6% Kering Share Slump After First Quarter Report

Table of Contents

Disappointing Q1 Earnings: A Closer Look at the Numbers

Kering's Q1 2024 results revealed a concerning picture, falling short of market expectations across several key performance indicators. Analyzing the financial performance reveals the depth of the problem.

-

Revenue Growth Stalled: While precise figures await further detailed analysis, early reports suggest that revenue growth was significantly lower than anticipated, failing to meet the projected targets set by analysts. This sluggish growth signals a potential weakening in demand for Kering's luxury goods.

-

Profit Margin Compression: The profit margin for the first quarter showed a noticeable decline compared to the same period last year and projections. Increased operating costs and supply chain challenges likely contributed to this squeeze on profitability. Understanding the specific factors behind this margin compression is crucial for assessing the long-term health of the business.

-

Earnings Per Share (EPS) Dip: The impact on earnings per share is directly reflected in the Kering stock price. A lower-than-expected EPS, a key metric for investors, significantly contributed to the negative market reaction and the subsequent share price drop.

-

Benchmark Comparison: Compared to competitors in the luxury goods sector and Kering's own performance in previous quarters, the Q1 2024 results appear significantly weaker. This relative underperformance further fueled concerns among investors.

-

Unexpected Costs: Unforeseen costs related to supply chain disruptions, increased raw material prices, or other operational challenges likely played a role in dampening the overall financial results. Transparency regarding these unexpected expenses is vital for restoring investor confidence.

Gucci's Underperformance: A Major Contributor to the Slump

Gucci, the flagship brand of Kering, bore the brunt of the disappointing Q1 performance. Its underperformance was a significant factor contributing to the overall share price slump.

-

Declining Gucci Sales: Reports indicate a substantial drop in Gucci's sales figures during the first quarter, a worrying trend for the brand and the parent company. This decline suggests challenges in maintaining market share and attracting new customers.

-

Factors Impacting Gucci's Sales: Several factors likely contributed to Gucci's underperformance. These include changing consumer preferences, increased competition from other luxury brands, and lingering supply chain issues that impacted product availability. A thorough investigation into these issues is necessary.

-

Strategic Revitalization Needed: To reverse the negative trend, Gucci needs a strategic overhaul. This could include a refreshed brand image, innovative product launches, and more targeted marketing campaigns to recapture market share and regain customer interest.

-

Brand Comparison: When comparing Gucci's performance against other Kering brands like Yves Saint Laurent or Balenciaga, the disparity in growth and profitability becomes stark. This highlights the need for targeted intervention within the Gucci brand.

Geopolitical Factors and Economic Uncertainty

Macroeconomic headwinds significantly impacted Kering's Q1 performance. Global economic uncertainties and geopolitical instability played a considerable role in the slump.

-

Inflation's Impact on Luxury Spending: Rising global inflation has squeezed consumer spending, particularly in the luxury goods sector. High inflation rates directly impact discretionary spending, forcing consumers to cut back on luxury purchases.

-

Geopolitical Instability's Influence: The ongoing war in Ukraine and other geopolitical tensions created uncertainty in the global economy, impacting consumer confidence and reducing demand for luxury goods.

-

Economic Slowdown Concerns: Growing fears of a potential global recession further dampened consumer spending, significantly impacting Kering's sales and profitability. The anticipation of an economic slowdown contributed to the investor's negative reaction.

-

Chinese Market Slowdown: The Chinese market, a crucial region for luxury goods sales, experienced a slowdown in growth, further adding to Kering's woes. Analyzing the specifics of the Chinese market performance is crucial for understanding the overall slump.

The Impact on Investor Confidence

The 6% drop in Kering's share price reflects a significant loss of investor confidence. The market reaction to the Q1 report underscores the gravity of the situation.

-

Share Price Volatility: The immediate and sharp drop in Kering stock price highlights the market's sensitivity to the disappointing financial results. The volatility underscores the risk associated with investing in luxury goods companies during uncertain economic times.

-

Negative Investor Sentiment: The Q1 report fueled negative sentiment among investors, leading to a sell-off and a decline in the company's market capitalization. Restoring investor confidence will require decisive action and clear communication from Kering's leadership.

-

Short-Term and Long-Term Outlook: The short-term outlook for Kering stock appears uncertain, with potential for further volatility. The long-term outlook depends on Kering's ability to address the underlying issues impacting its performance.

-

Implications for Investors: Current and prospective investors need to carefully assess the risks before making any decisions regarding their Kering stock holdings. Thorough due diligence and a comprehensive understanding of the company's strategic response are vital for informed investment choices.

Conclusion

The 6% Kering share slump following its disappointing first-quarter report underscores the challenges facing even the most established luxury brands. A combination of Gucci's underperformance, broader economic uncertainty, and geopolitical factors contributed to this significant downturn. The impact on investor confidence is undeniable, raising serious questions about the short-term and long-term prospects for the company. Understanding these complexities is crucial for navigating the current market environment.

Call to Action: Staying informed about Kering's performance and the broader luxury goods market is essential for making informed investment decisions regarding Kering stock. Continue monitoring Kering’s response to the Q1 results, analyzing future financial reports, and staying abreast of market trends to make sound judgments about your Kering stock portfolio. Further analysis of the Kering Q1 report and future market trends will provide critical information for investors.

Featured Posts

-

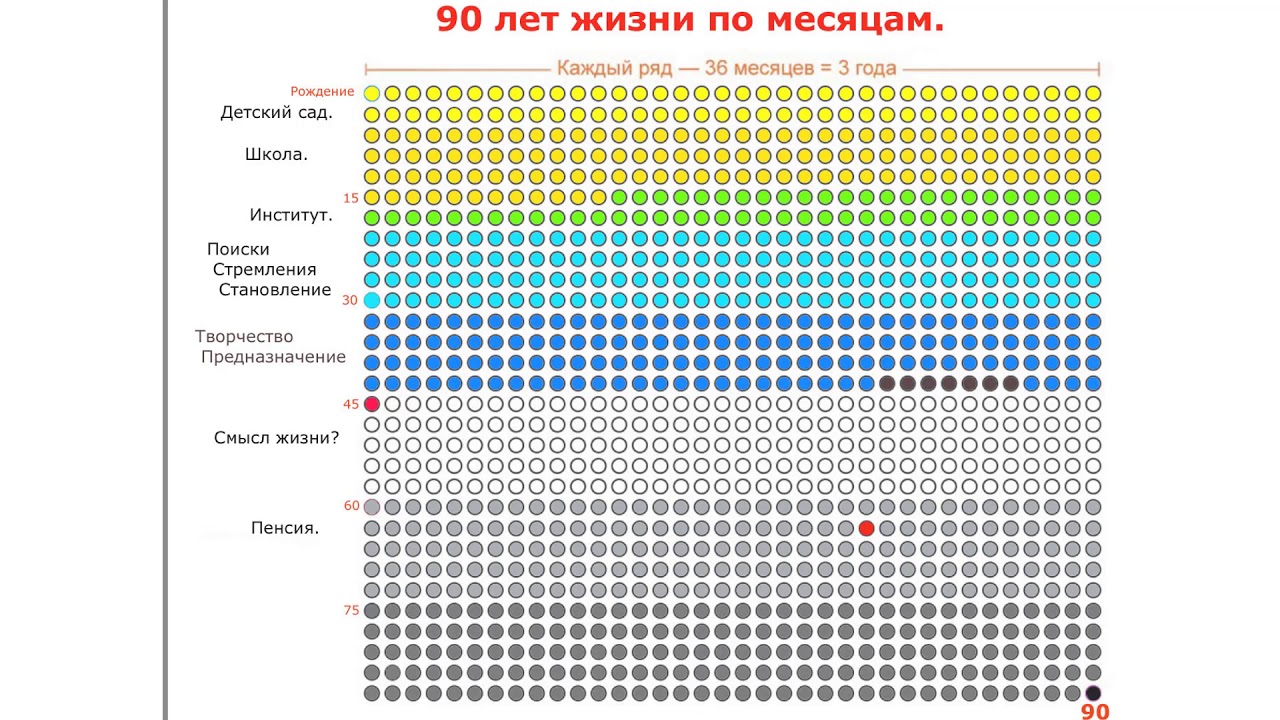

Sergey Yurskiy 90 Let Zhizni I Tvorchestva Velikogo Aktera

May 24, 2025

Sergey Yurskiy 90 Let Zhizni I Tvorchestva Velikogo Aktera

May 24, 2025 -

Impact Of Trumps Tariff Comments European Market Analysis And Lvmh Decline

May 24, 2025

Impact Of Trumps Tariff Comments European Market Analysis And Lvmh Decline

May 24, 2025 -

Demna At Gucci Analyzing The Impact Of The New Creative Director

May 24, 2025

Demna At Gucci Analyzing The Impact Of The New Creative Director

May 24, 2025 -

Amsterdam Stock Exchange 7 Fall As Trade War Fears Rise

May 24, 2025

Amsterdam Stock Exchange 7 Fall As Trade War Fears Rise

May 24, 2025 -

A Look At Nicki Chapmans Country Escape Her Chiswick Garden

May 24, 2025

A Look At Nicki Chapmans Country Escape Her Chiswick Garden

May 24, 2025

Latest Posts

-

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Mia Farrow Demands Trump Be Jailed For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrow Demands Trump Be Jailed For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation Policy

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation Policy

May 24, 2025 -

Reputation Wreckage 17 Celebrities Whose Careers Ended Abruptly

May 24, 2025

Reputation Wreckage 17 Celebrities Whose Careers Ended Abruptly

May 24, 2025 -

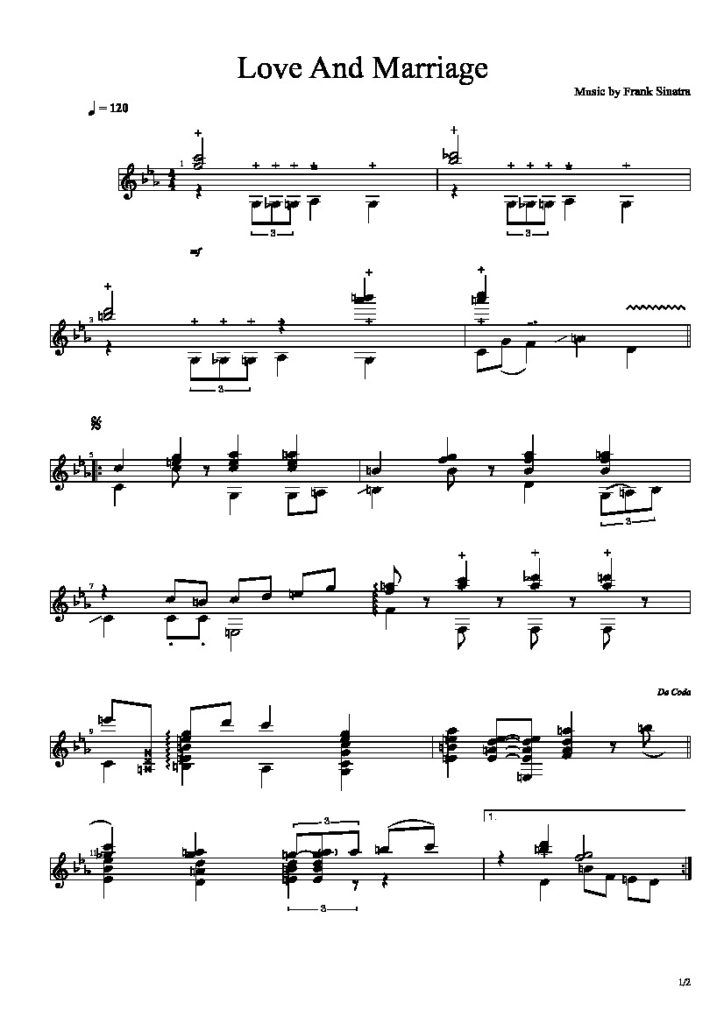

Understanding Frank Sinatras Four Marriages

May 24, 2025

Understanding Frank Sinatras Four Marriages

May 24, 2025