XRP Price Prediction: Post-SEC Lawsuit Analysis And Future Outlook

Table of Contents

The SEC Lawsuit's Impact on XRP Price

The SEC's lawsuit against Ripple, alleging the unregistered sale of securities, significantly impacted XRP's price. Understanding this impact is crucial for any accurate XRP price prediction.

Immediate Aftermath

The lawsuit's filing in December 2020 triggered an immediate price drop. However, the price didn't remain static. Various stages of the lawsuit, including the partial summary judgment, led to significant price fluctuations.

- December 2020: Sharp decline following the lawsuit's announcement.

- July 2022: Partial summary judgment ruling caused a temporary dip, followed by a gradual recovery.

- July 2023: Positive news regarding the case led to significant price rallies.

Several exchanges delisted XRP in the wake of the lawsuit, further exacerbating the uncertainty and influencing the XRP price prediction models. The resulting regulatory uncertainty added to the volatility.

Long-Term Effects on Market Sentiment

The lawsuit profoundly affected investor confidence. Regulatory uncertainty surrounding XRP remains a key factor influencing its price.

- Regulatory Uncertainty: The ongoing legal battles created a climate of uncertainty, impacting investor sentiment.

- Institutional Adoption: The lawsuit hindered the progress of institutional adoption, a critical factor for long-term price growth.

- Community Support: Despite the challenges, the XRP community remained steadfast, showcasing resilience and continued support.

Many analysts believe that the long-term effects on market sentiment will largely depend on the final outcome of the lawsuit and subsequent regulatory clarity.

Ripple's Legal Strategy and its Influence on XRP Price Prediction

Ripple's legal strategy and the court's decisions are paramount to any accurate XRP price forecast.

Key Arguments and Outcomes

Ripple's defense focused on arguing that XRP is not a security. Key arguments revolved around the concept of "programmatic sales" and the decentralized nature of the XRP Ledger.

- Significant Legal Victories: Several rulings favored Ripple, bolstering investor confidence and impacting the XRP price prediction.

- Setbacks: Certain rulings presented challenges, contributing to periods of price volatility.

- Programmatic Sales: The court's interpretation of "programmatic sales" significantly influenced the trajectory of the case and market sentiment.

The legal battles' ebb and flow directly impact the overall market perception of XRP, shaping any credible XRP future predictions.

Potential Settlements and their Price Impact

The possibility of a settlement significantly influences XRP price projections.

- Optimistic Scenario: A favorable settlement could trigger a substantial price surge, potentially reaching significantly higher levels.

- Pessimistic Scenario: An unfavorable settlement or a protracted legal battle could lead to further price declines.

- Market Reaction to Rumors: Even rumors of a settlement, regardless of the details, have historically triggered notable price swings.

Technical Analysis of XRP Price

Technical analysis provides another lens through which to view potential XRP price predictions.

Chart Patterns and Indicators

Analyzing XRP's historical price charts reveals interesting patterns.

- Support/Resistance Levels: Identifying key support and resistance levels allows us to predict potential price reversals or breakouts.

- Chart Patterns: Patterns like head and shoulders or triangles can provide clues about future price movements.

- Technical Indicators: Indicators such as RSI and MACD offer insights into momentum and potential overbought/oversold conditions. (Include charts here)

These technical analyses offer valuable input, though should be used in conjunction with fundamental analysis for a more comprehensive XRP price outlook.

Trading Volume and Market Capitalization

Examining trading volume and market capitalization provides insights into XRP's overall market strength.

- Trading Volume: High trading volume often suggests strong market interest and potential price volatility.

- Market Capitalization: Market cap indicates the overall value of XRP, reflecting its market position relative to other cryptocurrencies.

(Include charts and data showing these metrics' evolution post-lawsuit.)

Future Adoption and Technological Developments

Future adoption and technological advancements are critical to any long-term XRP price prediction.

Potential for Institutional Adoption

Regulatory clarity could significantly boost institutional adoption of XRP.

- Partnerships and Collaborations: Strategic partnerships could accelerate adoption by large financial institutions.

- Use Cases: Expanding use cases in cross-border payments and other financial applications could drive demand.

- Regulatory Clarity: Clear regulatory guidelines are essential to attract institutional investors.

Increased institutional interest could significantly boost XRP's price.

Technological Advancements in Ripple's Ecosystem

Improvements to the XRP Ledger and RippleNet could enhance XRP's value proposition.

- XRP Ledger Upgrades: Upgrades to the XRP Ledger's speed, scalability, and security enhance its attractiveness to users.

- New Features: Introduction of new features and functionalities can broaden XRP's appeal.

These advancements can create a more robust ecosystem, attracting more users and potentially driving up demand.

Conclusion: XRP Price Prediction – A Final Outlook

The SEC lawsuit's impact, Ripple's legal strategy, technical indicators, and future adoption prospects all contribute to the complexity of predicting XRP's price. While predicting the future is inherently uncertain, a cautiously optimistic outlook is justified if Ripple secures favorable outcomes and regulatory clarity emerges. The potential price range remains highly speculative, ranging from modest growth to significantly higher levels depending on the factors discussed above.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are inherently risky, and readers should conduct their own thorough research before making any investment decisions.

Call to Action: Continue researching and monitoring XRP developments. Stay informed about the ongoing legal proceedings, technical analysis updates, and future adoption prospects to develop a more comprehensive understanding of XRP price forecast, XRP future predictions, and the overall XRP price outlook.

Featured Posts

-

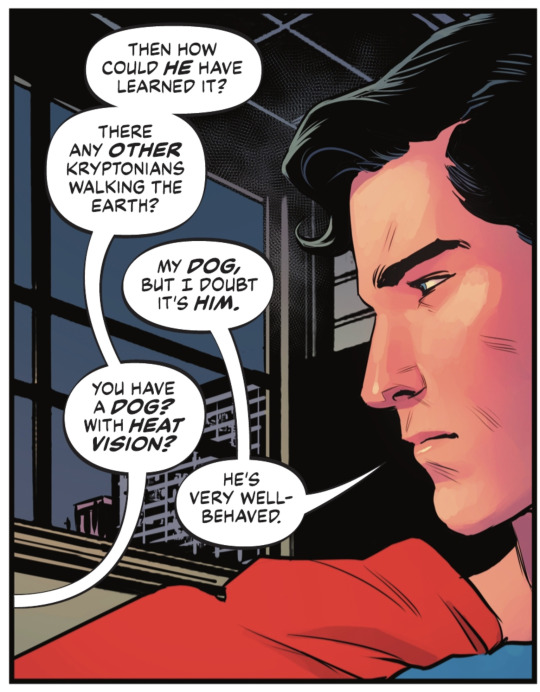

Unforgettable Krypto Stories You Need To Read

May 08, 2025

Unforgettable Krypto Stories You Need To Read

May 08, 2025 -

Billions In Crypto Options Expire Potential For Significant Market Volatility

May 08, 2025

Billions In Crypto Options Expire Potential For Significant Market Volatility

May 08, 2025 -

Jayson Tatum On Larry Bird Respect Inspiration And The Celtics Legacy

May 08, 2025

Jayson Tatum On Larry Bird Respect Inspiration And The Celtics Legacy

May 08, 2025 -

The Arteta Dilemma Collymores Arsenal Critique

May 08, 2025

The Arteta Dilemma Collymores Arsenal Critique

May 08, 2025 -

Ripple Xrp News Brazils First Spot Xrp Etf Approved Trumps Ripple Post Sparks Interest

May 08, 2025

Ripple Xrp News Brazils First Spot Xrp Etf Approved Trumps Ripple Post Sparks Interest

May 08, 2025