XRP's 400% Jump: Predicting Future Price Movements

Table of Contents

Analyzing the Reasons Behind XRP's 400% Price Increase

XRP's meteoric rise wasn't a random event. Several interconnected factors contributed to this significant price jump. Let's break them down:

Ripple's Legal Victory and Market Sentiment

Ripple Labs' partial victory against the SEC significantly boosted investor confidence. The ruling, while not a complete exoneration, removed a considerable overhang of uncertainty that had plagued XRP for years.

- Increased Trading Volume: The ruling unlocked significant pent-up demand, leading to a massive surge in trading volume.

- Improved Market Perception: The positive court decision shifted market sentiment, portraying XRP in a more favorable light and attracting new investors.

- Reduced Regulatory Risk: While the legal battle isn't entirely over, the partial victory reduced perceived regulatory risk, making XRP a more appealing investment.

[Insert chart showing XRP price movements before and after the ruling, highlighting volume spikes].

Growing Institutional Adoption and Partnerships

Beyond the legal win, increasing institutional adoption and strategic partnerships fueled XRP's price climb. Ripple's focus on building relationships with financial institutions is starting to pay dividends.

- Key Partnerships: Ripple has forged partnerships with several major financial institutions globally, expanding XRP's utility in cross-border payments. [List specific examples of significant partnerships and their impact].

- Enhanced Liquidity: Increased institutional adoption leads to greater liquidity in the XRP market, reducing price volatility and increasing stability.

- Global Reach: Ripple's partnerships are expanding XRP's reach into new markets, increasing demand and potentially driving further price appreciation.

Macroeconomic Factors and Market Trends

The broader cryptocurrency market and macroeconomic conditions also play a role in XRP's price fluctuations.

- Correlation with Bitcoin: Like most cryptocurrencies, XRP shows some correlation with Bitcoin's price movements. A bullish Bitcoin market generally benefits altcoins like XRP.

- Overall Market Sentiment: Positive sentiment across the broader crypto market can contribute to increased demand for XRP. Conversely, negative sentiment can trigger sell-offs.

- Inflationary Concerns: In times of economic uncertainty and inflation, investors often seek alternative assets, potentially increasing demand for cryptocurrencies, including XRP.

[Insert chart showing the correlation between Bitcoin's price and XRP's price, along with a broader market index].

Predicting Future XRP Price Movements: Challenges and Opportunities

Predicting future XRP price movements is inherently complex, but by combining technical and fundamental analysis, we can gain valuable insights.

Technical Analysis and Chart Patterns

Technical analysis uses historical price data and indicators to predict future price action.

- Moving Averages: Examining moving averages (e.g., 50-day, 200-day) can reveal trends and potential support/resistance levels.

- Relative Strength Index (RSI): The RSI helps gauge the momentum of price movements, indicating whether XRP is overbought or oversold.

- Moving Average Convergence Divergence (MACD): The MACD identifies potential buy/sell signals by analyzing the relationship between two moving averages.

[Include chart examples showcasing these technical indicators]. It's crucial to remember that technical analysis is not foolproof and should be used in conjunction with other forms of analysis.

Fundamental Analysis and Ripple's Roadmap

Fundamental analysis focuses on the underlying value of XRP and Ripple's long-term prospects.

- Technological Advancements: Ripple's ongoing development of its technology, including improvements to its payment solutions, could enhance XRP's utility and value.

- Expansion into New Markets: Ripple's efforts to expand into new geographical markets and sectors could increase demand for XRP.

- Regulatory Landscape: The evolving regulatory landscape for cryptocurrencies will significantly impact XRP's future price. Positive regulatory developments could boost its price.

[Include quotes from relevant industry analysts or experts supporting these points].

Risk Assessment and Potential Volatility

Investing in cryptocurrencies, including XRP, carries significant risk.

- Price Volatility: XRP's price is notoriously volatile, subject to rapid and significant price swings.

- Market Manipulation: The cryptocurrency market is susceptible to manipulation, potentially affecting XRP's price.

- Regulatory Uncertainty: The regulatory environment surrounding cryptocurrencies remains uncertain, posing a risk to investors.

Always remember that crypto investments are speculative and high-risk. Diversification and risk management are crucial.

Conclusion: The Future of XRP: Informed Decisions Based on Price Prediction

XRP's recent price surge is a testament to the interplay of legal victories, increased institutional adoption, and broader market trends. While predicting the future is impossible, analyzing these factors allows us to make more informed decisions. The path ahead presents both opportunities and challenges. XRP's price is likely to remain volatile, making careful risk management essential. To effectively track XRP price predictions and analyze XRP's future potential, it's vital to continuously monitor market trends, conduct thorough research, and stay updated on Ripple's developments and the overall regulatory landscape. Consider further reading on XRP whitepapers, market analysis reports, and expert opinions to enhance your understanding before making any investment decisions. Remember to always conduct your own research and invest responsibly.

Featured Posts

-

Dwp Announces Major Universal Credit Claim Verification Changes

May 08, 2025

Dwp Announces Major Universal Credit Claim Verification Changes

May 08, 2025 -

Assessing The Risk Chinas Activities In Greenland And Us Response

May 08, 2025

Assessing The Risk Chinas Activities In Greenland And Us Response

May 08, 2025 -

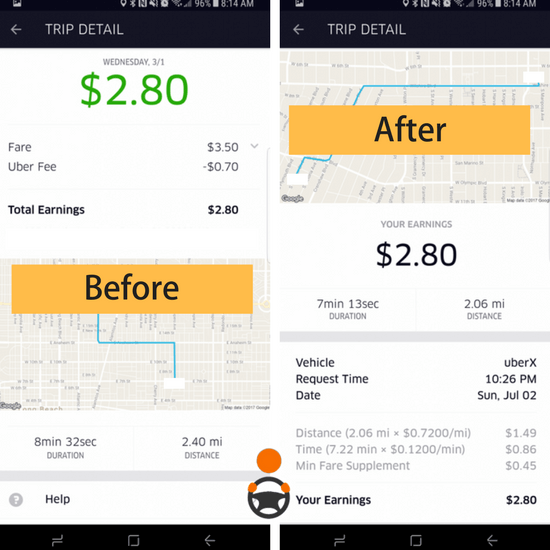

Cash Only Understanding Ubers Auto Service Policy Change

May 08, 2025

Cash Only Understanding Ubers Auto Service Policy Change

May 08, 2025 -

Is The Dwp Owed You Money Claim Your Universal Credit Refund

May 08, 2025

Is The Dwp Owed You Money Claim Your Universal Credit Refund

May 08, 2025 -

Car Dealers Renew Opposition To Ev Mandates A Growing Revolt

May 08, 2025

Car Dealers Renew Opposition To Ev Mandates A Growing Revolt

May 08, 2025