XRP Price Surge: Ripple Vs. SEC Case Update And The Potential For A US XRP ETF

Table of Contents

Ripple vs. SEC Case Update

Recent Developments in the Court Case

The Ripple vs. SEC case has seen several crucial developments. These legal proceedings significantly impact XRP's price and overall market sentiment. Recent key events include:

- Partial Summary Judgment Victory for Ripple: In July 2023, Judge Analisa Torres ruled that XRP sales on public exchanges did not constitute unregistered securities offerings. This positive development led to a noticeable XRP price surge. [Link to relevant court document/news article]

- Ongoing Discovery Process: The discovery process continues, with both sides exchanging evidence and preparing for potential further legal arguments. This ongoing process creates uncertainty that contributes to price fluctuations. [Link to relevant news article]

- Expert Witness Testimonies: Expert witnesses from both sides have presented their arguments, further shaping the legal landscape and influencing investor perceptions of the case's potential outcomes. [Link to relevant news article]

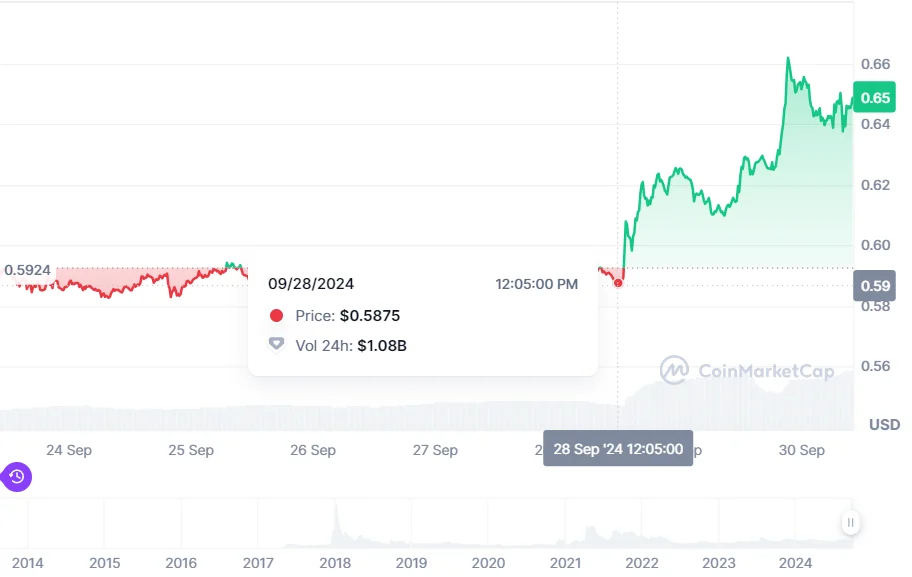

These developments have demonstrably impacted the XRP price. Positive news tends to drive the price upward, while negative developments can trigger price drops. The fluctuating nature of the legal process contributes to significant volatility in the XRP market.

Potential Outcomes and Their Impact on XRP

The Ripple vs. SEC case could have several outcomes:

- Ripple Wins: A complete victory for Ripple could lead to a substantial and sustained XRP price surge, as the classification of XRP as a security would be refuted. This would likely boost investor confidence and attract significant institutional investment.

- SEC Wins: An SEC victory would likely result in a considerable XRP price drop, potentially leading to delisting from major exchanges and harming investor confidence.

- Settlement: A settlement between Ripple and the SEC could have a mixed impact on the XRP price, depending on the terms of the agreement. A favorable settlement could mitigate losses, while an unfavorable one could still negatively affect the price.

The uncertainty surrounding the outcome significantly influences investor sentiment and contributes to the XRP price volatility.

The Potential for a US XRP ETF

What is an ETF and Why is it Important for XRP?

An Exchange Traded Fund (ETF) is an investment fund traded on stock exchanges, much like individual stocks. XRP ETFs would allow investors to easily buy and sell XRP through their brokerage accounts, increasing accessibility and liquidity. The benefits of an XRP ETF include:

- Increased Liquidity: Facilitates easier buying and selling of XRP.

- Accessibility: Makes XRP investing more accessible to a broader range of investors.

- Institutional Investment: Attracts significant investment from institutional investors, leading to greater market stability and potentially higher prices.

The SEC's approval process for ETFs is rigorous, involving a comprehensive review of the applicant's proposal and the underlying asset (in this case, XRP).

Factors Influencing SEC Approval of an XRP ETF

The SEC's primary concern regarding XRP is its classification as a security. The arguments for and against XRP ETF approval center around this classification:

- Arguments for Approval: Point to the increasing regulatory clarity surrounding cryptocurrencies and the growing acceptance of XRP as a functional utility token.

- Arguments Against Approval: Focus on the potential for XRP to be considered a security, given its historical use in initial coin offerings (ICOs) and Ripple's role in its distribution.

The SEC's decision will likely be influenced by the outcome of the Ripple vs. SEC case, as well as the broader regulatory landscape surrounding cryptocurrencies in the US. The success of other crypto ETFs could also positively influence the decision-making process.

Impact of ETF Approval on XRP Price

Approval of an XRP ETF would likely have a considerable positive impact on its price:

- Significant Price Increase: Increased demand and liquidity resulting from ETF listing would drive the price upward.

- Increased Trading Volume: ETF accessibility would significantly increase trading volume, adding to market liquidity.

- Institutional Investment: Institutional investors would be more likely to invest in XRP through an ETF, driving further price increases.

However, market speculation and investor sentiment will also play a significant role in determining the extent of the price increase following ETF approval.

Analyzing XRP Price Volatility

Factors Affecting XRP Price Beyond the Legal Battle

Several factors beyond the Ripple vs. SEC case and ETF prospects influence XRP's price:

- Market Trends: The overall crypto market sentiment and the price of Bitcoin significantly impact XRP's price.

- Ripple's Technological Developments: Advances in Ripple's technology and new partnerships can boost XRP's price.

- Global Economic Events: Macroeconomic factors and regulatory changes worldwide also influence XRP's performance.

Strategies for Navigating XRP Price Volatility

Investing in XRP involves considerable risk due to its volatility. Effective strategies for managing this risk include:

- Diversification: Spread investments across different asset classes to mitigate potential losses.

- Dollar-Cost Averaging (DCA): Invest a fixed amount of money regularly, regardless of price fluctuations.

- Informed Decision-Making: Stay updated on market trends, legal developments, and news related to XRP.

Avoid impulsive trading decisions based solely on short-term price movements.

Conclusion

The future of XRP's price is intertwined with the outcome of the Ripple vs. SEC case and the potential approval of a US XRP ETF. While the legal battle creates uncertainty, the possibility of increased accessibility and institutional investment through an ETF presents significant upside potential. Investors should carefully evaluate the risks and rewards, keeping abreast of court proceedings and regulatory developments. By comprehending the interplay of these factors, investors can better navigate the XRP market and potentially capitalize on future XRP price surges. Stay updated on the latest news surrounding the XRP price surge and the ongoing legal battle to make informed investment decisions.

Featured Posts

-

Wednesdays Daily Lotto Results April 16 2025

May 02, 2025

Wednesdays Daily Lotto Results April 16 2025

May 02, 2025 -

Medias Definitie Van Een Zware Auto Een Geen Stijl Analyse

May 02, 2025

Medias Definitie Van Een Zware Auto Een Geen Stijl Analyse

May 02, 2025 -

127 Years Of Brewing History Anchor Brewing Companys Closure

May 02, 2025

127 Years Of Brewing History Anchor Brewing Companys Closure

May 02, 2025 -

Cooper Siblings Next Bbc Venture Following Celeb Traitors

May 02, 2025

Cooper Siblings Next Bbc Venture Following Celeb Traitors

May 02, 2025 -

Analysis Abu Jinapors Reaction To The Npps 2024 Election Setback

May 02, 2025

Analysis Abu Jinapors Reaction To The Npps 2024 Election Setback

May 02, 2025

Latest Posts

-

End Of An Era Justice Department Decision On Louisiana School Desegregation

May 03, 2025

End Of An Era Justice Department Decision On Louisiana School Desegregation

May 03, 2025 -

Justice Department Concludes Louisiana School Desegregation Case

May 03, 2025

Justice Department Concludes Louisiana School Desegregation Case

May 03, 2025 -

Louisiana School Desegregation Order Terminated By Justice Department

May 03, 2025

Louisiana School Desegregation Order Terminated By Justice Department

May 03, 2025 -

Score Free Captain America Fortnite Items Time Sensitive

May 03, 2025

Score Free Captain America Fortnite Items Time Sensitive

May 03, 2025 -

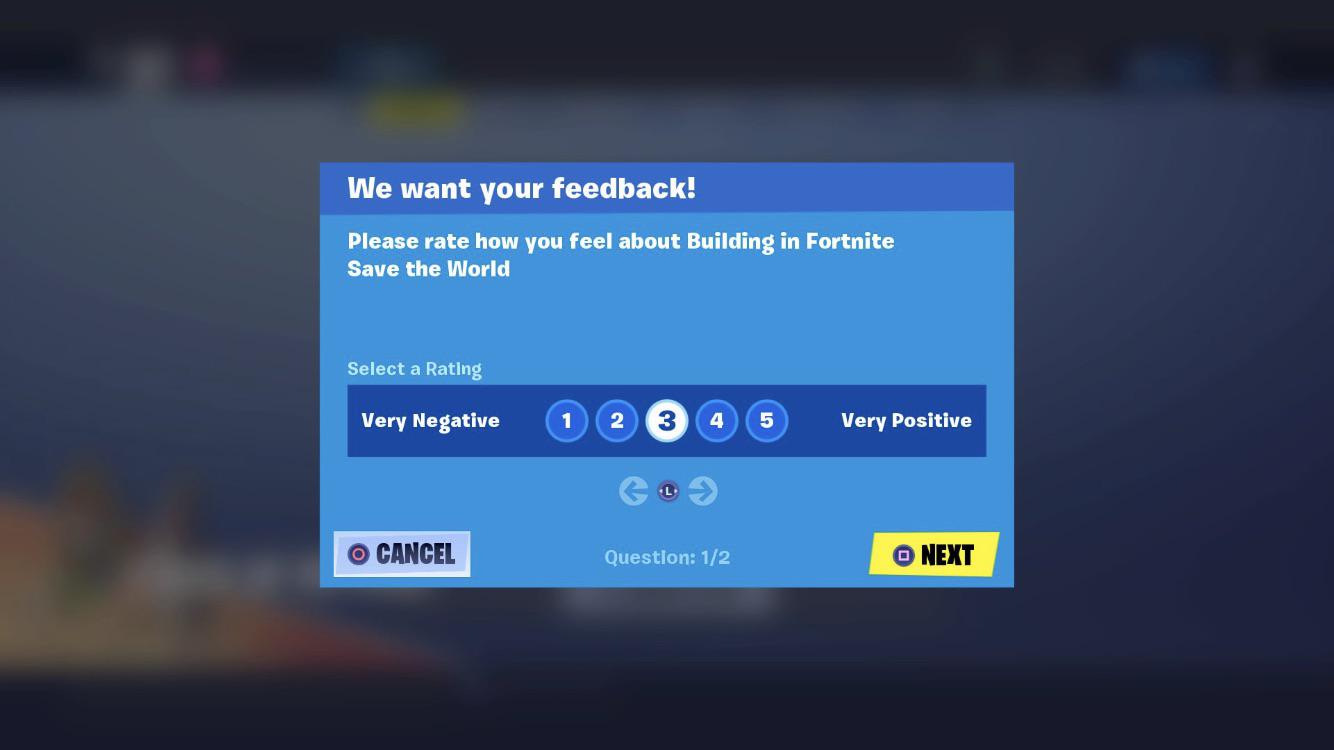

Negative Feedback Floods Fortnite After Backwards Music Implementation

May 03, 2025

Negative Feedback Floods Fortnite After Backwards Music Implementation

May 03, 2025