1050% VMware Price Hike: AT&T's Concerns Over Broadcom's Acquisition

Table of Contents

AT&T's Vocal Opposition to the VMware Price Surge

AT&T's outspoken opposition to the dramatic VMware price increase underscores the significant implications for large-scale enterprises. AT&T relies heavily on VMware's virtualization technology for its critical infrastructure, and the proposed price hike represents a substantial financial burden. The sheer magnitude of the increase—a 1050% jump—is unprecedented and threatens to significantly increase AT&T's operational costs.

AT&T's concerns are not merely about increased expenses; they also reflect a potential weakening of their competitive position. The company has publicly expressed its worries about the impact on its services and pricing strategies, highlighting the risk of reduced competitiveness in a fiercely contested market. Their response underscores the potential for major disruptions within the telecom industry and other sectors reliant on VMware's solutions. AT&T is reportedly exploring alternative virtualization solutions, a move that could signal a significant shift in the industry landscape.

- Increased operational costs for AT&T: The sheer scale of the price increase necessitates a reassessment of AT&T's IT budget and operational strategies.

- Potential impact on AT&T's services and pricing: Higher costs could translate to increased prices for consumers or a reduction in service quality.

- Risk of reduced competitiveness in the market: The price hike puts AT&T at a disadvantage compared to competitors who may adopt alternative virtualization technologies.

- Exploration of alternative virtualization solutions: This highlights the urgency of the situation and the potential for a market shift away from VMware.

The Broader Implications of the VMware Price Hike for Businesses

The VMware price hike's impact extends far beyond AT&T, affecting businesses of all sizes. While large corporations like AT&T possess more negotiating power, smaller and medium-sized businesses (SMBs) face a disproportionately greater challenge. The 1050% increase could cripple SMBs' IT budgets, forcing them to make difficult choices between investing in essential technology and other crucial business needs.

This price surge may also accelerate market consolidation. Larger companies, with their greater financial resources, can absorb the increased costs more easily, potentially leading to reduced competition and a less diverse market. The situation could even expedite the migration to cloud-based solutions or open-source alternatives as businesses seek more cost-effective options.

- Increased IT budgets for businesses: The price hike necessitates a significant increase in IT spending for many companies.

- Shift to open-source alternatives: Businesses are increasingly exploring open-source virtualization solutions as a cost-effective alternative.

- Potential for cloud migration acceleration: The cost increase could further fuel the already rapid migration towards cloud computing services.

- Negotiating power of large corporations vs. SMBs: Large corporations possess significantly greater bargaining power in negotiations with VMware compared to SMBs.

Examining Broadcom's Rationale Behind the Price Increase

Broadcom's rationale behind the drastic VMware price increase requires careful scrutiny. Several factors could be at play. One possibility is a significant increase in research and development (R&D) investment to enhance VMware's offerings and integrate them with Broadcom's existing product portfolio. Another factor could be a strategic move towards market dominance, leveraging the price increase to consolidate their position and discourage competition. Finally, the price hike could also be seen as a way to maximize return on investment for shareholders after the significant acquisition cost.

- Increased R&D investment: Investment in improving VMware's products and services could justify a price increase.

- Market dominance strategy: A price increase could be a strategic move to limit competition and consolidate market share.

- Return on investment for shareholders: Increasing prices is a way for Broadcom to maximize profitability from their investment in VMware.

- Integration costs and efficiencies: The costs of integrating VMware into Broadcom's operations may be a contributing factor to the price increase.

Regulatory Scrutiny and Future Outlook for VMware Pricing

The significant VMware price increase has inevitably attracted regulatory scrutiny. Antitrust concerns are being raised, particularly regarding the potential for reduced competition in the virtualization market. Investigations are likely to ensue, potentially leading to government intervention to address concerns about monopolistic practices. The long-term consequences for VMware's market position and future pricing strategies remain uncertain, but the current situation underscores the need for vigilance and adaptation within the industry.

- Antitrust concerns and investigations: Regulatory bodies are likely to investigate potential antitrust violations.

- Impact on competition within the virtualization market: The price hike could significantly reduce competition in the virtualization market.

- Potential for government intervention: Government intervention may be necessary to ensure fair competition and prevent monopolistic practices.

- Long-term implications for VMware's market share: The price hike could impact VMware's market share, leading to increased adoption of alternative solutions.

Conclusion: Navigating the Post-Acquisition VMware Landscape

The 1050% VMware price hike following Broadcom's acquisition presents a significant challenge for businesses globally. AT&T's vocal concerns highlight the potential for substantial financial strain and reduced competitiveness. The broader implications extend to businesses of all sizes, forcing them to reassess their IT budgets and explore alternative virtualization solutions. Regulatory scrutiny is likely, adding another layer of uncertainty to the future of VMware pricing.

It is crucial for businesses to stay informed about the evolving situation concerning the VMware price hike and its impact on their operations. Proactive steps, such as exploring alternative virtualization technologies, renegotiating contracts, and carefully planning for potential cost increases, are essential to mitigate the impact. Don't be caught off guard; stay informed about the VMware price hike and adapt your strategies accordingly to avoid future financial surprises.

Featured Posts

-

Reactie Van Der Gijp Op Potentiele Farioli Opvolger Een Verrassende Mening

May 29, 2025

Reactie Van Der Gijp Op Potentiele Farioli Opvolger Een Verrassende Mening

May 29, 2025 -

Pokemon Tcg Pocket Gen 9 Pokemon And Shiny Cards Flood The Latest Expansion

May 29, 2025

Pokemon Tcg Pocket Gen 9 Pokemon And Shiny Cards Flood The Latest Expansion

May 29, 2025 -

Bell Shakespeares Fast Paced Vital Henry V

May 29, 2025

Bell Shakespeares Fast Paced Vital Henry V

May 29, 2025 -

State Fair Park Hosts The Annual Realtors Home And Garden Show

May 29, 2025

State Fair Park Hosts The Annual Realtors Home And Garden Show

May 29, 2025 -

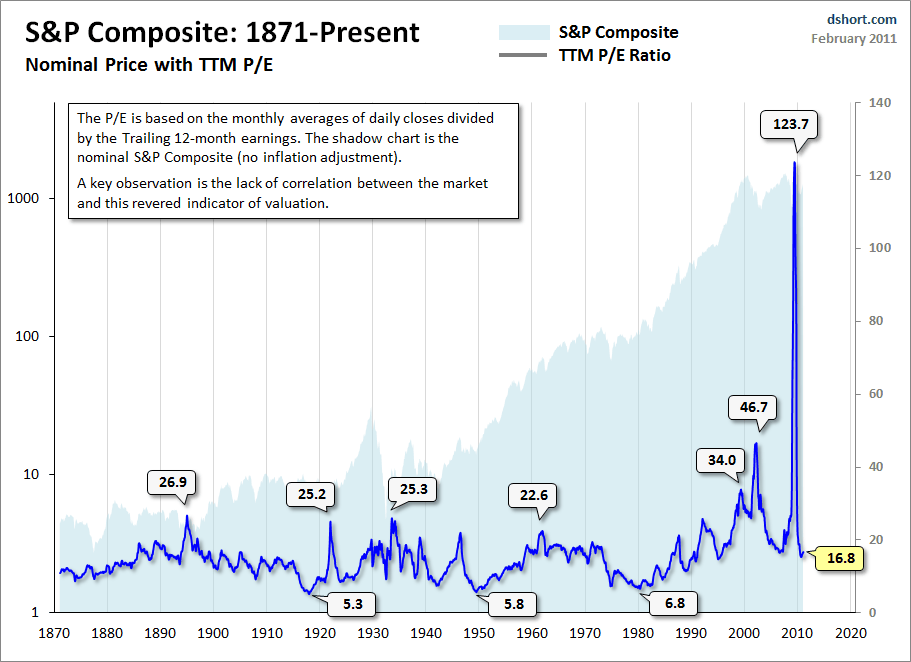

High Stock Market Valuations A Bof A Analysis And Why Investors Shouldnt Worry

May 29, 2025

High Stock Market Valuations A Bof A Analysis And Why Investors Shouldnt Worry

May 29, 2025

Latest Posts

-

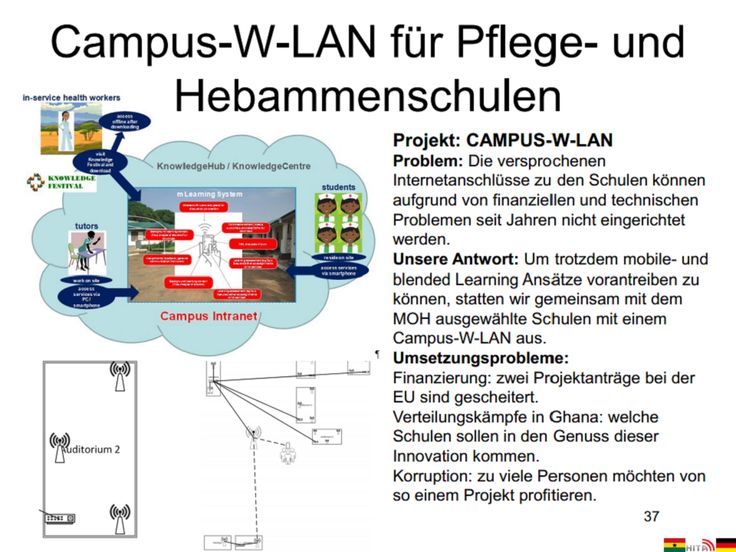

Bodenseekreis Die Erste Pflegekonferenz Informationen Und Anmeldung

May 31, 2025

Bodenseekreis Die Erste Pflegekonferenz Informationen Und Anmeldung

May 31, 2025 -

France Far Left Uses Muslim Mans Death To Attack Perceived Islamophobia

May 31, 2025

France Far Left Uses Muslim Mans Death To Attack Perceived Islamophobia

May 31, 2025 -

Sanofis Commitment To Respiratory Health Latest Developments In Asthma And Copd

May 31, 2025

Sanofis Commitment To Respiratory Health Latest Developments In Asthma And Copd

May 31, 2025 -

Incendio Forestal En Constanza La Lucha De Los Bomberos Contra El Fuego Y El Humo

May 31, 2025

Incendio Forestal En Constanza La Lucha De Los Bomberos Contra El Fuego Y El Humo

May 31, 2025 -

Death Of Muslim Man In France Far Lefts Response And Islamophobia Debate

May 31, 2025

Death Of Muslim Man In France Far Lefts Response And Islamophobia Debate

May 31, 2025