XRP's Price Prediction: Evaluating The Potential For Millionaire-Making Returns

Table of Contents

Analyzing XRP's Past Performance and Current Market Position

Historical Price Analysis

XRP's price history is a rollercoaster ride reflecting both periods of explosive growth and significant setbacks. A key event impacting its price was the SEC lawsuit filed against Ripple Labs in December 2020. This legal battle created considerable uncertainty, leading to price volatility.

- 2017 Bull Run: XRP experienced a meteoric rise, reaching an all-time high of over $3.00 in January 2018. This represented a massive increase from its previous year's price.

- Post-2018 Correction: Following the 2017 boom, XRP, like much of the crypto market, experienced a significant correction, falling to below $0.20.

- SEC Lawsuit Impact: The SEC lawsuit against Ripple caused a substantial drop in price, although the price has shown resilience in the face of ongoing legal battles.

- Recent Price Action: XRP's price has demonstrated fluctuating behavior in recent months, influenced by various market factors and news related to the SEC case. (Include a relevant chart showing XRP's price history here).

Current Market Capitalization and Trading Volume

As of [Insert Date], XRP holds a market capitalization of approximately [Insert Current Market Cap] and a 24-hour trading volume of roughly [Insert Current Trading Volume]. While this places it among the top cryptocurrencies by market cap, its position fluctuates depending on market conditions. Comparing this to Bitcoin and Ethereum, it's evident that XRP's market share is significantly smaller, although this could change depending on future market dynamics.

- Market Rank: [Insert Current Market Rank].

- Comparison to Bitcoin & Ethereum: XRP’s market cap is [percentage]% of Bitcoin's and [percentage]% of Ethereum's.

- Liquidity: XRP enjoys relatively high liquidity across many exchanges, facilitating easier buying and selling.

Ripple's Technological Developments and Partnerships

Ripple, the company behind XRP, is actively developing the XRP Ledger and forging partnerships to enhance XRP's utility. These developments are key factors influencing XRP's price prediction.

- XRP Ledger Upgrades: Improvements to transaction speed, scalability, and efficiency are continuously being implemented.

- Key Partnerships: Ripple has established partnerships with various financial institutions globally, facilitating cross-border payments using XRP. Examples include [mention specific institutions and their use cases].

- On-Demand Liquidity (ODL): Ripple's ODL solution allows financial institutions to utilize XRP for faster and more cost-effective cross-border payments. The expansion of ODL is directly related to the demand for XRP.

Factors Influencing XRP's Future Price

Regulatory Landscape and the SEC Lawsuit

The outcome of the SEC lawsuit against Ripple significantly impacts XRP's future. A favorable ruling could lead to a surge in price, while an unfavorable ruling might cause further price decline.

- Positive Scenario: A win for Ripple could unlock institutional investment and boost confidence in XRP.

- Negative Scenario: An unfavorable ruling could negatively impact investor sentiment and limit XRP's growth potential.

- Uncertainty: The ongoing uncertainty surrounding the lawsuit contributes to XRP's price volatility.

Adoption by Financial Institutions

Increased adoption of XRP by financial institutions for cross-border payments is crucial for its future price. Wider adoption increases demand, potentially driving the price upward.

- Current Adoption: Several financial institutions are already utilizing XRP or exploring its potential for cross-border payments.

- Future Potential: Expanding partnerships with more banks and financial institutions could create significant demand for XRP.

- Scalability and Efficiency: XRP's speed and low transaction costs make it attractive for financial institutions seeking efficient cross-border payment solutions.

Technological Advancements and Competition

The cryptocurrency landscape is constantly evolving. Technological advancements and the emergence of competing cryptocurrencies influence XRP's long-term viability.

- Competing Technologies: Other cryptocurrencies offer similar functionalities and are vying for market share.

- Technological Innovation: Continuous improvements to the XRP Ledger are vital to maintaining its competitive edge.

- Market Share: XRP needs to maintain its position and innovate to keep its market share from being eroded by competitors.

Overall Market Sentiment and Bitcoin's Influence

Bitcoin’s price movements and overall market sentiment significantly impact XRP's price. XRP tends to exhibit a correlation with Bitcoin’s price.

- Bitcoin Correlation: A bull market in Bitcoin often leads to gains in XRP, while a bear market usually impacts XRP negatively.

- Market Sentiment: Positive market sentiment boosts demand for cryptocurrencies, including XRP.

- Risk-On/Risk-Off: Investors often adopt a risk-on approach during bull markets, buying XRP along with other cryptocurrencies.

Realistic Price Predictions and Millionaire-Making Potential

Short-Term Price Predictions

Predicting short-term price movements is challenging due to the volatile nature of the cryptocurrency market. Based on current trends and technical analysis, [Insert disclaimer about uncertainity]. A range of [price range] is possible within the next [timeframe]. (Support this prediction with relevant technical indicators and market analysis.)

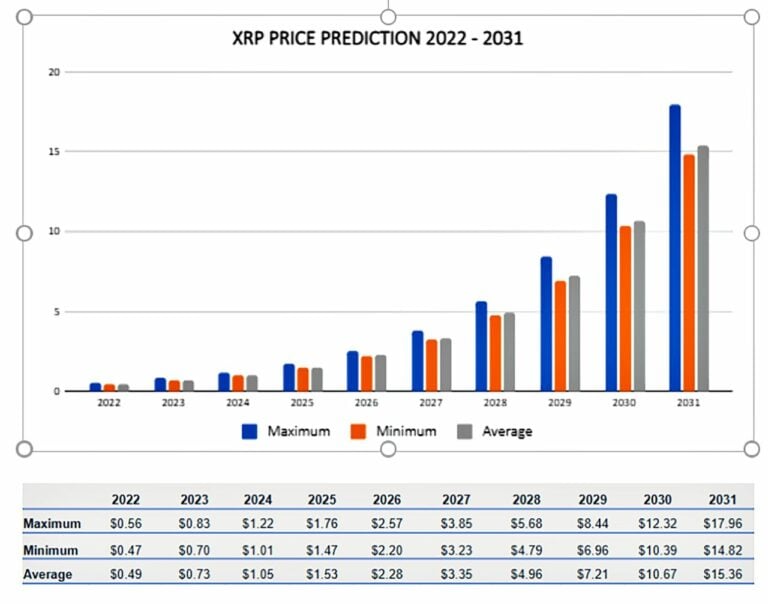

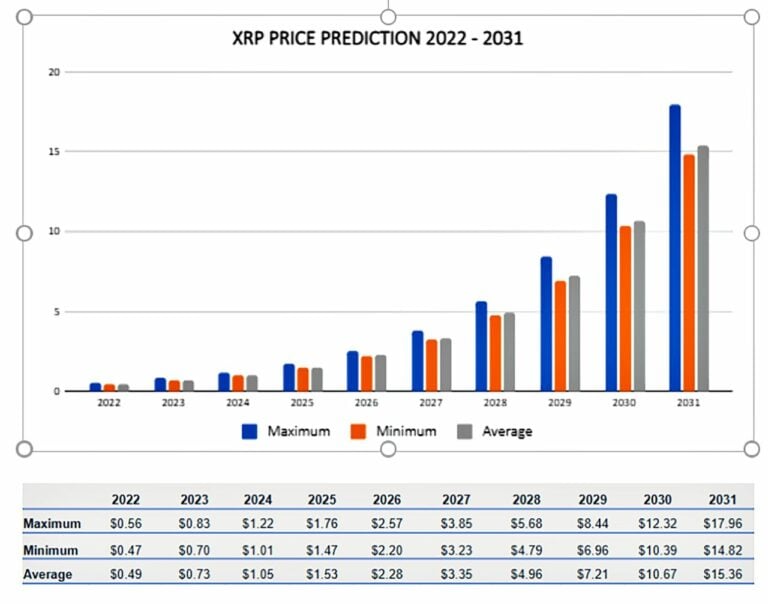

Long-Term Price Predictions and the Path to Millionaire Status

Reaching a price point that would generate millionaire-making returns for XRP investors requires several factors to align favorably. Significant price appreciation would necessitate widespread adoption, regulatory clarity, and continued technological advancements. The scenario of XRP reaching [price level] within [timeframe] is possible, but depends heavily on the aforementioned conditions.

Risk Assessment and Investment Strategies

Investing in cryptocurrencies carries inherent risks. Volatility, regulatory uncertainty, and potential security breaches are all significant factors to consider.

- Volatility: XRP's price can fluctuate dramatically in short periods.

- Regulatory Risks: The regulatory landscape for cryptocurrencies remains uncertain.

- Diversification: Diversifying your investment portfolio is crucial to mitigate risk.

- Risk Tolerance: Only invest amounts you can afford to lose.

Conclusion

XRP's price prediction is subject to many influencing factors, including the outcome of the SEC lawsuit, its adoption by financial institutions, technological advancements, and overall market sentiment. While the potential for substantial gains exists, it's crucial to acknowledge the inherent risks involved. While an XRP price prediction cannot guarantee millionaire-making returns, understanding these factors is crucial for any investor considering adding XRP to their portfolio. Conduct your own thorough research and consider consulting with a financial advisor before making any investment decisions related to XRP or other cryptocurrencies. Continue to stay informed on the latest XRP price predictions and market trends to make the most informed decisions.

Featured Posts

-

Texas Techs Road Win Over Kansas A 78 73 Victory

May 02, 2025

Texas Techs Road Win Over Kansas A 78 73 Victory

May 02, 2025 -

Us Economic Slowdown A Review Of Bidens Economic Policies And Their Effects

May 02, 2025

Us Economic Slowdown A Review Of Bidens Economic Policies And Their Effects

May 02, 2025 -

Het Falende Systeem Jarenlange Wachttijden Bij Tbs Klinieken

May 02, 2025

Het Falende Systeem Jarenlange Wachttijden Bij Tbs Klinieken

May 02, 2025 -

Hudsons Bay Brand And Charter Toronto Firm Faces Stiff Competition

May 02, 2025

Hudsons Bay Brand And Charter Toronto Firm Faces Stiff Competition

May 02, 2025 -

April 15 2025 Daily Lotto Winning Numbers Announced

May 02, 2025

April 15 2025 Daily Lotto Winning Numbers Announced

May 02, 2025

Latest Posts

-

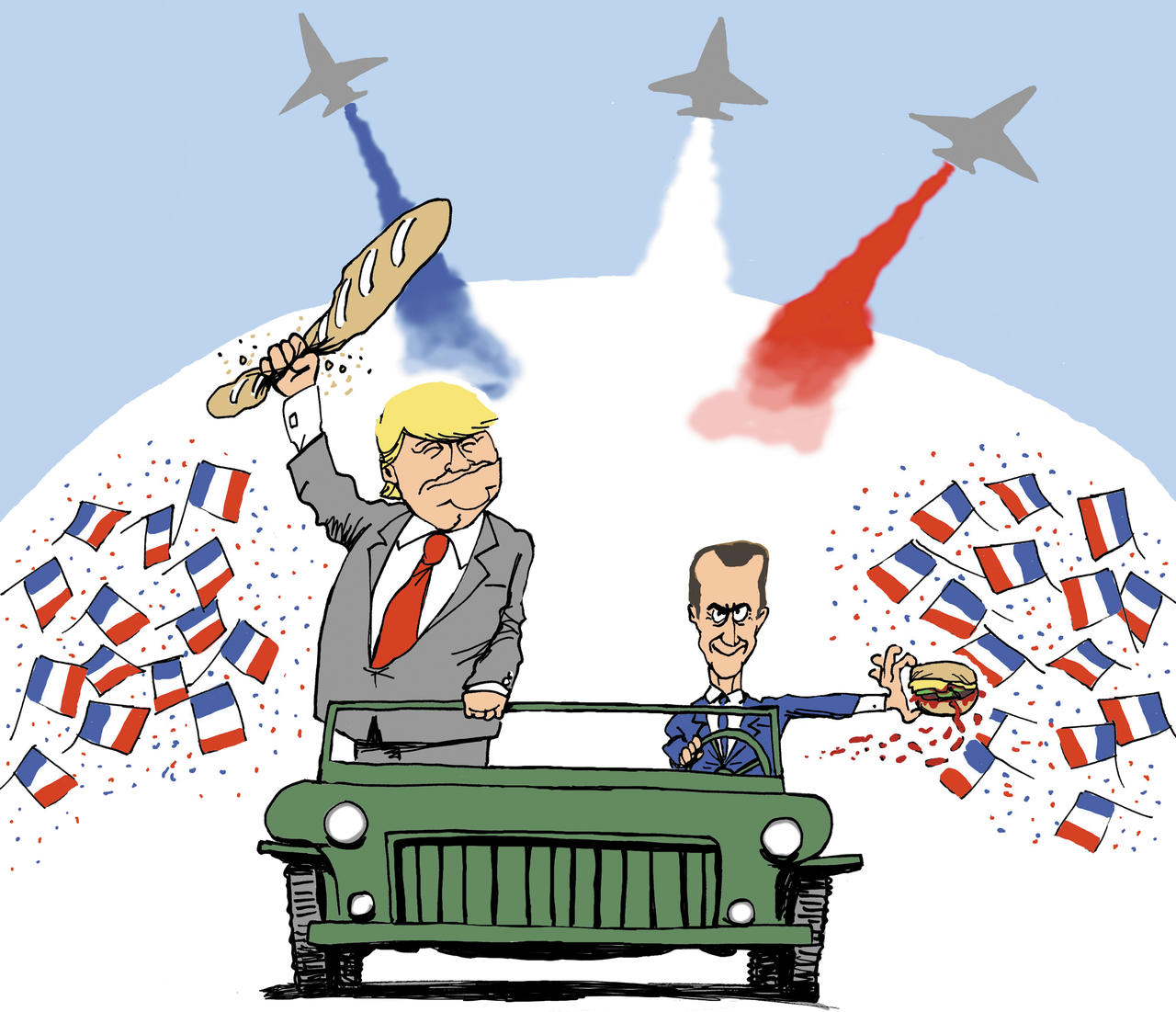

Macron Et Sardou Un Diner Tendu Ca Vient Du Ventre

May 03, 2025

Macron Et Sardou Un Diner Tendu Ca Vient Du Ventre

May 03, 2025 -

Visite Du Vatican L Echange Houleux Entre Trump Et Macron

May 03, 2025

Visite Du Vatican L Echange Houleux Entre Trump Et Macron

May 03, 2025 -

Trump A Macron Au Vatican Tu Ne Devrais Pas Etre Ici

May 03, 2025

Trump A Macron Au Vatican Tu Ne Devrais Pas Etre Ici

May 03, 2025 -

Le Vatican Temoin D Une Dispute Entre Trump Et Macron

May 03, 2025

Le Vatican Temoin D Une Dispute Entre Trump Et Macron

May 03, 2025 -

Le Patriotisme Economique De Macron Face Au Defi De L Intelligence Artificielle

May 03, 2025

Le Patriotisme Economique De Macron Face Au Defi De L Intelligence Artificielle

May 03, 2025