$254 Apple Stock Prediction: Investment Analysis And Outlook

Table of Contents

Analyzing Apple's Current Financial Performance: Apple's Q4 2023 Earnings: A Deep Dive

Apple's Q4 2023 earnings report offers crucial insights into the company's financial health, providing a foundation for evaluating the $254 Apple stock prediction. Analyzing key performance indicators (KPIs) is essential. Let's delve into the significant data points:

-

Revenue Growth: Examining revenue growth across key product segments like iPhones, Services (including App Store, Apple Music, iCloud), Mac, iPads, and Wearables is vital. Strong growth in these areas would support a bullish outlook for the $254 prediction. For example, a consistent double-digit growth rate in Services demonstrates the strength and recurring revenue potential of Apple's ecosystem.

-

Profit Margins: Analyzing profit margins and their trends reveals the company's profitability and efficiency. High and stable profit margins indicate strong pricing power and operational efficiency, further bolstering the prediction. A decline, however, might signal concerns.

-

Year-over-Year Growth: Comparing current quarter results to those of the previous year helps gauge the overall growth trajectory. Sustained year-over-year growth in revenue and earnings would strongly suggest the $254 target is achievable.

(Insert relevant chart/graph showing revenue, earnings per share, and profit margins for the last few quarters.)

Factors Influencing Apple Stock Price: Market Forces and Apple Stock: External Pressures and Opportunities

While Apple's internal performance is crucial, external factors significantly influence its stock price. These include:

-

Macroeconomic Factors: Interest rate hikes, inflation rates, and overall economic growth directly impact consumer spending and investor sentiment. A recession could dampen demand for Apple products, impacting the $254 prediction negatively.

-

Industry Trends: Competition from other tech giants (Samsung, Google, etc.) and rapid technological advancements in areas like AI and AR/VR constantly challenge Apple's dominance. Successful navigation of this competitive landscape is crucial for reaching the $254 target.

-

Geopolitical Risks: Global events and political instability can disrupt supply chains, impact sales in certain regions, and affect investor confidence. Any significant geopolitical risk could hinder Apple's progress towards the predicted stock price.

-

Key Influential Factors:

- Supply Chain Disruptions: Continued disruptions could impact production and sales, potentially delaying the achievement of the $254 price.

- Consumer Spending: A decline in consumer confidence and spending would directly affect demand for Apple products.

- New Product Releases: The success of new products, such as anticipated AR/VR headsets or new iPhone models, plays a significant role in shaping future stock performance. Positive reception and strong sales could drive the price upward.

- Regulatory Changes: Increasing regulatory scrutiny in various markets (e.g., antitrust concerns) could negatively impact Apple's growth and profitability.

Predicting Apple's Stock Price: A Look at Various Valuation Methods

Several valuation methods can help assess the feasibility of the $254 Apple stock prediction. Let’s examine some key approaches:

-

Discounted Cash Flow (DCF) Analysis: This method projects future cash flows and discounts them to their present value, providing an intrinsic value estimate for Apple. A DCF analysis exceeding $254 would support the prediction.

-

Price-to-Earnings (P/E) Ratio: Comparing Apple's P/E ratio to its historical average and those of its competitors provides insights into its relative valuation. A P/E ratio justifying a stock price of $254 needs to be supported by strong growth projections.

-

Comparable Company Analysis: Analyzing the valuation multiples of similar companies in the tech sector allows for a benchmark comparison, providing context for Apple's valuation.

-

Models and Results:

- DCF Analysis: (Insert projected cash flows and resulting intrinsic value)

- P/E Ratio: (Insert Apple's P/E ratio and comparison to historical data and competitors)

- Comparable Company Analysis: (Insert valuation multiples of comparable companies)

Apple Stock Prediction: Understanding the Risks Involved

While the $254 Apple stock prediction appears optimistic, it's crucial to acknowledge potential downsides:

-

Increased Competition: The intensified rivalry from tech giants could erode Apple's market share and profit margins.

-

Economic Slowdown: A global economic slowdown could significantly impact consumer spending, reducing demand for Apple products.

-

Geopolitical Instability: Geopolitical uncertainties might disrupt Apple's supply chains and impact sales in key markets.

-

Supply Chain Issues: Persistent supply chain bottlenecks could affect production and impact revenue targets.

Conclusion: The $254 Apple Stock Prediction: A Balanced Perspective and Next Steps

The $254 Apple stock prediction is a complex issue, influenced by both Apple's internal performance and external market factors. Our analysis suggests that while Apple's strong financial fundamentals and innovative products provide a bullish case, significant risks and uncertainties remain. Achieving the $254 target depends on continued strong financial performance, navigating competitive pressures, and avoiding major economic or geopolitical disruptions.

A balanced approach is needed. While the potential upside is enticing, investors should proceed with caution, considering the outlined risks. Further research is essential before making investment decisions. Stay informed about the latest developments affecting the $254 Apple stock prediction and your overall investment strategy. Continue your research and make informed investment decisions based on thorough analysis.

Featured Posts

-

Hihetetlenuel Draga Porsche 911 80 Millio Forint Az Extrakban

May 24, 2025

Hihetetlenuel Draga Porsche 911 80 Millio Forint Az Extrakban

May 24, 2025 -

Sean Penns Doubts Re Examining The Woody Allen Dylan Farrow Allegations

May 24, 2025

Sean Penns Doubts Re Examining The Woody Allen Dylan Farrow Allegations

May 24, 2025 -

M56 Motorway Accident Live Traffic News And Delays

May 24, 2025

M56 Motorway Accident Live Traffic News And Delays

May 24, 2025 -

Europese Aandelen Vs Wall Street Doorzetting Van De Snelle Marktbeweging

May 24, 2025

Europese Aandelen Vs Wall Street Doorzetting Van De Snelle Marktbeweging

May 24, 2025 -

Ai I Phone

May 24, 2025

Ai I Phone

May 24, 2025

Latest Posts

-

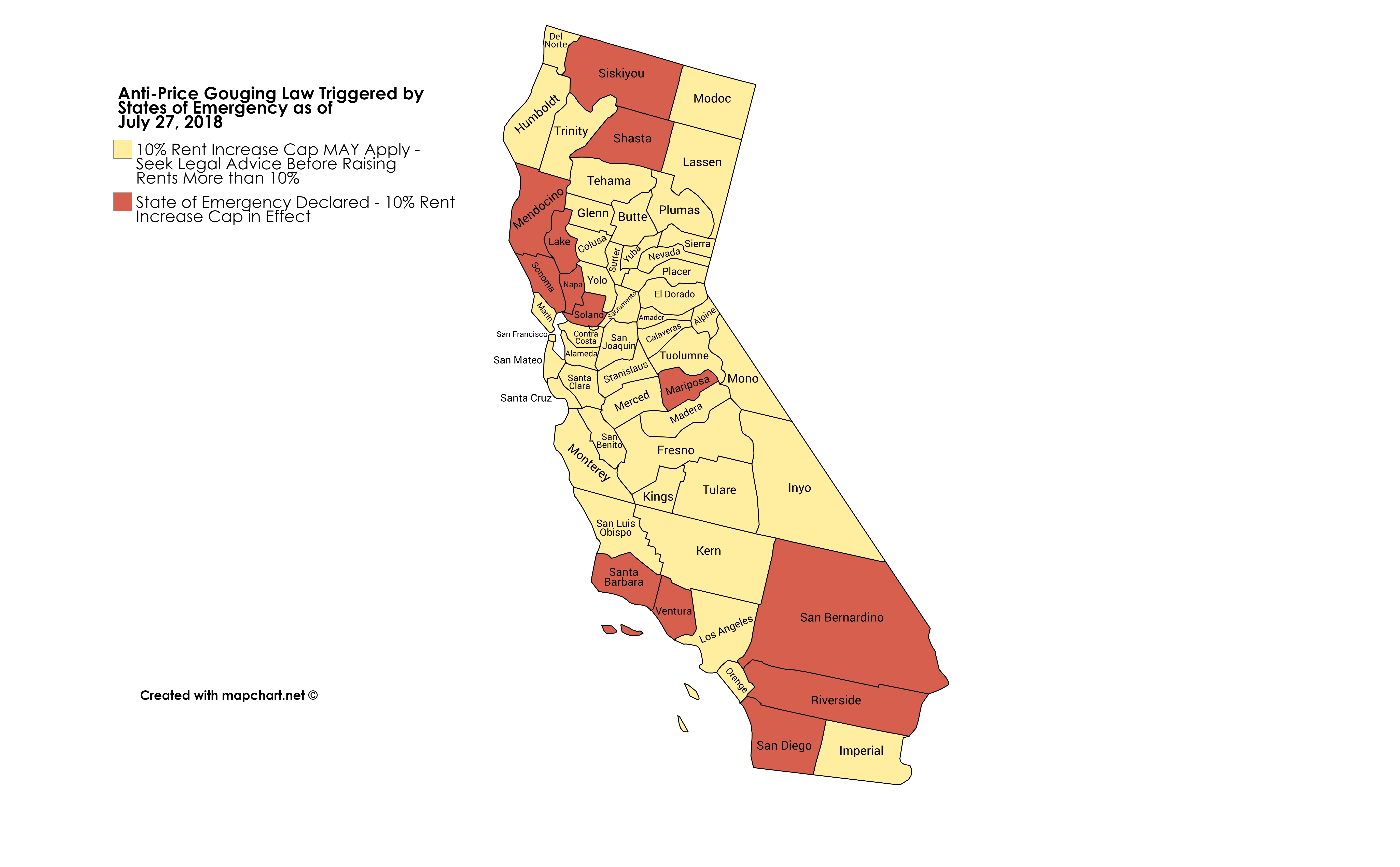

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025 -

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025 -

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025 -

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025 -

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025