XRP Price Surge: Ripple SEC Case Update And US ETF Possibilities

Table of Contents

The Ripple-SEC Lawsuit: A Turning Point for XRP?

The Ripple-SEC lawsuit has cast a long shadow over XRP's price, creating uncertainty and volatility. The Securities and Exchange Commission (SEC) alleges that Ripple sold XRP as an unregistered security, a claim Ripple vehemently denies. This legal battle has significantly impacted XRP's price, leading to periods of both dramatic drops and surprising rallies.

Key developments and rulings in the case have shaped investor sentiment. Judge Analisa Torres's partial summary judgment ruling in July 2023, while not a complete victory for either side, significantly influenced the market. The ruling clarified that institutional sales of XRP did not constitute securities, while programmatic sales were deemed unregistered securities. This mixed outcome has led to a period of relative stability, but the ultimate resolution will significantly affect XRP's future.

- SEC's Allegations: The SEC claims Ripple violated federal securities laws by selling unregistered securities.

- Ripple's Defense: Ripple argues that XRP is a decentralized digital asset and not a security, and therefore not subject to SEC regulation.

- Judge Torres's Rulings: The partial summary judgment created a complex situation, leaving the door open for further legal battles.

- Potential Scenarios: A Ripple win could lead to a substantial XRP price surge. An SEC win could severely depress the price. A settlement is also possible, with an outcome yet to be determined.

- Impact on Regulatory Status: The final ruling will heavily influence how XRP is classified and regulated in the US, profoundly affecting its price and future prospects.

US ETF Approval: A Catalyst for XRP Price Growth?

The approval of a US-based XRP ETF could be a game-changer. Currently, the US has seen limited cryptocurrency ETF approvals, with many applications still pending. An XRP ETF would offer investors easier access to XRP, potentially boosting its liquidity and price.

However, securing ETF approval for XRP faces significant hurdles. Regulatory uncertainty and market volatility remain major concerns for regulators. The SEC's scrutiny of cryptocurrencies and the potential for price manipulation present substantial challenges. Despite this, the approval of an XRP ETF could unlock significant investment, leading to a substantial XRP price surge.

- ETF Application Process: A rigorous process involves demonstrating compliance with SEC regulations, including addressing concerns about market manipulation and investor protection.

- Advantages of an XRP ETF: Easier access, increased liquidity, and diversification benefits for investors.

- Challenges to ETF Approval: Regulatory hurdles, market volatility, and concerns about price manipulation.

- Comparison with Other Crypto ETFs: Examining the approvals and rejections of other crypto ETFs provides valuable context for assessing XRP's prospects.

- Predicting Price Surge: While difficult to predict accurately, ETF approval is widely expected to result in increased demand and price appreciation for XRP.

Market Sentiment and Technical Analysis of XRP

Current market sentiment towards XRP is cautiously optimistic, influenced by the ongoing Ripple-SEC case and the potential for ETF approval. Technical analysis, examining price charts, trading volume, and indicators like moving averages and RSI, can provide insights into potential price movements.

Analyzing trading volume is crucial. High trading volume alongside price increases suggests strong buying pressure. Conversely, high volume with price decreases indicates significant selling pressure. Identifying support and resistance levels helps gauge potential price reversals.

- Trading Volume Analysis: Correlation between trading volume and price movements provides crucial context for interpreting market sentiment.

- Key Technical Indicators: Moving averages, Relative Strength Index (RSI), and other technical indicators assist in assessing momentum and potential trend reversals.

- Potential Price Targets: Technical analysis can help estimate potential price targets, although these should be considered with caution.

- Overall Market Conditions: The broader cryptocurrency market's performance inevitably affects XRP's price.

- Disclaimer: Price predictions are inherently uncertain and should not be considered financial advice.

Ripple's Ongoing Development and Partnerships

Ripple continues to actively develop its technology and expand its partnerships, fostering the adoption of XRP and potentially driving its price. New collaborations and technological advancements strengthen XRP's utility and position within the broader payments ecosystem. Positive news and announcements concerning Ripple's activities often influence investor sentiment and XRP's price.

- Recent Partnerships and Collaborations: Tracking Ripple's partnerships reveals its expanding network and influence in the financial industry.

- Impact on XRP Utility: New partnerships and applications for XRP improve its usability and increase its value proposition.

- Ripple's Technological Advancements: Innovations in Ripple's technology enhance its efficiency and appeal, potentially boosting XRP's adoption.

Conclusion: Investing in XRP Amidst the Price Surge

The XRP price surge is intricately linked to the Ripple-SEC lawsuit, the possibility of US ETF approval, and overall market sentiment. The ongoing legal battle creates uncertainty, but a positive resolution could significantly boost XRP's price. Meanwhile, ETF approval would likely unlock significant investment and enhance liquidity. However, it's crucial to remember that investing in cryptocurrencies carries inherent risks. Thorough research and understanding of these factors are paramount before investing in XRP.

To stay informed about the evolving situation and potential future XRP price surges, follow reputable news sources and track developments in the Ripple-SEC case and ETF applications. Conduct your own due diligence and consult with a financial advisor before making any investment decisions. Remember, understanding the nuances of the XRP price surge is key to making informed investment choices.

Featured Posts

-

Verdeelstation Oostwold Protesten Ten Spijt Bouw Gaat Door

May 01, 2025

Verdeelstation Oostwold Protesten Ten Spijt Bouw Gaat Door

May 01, 2025 -

Dalys Late Show Steals Victory For England Against France In Six Nations Clash

May 01, 2025

Dalys Late Show Steals Victory For England Against France In Six Nations Clash

May 01, 2025 -

Zdravka Colica Prva Ljubav Prica Iza Pjesme Kad Sam Se Vratio

May 01, 2025

Zdravka Colica Prva Ljubav Prica Iza Pjesme Kad Sam Se Vratio

May 01, 2025 -

Pakstan Myn Kshmyr Ywm Ykjhty Ke Shandar Azhar

May 01, 2025

Pakstan Myn Kshmyr Ywm Ykjhty Ke Shandar Azhar

May 01, 2025 -

Conservative Party Leader Poilievre Loses Seat In Federal Election

May 01, 2025

Conservative Party Leader Poilievre Loses Seat In Federal Election

May 01, 2025

Latest Posts

-

Trumps Plan To Mitigate Automotive Tariff Impact

May 01, 2025

Trumps Plan To Mitigate Automotive Tariff Impact

May 01, 2025 -

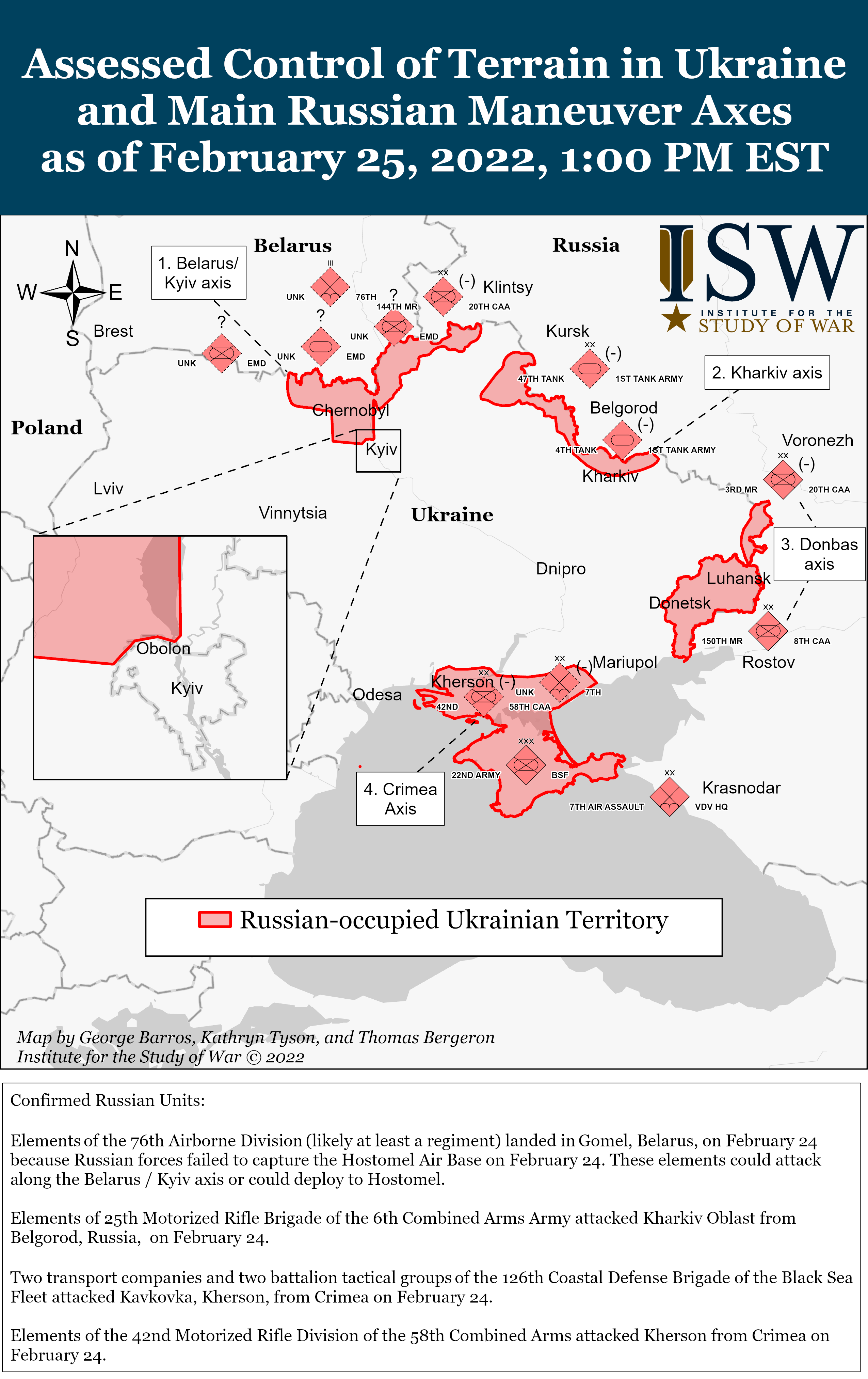

Analyzing The Influence Of Weather On Russias Spring Offensive In Ukraine

May 01, 2025

Analyzing The Influence Of Weather On Russias Spring Offensive In Ukraine

May 01, 2025 -

Impact Of Warmer Weather On Russias Military Campaign In Ukraine

May 01, 2025

Impact Of Warmer Weather On Russias Military Campaign In Ukraine

May 01, 2025 -

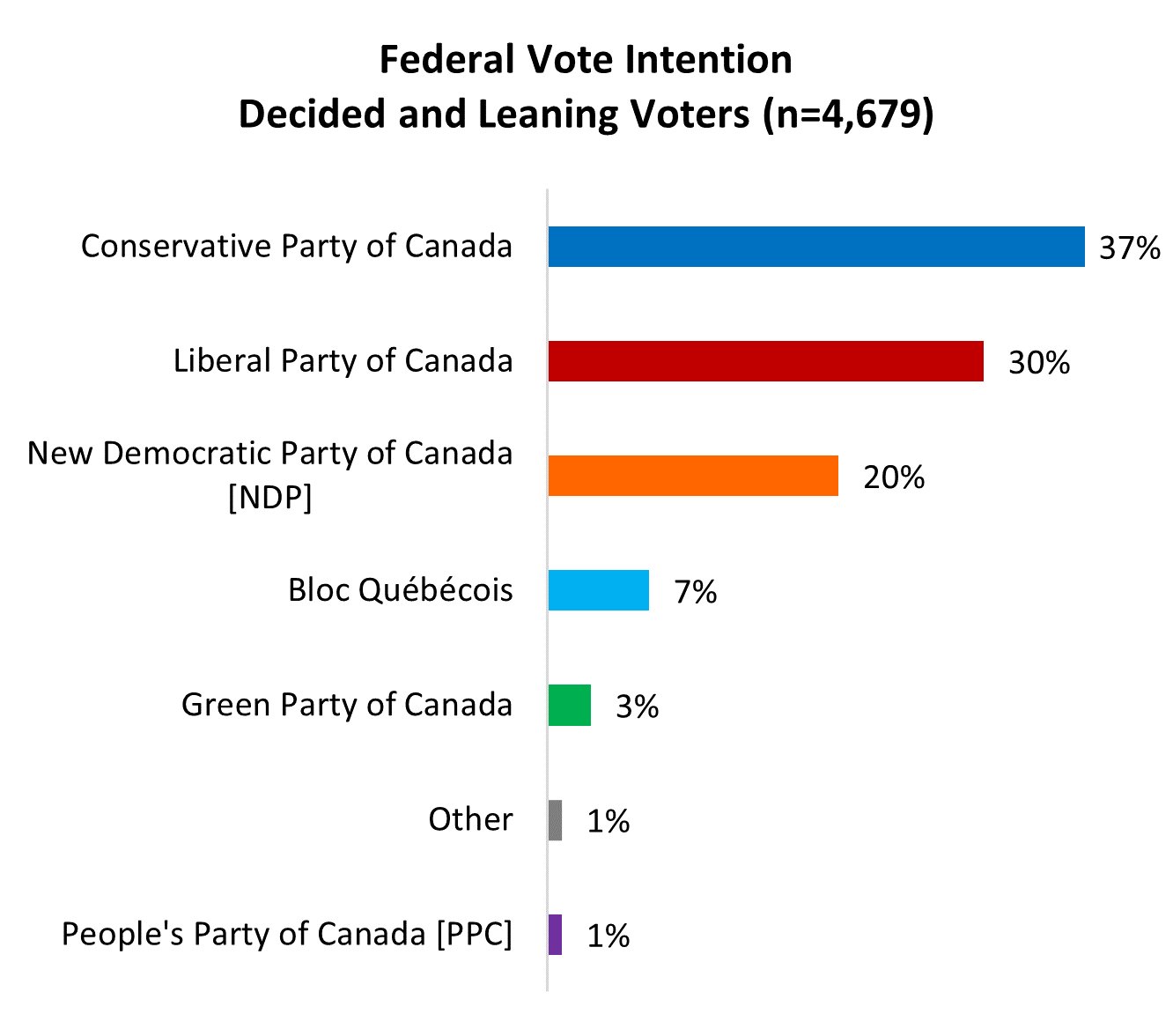

Mark Carneys Liberals Win Canadian Federal Election A Challenge To Trump

May 01, 2025

Mark Carneys Liberals Win Canadian Federal Election A Challenge To Trump

May 01, 2025 -

Russias Flagging Spring Offensive Weathers Impact On Military Operations

May 01, 2025

Russias Flagging Spring Offensive Weathers Impact On Military Operations

May 01, 2025