XRP's Big Moment: Will ETF Listings And SEC Resolutions Change Everything?

Table of Contents

Keywords: XRP, XRP ETF, SEC, Ripple, cryptocurrency, ETF listing, SEC lawsuit, Ripple vs SEC, crypto regulation, investment, digital asset

The cryptocurrency world is watching intently as XRP, the native token of Ripple Labs, stands at a crossroads. The ongoing SEC lawsuit against Ripple and the potential for XRP ETF listings are poised to dramatically reshape the future of this digital asset. This article delves into the complexities of this situation, exploring the potential outcomes and their implications for XRP's price, market position, and the broader cryptocurrency landscape.

The SEC Lawsuit and its Potential Outcomes

The SEC's lawsuit against Ripple, alleging that XRP is an unregistered security, has cast a long shadow over the cryptocurrency. The outcome will significantly influence XRP's trajectory.

Ripple's Defense and Arguments

Ripple's defense centers on the argument that XRP is not a security, emphasizing its decentralized nature and widespread use in various financial applications. Their key arguments include:

- Decentralization: Ripple argues that XRP's operational characteristics align with a decentralized asset, not a centrally controlled security.

- Programmatic Sale: They contend that the sale of XRP was conducted programmatically, lacking the hallmarks of a securities offering.

- Widespread Adoption: Ripple highlights the extensive adoption of XRP in cross-border payments and other use cases.

Ripple has employed a robust legal strategy, including presenting expert witnesses and leveraging legal precedents to bolster their case. The outcome will set a crucial precedent for future crypto regulation.

Possible Scenarios and Their Impact on XRP's Price

Several scenarios could unfold:

- Ripple Wins: A victory for Ripple could send XRP's price soaring, potentially boosting investor confidence and attracting significant institutional investment.

- SEC Wins: An SEC victory could severely impact XRP's price, potentially leading to delisting from exchanges and a significant market correction.

- Settlement: A negotiated settlement could lead to a mixed outcome, with potential consequences ranging from minor price adjustments to more significant market shifts.

The uncertainty surrounding the outcome significantly impacts investor sentiment, creating volatility in XRP's price.

Regulatory Clarity and its Significance for the Crypto Market

The SEC lawsuit's resolution will profoundly impact cryptocurrency regulation. A clear ruling, regardless of the outcome, will provide much-needed clarity for the industry, fostering greater legal certainty and potentially encouraging further innovation and investment. This clarity could shape the regulatory landscape for other cryptocurrencies as well, impacting the entire market's stability.

The Potential for XRP ETFs and Their Market Impact

The possibility of XRP ETFs (Exchange-Traded Funds) is another critical factor shaping XRP's future.

What are XRP ETFs and How Do They Work?

XRP ETFs would allow investors to gain exposure to XRP through a regulated and easily accessible investment vehicle. ETFs pool investor money to buy XRP, making it easier for individuals to invest and trade XRP like a traditional stock. Approval is a lengthy process involving rigorous regulatory scrutiny.

Increased Liquidity and Accessibility

XRP ETF listings would significantly increase XRP's liquidity, making it easier to buy and sell large quantities without dramatically impacting the price. ETFs would also improve XRP's accessibility, attracting a broader range of investors, including institutional investors who might otherwise be hesitant to invest directly in cryptocurrencies. This accessibility could drive up trading volume.

Institutional Investment and Market Maturity

Institutional investors often prefer regulated investment vehicles like ETFs. The availability of XRP ETFs could significantly attract institutional money, boosting XRP's market capitalization and fostering greater market maturity and stability. Increased institutional participation tends to lead to less volatility.

Beyond the SEC and ETFs: XRP's Technological Advantages and Future Potential

XRP's technological attributes and potential future development should not be overlooked.

XRP's Use Cases and Real-World Applications

XRP’s speed and efficiency in cross-border payments are key selling points. It is designed for fast and low-cost transactions, making it attractive for international money transfers and other financial applications. Partnerships with financial institutions are constantly expanding its use cases.

Technological Advancements and Future Development

The XRP Ledger is continuously evolving, with ongoing developments and planned upgrades aimed at enhancing its scalability, security, and efficiency. Future technological advancements could further solidify XRP's position in the cryptocurrency market.

Conclusion

The future of XRP hinges on the resolution of the SEC lawsuit and the possibility of XRP ETF listings. A favorable outcome in both areas could propel XRP to new heights, increasing its price, liquidity, and overall adoption. However, the uncertainty inherent in the current situation demands careful consideration. Staying informed about the ongoing legal battles and market trends is essential for any investor considering XRP. By understanding the potential impact of XRP ETF listings and the SEC resolutions, you can make informed investment decisions about XRP and navigate this dynamic space effectively.

Featured Posts

-

The Ukraine Wars Effect On Global Military Spending Europes Increased Defense Budgets

May 01, 2025

The Ukraine Wars Effect On Global Military Spending Europes Increased Defense Budgets

May 01, 2025 -

Dragons Den Success Strategies Tips For Aspiring Entrepreneurs

May 01, 2025

Dragons Den Success Strategies Tips For Aspiring Entrepreneurs

May 01, 2025 -

Xrp Price Prediction 2024 Boom Or Bust After Sec Case

May 01, 2025

Xrp Price Prediction 2024 Boom Or Bust After Sec Case

May 01, 2025 -

Kshmyr Brtanwy Wzyr Aezm Kw Pysh Ky Gyy Drkhwast

May 01, 2025

Kshmyr Brtanwy Wzyr Aezm Kw Pysh Ky Gyy Drkhwast

May 01, 2025 -

Xrp Price Prediction Dubai License And Technical Analysis Point To 10 Potential

May 01, 2025

Xrp Price Prediction Dubai License And Technical Analysis Point To 10 Potential

May 01, 2025

Latest Posts

-

Southern Cruises 2025 New Ships And Itineraries

May 01, 2025

Southern Cruises 2025 New Ships And Itineraries

May 01, 2025 -

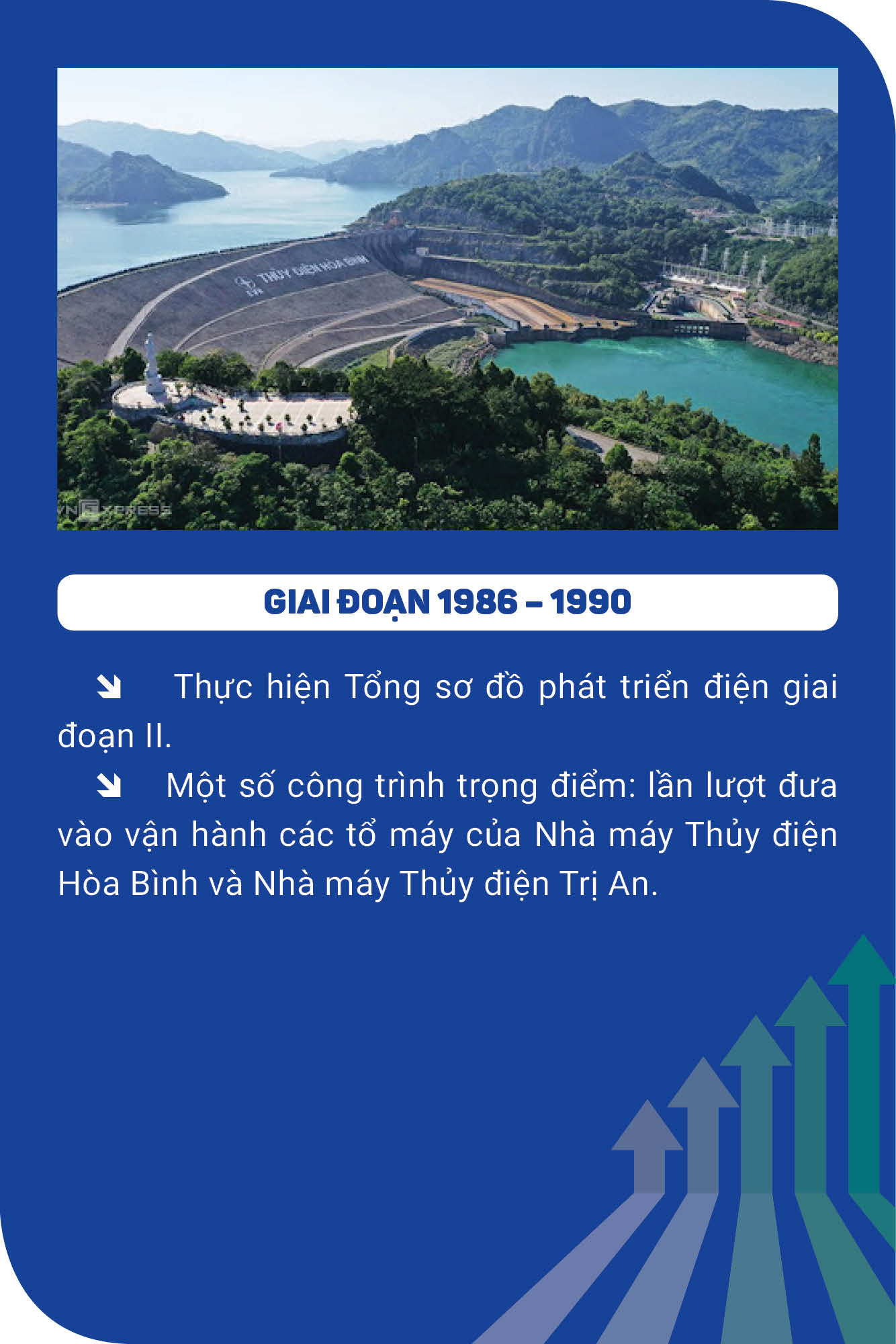

Cau Chuyen Phia Sau Du An 500k V Mach 3 Goc Nhin Tu Cong Nhan Dien Luc Mien Nam

May 01, 2025

Cau Chuyen Phia Sau Du An 500k V Mach 3 Goc Nhin Tu Cong Nhan Dien Luc Mien Nam

May 01, 2025 -

Du An 500k V Mach 3 Ghi Dau Hanh Trinh Cua Cong Nhan Dien Luc Mien Nam

May 01, 2025

Du An 500k V Mach 3 Ghi Dau Hanh Trinh Cua Cong Nhan Dien Luc Mien Nam

May 01, 2025 -

Nhung Thach Thuc Va Thanh Cong Cua Cong Nhan Dien Luc Mien Nam Trong Du An 500k V Mach 3

May 01, 2025

Nhung Thach Thuc Va Thanh Cong Cua Cong Nhan Dien Luc Mien Nam Trong Du An 500k V Mach 3

May 01, 2025 -

New Cruise Ships 2025 A Travelers Guide To The Best Options

May 01, 2025

New Cruise Ships 2025 A Travelers Guide To The Best Options

May 01, 2025