XRP's Big Moment: ETF Applications, SEC Settlements, And Market Predictions

Table of Contents

The Ripple-SEC Settlement and its Impact on XRP

Understanding the SEC Lawsuit:

The SEC lawsuit against Ripple Labs, the company behind XRP, alleged that Ripple conducted an unregistered securities offering of XRP. The lawsuit, filed in December 2020, centered on whether XRP should be classified as a security under US law. This had significant implications for XRP's price and trading.

- Key allegations against Ripple: The SEC argued that Ripple sold XRP as an unregistered security, violating federal securities laws. They pointed to Ripple's sales of XRP to institutional investors and its control over XRP distribution.

- Ripple's defense strategy: Ripple maintained that XRP is a currency and not a security, arguing that it lacked the characteristics of an investment contract as defined by the Howey Test. They emphasized the decentralized nature of XRP and its widespread use on various exchanges.

- The judge's ruling: In July 2023, Judge Analisa Torres ruled that programmatic sales of XRP on exchanges did not constitute the sale of unregistered securities. However, direct sales to institutional investors were deemed to be unregistered securities offerings. This partial victory for Ripple significantly impacted the price of XRP and clarified certain aspects of its regulatory status.

- Overall significance: The partial victory in the SEC lawsuit provided a degree of regulatory clarity for XRP, boosting investor confidence and potentially paving the way for increased adoption. However, the ongoing legal landscape remains complex.

The Settlement's Implications for XRP Price:

The outcome of the Ripple-SEC lawsuit has had a direct and significant impact on XRP's price.

- Potential short-term and long-term price movements: The partial victory led to a surge in XRP's price, reflecting the market's relief at the reduced regulatory uncertainty. However, long-term price movements depend on several factors, including future regulatory developments and broader market conditions.

- Increased regulatory clarity: While not a complete victory, the ruling provided clarity on certain aspects of XRP's regulatory status, removing some of the uncertainty that had previously weighed on its price. Further regulatory clarity could lead to further price increases.

- Investor confidence: The ruling boosted investor confidence, potentially attracting new investments and increasing trading volume. This renewed confidence is crucial for the long-term success of XRP.

Future Regulatory Landscape for XRP:

The Ripple-SEC case sets a precedent that could influence how other cryptocurrencies are regulated.

- Increased regulatory scrutiny on other cryptocurrencies: The case has heightened regulatory scrutiny on other cryptocurrencies, prompting other companies to review their own token offerings and compliance strategies.

- Potential for increased adoption: Increased regulatory clarity, even partially, could lead to increased adoption by institutional investors and businesses, boosting demand for XRP.

- Implications for institutional investment: The ruling could pave the way for increased institutional investment in XRP, as some institutions were hesitant to invest while the legal uncertainty remained.

The Surge in XRP ETF Applications and Their Significance

Understanding Exchange-Traded Funds (ETFs):

ETFs are investment funds traded on stock exchanges, offering investors diversified exposure to a specific asset class or market segment.

- What are ETFs?: ETFs are essentially baskets of assets (like stocks or, potentially, cryptocurrencies) that trade on exchanges like stocks.

- How do they work?: Investors buy and sell ETF shares, reflecting the underlying assets' value. This provides easy access to a diversified portfolio.

- Why are they important for market accessibility?: ETFs make investing in specific asset classes more accessible to retail investors, improving liquidity and price discovery.

The Current State of XRP ETF Applications:

Several firms have filed applications with the SEC to list XRP ETFs in the US.

- List of firms applying: While the exact list may change, several prominent financial institutions are reportedly pursuing XRP ETF listings.

- Potential listing dates (if known): The timing of potential listings remains uncertain and is dependent on SEC approval.

- The impact of ETF listing on liquidity and price discovery: Listing of XRP ETFs would significantly increase XRP's liquidity, leading to more efficient price discovery and potentially greater price stability.

The Potential Impact on XRP Adoption and Liquidity:

Increased accessibility through ETFs could significantly boost XRP adoption.

- Increased institutional investment: ETFs make it easier for institutional investors to allocate capital to XRP, potentially increasing demand.

- Broader retail investor access: Retail investors can gain easier access to XRP through ETFs, broadening its market reach.

- Potential for price appreciation: Increased demand from both institutional and retail investors could lead to XRP's price appreciation.

- Increased trading volume: ETF listings are expected to significantly increase trading volume for XRP.

Market Predictions and Future Outlook for XRP

Analyst Predictions and Price Targets:

Several analysts have offered price predictions for XRP, but these should be viewed cautiously.

- Include different price predictions with associated timelines: Various sources offer varying price targets for XRP, ranging from conservative to extremely bullish. It's important to remember these are predictions, not guarantees. Reference specific sources to maintain credibility.

Factors Influencing Future XRP Price:

Several factors will influence XRP's future price movements.

- Adoption by businesses: Wider adoption of XRP by businesses for payments and other use cases could boost its price.

- Regulatory developments: Further regulatory clarity or uncertainty will significantly impact XRP's price.

- Technological advancements: Improvements in XRP's underlying technology could attract more users and investors.

- Overall market sentiment: The overall sentiment in the cryptocurrency market will influence XRP's price.

- Macroeconomic factors: Global economic conditions can significantly affect XRP's price.

Risk Assessment for Investing in XRP:

Investing in XRP carries significant risks.

- Volatility: XRP's price is highly volatile, meaning it can experience substantial price swings in short periods.

- Regulatory uncertainty: The regulatory landscape for cryptocurrencies remains uncertain, posing a risk to XRP investors.

- The potential for significant losses: Investing in cryptocurrencies always carries the risk of significant financial losses.

Conclusion:

The future of XRP remains uncertain, yet the recent developments surrounding ETF applications and the Ripple-SEC settlement are significant catalysts. While market predictions vary, the potential for increased adoption and liquidity through ETFs cannot be ignored. Understanding the nuances of the legal battles, the implications of ETF listings, and the inherent risks associated with investing in XRP is crucial for informed decision-making. Conduct thorough research and carefully consider your own risk tolerance before investing in XRP or any other cryptocurrency. Stay updated on the latest developments surrounding XRP, and make informed decisions based on a comprehensive understanding of the market dynamics. Consider diversifying your portfolio and only investing what you can afford to lose.

Featured Posts

-

Aj Ke Ywm Ykjhty Kshmyr Ke Ealmy Tqrybat

May 02, 2025

Aj Ke Ywm Ykjhty Kshmyr Ke Ealmy Tqrybat

May 02, 2025 -

Rambo First Blood Director Ted Kotcheff Passes Away At 94

May 02, 2025

Rambo First Blood Director Ted Kotcheff Passes Away At 94

May 02, 2025 -

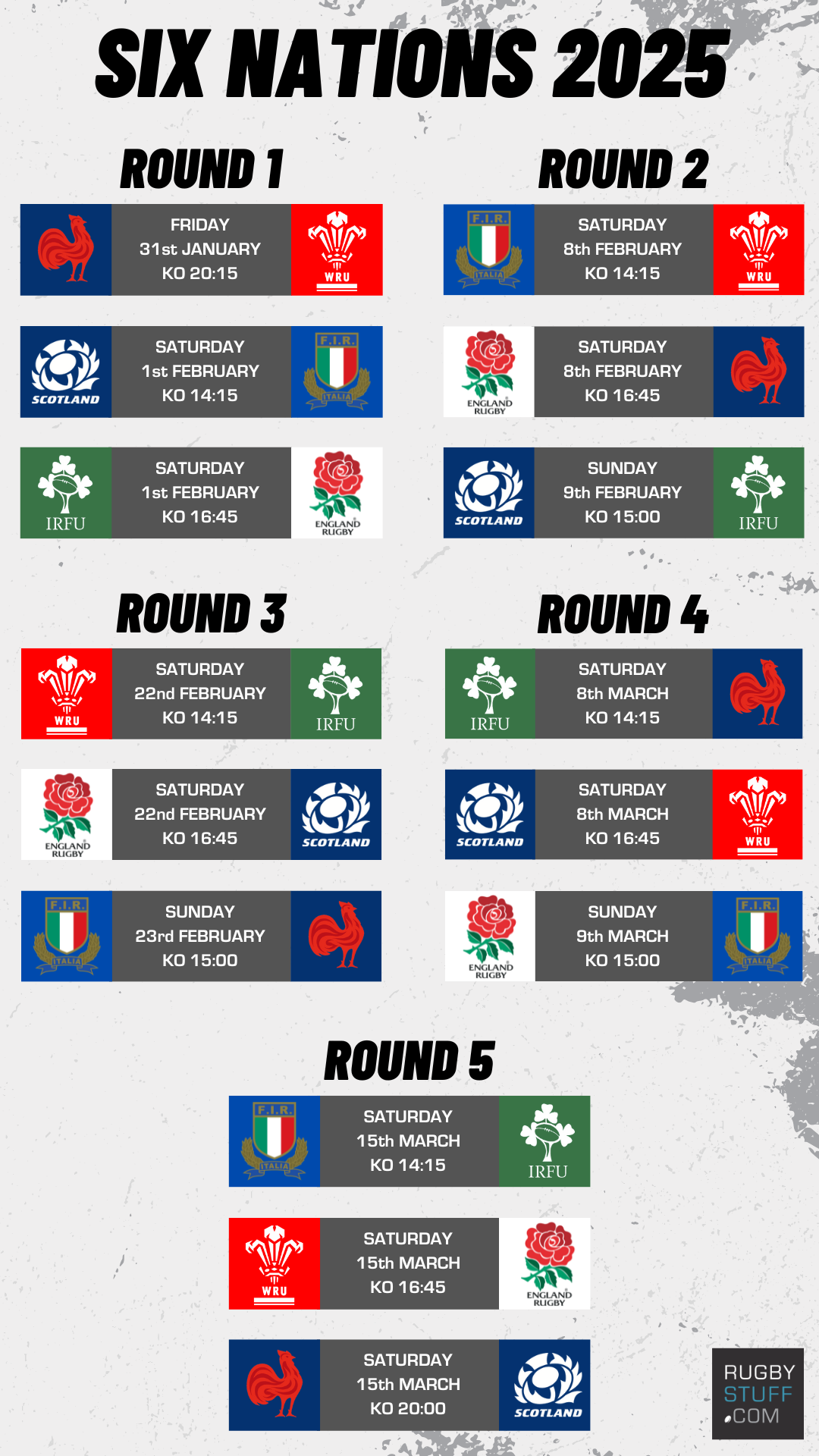

Six Nations 2025 Can France Continue Their Success

May 02, 2025

Six Nations 2025 Can France Continue Their Success

May 02, 2025 -

Eco Flow Wave 3 Review Features Performance And Value For Money

May 02, 2025

Eco Flow Wave 3 Review Features Performance And Value For Money

May 02, 2025 -

Tarykh Isdar Blay Styshn 6 W Ahm Mmyzath

May 02, 2025

Tarykh Isdar Blay Styshn 6 W Ahm Mmyzath

May 02, 2025

Latest Posts

-

Could Boris Johnsons Return Save The Tory Party

May 03, 2025

Could Boris Johnsons Return Save The Tory Party

May 03, 2025 -

Amant Alastthmar Baljbht Alwtnyt Wrqt Syasat Aqtsadyt Jdydt

May 03, 2025

Amant Alastthmar Baljbht Alwtnyt Wrqt Syasat Aqtsadyt Jdydt

May 03, 2025 -

Understanding Reform Uks Approach To Agriculture In The Uk

May 03, 2025

Understanding Reform Uks Approach To Agriculture In The Uk

May 03, 2025 -

What Does Reform Uk Offer Uk Farmers A Comprehensive Guide

May 03, 2025

What Does Reform Uk Offer Uk Farmers A Comprehensive Guide

May 03, 2025 -

Reform Uk And Agriculture Examining Their Plans For The Uk Farming Industry

May 03, 2025

Reform Uk And Agriculture Examining Their Plans For The Uk Farming Industry

May 03, 2025