Yes Bank: SMFG's Potential Minority Shareholding Deal

Table of Contents

SMFG's Potential Investment: Size and Significance

Rumors suggest SMFG's potential investment in Yes Bank could be substantial, although the exact figures remain undisclosed. The strategic importance of this investment is undeniable for both parties. For SMFG, a minority stake in Yes Bank offers:

- Access to the burgeoning Indian market: India's rapidly growing economy presents significant opportunities for expansion.

- Portfolio diversification: Investing in a major Indian bank diversifies SMFG's risk profile.

- Enhanced regional expertise: Gaining a foothold in India allows SMFG to tap into local market knowledge and expertise.

Meanwhile, for Yes Bank, SMFG's investment signifies:

- Crucial capital infusion: Boosting Yes Bank's capital adequacy ratio (CAR) is vital for financial stability.

- Technological advancements: SMFG's expertise in cutting-edge banking technology could significantly benefit Yes Bank.

- Brand enhancement: Association with a globally renowned financial institution like SMFG can improve Yes Bank's reputation.

SMFG has a history of successful international investments, demonstrating its strategic acumen and global reach. Analyzing these past ventures provides valuable insight into their potential approach with Yes Bank.

Implications for Yes Bank's Financial Health

The SMFG investment has the potential to significantly improve Yes Bank's financial health. A key area is the likely improvement in the bank's capital adequacy ratio (CAR). A higher CAR indicates better financial stability and resilience against potential shocks. Furthermore, the infusion of capital could assist in:

- NPA reduction: The investment could help Yes Bank address its Non-Performing Assets (NPAs) more effectively.

- Improved profitability: With stronger capital reserves and improved operational efficiency, Yes Bank's profitability is expected to increase.

- Enhanced long-term stability: The partnership offers a pathway to long-term sustainable growth and increased investor confidence, potentially leading to a rise in Yes Bank share price.

The short-term impact might involve restructuring efforts, while the long-term benefits include enhanced financial stability and increased competitiveness.

Impact on the Indian Banking Sector

The SMFG-Yes Bank deal could have far-reaching consequences for the Indian banking sector. Increased foreign investment in Indian banks can lead to:

- Heightened competition: The entry of a major global player like SMFG could intensify competition within the Indian banking market.

- Market share shifts: Yes Bank, bolstered by the investment, might gain market share, impacting the positions of other players.

- Economic growth stimulation: Increased foreign investment can boost economic activity and development within the country.

The deal sets a precedent, potentially attracting further foreign investment into the Indian banking sector, driving innovation and competition. This could ultimately lead to more options and better services for Indian consumers.

Regulatory Approvals and Challenges

Securing the deal requires navigating various regulatory hurdles. Key regulatory bodies like the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) will scrutinize the deal for compliance with regulations. Potential challenges include:

- Scrutiny of SMFG's business practices: Regulatory bodies will thoroughly investigate SMFG's operations and compliance record.

- Compliance with Indian banking regulations: The deal must adhere to all applicable Indian laws and regulations.

- Timeline for approvals: The approval process might take considerable time, influencing the deal's completion timeline.

The approval process is crucial and will significantly influence the deal's success and its overall impact on Yes Bank and the Indian banking sector.

Conclusion: The Future of Yes Bank and the SMFG Deal

The potential SMFG minority shareholding deal presents both significant opportunities and challenges for Yes Bank. While the investment could revitalize Yes Bank's financial health and position it for future growth, navigating the regulatory hurdles is paramount. The deal's success will significantly impact not only Yes Bank's recovery but also the broader Indian banking sector. It's crucial to monitor the regulatory process closely and analyze its outcome. Stay tuned for further updates on the Yes Bank and SMFG deal. Continue following our coverage for in-depth analysis on this significant development in the Indian banking sector and the implications of this potential minority shareholding deal. This Yes Bank SMFG partnership could reshape the Indian financial landscape.

Featured Posts

-

Is John Wick 5 Actually Happening A Look At The Latest News

May 07, 2025

Is John Wick 5 Actually Happening A Look At The Latest News

May 07, 2025 -

Saturday April 12th Lotto Results Check The Winning Numbers

May 07, 2025

Saturday April 12th Lotto Results Check The Winning Numbers

May 07, 2025 -

Steph Currys All Star Championship A Dud Format

May 07, 2025

Steph Currys All Star Championship A Dud Format

May 07, 2025 -

Anthony Edwards Injury Report Playing Status For Timberwolves Lakers Game

May 07, 2025

Anthony Edwards Injury Report Playing Status For Timberwolves Lakers Game

May 07, 2025 -

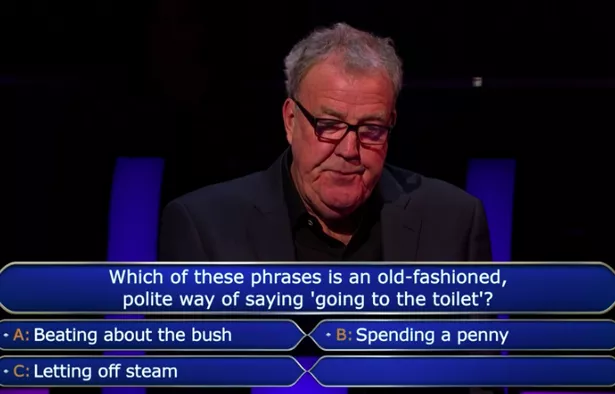

Unbelievable Contestant Uses All Three Lifelines On Easy Who Wants To Be A Millionaire Question

May 07, 2025

Unbelievable Contestant Uses All Three Lifelines On Easy Who Wants To Be A Millionaire Question

May 07, 2025

Latest Posts

-

Apo Group Press Release On Minister Tavios Participation In Zambias Ldc Future Forum

May 07, 2025

Apo Group Press Release On Minister Tavios Participation In Zambias Ldc Future Forum

May 07, 2025 -

Building A Resilient Future Outcomes From The Third Ldc Future Forum For Least Developed Countries

May 07, 2025

Building A Resilient Future Outcomes From The Third Ldc Future Forum For Least Developed Countries

May 07, 2025 -

Minister Tavio To Attend Least Developed Countries Future Forum In Zambia Apo Group Press Release

May 07, 2025

Minister Tavio To Attend Least Developed Countries Future Forum In Zambia Apo Group Press Release

May 07, 2025 -

Apo Group Minister Tavios Zambia Visit And Ldc Future Forum Participation

May 07, 2025

Apo Group Minister Tavios Zambia Visit And Ldc Future Forum Participation

May 07, 2025 -

Third Ldc Future Forum Building Resilience In Least Developed Countries

May 07, 2025

Third Ldc Future Forum Building Resilience In Least Developed Countries

May 07, 2025