XRP Price Recovery Falters: Derivatives Market Holds Back

Table of Contents

The Role of Derivatives in Price Suppression

Short selling and futures contracts play a significant role in putting downward pressure on XRP's price. These derivative instruments allow investors to speculate on price movements without actually owning the underlying asset. This can create a self-fulfilling prophecy: if enough investors bet against XRP (short selling), their actions can drive the price down, leading to further short selling and reinforcing the negative trend.

- High short interest indicates a bearish sentiment among institutional investors. A high level of short positions suggests that a significant portion of the market anticipates a price decline. This bearish sentiment can discourage new investors from entering the market.

- Futures contracts allow for speculation on price movements, independent of underlying demand. The volume of futures trading can significantly outweigh the actual demand for XRP in the spot market, distorting price discovery.

- Manipulation through derivatives is a concern, although difficult to prove definitively. While outright manipulation is difficult to prove, the potential for large players to influence price through coordinated short selling or futures trading remains a concern within the XRP community.

- Cascading liquidations can impact the spot market. If a significant number of short positions are liquidated simultaneously (due to a sudden price surge), it can trigger a cascading effect, further impacting the spot market price of XRP and potentially causing further volatility in XRP price charts.

The mechanics of short selling involve borrowing XRP, selling it at the current market price, and hoping to buy it back later at a lower price to return it to the lender, profiting from the price difference. Futures contracts, on the other hand, are agreements to buy or sell XRP at a predetermined price on a future date. Both mechanisms allow for leveraged bets, amplifying potential profits but also magnifying potential losses. Data on XRP short interest, while not always publicly available with complete transparency, often shows periods of high short interest coinciding with periods of price suppression. Regulatory concerns, especially surrounding potential market manipulation, remain a key area of focus for the future of XRP.

Lack of Significant On-Chain Activity

A key indicator of a cryptocurrency's health and potential for price appreciation is its on-chain activity. Metrics such as transaction volume and the number of active addresses directly reflect the level of real-world adoption and usage. Low on-chain activity suggests limited interest and real-world usage, which can negatively impact XRP's price.

- Low transaction volume suggests limited real-world adoption. A low volume indicates fewer people are using XRP for actual transactions, suggesting limited demand.

- Decreasing active addresses may signal a loss of interest from users. Fewer unique addresses interacting with the XRP ledger suggest a shrinking user base.

- Comparing XRP's on-chain activity to other major cryptocurrencies highlights its relative underperformance. Analyzing XRP's metrics against Bitcoin, Ethereum, or other leading cryptocurrencies provides a benchmark for assessing its current level of adoption and potential for future growth.

Data analysis reveals that XRP's on-chain activity, while showing periods of increased activity, often lags behind other major cryptocurrencies. This lower level of on-chain engagement compared to historical trends and competitors contributes to the perception of reduced demand and puts downward pressure on the XRP price forecast.

Regulatory Uncertainty Continues to Weigh Down XRP

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) continues to cast a shadow over XRP. The SEC's classification of XRP as an unregistered security has created significant uncertainty in the market. This uncertainty discourages institutional investors and creates a volatile trading environment.

- Uncertainty surrounding the SEC lawsuit creates a volatile market. The lack of clarity surrounding the legal outcome makes it difficult for investors to assess the long-term risks associated with holding XRP.

- Regulatory clarity is crucial for attracting institutional investment. Institutional investors often require a high degree of regulatory certainty before committing significant capital to an asset.

- The potential for a positive or negative ruling significantly impacts XRP's future. A favorable ruling could lead to a substantial price increase, while an unfavorable outcome could further depress the price.

The Ripple vs. SEC case is a landmark legal battle with far-reaching implications for the cryptocurrency industry. Different scenarios – including a complete victory for Ripple, a partial settlement, or a ruling against Ripple – will profoundly impact investor confidence and, subsequently, the XRP price. The need for regulatory clarity is not unique to XRP; it is crucial for the overall development and stability of the cryptocurrency market.

Impact on Investor Sentiment

The combined effect of the factors discussed above contributes to significant negative investor sentiment.

- Fear, Uncertainty, and Doubt (FUD) spread by negative news. Negative news reports about the SEC lawsuit, low on-chain activity, and potential market manipulation can create a climate of fear and uncertainty.

- Hesitation from institutional investors to enter the market. The lack of regulatory clarity and overall bearish sentiment discourages institutional investors from participating.

- Reduced overall trading volume and liquidity. Lower trading volume can exacerbate price volatility and make it more difficult for investors to enter or exit positions.

The psychological impact of negative news and regulatory uncertainty on investor behavior cannot be overstated. Fear and uncertainty often lead to selling pressure, further depressing prices and creating a vicious cycle.

Conclusion

The XRP price recovery faces multiple headwinds, primarily stemming from the influence of the derivatives market, weak on-chain activity, and continued regulatory uncertainty. While positive developments might temporarily boost prices, a sustained XRP price recovery requires addressing these fundamental challenges. Increased on-chain activity, a positive resolution to the Ripple lawsuit, and a reduction in bearish sentiment in the derivatives market are crucial for a truly robust and sustainable recovery. Stay informed about developments in the XRP market and keep an eye on these key indicators to navigate the complexities of this volatile asset. Continue following our updates for more insights into the future of XRP price recovery and how to improve your XRP price prediction.

Featured Posts

-

Isabela Merceds Hawkgirl A Realistic Look At Organic Wings In A Superhero Context

May 07, 2025

Isabela Merceds Hawkgirl A Realistic Look At Organic Wings In A Superhero Context

May 07, 2025 -

Dhk Wrqs Wghnae Wyl Smyth Yhtfl Beyd Mylad Jaky Shan

May 07, 2025

Dhk Wrqs Wghnae Wyl Smyth Yhtfl Beyd Mylad Jaky Shan

May 07, 2025 -

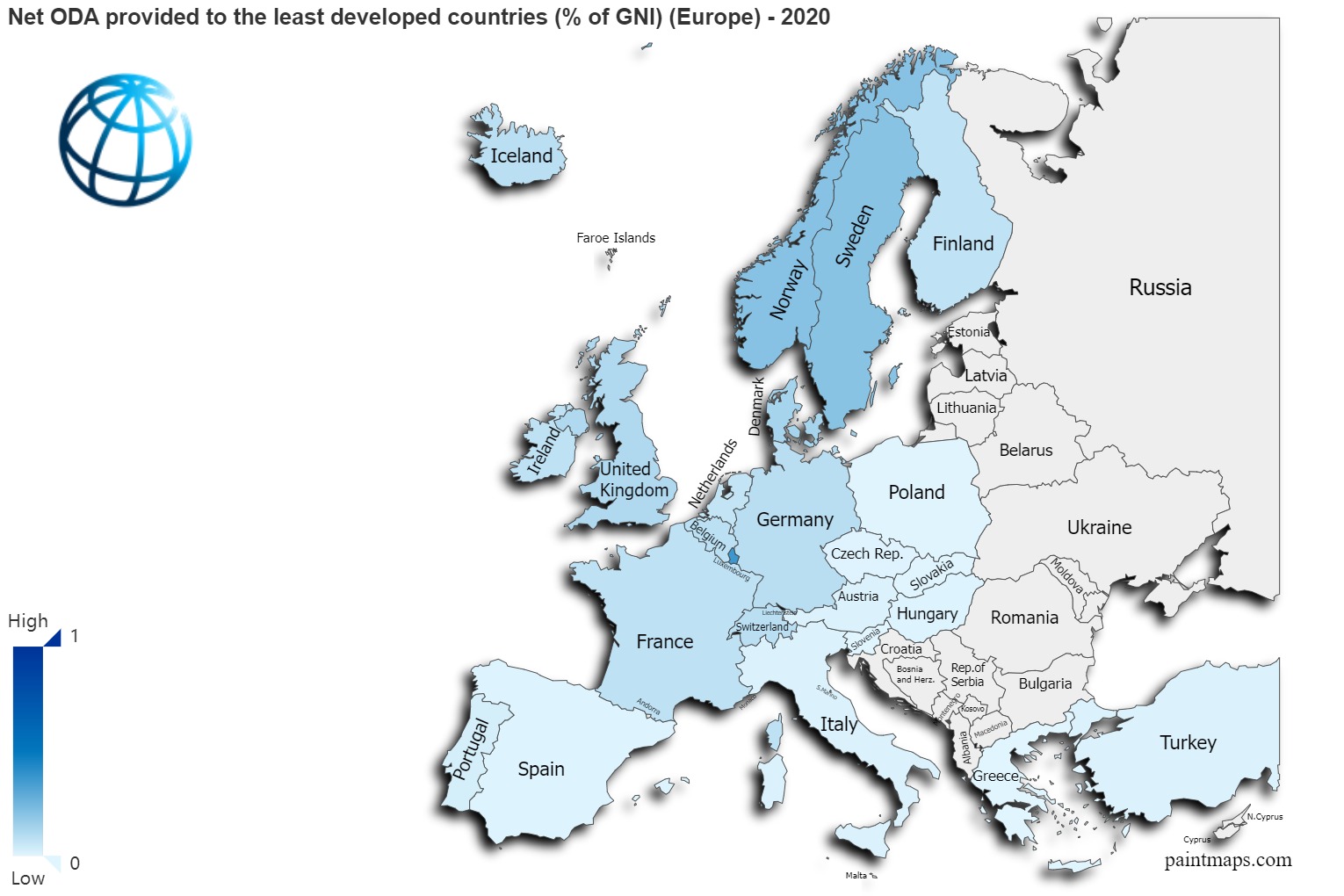

The Privilege Factor Speeding Up Wto Accession

May 07, 2025

The Privilege Factor Speeding Up Wto Accession

May 07, 2025 -

Acelerando La Graduacion De Los Paises Menos Adelantados Un Analisis Del Caso Ca

May 07, 2025

Acelerando La Graduacion De Los Paises Menos Adelantados Un Analisis Del Caso Ca

May 07, 2025 -

Pristrasna Rianna Garyachi Foto U Rozhevomu Merezhivnomu Vbranni

May 07, 2025

Pristrasna Rianna Garyachi Foto U Rozhevomu Merezhivnomu Vbranni

May 07, 2025

Latest Posts

-

Kripto Varliklar Icin Yeni Duezenleme Spk Nin Sermaye Ve Guevenlik Standartlari

May 08, 2025

Kripto Varliklar Icin Yeni Duezenleme Spk Nin Sermaye Ve Guevenlik Standartlari

May 08, 2025 -

Spk Dan Kripto Platformlarina Yeni Duezenleme Sermaye Ve Guevenlik Sartlari

May 08, 2025

Spk Dan Kripto Platformlarina Yeni Duezenleme Sermaye Ve Guevenlik Sartlari

May 08, 2025 -

Did Counting Crows Snl Appearance Change Everything

May 08, 2025

Did Counting Crows Snl Appearance Change Everything

May 08, 2025 -

Saturday Night Live Did It Make Or Break Counting Crows

May 08, 2025

Saturday Night Live Did It Make Or Break Counting Crows

May 08, 2025 -

The Impact Of Saturday Night Live On Counting Crows Success

May 08, 2025

The Impact Of Saturday Night Live On Counting Crows Success

May 08, 2025