Are High Stock Market Valuations A Concern? BofA Weighs In.

Table of Contents

BofA's Key Concerns Regarding High Stock Market Valuations

Bank of America, a global financial powerhouse with significant influence on market sentiment, has expressed considerable caution regarding current high stock market valuations. Their concerns stem from a confluence of factors, suggesting a potential for increased market volatility. BofA's analysis, frequently cited in financial news, highlights several key risks:

-

High Price-to-Earnings (P/E) Ratios: Across numerous sectors, BofA notes significantly elevated P/E ratios, indicating that stock prices may be exceeding justifiable levels based on current earnings. This suggests potential overvaluation and increased susceptibility to a market downturn. Many analysts agree that certain sectors are particularly vulnerable to this risk.

-

Overvaluation Compared to Historical Data and Economic Fundamentals: BofA's analysis compares current stock prices to historical data and key economic indicators. Their findings often suggest that current valuations are not entirely supported by fundamental economic strength, raising concerns about a potential bubble. This divergence between price and fundamentals is a significant cause for concern.

-

Interest Rate Hikes and Their Impact on Valuations: The Federal Reserve's interest rate hikes directly impact borrowing costs for businesses and investors. Higher rates generally lead to lower valuations as future earnings are discounted more heavily. BofA's analysis has consistently highlighted the potential negative impact of these hikes on stock prices and overall market valuations.

-

Geopolitical Risks and Their Influence on Market Stability and Valuations: Global instability, including geopolitical tensions and conflicts, can significantly impact investor confidence and market sentiment. BofA's perspective incorporates these risks, understanding their potential to trigger significant market corrections, further exacerbating concerns about already high stock market valuations.

Factors Supporting BofA's Cautious Outlook

BofA's cautious outlook is grounded in several key economic factors that contribute to a heightened risk profile for the market. These factors, often interlinked, paint a picture of potential challenges ahead:

-

Inflationary Pressures and Their Impact on Corporate Earnings: Persistent inflation erodes purchasing power and increases input costs for businesses, potentially squeezing profit margins and negatively impacting corporate earnings growth. This is a significant concern, as it undermines the foundation upon which high stock market valuations are built.

-

Supply Chain Disruptions and Their Effect on Profitability: Lingering supply chain issues continue to disrupt production and increase costs for many companies. This can negatively affect profitability and ultimately, depress stock prices, despite high market valuations.

-

Uncertainty Surrounding Future Economic Growth: Economic forecasts remain uncertain, with a range of possible outcomes, from a mild slowdown to a more significant recession. This uncertainty increases investor risk aversion and can contribute to market volatility and potential corrections.

-

Potential for Increased Volatility in the Near Term: Considering the combined effect of high valuations, inflation, geopolitical risks and economic uncertainty, BofA's analysis suggests a higher probability of increased market volatility and potential price corrections in the near term.

Counterarguments and Potential Opportunities

While BofA's analysis leans towards caution, it's crucial to acknowledge counterarguments and potential opportunities in the current market.

-

Strong Corporate Earnings Growth in Specific Sectors: Certain sectors continue to demonstrate robust earnings growth, defying the overall trend of high valuations. This presents opportunities for investors who are able to identify these pockets of strength.

-

Potential for Long-Term Growth Despite Short-Term Volatility: Despite near-term uncertainties, the long-term growth prospects for many companies remain positive. This perspective suggests that periods of volatility may present buying opportunities for long-term investors.

-

Opportunities in Undervalued Sectors or Specific Companies: Despite generally high valuations, some sectors or individual companies may be undervalued relative to their fundamentals. Careful research and analysis can reveal these opportunities.

-

Strategies for Mitigating Risk in a High-Valuation Market: Diversification, strategic asset allocation, and defensive investment strategies can help mitigate risk in a market characterized by high valuations.

BofA's Recommendations for Investors

Based on their analysis of high stock market valuations, BofA typically recommends a cautious approach. Their recommendations often include:

-

Adjusting Investment Portfolios to Reflect Risk Tolerance: Investors should carefully review their portfolios and ensure that their asset allocation aligns with their individual risk tolerance.

-

Considering Defensive Investment Strategies: Defensive investment strategies, such as investing in lower-risk assets, can help protect portfolios during periods of market volatility.

-

Focusing on Quality Companies with Strong Fundamentals: Investors should prioritize companies with strong balance sheets, consistent earnings growth, and a history of weathering economic downturns.

-

Regularly Reviewing Investment Strategies: The current market environment demands regular monitoring and adjustment of investment strategies to ensure they remain aligned with evolving conditions and changing risk assessments.

Conclusion: Navigating High Stock Market Valuations with BofA's Insights

BofA's analysis highlights significant concerns about high stock market valuations, emphasizing risks stemming from high P/E ratios, inflationary pressures, and geopolitical uncertainty. While opportunities exist, their cautious outlook is supported by several key economic factors. Their recommendations emphasize the importance of risk management, portfolio diversification, and a focus on quality companies with strong fundamentals. Understanding the implications of high stock market valuations is crucial for informed investment decisions. Continue your research and develop a strategy that aligns with your financial objectives, focusing on effectively managing high stock market valuations and assessing high stock market valuations within your individual risk tolerance.

Featured Posts

-

Tour De France 2027 Grand Depart From Edinburgh United Kingdom

May 23, 2025

Tour De France 2027 Grand Depart From Edinburgh United Kingdom

May 23, 2025 -

Siren Review A Thrilling Performance From Moore Fahy And Alcock

May 23, 2025

Siren Review A Thrilling Performance From Moore Fahy And Alcock

May 23, 2025 -

Zimbabwe Vs Bangladesh Muzarabanis Bowling Dominance Secures Historic Test Win

May 23, 2025

Zimbabwe Vs Bangladesh Muzarabanis Bowling Dominance Secures Historic Test Win

May 23, 2025 -

Italian Citizenship New Rules For Claiming Through Great Grandparents

May 23, 2025

Italian Citizenship New Rules For Claiming Through Great Grandparents

May 23, 2025 -

Alhryt Lflstyn Sda Emlyt Washntn Wsrakh Rwdryghyz Ela Mnsat Altwasl

May 23, 2025

Alhryt Lflstyn Sda Emlyt Washntn Wsrakh Rwdryghyz Ela Mnsat Altwasl

May 23, 2025

Latest Posts

-

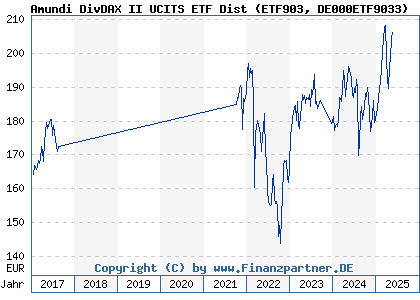

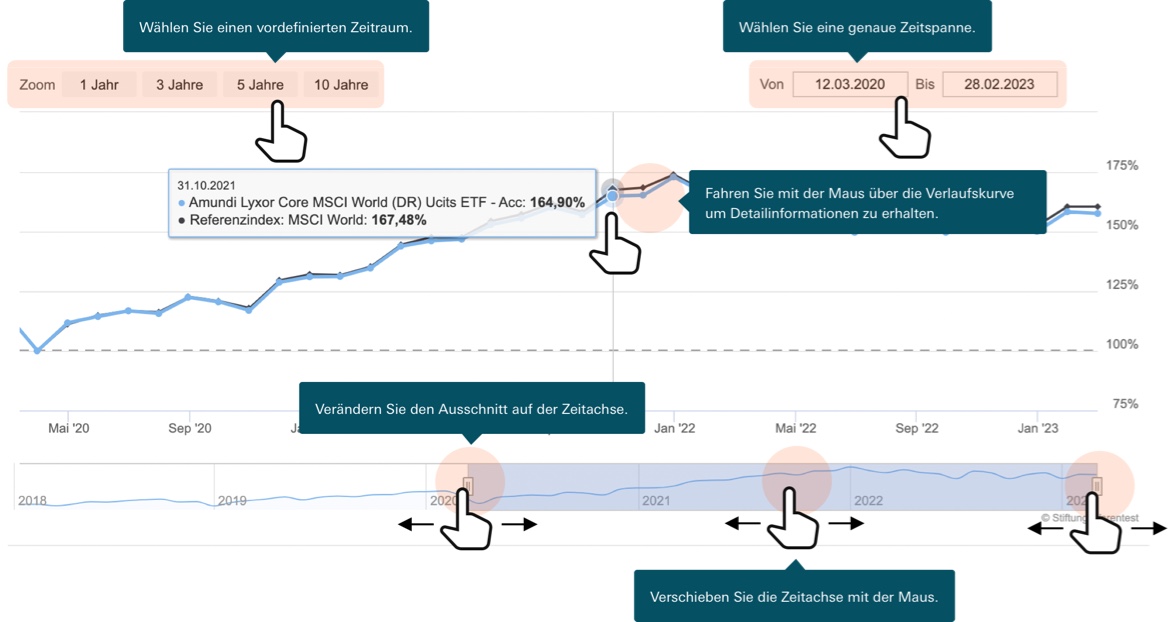

Amundi Msci World Ii Ucits Etf Dist Nav Calculation And Implications

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist Nav Calculation And Implications

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Net Asset Value

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Net Asset Value

May 24, 2025 -

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist Explained

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist Explained

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Analysis And Tracking

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Analysis And Tracking

May 24, 2025 -

Apakah Mtel Dan Mbma Layak Dibeli Setelah Masuk Msci Small Cap

May 24, 2025

Apakah Mtel Dan Mbma Layak Dibeli Setelah Masuk Msci Small Cap

May 24, 2025