XRP (Ripple) Price Analysis: Buy Or Sell At Under $3?

Table of Contents

Current Market Conditions and Technical Analysis of XRP

The overall cryptocurrency market sentiment is currently [insert current market sentiment - bullish, bearish, or neutral, with supporting data]. This broader market trend significantly influences XRP's price, as it often moves in correlation with other major cryptocurrencies like Bitcoin and Ethereum. Understanding the general market direction is crucial for interpreting XRP's price action.

Analyzing the XRP price chart using technical indicators provides valuable insights into potential future price movements. [Insert chart here showing XRP price with relevant indicators like moving averages (e.g., 50-day and 200-day MA), RSI, and MACD].

Key support and resistance levels for XRP are currently observed around [insert support and resistance levels with explanations]. Breaking above resistance levels often indicates a bullish trend, while falling below support levels suggests a bearish trend.

- Recent Price Movements and Volatility: XRP has experienced [describe recent price movements – e.g., a period of consolidation, a significant price drop, a steady upward trend] in recent weeks/months, exhibiting [describe volatility – high, low, moderate] volatility.

- Significant Technical Patterns: While no definitive patterns are guaranteed, observing potential patterns like head and shoulders or double bottoms can offer clues about potential price reversals. [Explain any observable patterns and their potential implications].

- Trading Volume and Implications: High trading volume accompanying price increases generally signals strong bullish momentum, while low volume suggests weaker price movements and potential for reversals. Current trading volume is [describe current volume and its interpretation].

Fundamental Analysis of Ripple and XRP

Ripple's technology, a real-time gross settlement system, currency exchange, and remittance network, aims to provide fast, efficient, and cost-effective cross-border payments. Its use cases extend beyond just cryptocurrency, encompassing traditional financial institutions seeking streamlined solutions. The adoption rate of RippleNet, Ripple's payment network, is steadily increasing, with numerous financial institutions globally integrating its technology.

Ripple's partnerships and collaborations with major financial institutions are a significant factor influencing XRP's value. [List key partnerships and explain their potential impact on XRP's price and adoption]. These partnerships demonstrate the growing acceptance of Ripple's technology within the traditional financial sector.

The ongoing SEC lawsuit against Ripple presents a significant risk to XRP's price. The outcome of this legal battle will likely have a profound impact on XRP's future. [Explain the current status of the lawsuit and potential outcomes, both positive and negative].

- RippleNet and its Global Reach: RippleNet's expansion into new markets and its increasing number of clients are positive signs for XRP's long-term prospects.

- Key Partnerships and their Potential Impact: Highlight the strategic importance of each partnership and its potential contribution to XRP's growth and adoption.

- Legal Implications of the SEC Case and Potential Outcomes: Thoroughly discuss various scenarios and their potential impact on XRP's price and future.

- Positive Developments and News Impacting Ripple's Prospects: Mention any recent positive developments, such as successful partnerships, technological advancements, or regulatory approvals, that could boost XRP's value.

Predicting Future XRP Price Movement: Potential Catalysts and Risks

Several factors could drive XRP's price upwards. A positive court ruling in the SEC lawsuit is a major potential catalyst, potentially unlocking significant institutional investment. Increased adoption by financial institutions and broader regulatory clarity would also contribute to a price surge.

However, potential risks exist. An unfavorable court ruling could severely impact XRP's price. Increased competition from other cryptocurrencies and payment solutions could also hinder XRP's growth. Furthermore, broader market downturns often drag down even the most promising cryptocurrencies.

Various price prediction models exist, ranging from technical analysis to algorithmic predictions. However, it's crucial to remember that these models are not foolproof and should be viewed with caution. [Discuss limitations and why they should not be the sole basis of investment decisions].

- Potential Bullish Catalysts and their Likelihood: List potential positive events (e.g., regulatory clarity, major partnerships, technological breakthroughs) and assess their likelihood of occurring.

- Potential Bearish Catalysts and their Potential Impact: List potential negative events (e.g., negative court rulings, increased competition, market downturns) and assess their potential impact on XRP's price.

- Importance of Diversification: Always diversify your investment portfolio to mitigate risk. Don't put all your eggs in one basket.

- Speculative Nature of Cryptocurrency Investments: Cryptocurrency investments are inherently risky and speculative. Never invest more than you can afford to lose.

XRP Price Prediction Scenarios: Best-Case, Worst-Case, and Most Likely

Based on the analysis, here are plausible XRP price scenarios:

- Best-Case Scenario (Next 3-6 months): [Price Target] – Driven by a positive court ruling, significant partnerships, and a bullish market.

- Worst-Case Scenario (Next 3-6 months): [Price Target] – Driven by a negative court ruling, increased competition, and a bearish market.

- Most Likely Scenario (Next 3-6 months): [Price Target] – A more conservative estimate reflecting a balanced outlook considering both positive and negative factors.

These are just educated guesses. Actual results could differ significantly. Long-term predictions (1-3 years) are even more speculative and are omitted for the sake of clarity.

Conclusion

This XRP price analysis reveals a complex picture influenced by market sentiment, technical indicators, Ripple's fundamental strengths, and the ongoing SEC lawsuit. Whether buying XRP under $3 is advisable depends heavily on your risk tolerance and investment horizon. While the potential for significant gains exists, the risks are substantial.

Ultimately, the decision to buy or sell XRP at under $3 is a personal one based on your risk tolerance and investment goals. Conduct thorough research, consider the information presented in this XRP price analysis, and consult with a financial advisor before making any investment decisions. Remember to always do your own due diligence before investing in any cryptocurrency, including XRP (Ripple).

Featured Posts

-

How Michael Sheen Erased 1 Million In Debt For 900 People

May 01, 2025

How Michael Sheen Erased 1 Million In Debt For 900 People

May 01, 2025 -

Actress Priscilla Pointer Dead At 100 A Legacy Remembered

May 01, 2025

Actress Priscilla Pointer Dead At 100 A Legacy Remembered

May 01, 2025 -

Michael Sheen And Sharon Horgans British Drama Finds A New Home

May 01, 2025

Michael Sheen And Sharon Horgans British Drama Finds A New Home

May 01, 2025 -

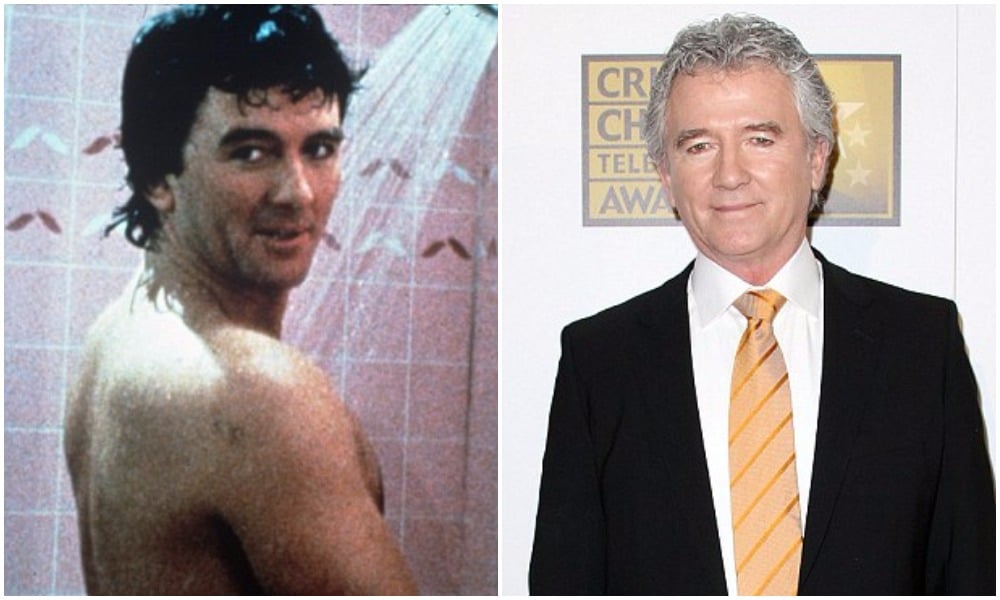

Centenarian Dallas Star Passes Away

May 01, 2025

Centenarian Dallas Star Passes Away

May 01, 2025 -

Kogi Train Malfunction Leaves Passengers Stranded

May 01, 2025

Kogi Train Malfunction Leaves Passengers Stranded

May 01, 2025

Latest Posts

-

Dallas Cast Mourns Another 80s Soap Icon Passes Away

May 01, 2025

Dallas Cast Mourns Another 80s Soap Icon Passes Away

May 01, 2025 -

Stage And Screen Icon Priscilla Pointer Passes Away

May 01, 2025

Stage And Screen Icon Priscilla Pointer Passes Away

May 01, 2025 -

80s Soap Opera Tragedy A Dallas Star Dies

May 01, 2025

80s Soap Opera Tragedy A Dallas Star Dies

May 01, 2025 -

Remembering Priscilla Pointer A Century Of Stage And Screen Excellence

May 01, 2025

Remembering Priscilla Pointer A Century Of Stage And Screen Excellence

May 01, 2025 -

Tvs Dallas The Death Of Another Beloved 80s Star

May 01, 2025

Tvs Dallas The Death Of Another Beloved 80s Star

May 01, 2025