Tesla's Q1 2024 Earnings Report: A 71% Drop In Net Income

Table of Contents

Main Points: Unpacking Tesla's Q1 2024 Performance

2.1. Deep Dive into the 71% Net Income Decline

H3: Impact of Price Cuts: Tesla's aggressive price cuts across its vehicle lineup significantly impacted profitability margins in Q1 2024.

- Magnitude of Reductions: Price cuts ranged from several thousand dollars, varying across models like the Model 3, Model Y, Model S, and Model X. These reductions were implemented globally, aiming to boost sales volume in a competitive market.

- Strategic Reasoning: The strategy behind these price cuts was twofold: increasing market share in a rapidly expanding EV market and stimulating demand amidst softening economic conditions. The hope was that higher sales volume would offset the reduced profit margin per vehicle.

- Expert Analysis: Many financial analysts remain divided on the long-term viability of this strategy. While some praise the bold move to maintain market leadership, others express concern about the potential for sustained profitability if margins continue to erode.

H3: Rising Competition in the EV Market: The EV market is no longer Tesla's sole domain. Intense competition from established automakers and new EV startups is significantly impacting Tesla's market share and pricing power.

- Key Competitors: Companies like BYD, Volkswagen, Ford, and Rivian are aggressively expanding their EV offerings, leveraging economies of scale and technological advancements.

- Competitive Pressures: These competitors are not only offering comparable vehicles but are also engaging in competitive pricing strategies, squeezing Tesla's profit margins. Innovative features and improved battery technology further intensify the pressure.

- Market Share Comparison: While Tesla maintains a strong market share, data reveals a slowing growth rate compared to previous quarters, indicating a loss of momentum in certain key markets.

H3: Supply Chain Challenges and Increased Costs: Persistent supply chain disruptions continue to plague the automotive industry, affecting Tesla's production costs and profitability.

- Specific Challenges: Tesla faced challenges securing essential raw materials, including lithium for batteries, at stable prices, and experienced delays in logistics. These factors contributed to increased production costs.

- Impact on Profitability: Higher input costs directly reduced profit margins, exacerbating the impact of price cuts.

- Comparison to Previous Quarters: While supply chain issues have been ongoing, Q1 2024 saw a resurgence of these challenges, further impacting profitability compared to previous quarters.

H3: Other Contributing Factors: Macroeconomic headwinds and regulatory changes also played a role in Tesla's Q1 2024 performance.

- Global Economic Slowdown: A weakening global economy affected consumer spending, potentially reducing demand for high-priced vehicles like Teslas.

- Regulatory Changes: Changes in government subsidies and regulations in various markets impacted Tesla's operational costs and sales strategies.

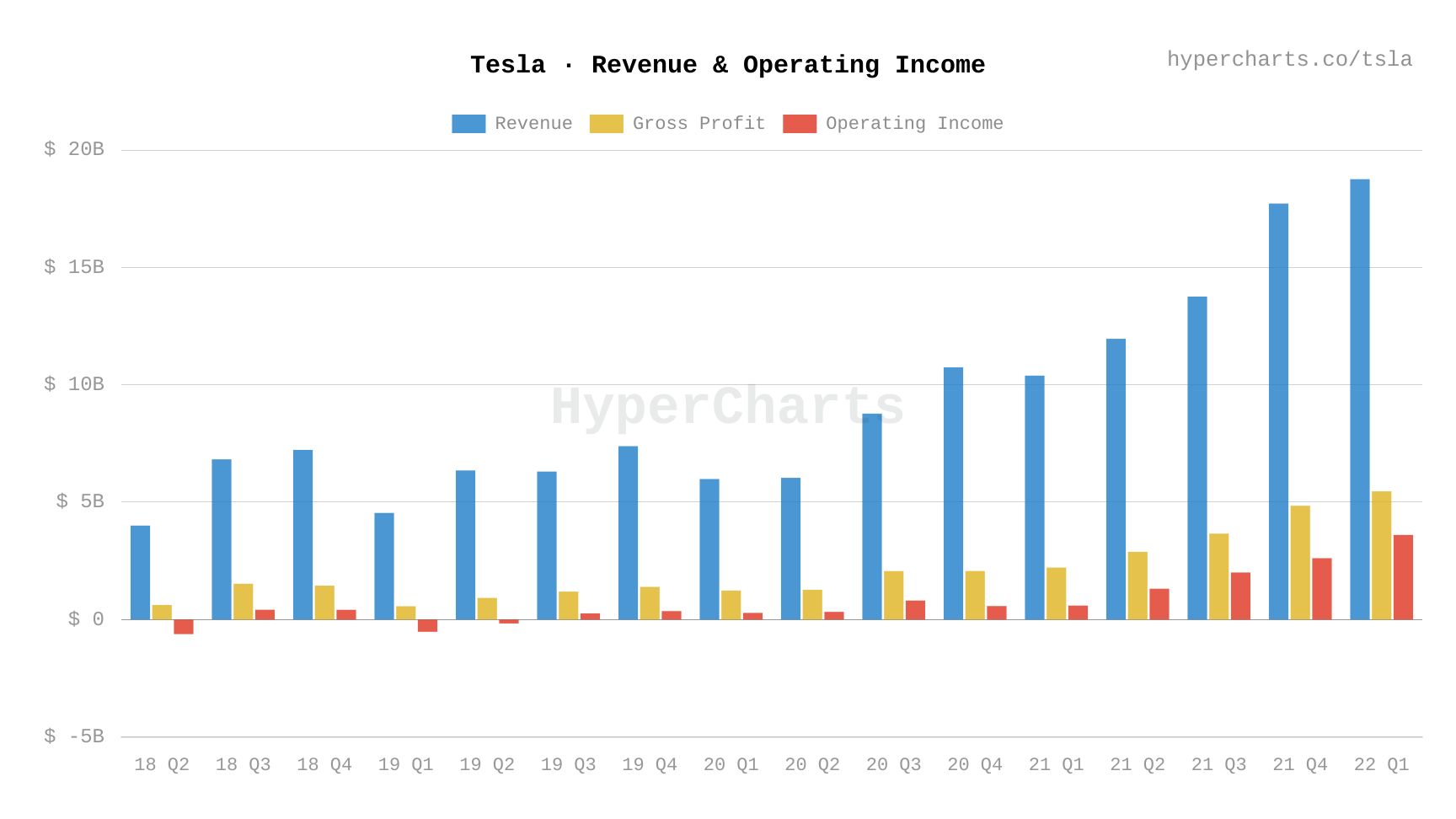

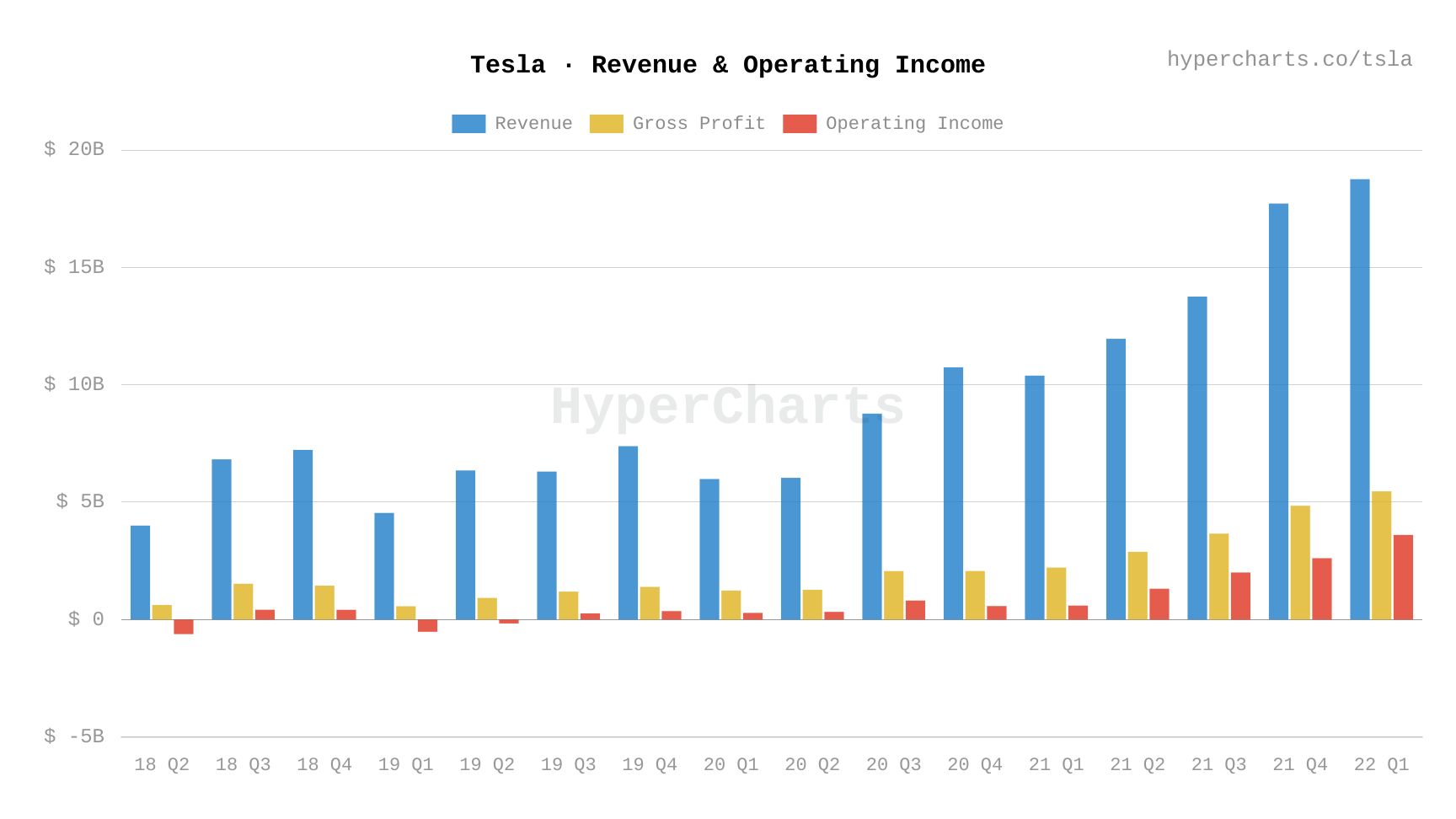

2.2. Analysis of Tesla's Q1 2024 Financial Performance Beyond Net Income

H3: Revenue and Sales Figures: Despite the net income decline, Tesla still reported strong revenue and sales figures, showcasing the company's substantial market presence.

- Quarter-over-Quarter and Year-over-Year Comparison: While sales increased compared to the previous quarter, the year-over-year growth rate showed a significant slowdown, indicating market saturation and competitive pressures.

- Regional Performance Variations: Performance varied across different geographical regions, with some markets showing stronger growth than others, highlighting the impact of local economic conditions and regulatory environments.

H3: Future Outlook and Guidance: Tesla's outlook for the remainder of 2024 remains cautiously optimistic, indicating a focus on improving profitability and addressing the challenges highlighted in the Q1 report.

- Plans for Improvement: The company outlined plans to optimize manufacturing processes, improve supply chain efficiency, and potentially adjust its pricing strategy to balance volume and profitability.

- Investor Reactions: Investor reactions to the Q1 2024 report were mixed, with some expressing concern over the long-term implications of the net income decline, while others remain confident in Tesla's long-term growth prospects.

H3: Impact on Tesla's Stock Price: The Q1 2024 earnings report resulted in a significant, albeit temporary, dip in Tesla's stock price.

- Stock Price Fluctuation: Charts and graphs illustrating the immediate and subsequent recovery of the stock price after the report’s release demonstrate investor volatility.

- Financial Analysis: Various financial news outlets and analysts offered diverse interpretations of the stock price movement, highlighting the uncertainty surrounding Tesla's future performance.

Conclusion: Navigating the Tesla Q1 2024 Earnings Report: What's Next?

The 71% drop in Tesla's Q1 2024 net income represents a significant challenge for the company. Price cuts, intensifying competition, supply chain issues, and macroeconomic factors all contributed to this decline. While the company’s revenue and sales figures remain strong, the reduced profitability raises concerns about the long-term sustainability of its current strategies. Tesla's response to these challenges, including its plans to improve efficiency and navigate the increasingly competitive EV market, will be crucial in determining its future success. To stay informed about future Tesla earnings reports and the evolving electric vehicle landscape, subscribe to our newsletter [link to newsletter] and follow us on [links to social media]. Understanding Tesla's performance is key to comprehending the future of the electric vehicle market.

Featured Posts

-

Analysis Chinese Stocks Strong Performance In Hong Kongs Market

Apr 24, 2025

Analysis Chinese Stocks Strong Performance In Hong Kongs Market

Apr 24, 2025 -

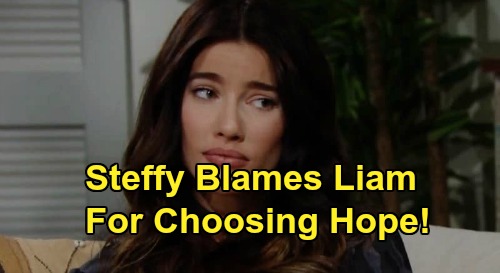

The Bold And The Beautiful April 9 Recap Steffy Blames Bill Finn In Icu Liams Demand For Silence

Apr 24, 2025

The Bold And The Beautiful April 9 Recap Steffy Blames Bill Finn In Icu Liams Demand For Silence

Apr 24, 2025 -

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025 -

The Zuckerberg Trump Dynamic Implications For Facebook And Beyond

Apr 24, 2025

The Zuckerberg Trump Dynamic Implications For Facebook And Beyond

Apr 24, 2025 -

California Gas Prices Soar Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025

California Gas Prices Soar Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025