1,050% Price Jump: AT&T's Concerns Over Broadcom's VMware Deal

Table of Contents

AT&T's Specific Concerns Regarding the Broadcom VMware Deal

AT&T's anxieties stem from several key areas concerning the Broadcom VMware deal. The potential for monopolistic practices, increased networking and infrastructure costs, and the jarring 1050% price jump exemplify the company's serious reservations.

Potential for Monopoly and Antitrust Issues

AT&T fears that the combined entity of Broadcom and VMware will create a monopoly, stifling competition and ultimately harming consumers. This concern is fueled by the significant market share held by both companies in their respective sectors.

- Affected Market Sectors: The merger could significantly impact the markets for server virtualization, networking infrastructure, and cloud computing, potentially leading to reduced choice and innovation.

- Higher Prices for AT&T and Others: The decreased competition could translate to substantially higher prices for essential technologies and services that AT&T relies on for its operations.

- Antitrust Lawsuits and Regulatory Investigations: The deal is already under intense regulatory scrutiny, with various antitrust lawsuits and investigations underway in different jurisdictions. The outcome of these investigations will be crucial in determining the future of the merger and its impact on the market. Keywords: antitrust, monopoly, competition, market dominance, regulatory scrutiny.

Impact on Networking and Infrastructure Costs

The Broadcom VMware merger could drastically increase AT&T's networking and infrastructure costs. This is a critical concern, given the massive infrastructure investments telecom companies like AT&T continuously make.

- Affected Technologies and Services: The merger could lead to increased costs for virtualization software, networking equipment, and cloud services—all integral parts of AT&T's network.

- Operational Efficiency and Profitability: Higher costs for these essential components could significantly impact AT&T's operational efficiency and ultimately reduce its profitability. Keywords: networking costs, infrastructure spending, operational efficiency, profitability.

The 1050% Price Jump: A Case Study

The reported 1050% price increase on a specific VMware product or service is a stark example of the potential cost implications of this merger. While the exact product and reasons behind this dramatic increase require further investigation, it serves as a cautionary tale.

- Specific Product/Service Affected: Identifying the exact product or service experiencing the 1050% price surge is crucial for a full understanding of the impact. Transparency from Broadcom and VMware is needed here.

- Contributing Factors: While the merger is a significant factor, other market dynamics might have also contributed to this price jump. A comprehensive analysis is needed to determine the precise weight of each contributing factor.

- (Insert Chart Here: A visual representation showing the price increase before and after the merger announcement would significantly enhance this section.) Keywords: price increase, cost escalation, price jump, VMware pricing, Broadcom pricing.

Potential Long-Term Implications of the Broadcom VMware Deal

The Broadcom VMware deal carries far-reaching consequences that extend beyond AT&T's immediate concerns.

Ripple Effects Across the Telecom Industry

The merger's impact on pricing and competition will likely ripple through the entire telecom industry, affecting other major players and potentially leading to a less competitive market. Smaller telecom providers could be particularly vulnerable.

Implications for Innovation and Technological Advancement

The reduced competition resulting from the merger could stifle innovation within the tech industry. A less competitive market may decrease the incentive for companies to invest in research and development, hindering technological advancement.

Regulatory Responses and Future Outcomes

The regulatory response to the Broadcom VMware deal will be crucial in shaping its long-term impact. Stringent regulatory oversight could mitigate some of the negative consequences, while a more lenient approach could allow the merger to proceed with potentially harmful effects. Keywords: telecom industry, technological innovation, regulatory response, future outlook, market consolidation.

Conclusion: Understanding the Stakes of the Broadcom VMware Deal for AT&T and Beyond

AT&T's concerns regarding the Broadcom VMware deal are significant, underscored by the alarming 1050% price jump in a specific product or service. The potential for monopolistic practices, increased costs, and decreased innovation pose substantial risks to AT&T and the broader telecom and tech industries. The ongoing regulatory scrutiny and its outcome will be pivotal in determining the long-term implications of this merger. Stay updated on the ongoing developments in the Broadcom VMware deal and its implications for AT&T and the future of the tech industry. Keep an eye on future price changes and regulatory decisions impacting the Broadcom VMware acquisition.

Featured Posts

-

Execs Office365 Accounts Breached Crook Makes Millions Feds Say

Apr 24, 2025

Execs Office365 Accounts Breached Crook Makes Millions Feds Say

Apr 24, 2025 -

Early Detection Is Key Lessons From Tina Knowles Breast Cancer Journey

Apr 24, 2025

Early Detection Is Key Lessons From Tina Knowles Breast Cancer Journey

Apr 24, 2025 -

World Economic Forum New Probe Into Klaus Schwabs Leadership

Apr 24, 2025

World Economic Forum New Probe Into Klaus Schwabs Leadership

Apr 24, 2025 -

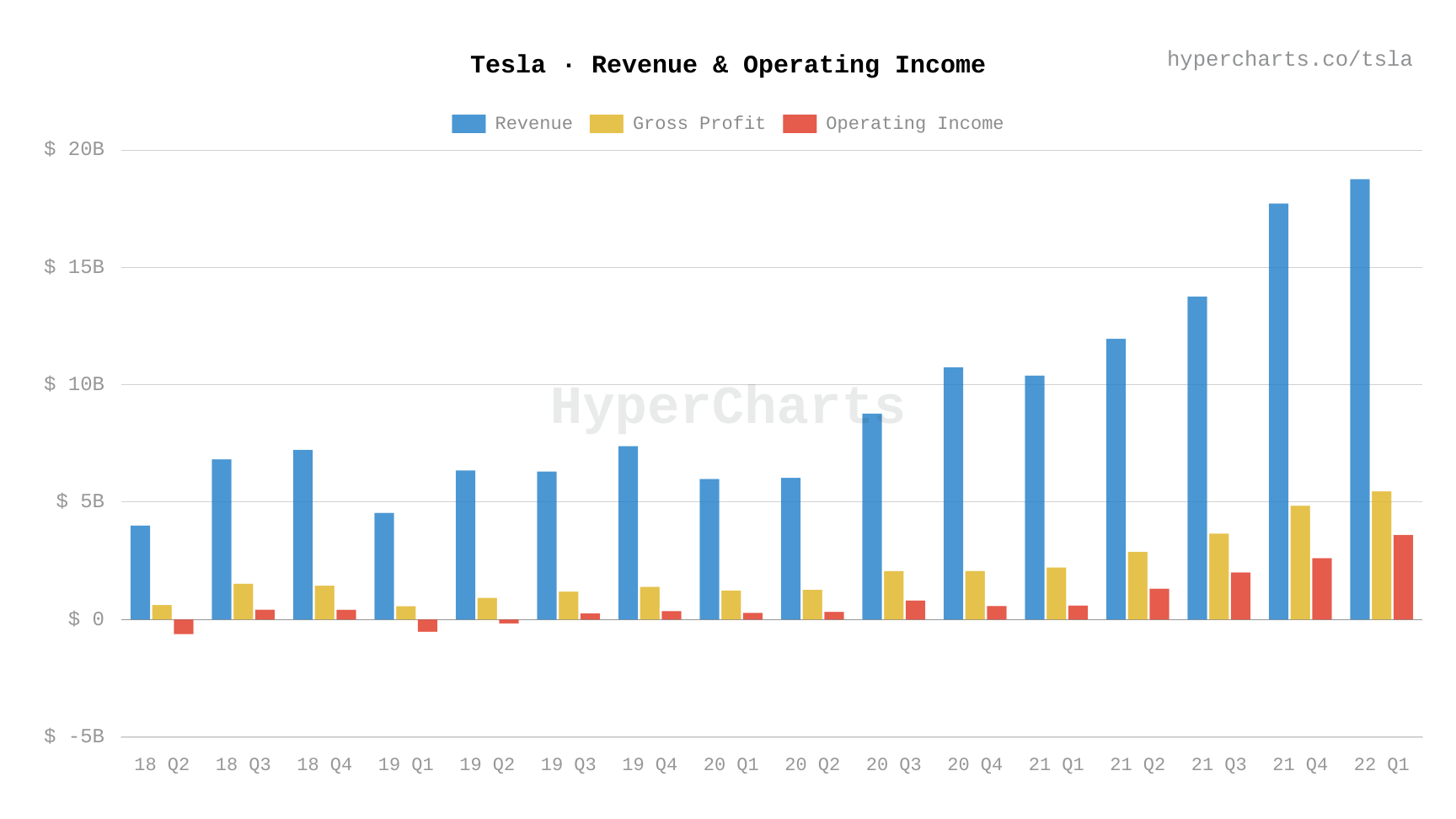

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025 -

Luxury Car Sales In China Bmw Porsche And The Competitive Landscape

Apr 24, 2025

Luxury Car Sales In China Bmw Porsche And The Competitive Landscape

Apr 24, 2025