1,050% Price Hike: AT&T's Concerns Over Broadcom's VMware Acquisition

Table of Contents

AT&T's Specific Concerns and the 1,050% Figure

AT&T's alarming 1,050% price hike claim stems from concerns about Broadcom's post-acquisition pricing strategy for VMware's networking products. While the exact details remain somewhat opaque, AT&T alleges that critical networking services, integral to its infrastructure, would experience this drastic increase. The claim isn't based on mere speculation; it’s supported by internal documents and public statements highlighting projected cost increases following the merger.

- Specific VMware products impacted: While AT&T hasn't publicly named all specific VMware products, it's heavily implied that key networking and virtualization components within VMware's portfolio are central to their concerns. This could include products crucial for data center operations and network management.

- Explanation of how the price increase is calculated: The 1,050% figure represents a projected increase based on AT&T's current contracts and Broadcom's potential pricing model following the acquisition. The exact calculation methodology likely involves comparing current pricing with projected future pricing based on information obtained from various sources.

- Potential impact on AT&T's infrastructure and operational costs: Such a substantial price increase would significantly impact AT&T's operational costs, potentially affecting its profitability and ability to compete effectively. It also raises concerns about potential service disruptions or limitations due to increased cost constraints.

Related Keywords: AT&T VMware pricing, Broadcom pricing strategy, networking costs, telecom industry impact.

Antitrust Concerns and Regulatory Scrutiny

The potential for monopolistic practices following the Broadcom-VMware merger has triggered significant antitrust concerns. This merger would combine Broadcom's extensive semiconductor portfolio with VMware's dominant position in virtualization and cloud computing. This raises the specter of reduced competition and potential for price gouging across multiple segments of the technology market.

Regulatory bodies worldwide are carefully scrutinizing the deal. The Federal Trade Commission (FTC) in the US and the European Union's competition commission are both actively investigating the potential antitrust implications of this merger.

- Reduced competition in the market: The merger could significantly reduce competition, potentially leading to less innovation and higher prices for businesses and consumers.

- Potential for monopolistic practices: Broadcom's control over essential networking components coupled with VMware's virtualization dominance creates the potential for anti-competitive behavior.

- Arguments for and against the acquisition from various stakeholders: While Broadcom argues the merger will foster innovation and efficiency, competitors like AT&T, and consumer advocacy groups, express strong concerns about the potential negative impact on competition and pricing.

Related Keywords: Antitrust laws, FTC investigation, EU competition commission, merger approval, monopoly concerns, market dominance.

Impact on the Broader Technology Landscape

The Broadcom-VMware merger's ramifications extend far beyond AT&T's concerns. Its impact on the broader technology landscape could be profound and far-reaching.

- Impact on cloud computing services: The merger's impact on cloud computing services is substantial, potentially influencing pricing and the competitive dynamics within this rapidly growing sector.

- Potential price increases for other VMware products: The price increases aren’t necessarily confined to networking. Other VMware products could also see price hikes, indirectly impacting businesses across various industries.

- Changes in the competitive landscape for network infrastructure: The merger could significantly alter the competitive landscape, potentially leading to market consolidation and reduced innovation.

Related Keywords: Cloud computing costs, enterprise software pricing, technology market consolidation, innovation impact, digital transformation.

Alternative Solutions and Potential Outcomes

Several alternative solutions could prevent the merger's potentially damaging consequences. Regulatory intervention remains a key possibility, with the FTC and EU investigations holding considerable power to block or modify the acquisition.

- Potential for the deal to be blocked: If regulators find the merger anti-competitive, they could block it outright.

- Potential concessions Broadcom might offer: To secure approval, Broadcom might be forced to offer significant concessions, such as divestitures of certain assets or commitments to maintain competitive pricing.

- Impact of different regulatory outcomes on the market: The final outcome – approval, blocking, or conditional approval – will drastically alter the technological landscape, influencing prices, competition, and innovation.

Related Keywords: Merger approval process, regulatory intervention, antitrust remedies, deal failure, alternative acquisition scenarios.

Conclusion

AT&T’s concerns about Broadcom’s acquisition of VMware, particularly the potential for a staggering 1,050% price hike and the broader implications for the technology industry, are significant. The ongoing regulatory scrutiny highlights the uncertainties surrounding the deal's future and its potential for significantly impacting the competitive landscape and prices. The outcome of the regulatory review will have far-reaching implications for businesses and consumers alike.

Call to Action: Stay informed about the developments in the Broadcom-VMware acquisition. The potential impact of this merger on pricing and competition is significant, and understanding the ongoing developments is crucial for both businesses and consumers. Keep monitoring news related to the Broadcom VMware acquisition and its potential impact on your organization.

Featured Posts

-

Accident Mortel A Seoul Effondrement De Chaussee Et Deces D Un Motard

May 23, 2025

Accident Mortel A Seoul Effondrement De Chaussee Et Deces D Un Motard

May 23, 2025 -

Royal Albert Hall Hosts Grand Ole Oprys Inaugural International Show

May 23, 2025

Royal Albert Hall Hosts Grand Ole Oprys Inaugural International Show

May 23, 2025 -

Are High Stock Market Valuations A Concern Bof A Weighs In

May 23, 2025

Are High Stock Market Valuations A Concern Bof A Weighs In

May 23, 2025 -

Today Show Controversy Al Rokers Off The Record Remarks Spark Backlash

May 23, 2025

Today Show Controversy Al Rokers Off The Record Remarks Spark Backlash

May 23, 2025 -

Luis Castro Attacks Ten Hag Over Ronaldo Situation

May 23, 2025

Luis Castro Attacks Ten Hag Over Ronaldo Situation

May 23, 2025

Latest Posts

-

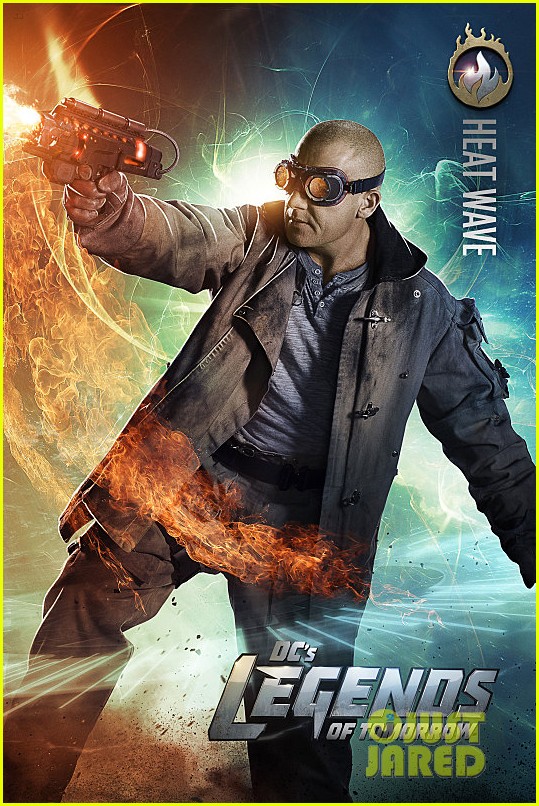

Dc Legends Of Tomorrow The Ultimate Fan Guide

May 23, 2025

Dc Legends Of Tomorrow The Ultimate Fan Guide

May 23, 2025 -

Understanding The Metaverse Of Dc Legends Of Tomorrow

May 23, 2025

Understanding The Metaverse Of Dc Legends Of Tomorrow

May 23, 2025 -

Review The Last Rodeo A Heartfelt Bull Riding Story

May 23, 2025

Review The Last Rodeo A Heartfelt Bull Riding Story

May 23, 2025 -

Dc Legends Of Tomorrow Character Guide And Team Building Strategies

May 23, 2025

Dc Legends Of Tomorrow Character Guide And Team Building Strategies

May 23, 2025 -

The Last Rodeo A Review Of A Familiar Yet Powerful Film

May 23, 2025

The Last Rodeo A Review Of A Familiar Yet Powerful Film

May 23, 2025