XRP's Big Moment? Understanding The Implications Of ETF Listings And SEC Actions

Table of Contents

The Potential for XRP ETFs and Their Market Impact

What are XRP ETFs and why are they significant?

Exchange Traded Funds (ETFs) are investment funds traded on stock exchanges, offering investors easy access to a diversified portfolio. An XRP ETF would allow investors to buy and sell XRP shares through traditional brokerage accounts, significantly increasing accessibility. The approval of XRP ETFs could propel XRP into the mainstream, boosting liquidity and adoption. This increased accessibility would likely lead to greater price stability and substantially higher trading volume compared to its current status.

- Increased investor access: Makes XRP investment simpler for a broader range of investors.

- Enhanced liquidity: Facilitates easier buying and selling of XRP, reducing price volatility.

- Price stabilization potential: Increased trading volume can lead to more stable price fluctuations.

- Greater market maturity: ETF listing is often seen as a sign of a cryptocurrency's increased legitimacy and acceptance.

Challenges and Hurdles to XRP ETF Approval

The primary hurdle to XRP ETF approval is the ongoing SEC lawsuit against Ripple Labs, the company behind XRP. The SEC's classification of XRP as a security significantly impacts the likelihood of ETF approval. Regulatory uncertainty surrounding the lawsuit creates considerable investor hesitation. Even if the lawsuit concludes favorably for Ripple, the SEC approval process for any new ETF is complex and lengthy, potentially leading to significant delays. Alternative listing strategies, such as launching on international exchanges less regulated than the US, might be considered if SEC approval proves impossible in the near term.

- SEC lawsuit uncertainty: The ongoing legal battle casts a shadow over XRP's future.

- Regulatory approval process complexities: ETF listings require rigorous scrutiny and compliance.

- Potential for delays: The approval process can take considerable time, impacting investor sentiment.

- Alternative listing strategies: Exploring international exchanges might be necessary if US approval is delayed or denied.

The Ripple-SEC Lawsuit and Its Ongoing Influence on XRP

Understanding the Core Issues of the Lawsuit

The SEC alleges that Ripple sold XRP as an unregistered security, raising concerns about investor protection. The lawsuit's outcome will significantly impact XRP's legal status and future. Ripple argues that XRP is a decentralized digital asset, not a security, and that its sales did not constitute an investment contract. The arguments hinge on the definition of a security and the degree of centralization involved in XRP's distribution.

- SEC's classification of XRP: The core issue is whether XRP meets the definition of a security under US law.

- Ripple's defense strategy: Ripple argues XRP functions as a decentralized currency, not a security.

- Potential outcomes of the lawsuit: A win for either side could have wide-reaching consequences.

- Impact on future regulatory clarity: The ruling will provide significant guidance on the regulation of cryptocurrencies.

How the Lawsuit Outcome Could Shape the Future of XRP

The lawsuit's outcome will profoundly affect XRP's trajectory. A positive ruling for Ripple could unlock significant growth, potentially boosting the price and accelerating ETF listing prospects. A negative ruling could severely damage XRP's reputation and price, potentially leading to delisting from exchanges. A settlement might offer a compromise but could still create uncertainty. The result will influence other cryptocurrencies facing similar regulatory scrutiny and could shape future regulatory approaches globally.

- Price volatility: The outcome will likely cause significant price fluctuations in the short term.

- Investor confidence: A positive outcome would likely restore investor confidence, while a negative one could severely damage it.

- Regulatory precedents: The ruling will set precedents for future regulatory actions concerning cryptocurrencies.

- Impact on wider cryptocurrency market: The outcome will influence the overall regulatory environment for cryptocurrencies.

Investing in XRP: Risks and Potential Rewards

Assessing the Risks of XRP Investment

Investing in XRP carries inherent risks. Cryptocurrencies are highly volatile, and XRP is no exception. The ongoing regulatory uncertainty surrounding the SEC lawsuit adds to the risk profile. Security breaches and technological disruptions could also impact the value of XRP. Thorough due diligence and a conservative investment strategy are crucial to mitigate potential losses.

- Market volatility: XRP's price can fluctuate dramatically in short periods.

- Regulatory uncertainty: The SEC lawsuit creates significant uncertainty about XRP's future.

- Security risks: Cryptocurrencies are susceptible to hacking and theft.

- Technological risks: Technological advancements and failures could affect XRP's value and functionality.

Potential Rewards and Long-Term Outlook for XRP

Despite the risks, XRP offers substantial potential rewards. Its growing adoption in cross-border payments provides a solid use case. Technological advancements within the XRP Ledger continuously improve its efficiency and scalability. The long-term prospects depend significantly on the outcome of the SEC lawsuit and its subsequent market adoption.

- High growth potential: XRP's price could significantly increase if the market reacts positively.

- Cross-border payment adoption: XRP's use in international payments could drive significant demand.

- Technological advancements: Improvements to the XRP Ledger could enhance its functionality.

- Ecosystem development: The growth of the XRP ecosystem could further increase its value.

Conclusion

The future of XRP hinges on the outcomes of potential ETF listings and the ongoing SEC lawsuit. While the path forward is uncertain, understanding the implications of these events is crucial for investors. The potential rewards are significant, but so are the risks. Thorough research and a well-defined investment strategy are essential before considering investing in XRP. Stay informed about the latest developments and make informed decisions about your XRP investment strategy. Remember to conduct your own research before making any investment decisions related to XRP.

Featured Posts

-

Sleduyuschiy Papa Rimskiy Vozmozhnye Kandidaty Posle Frantsiska

May 07, 2025

Sleduyuschiy Papa Rimskiy Vozmozhnye Kandidaty Posle Frantsiska

May 07, 2025 -

Mlb Tigers Cruise Past Mariners 9 6 In Season Opener

May 07, 2025

Mlb Tigers Cruise Past Mariners 9 6 In Season Opener

May 07, 2025 -

Is Xrp Ripple A Smart Investment For Long Term Financial Success

May 07, 2025

Is Xrp Ripple A Smart Investment For Long Term Financial Success

May 07, 2025 -

2000 Yankees Diary Comeback Bid Falls Short Record At 500

May 07, 2025

2000 Yankees Diary Comeback Bid Falls Short Record At 500

May 07, 2025 -

Thdythat Jdydt Bshan Rhlat Alkhtwt Almlkyt Almghrbyt Byn Saw Bawlw Waldar Albydae

May 07, 2025

Thdythat Jdydt Bshan Rhlat Alkhtwt Almlkyt Almghrbyt Byn Saw Bawlw Waldar Albydae

May 07, 2025

Latest Posts

-

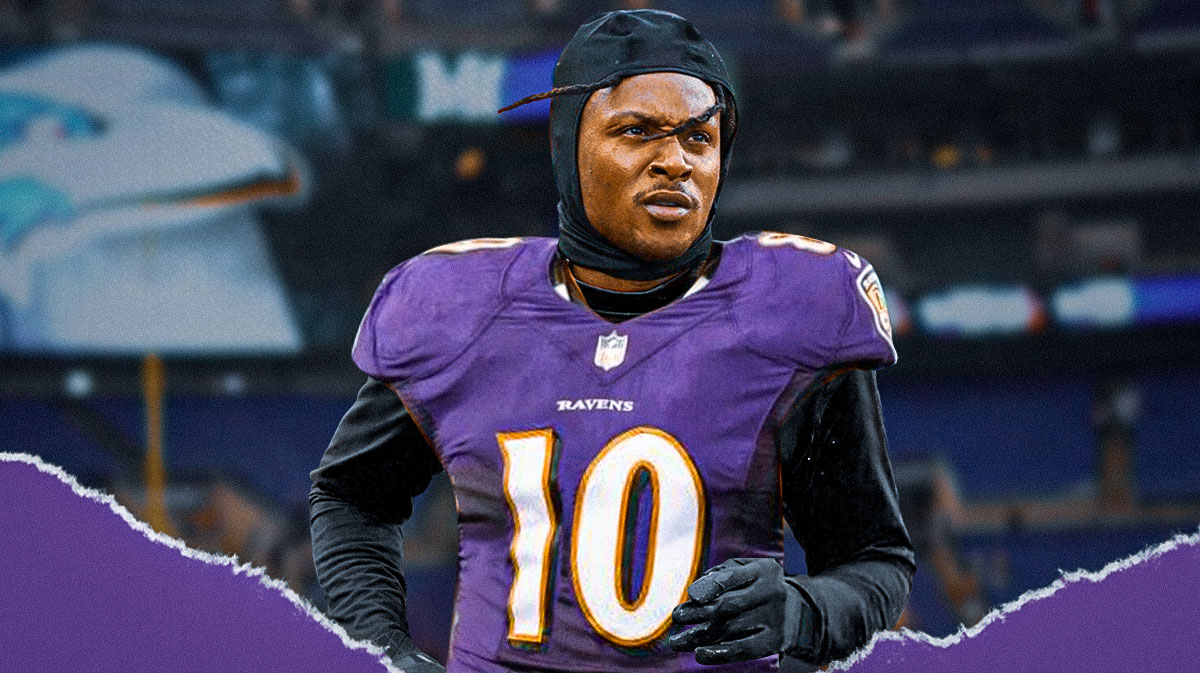

One Year Deal De Andre Hopkins Move To Baltimore

May 08, 2025

One Year Deal De Andre Hopkins Move To Baltimore

May 08, 2025 -

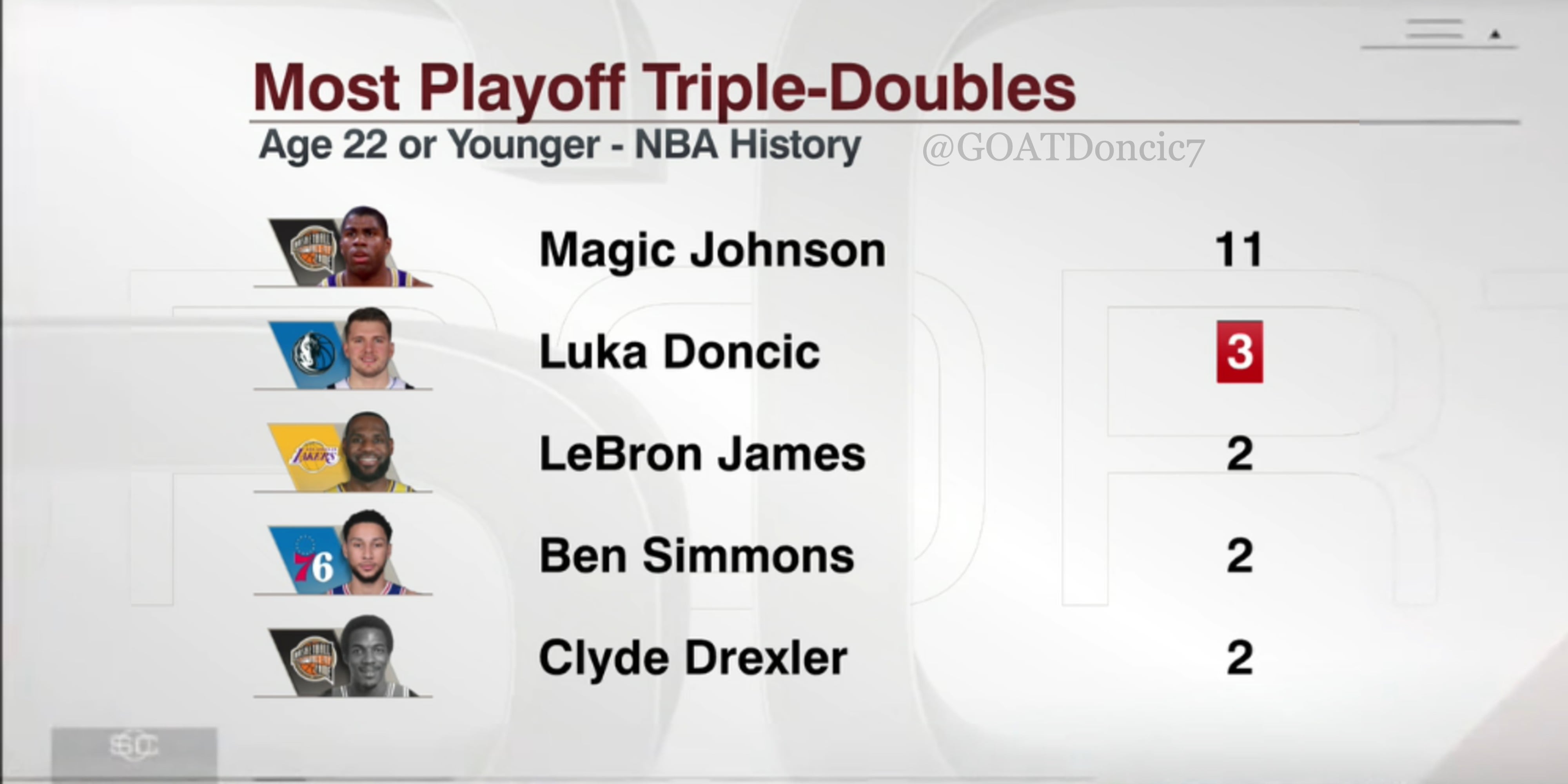

Are You An Nba Expert Take This Triple Doubles Playoffs Quiz

May 08, 2025

Are You An Nba Expert Take This Triple Doubles Playoffs Quiz

May 08, 2025 -

Ravens Bolster Receiving Corps With Hopkins Signing

May 08, 2025

Ravens Bolster Receiving Corps With Hopkins Signing

May 08, 2025 -

How Well Do You Know Nba Playoff Triple Doubles Leaders

May 08, 2025

How Well Do You Know Nba Playoff Triple Doubles Leaders

May 08, 2025 -

De Andre Hopkins Joins Ravens Impact And Expectations

May 08, 2025

De Andre Hopkins Joins Ravens Impact And Expectations

May 08, 2025