XRP Recovery In Limbo: Derivatives Market Impact

Table of Contents

The Ripple-SEC Lawsuit and its Lingering Effect on XRP Price

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) is the elephant in the room when discussing XRP's future. This uncertainty is the primary driver of XRP price volatility and significantly impacts investor confidence.

Uncertainty Creates Volatility

The fluctuating nature of the legal proceedings creates a constant state of uncertainty, leading to unpredictable XRP price movements.

- Negative news: Negative court rulings or SEC statements can trigger sharp drops in XRP's value, causing significant losses for investors holding XRP.

- Positive developments: Conversely, positive developments, such as favorable court rulings or settlements, can spark significant rallies, potentially rewarding those who held onto their XRP investments.

- Predictability challenge: This volatility makes it extremely challenging for investors to accurately predict XRP's price movement, making long-term investment strategies particularly difficult. Technical analysis becomes less reliable due to the overriding influence of the legal proceedings.

Impact on Trading Volume

The uncertainty surrounding the lawsuit also significantly impacts XRP trading volume. Volume often surges during periods of significant news, reflecting heightened investor activity and speculation.

- High volatility attracts traders: High volatility attracts both short-term speculators seeking quick profits from price swings and long-term holders hoping to capitalize on potential future price increases.

- Low volume indicates uncertainty: Conversely, periods of lower trading volume can indicate a lack of strong conviction in either direction, suggesting investors are waiting for greater clarity before making significant trades.

- Market sentiment analysis: Analyzing XRP trading volume alongside price action can provide valuable insights into market sentiment and the overall strength of the buy and sell pressure.

The Role of XRP Derivatives in Amplifying Price Movements

The XRP derivatives market plays a significant role in amplifying price movements, adding another layer of complexity to the already volatile situation.

Leverage and Margin Trading

The use of leverage in XRP derivatives trading allows traders to control larger positions with smaller amounts of capital. While this magnifies potential gains, it also significantly amplifies losses.

- Magnified price impacts: High leverage magnifies the impact of even small price changes, leading to potentially large gains or devastating losses.

- Liquidations exacerbate downward pressure: When XRP's price moves against a leveraged position, margin calls can trigger liquidations, forcing traders to sell their XRP holdings, thus exacerbating downward price pressure.

- Risk management is crucial: Experienced traders can use leverage to their advantage, but it carries significant risk, and effective risk management strategies are essential for survival in this market.

Futures Contracts and Price Prediction

XRP futures contracts allow traders to speculate on the future price of XRP, potentially influencing the current market price through their collective actions.

- Market sentiment reflection: Futures prices often reflect the collective market sentiment and expectations about XRP's future price movements.

- Open interest as indicator: A high open interest in XRP futures contracts suggests considerable market activity and a potential for significant price movements in either direction.

- Future price trend insights: Analyzing the price and open interest of XRP futures contracts can provide valuable insights into potential future price trends, although it is not foolproof.

Assessing the Overall Market Sentiment Towards XRP

Market sentiment, encompassing the views of both institutional and retail investors, plays a vital role in shaping the long-term outlook for XRP.

Institutional Investors and XRP Adoption

The entry of institutional investors into the XRP market could be a significant catalyst for a long-term recovery.

- Price stability and upward momentum: Increased institutional adoption could lead to greater price stability and potentially fuel upward momentum as larger players enter the market.

- Regulatory clarity is key: Regulatory clarity is crucial for attracting institutional investment. A positive resolution to the SEC lawsuit would likely be a significant factor in attracting institutional funds.

- Monitoring institutional trends: Monitoring the investment activities of institutional players provides a valuable indicator of market confidence and potential future price direction.

Retail Investor Behavior and its Influence

Retail investor sentiment and behavior continue to play a significant role in XRP price fluctuations.

- FOMO-driven buying: Fear of missing out (FOMO) can drive impulsive buying, potentially creating unsustainable price bubbles that eventually burst.

- Fear-driven selling: Fear and uncertainty, particularly during periods of negative news, can lead to panic selling, further exacerbating price drops.

- Interpreting retail influence: Understanding retail investor psychology is crucial for interpreting short-term XRP price fluctuations and identifying potential market turning points.

Conclusion

The XRP recovery remains uncertain, intricately linked to the Ripple-SEC lawsuit's outcome and the dynamics of the XRP derivatives market. The inherent volatility and leverage involved in derivatives trading amplify price swings, making it crucial for investors to understand the risks involved. While the legal battle continues to dominate headlines, monitoring trading volume, futures contracts, and overall market sentiment, including both institutional and retail investor behavior, is essential for navigating the complexities of the XRP market. Remember, thorough research and risk management are vital for navigating the unpredictable world of XRP and cryptocurrency derivatives. Stay informed about all developments related to the Ripple case and the XRP derivatives market before making any investment decisions. Don't let the potential for XRP recovery lead to impulsive actions; careful analysis and risk assessment are key to responsible XRP trading and investment.

Featured Posts

-

Cherry Red Heels And A Giant Ring Rihannas Latest Look

May 07, 2025

Cherry Red Heels And A Giant Ring Rihannas Latest Look

May 07, 2025 -

Hawkgirls Wings A Key Detail Revealed In James Gunns Superman Movie

May 07, 2025

Hawkgirls Wings A Key Detail Revealed In James Gunns Superman Movie

May 07, 2025 -

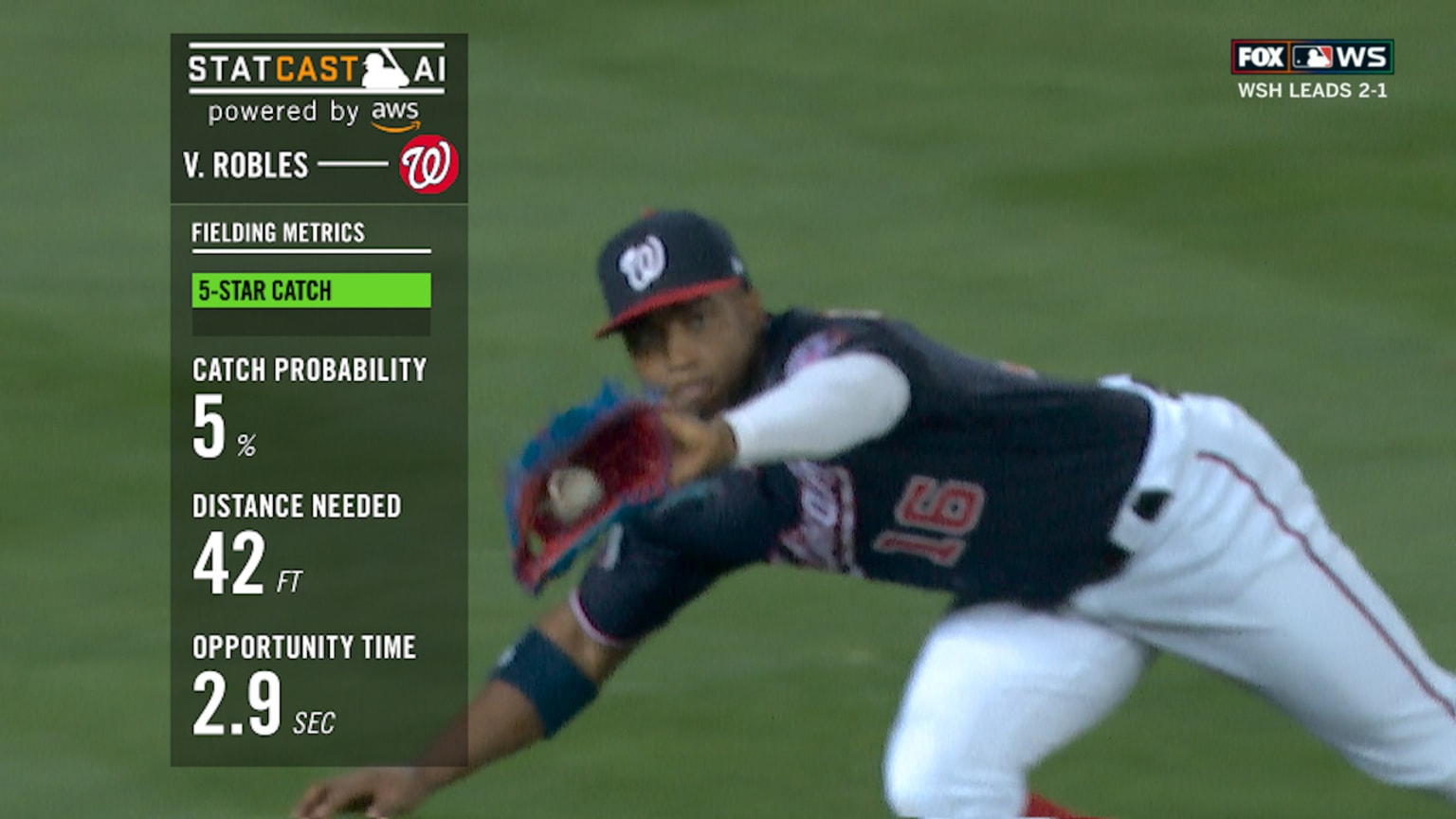

Robles Diving Catch And Injury Mariner Out After Crashing Into Oracle Park Netting

May 07, 2025

Robles Diving Catch And Injury Mariner Out After Crashing Into Oracle Park Netting

May 07, 2025 -

Recent Bitcoin Surge 10 Week High Broken Approaching 100 000

May 07, 2025

Recent Bitcoin Surge 10 Week High Broken Approaching 100 000

May 07, 2025 -

Najnowszy Sondaz Prezydencki Onetu Radosc Dla Trzaskowskiego I Nawrockiego

May 07, 2025

Najnowszy Sondaz Prezydencki Onetu Radosc Dla Trzaskowskiego I Nawrockiego

May 07, 2025

Latest Posts

-

The Night Counting Crows Changed Music History On Saturday Night Live

May 08, 2025

The Night Counting Crows Changed Music History On Saturday Night Live

May 08, 2025 -

Saturday Night Live The Catalyst For Counting Crows Rise To Stardom

May 08, 2025

Saturday Night Live The Catalyst For Counting Crows Rise To Stardom

May 08, 2025 -

Counting Crows Snl Appearance A Turning Point In Their Career

May 08, 2025

Counting Crows Snl Appearance A Turning Point In Their Career

May 08, 2025 -

Saturday Night Live And Counting Crows A Career Defining Moment

May 08, 2025

Saturday Night Live And Counting Crows A Career Defining Moment

May 08, 2025 -

Counting Crows 1995 Snl Performance A Retrospective

May 08, 2025

Counting Crows 1995 Snl Performance A Retrospective

May 08, 2025