XRP (Ripple) At Under $3: Investment Risks And Rewards

Table of Contents

Potential Rewards of Investing in XRP at Under $3

The current price of XRP presents several potential rewards for savvy investors. Let's explore some key aspects.

Technological Advantages

RippleNet, Ripple's payment solution, is a significant driver of XRP's potential. It facilitates fast, low-cost cross-border transactions for financial institutions, offering a compelling alternative to traditional methods. XRP's role within RippleNet is crucial, enabling near-instantaneous settlements and significantly reducing transaction fees compared to other cryptocurrencies like Bitcoin or Ethereum. Ripple boasts partnerships with major banks and financial institutions globally, indicating a growing level of institutional adoption and trust.

- Faster transaction speeds: XRP transactions are significantly faster than many other cryptocurrencies.

- Lower fees: XRP's transaction fees are considerably lower, making it a cost-effective solution for large-scale payments.

- Global reach: RippleNet's network spans the globe, facilitating international transactions efficiently.

- Institutional partnerships: Major financial institutions adopting RippleNet strengthen XRP's position and potential for future growth.

Price Appreciation Potential

XRP's historical price has demonstrated significant volatility. However, several potential catalysts could drive future price growth. Regulatory clarity, for instance, could unlock substantial investor confidence. Increased adoption by financial institutions and wider public acceptance are also key factors. The current low price point presents a potentially attractive entry point if these catalysts materialize. Market capitalization and adoption rates suggest considerable upside potential if XRP gains further traction. Positive news and technological advancements frequently correlate with price increases.

- Potential for significant price increase: Based on historical trends and market projections, substantial price appreciation is possible.

- Positive market sentiment: Positive news and developments often lead to increased demand and price appreciation.

- Regulatory developments: A positive resolution to the SEC lawsuit could significantly impact XRP's price.

Diversification Benefits

Adding XRP to a diversified investment portfolio can offer several advantages. Its price often exhibits low correlation with traditional assets like stocks and bonds, meaning its performance isn't necessarily tied to the performance of these other assets. This lack of correlation can act as a hedge against market volatility, potentially reducing overall portfolio risk. XRP's unique characteristics as both a cryptocurrency and a utility token within the Ripple ecosystem further enhance its diversification potential.

- Risk mitigation: Diversification reduces overall portfolio risk by spreading investments across different asset classes.

- Portfolio diversification: XRP offers a unique addition to a diversified portfolio, potentially reducing reliance on traditional assets.

- Potential for uncorrelated returns: XRP's performance may not always mirror that of other assets, offering potential for uncorrelated returns.

Significant Risks Associated with Investing in XRP

While the potential rewards are significant, investing in XRP also carries considerable risks. It's crucial to understand these before committing any capital.

Regulatory Uncertainty

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) casts a significant shadow over XRP's future. A negative court ruling could severely impact XRP's price and potentially restrict its use in the United States, the world's largest economy. The broader regulatory landscape for cryptocurrencies remains uncertain, presenting ongoing risk to XRP's adoption and value.

- SEC lawsuit: The ongoing legal battle creates significant uncertainty and price volatility.

- Regulatory uncertainty: The uncertain regulatory environment poses a substantial risk to XRP's future.

- Potential for price volatility: Negative regulatory developments can trigger significant price drops.

Market Volatility

The cryptocurrency market is inherently volatile. XRP's price can fluctuate dramatically in short periods due to market sentiment, news events, and broader economic factors. This volatility poses a significant risk to investors, who could experience substantial losses if the market turns bearish. The risk is amplified given XRP's relatively smaller market capitalization compared to Bitcoin or Ethereum.

- High price volatility: XRP's price is subject to considerable fluctuations.

- Market sentiment: Market sentiment can significantly influence XRP's price.

- Potential for significant losses: Sudden market downturns can result in substantial investment losses.

Competition in the Crypto Space

The cryptocurrency market is fiercely competitive. Many other payment solutions and cryptocurrencies are vying for market share, posing a challenge to XRP's dominance. The emergence of new technologies and improved solutions could impact XRP's adoption and long-term value. Analyzing XRP's strengths and weaknesses relative to its competitors is essential before investing.

- Competitive market: The cryptocurrency market is crowded and intensely competitive.

- Emergence of rival technologies: New payment solutions may challenge XRP's market position.

- Market share challenges: Maintaining market share against competitors is a significant challenge for XRP.

Conclusion

Investing in XRP at under $3 offers a compelling risk-reward proposition. The potential for significant price appreciation exists, driven by its technological advantages and potential for increased adoption. However, substantial risks remain, particularly regarding regulatory uncertainty and inherent market volatility. Before investing in XRP, conduct thorough research, understand the legal complexities, and carefully assess your risk tolerance. Remember, diligent due diligence is paramount before investing in any cryptocurrency, including XRP (Ripple). Weigh the potential rewards and risks carefully to determine if XRP aligns with your investment strategy.

Featured Posts

-

The Exclusive Reality Of Milwaukees Tight Rental Market

May 02, 2025

The Exclusive Reality Of Milwaukees Tight Rental Market

May 02, 2025 -

Bharty Ryasty Dhsht Grdy Kshmyr Myn Eyd Pr Nwjwan Shhyd

May 02, 2025

Bharty Ryasty Dhsht Grdy Kshmyr Myn Eyd Pr Nwjwan Shhyd

May 02, 2025 -

School Desegregation Order Ended What Happens Next

May 02, 2025

School Desegregation Order Ended What Happens Next

May 02, 2025 -

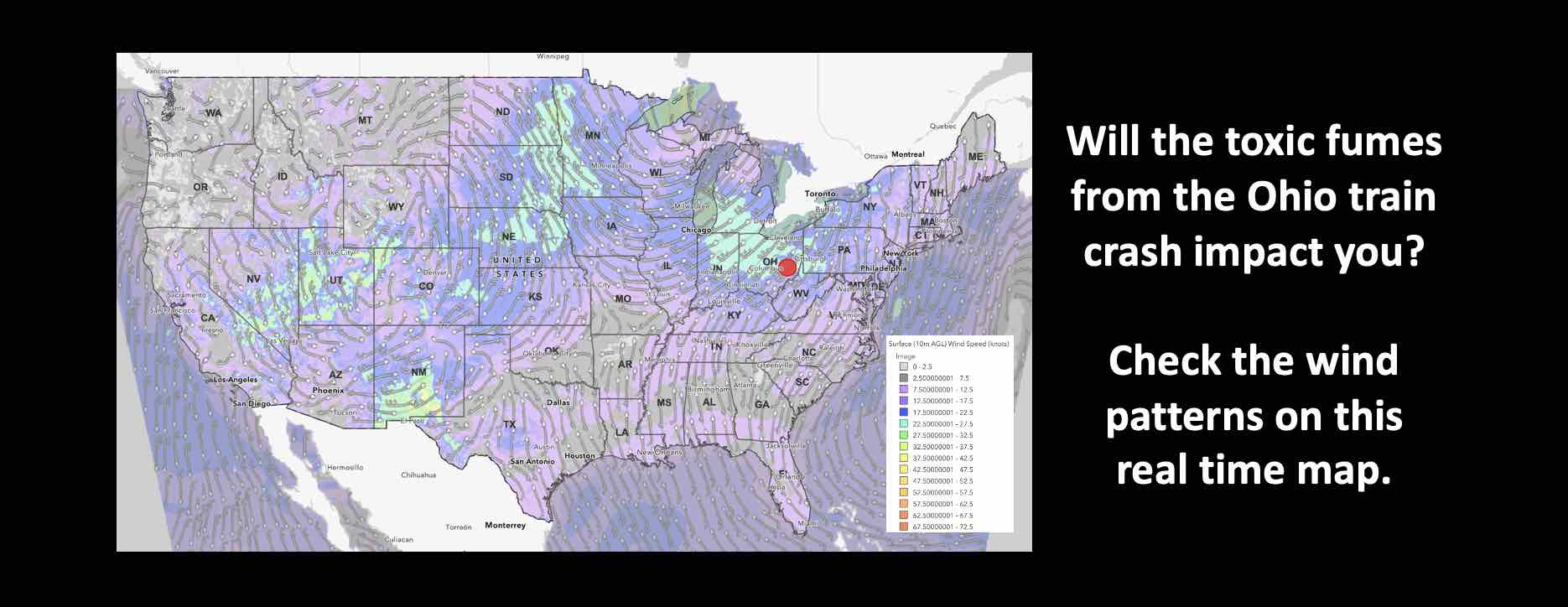

Toxic Chemical Residues From Ohio Derailment Months Long Building Contamination

May 02, 2025

Toxic Chemical Residues From Ohio Derailment Months Long Building Contamination

May 02, 2025 -

Aventure De 8 000 Km Le Recit De Trois Jeunes Du Bocage Ornais

May 02, 2025

Aventure De 8 000 Km Le Recit De Trois Jeunes Du Bocage Ornais

May 02, 2025

Latest Posts

-

Ananya Panday Celebrates Riots First Birthday A Look At The Puppys Special Day

May 02, 2025

Ananya Panday Celebrates Riots First Birthday A Look At The Puppys Special Day

May 02, 2025 -

1 Mayis In Oeykuesue Emek Ve Dayanisma Icin Verilen Muecadeleler

May 02, 2025

1 Mayis In Oeykuesue Emek Ve Dayanisma Icin Verilen Muecadeleler

May 02, 2025 -

Ananya Pandays Pet Dog Riot Turns One A Bone Cake Birthday Bash

May 02, 2025

Ananya Pandays Pet Dog Riot Turns One A Bone Cake Birthday Bash

May 02, 2025 -

Tuerkiye De 1 Mayis Emek Ve Dayanisma Guenue Gecmisten Guenuemueze Bir Bakis

May 02, 2025

Tuerkiye De 1 Mayis Emek Ve Dayanisma Guenue Gecmisten Guenuemueze Bir Bakis

May 02, 2025 -

1 Mayis Emek Ve Dayanisma Guenue Nde Yasananlar Gecmisten Guenuemueze

May 02, 2025

1 Mayis Emek Ve Dayanisma Guenue Nde Yasananlar Gecmisten Guenuemueze

May 02, 2025