing what you can afford to lose: Never invest more than you're willing to lose completely.

- Staying informed about market trends and news: Keep abreast of developments in the crypto market and the Ripple-SEC case.

Conclusion: Should You Invest in Ripple at an XRP Price Below $3?

The decision of whether to invest in Ripple at an XRP price below $3 is complex. While the technology shows promise and potential use cases are developing, the legal battle with the SEC casts a considerable shadow over its future. The market is volatile, and XRP's price is highly sensitive to news and court rulings. Therefore, careful consideration of the risks and potential rewards is crucial.

Make informed decisions about your XRP investment. Conduct thorough research, analyze the potential scenarios presented by the ongoing legal battle, and assess your own risk tolerance before investing in XRP. Remember that this article provides information, but not financial advice.

Featured Posts

-

Is Xrp Ripple A Good Investment Under 3 A Comprehensive Guide

May 02, 2025

Is Xrp Ripple A Good Investment Under 3 A Comprehensive Guide

May 02, 2025 -

England Women Vs Spain Women Match Preview Prediction And Lineups

May 02, 2025

England Women Vs Spain Women Match Preview Prediction And Lineups

May 02, 2025 -

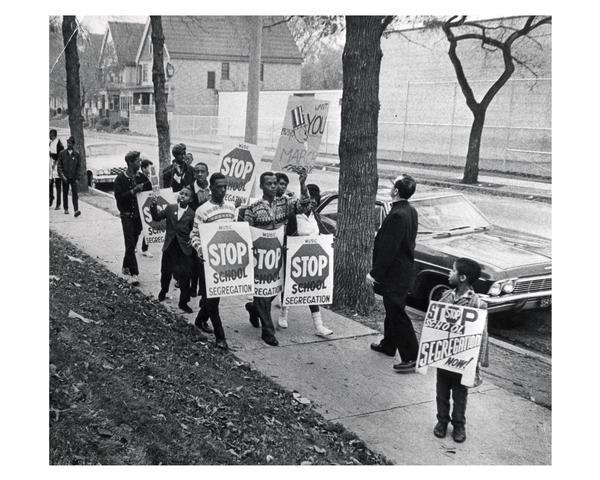

School Desegregation The End Of An Era Examining The Dojs Decision

May 02, 2025

School Desegregation The End Of An Era Examining The Dojs Decision

May 02, 2025 -

Ghanas Severe Psychiatrist Shortage 80 For 30 Million A National Emergency

May 02, 2025

Ghanas Severe Psychiatrist Shortage 80 For 30 Million A National Emergency

May 02, 2025 -

These Rare Fortnite Skins May Be Gone Forever

May 02, 2025

These Rare Fortnite Skins May Be Gone Forever

May 02, 2025

Latest Posts

-

Intervention De Macron Risque De Militarisation De L Aide Humanitaire A Gaza

May 03, 2025

Intervention De Macron Risque De Militarisation De L Aide Humanitaire A Gaza

May 03, 2025 -

Nigel Farages De Banking Case Against Nat West Concludes In Settlement

May 03, 2025

Nigel Farages De Banking Case Against Nat West Concludes In Settlement

May 03, 2025 -

Reform Partys Savile Related Slogan Public Reaction To Farages Campaign

May 03, 2025

Reform Partys Savile Related Slogan Public Reaction To Farages Campaign

May 03, 2025 -

Preoccupations De Macron Concernant La Militarisation De L Aide Humanitaire A Gaza Par Israel

May 03, 2025

Preoccupations De Macron Concernant La Militarisation De L Aide Humanitaire A Gaza Par Israel

May 03, 2025 -

Nigel Farages Whats Apps Fuel Reform Party Integrity Debate

May 03, 2025

Nigel Farages Whats Apps Fuel Reform Party Integrity Debate

May 03, 2025