XRP's Price Action: Grayscale ETF Filing And Potential Record High

Table of Contents

Grayscale's Bitcoin ETF Filing: A Ripple Effect on XRP?

Grayscale's application for a spot Bitcoin ETF is monumental for the entire cryptocurrency market, potentially unlocking a wave of institutional investment. This section explores the implications of this pivotal event on XRP's price.

The Importance of Grayscale's Application

The approval of Grayscale's application would signal a significant shift in the regulatory landscape, potentially paving the way for increased institutional acceptance of cryptocurrencies. This increased acceptance could:

- Boost investor confidence: A green light from the SEC could alleviate some of the uncertainty surrounding Bitcoin and, by extension, other cryptocurrencies like XRP.

- Enhance liquidity: Greater institutional participation often leads to increased trading volume and improved liquidity in the market, stabilizing prices and facilitating smoother trading.

- Attract new investors: The potential for increased regulatory clarity and institutional involvement could attract a new wave of investors, driving demand and potentially pushing XRP's price higher.

Historically, while not always perfectly correlated, Bitcoin's price movements have often influenced the performance of other cryptocurrencies, including XRP. A surge in Bitcoin's price fueled by the ETF approval could have a positive knock-on effect on XRP.

Regulatory Uncertainty and Its Influence

Despite the potential positive impacts, significant regulatory uncertainty remains. The SEC's stance on cryptocurrencies continues to be a major factor influencing market sentiment. The Ripple vs. SEC lawsuit, specifically, plays a crucial role in shaping XRP's future.

- Ripple vs. SEC Lawsuit: The outcome of this lawsuit will dramatically impact XRP's price. A favorable ruling could lead to a significant price surge, while an unfavorable outcome could trigger a substantial decline.

- Potential Scenarios:

- Positive Ruling: A win for Ripple could remove the legal cloud hanging over XRP, boosting investor confidence and potentially leading to a significant price increase.

- Negative Ruling: An adverse ruling could severely impact XRP's price, potentially leading to a prolonged period of bearish sentiment.

- Risks and Uncertainties: The regulatory landscape is constantly evolving, making accurate price predictions challenging. Investors should be aware of these significant risks.

Technical Analysis of XRP: Signs of a Potential Record High?

Technical analysis offers valuable insights into XRP's potential price movements. Examining chart patterns and indicators helps gauge the strength of current trends.

Chart Patterns and Indicators

Several technical indicators suggest potential upward movement:

- Moving Averages: A bullish crossover of the 50-day and 200-day moving averages could indicate a strong upward trend.

- RSI (Relative Strength Index): An RSI reading below 30 suggests XRP is oversold, potentially signaling a bounce.

- MACD (Moving Average Convergence Divergence): A bullish MACD crossover can precede a price increase.

[Insert relevant chart/graph here]

Support and resistance levels are also crucial in technical analysis. Identifying these key price points can provide insight into potential price reversals or breakouts.

- Support Levels: These are price points where buying pressure is expected to be strong, preventing further price declines.

- Resistance Levels: These are price points where selling pressure is expected to be strong, preventing further price increases.

Volume and Market Sentiment

Analyzing trading volume and market sentiment offers further insight into XRP's price action. High trading volume accompanying a price increase often signifies strong conviction.

- Social Media Sentiment: Positive sentiment on social media platforms can reflect growing interest and potential buying pressure.

- Whale Activity: The actions of large holders ("whales") can significantly impact XRP's price. Large buy orders can drive the price up, while large sell orders can trigger price drops.

- News Coverage: Positive news coverage, such as partnerships or technological advancements, can boost investor sentiment and drive up the price.

XRP's Fundamental Value Proposition and Future Outlook

XRP's value proposition extends beyond speculation, grounded in Ripple's technology and its potential for broader adoption.

Ripple's Technology and Ecosystem

Ripple's technology, including xRapid, xCurrent, and xVia, aims to facilitate faster and more cost-effective cross-border payments. Partnerships and developments in this area are vital for XRP's future growth.

- Key Partnerships: Collaborations with financial institutions can significantly increase XRP's adoption and utility.

- Technological Advancements: Ongoing improvements to Ripple's technology enhance its efficiency and appeal to potential users.

Long-Term Price Predictions (with Disclaimer)

While predicting long-term XRP price is inherently speculative, a cautiously optimistic outlook is possible considering the potential for widespread adoption of Ripple's technology and positive regulatory developments. However, it's crucial to remember that this is not financial advice. Market conditions can change rapidly, and various factors can influence XRP's price.

Conclusion: Navigating XRP's Price Action – Opportunities and Risks

Grayscale's ETF filing has the potential to significantly impact the entire crypto market, including XRP. Technical analysis suggests potential for upward price movement, while Ripple's technology and ecosystem offer a strong fundamental foundation. However, regulatory uncertainty and inherent market volatility present significant risks. Thorough research and a clear understanding of these risks are crucial before investing in XRP. Stay informed about the latest developments surrounding XRP price action and Grayscale's ETF filing to make well-informed investment decisions. Continue your own research on XRP price analysis and consider the potential for XRP investment and its future price before making any financial decisions.

Featured Posts

-

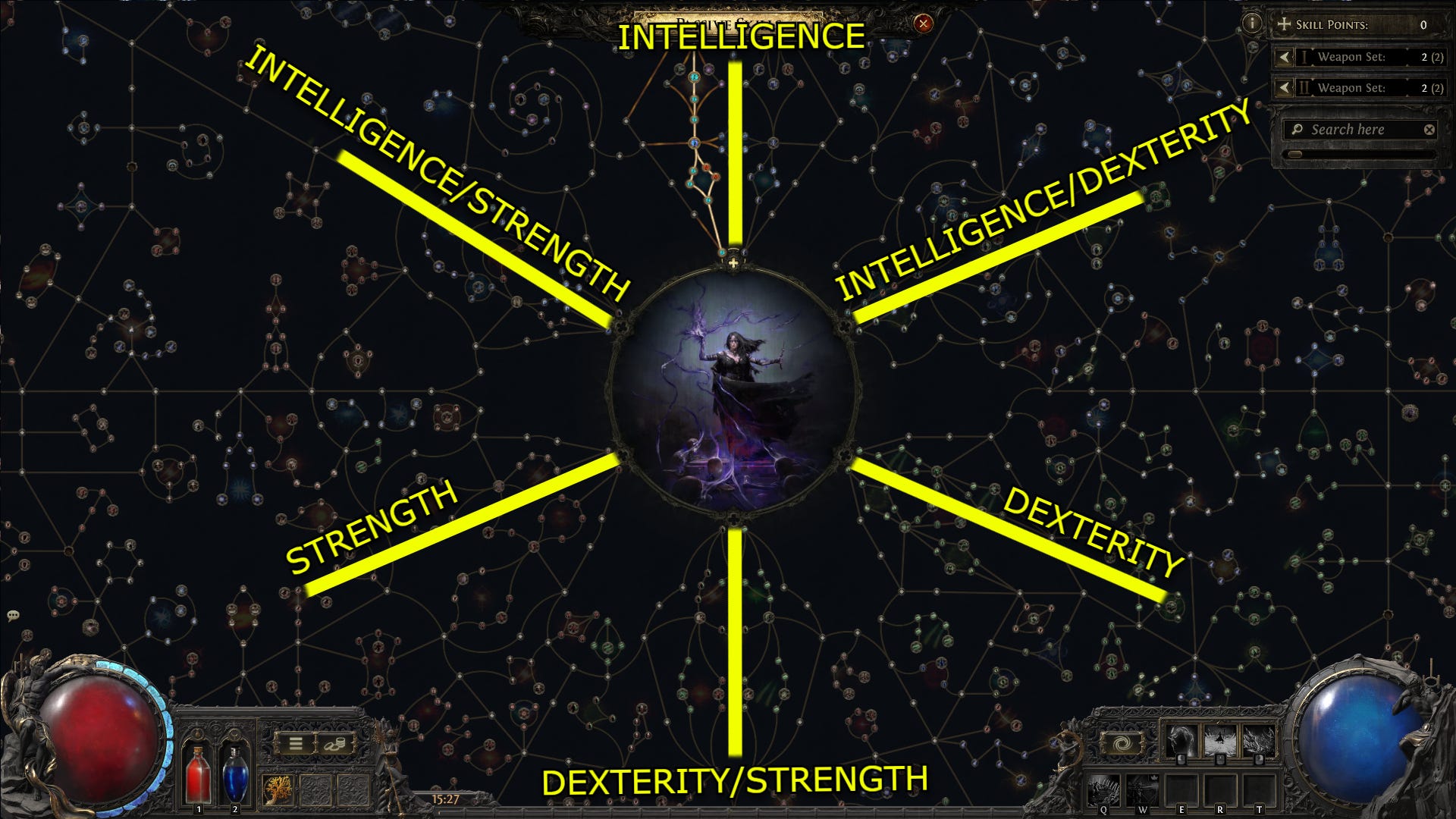

Exploring Rogue Exiles Your Path Of Exile 2 Guide

May 08, 2025

Exploring Rogue Exiles Your Path Of Exile 2 Guide

May 08, 2025 -

Kripto Para Mirasi Kayip Sifrelerin Yasal Sonuclari

May 08, 2025

Kripto Para Mirasi Kayip Sifrelerin Yasal Sonuclari

May 08, 2025 -

Grand Theft Auto Vi Bonnie And Clyde Dynamic Unveiled In Latest Trailer

May 08, 2025

Grand Theft Auto Vi Bonnie And Clyde Dynamic Unveiled In Latest Trailer

May 08, 2025 -

Dcs Krypto A Deep Dive Into The Animated Film

May 08, 2025

Dcs Krypto A Deep Dive Into The Animated Film

May 08, 2025 -

Counting Crows Downtown Indianapolis Show Venue Tickets And More

May 08, 2025

Counting Crows Downtown Indianapolis Show Venue Tickets And More

May 08, 2025