XRP Price: Derivatives Market Weighs On Potential Recovery

Table of Contents

The Impact of XRP Derivatives on Price Volatility

The availability of XRP derivatives, including futures and options contracts, significantly impacts price volatility. These instruments allow for increased leverage and short selling, magnifying both upward and downward price swings. This can create a self-fulfilling prophecy, where price movements driven by derivative trading further influence the spot market.

- High leverage in XRP derivatives amplifies both gains and losses. Traders can control large positions with relatively small amounts of capital, leading to amplified price swings. A small movement in the underlying XRP price can result in substantial gains or losses for derivatives traders.

- Short selling can put downward pressure on the XRP price, hindering recovery. Short sellers bet against the price of XRP, potentially exacerbating downward trends and making it harder for the price to rebound. This increased selling pressure can outweigh positive news or underlying demand.

- The derivatives market can be susceptible to manipulation, further impacting price stability. Large players can potentially influence price movements through coordinated actions in the derivatives market, affecting the spot price of XRP.

- Increased trading volume in derivatives doesn't always translate to increased demand for XRP itself. While high trading volume might suggest heightened interest, it doesn't necessarily mean increased buying pressure in the underlying asset. Much of the activity could be speculative, unrelated to genuine demand for XRP.

Regulatory Uncertainty and its Influence on XRP Price

The ongoing SEC lawsuit against Ripple casts a long shadow over XRP's price. The legal uncertainty surrounding the case significantly impacts investor sentiment and the willingness of institutional investors to engage with XRP. This regulatory uncertainty creates a significant headwind for price recovery.

- Negative news related to the SEC lawsuit often leads to price drops. Negative judgments or setbacks in the legal battle typically trigger selling pressure and depress XRP's price.

- Positive legal developments could potentially drive a price surge. Conversely, favorable rulings or settlements could significantly boost investor confidence and lead to a rapid price increase.

- Regulatory clarity is crucial for fostering investor confidence and driving price recovery. A clear regulatory framework would reduce uncertainty and encourage institutional investment, potentially leading to higher prices.

- The lack of regulatory clarity creates uncertainty for institutional adoption. Many large institutional investors are hesitant to invest in assets with unclear regulatory status, limiting potential demand for XRP.

Market Sentiment and Trading Volume

Market sentiment towards XRP plays a crucial role in its price movements. Positive sentiment often correlates with higher prices and increased trading volume, while negative sentiment can lead to selling pressure and price declines. The activity of large investors ("whales") can also significantly impact short-term volatility.

- Increased trading volume often indicates increased interest, but not always a price increase. High volume can be driven by both buying and selling pressure, and doesn't guarantee a price increase.

- Negative sentiment can lead to selling pressure and lower prices. News or events that damage investor confidence can lead to a wave of selling, driving the price down.

- Large transactions ("whale" activity) can significantly influence short-term price volatility. Large buy or sell orders from whales can create significant price swings, particularly in a relatively illiquid market.

- Analyzing market capitalization provides a broader perspective on XRP's overall market position. Market cap gives a broader view of XRP's value compared to other cryptocurrencies.

Technical Analysis of XRP Price Charts (Optional)

Technical analysis of XRP price charts, using indicators such as moving averages, RSI, and support/resistance levels, can offer potential insights into future price movements. However, it's crucial to remember that technical analysis is not a foolproof method and should be used cautiously, combined with fundamental analysis.

Conclusion

The XRP price remains susceptible to numerous factors, with the derivatives market playing a significant role in its volatility. The ongoing regulatory uncertainty surrounding the SEC lawsuit continues to dampen investor confidence. While positive developments could trigger price increases, the leverage and short-selling capabilities of derivatives markets present challenges to sustained recovery. Understanding these dynamics is critical for navigating the XRP market.

Call to Action: Stay informed about the latest XRP market developments and the ongoing legal battle to make informed decisions about your XRP investments. Monitor the influence of the derivatives market and regulatory updates to better understand the potential for future XRP price recovery. Consider diversifying your cryptocurrency portfolio to mitigate risk.

Featured Posts

-

New Route Stansted To Casablanca Easier Than Ever

May 07, 2025

New Route Stansted To Casablanca Easier Than Ever

May 07, 2025 -

Hollywood Strike Understanding The Actors And Writers Demands

May 07, 2025

Hollywood Strike Understanding The Actors And Writers Demands

May 07, 2025 -

A List Stars Dazzle At The Met Gala Red Carpet

May 07, 2025

A List Stars Dazzle At The Met Gala Red Carpet

May 07, 2025 -

Warriors Upbeat Tempo Vs Rockets Grit A Generational Clash

May 07, 2025

Warriors Upbeat Tempo Vs Rockets Grit A Generational Clash

May 07, 2025 -

2025 Nhl Draft Lottery What It Means For The Utah Hockey Club

May 07, 2025

2025 Nhl Draft Lottery What It Means For The Utah Hockey Club

May 07, 2025

Latest Posts

-

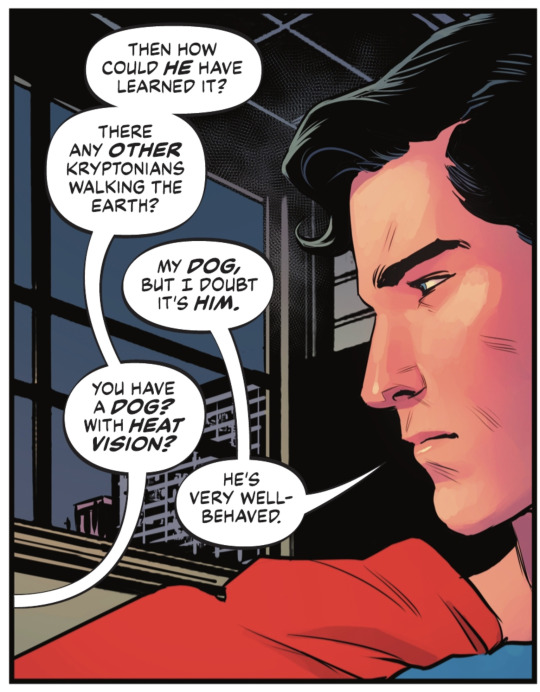

Exploring The Best Krypto Stories

May 08, 2025

Exploring The Best Krypto Stories

May 08, 2025 -

Classic And Modern Krypto Stories A Comprehensive Guide

May 08, 2025

Classic And Modern Krypto Stories A Comprehensive Guide

May 08, 2025 -

Essential Reading The Best Krypto Stories

May 08, 2025

Essential Reading The Best Krypto Stories

May 08, 2025 -

Batman Reborn Dc Comics Announces New Comic Series And Design

May 08, 2025

Batman Reborn Dc Comics Announces New Comic Series And Design

May 08, 2025 -

Unforgettable Krypto Stories You Need To Read

May 08, 2025

Unforgettable Krypto Stories You Need To Read

May 08, 2025