7% Plunge: Amsterdam Stock Market Reeling From Trade War Anxiety

Table of Contents

Impact of Trade War Uncertainty on Dutch Businesses

The uncertainty surrounding escalating trade wars has dealt a heavy blow to Dutch businesses, particularly those heavily reliant on exports. The ripple effects are far-reaching, impacting investor sentiment and capital flows.

Export-Oriented Sectors Hit Hardest

Dutch export-dependent industries, such as agriculture and technology, are bearing the brunt of the trade war's impact. Increased tariffs on Dutch goods have reduced global demand, disrupting supply chains and slashing sales.

- Agriculture: The Dutch agricultural sector, a significant contributor to the national economy, is facing reduced demand for its products due to increased import tariffs in key markets. This is clearly reflected in the falling stock prices of major agricultural companies like [insert example company name and stock performance data].

- Technology: The technology sector is experiencing supply chain disruptions due to trade restrictions and retaliatory tariffs. This has led to reduced sales in affected markets, negatively impacting the profitability of several prominent Dutch tech companies. [Insert example company name and stock performance data].

- Other Affected Sectors: The impact extends beyond agriculture and technology to other export-oriented sectors, including manufacturing, chemicals and logistics, all facing reduced demand and increased costs.

Investor Sentiment and Capital Flight

The uncertainty created by the trade war has fueled significant investor anxiety, leading to substantial capital flight from the Amsterdam stock market. Foreign investment has decreased dramatically, exacerbating the downturn.

- Decreased Investment: The uncertain economic climate has prompted a sharp reduction in investment in new projects, hindering economic growth.

- Stock Sell-offs: Fear and uncertainty have driven widespread stock sell-offs, further depressing market valuations.

- Currency Market Volatility: The EUR has also experienced increased volatility, adding another layer of complexity for businesses and investors navigating this turbulent period.

Government Response and Economic Outlook

The Dutch government has responded to the market downturn with a range of measures aimed at mitigating the impact on the economy. However, the short-term and long-term economic projections remain uncertain.

Government Measures to Mitigate the Impact

The government has announced a package of measures, including [mention specific government measures, e.g., tax breaks, subsidies for affected industries]. The effectiveness of these measures in stemming the decline remains to be seen.

- Effectiveness Assessment: [Discuss the predicted/observed effectiveness of these measures, citing sources if possible. Analyze whether these measures sufficiently address the core issues or merely offer temporary relief.]

Short-Term and Long-Term Economic Projections

Experts offer varying opinions on the economic outlook. Some predict a short-term recession, while others are more optimistic, anticipating a recovery in the next quarter. The risk of a prolonged economic slowdown remains a significant concern.

- GDP Growth Forecasts: [Cite forecasts from reputable economic institutions and analysts regarding GDP growth rates for the coming quarters and years].

- Recession Risk Assessment: [Discuss the likelihood of a recession based on current economic indicators and expert opinions.]

Global Market Reactions and Interdependence

The Amsterdam stock market's plunge is not an isolated incident. The ripple effects are being felt across global markets, highlighting the interconnected nature of the modern financial system.

Ripple Effect on Global Markets

The downturn in Amsterdam has triggered concerns about broader market contagion, impacting European Union markets and other global stock markets. The interconnectedness of the Amsterdam stock market with global financial systems is clearly evident.

- Affected Markets: [Mention specific examples of other affected markets and their respective reactions].

- Market Contagion Risk: [Discuss the risk of market contagion and potential further spread of negative sentiment].

Future Implications of Trade Tensions

The ongoing trade disputes pose significant challenges for the global economy. The long-term implications are uncertain, but the potential for further market instability remains high.

- Trade Negotiations: The outcome of ongoing trade negotiations will play a pivotal role in shaping the future of global markets.

- Protectionism vs. Globalization: The debate between protectionism and globalization will continue to influence trade policies and their impact on global stock markets.

Conclusion: Amsterdam Stock Market's Future Amidst Trade War Anxiety

The 7% plunge in the Amsterdam stock market underscores the significant impact of trade war anxiety on global markets. The vulnerability of export-oriented sectors and the resulting investor uncertainty have created a volatile environment. While the Dutch government has implemented measures to mitigate the impact, the short-term and long-term economic outlook remains uncertain.

Stay informed about the evolving situation in the Amsterdam stock market and the impact of ongoing trade war anxiety. Monitor global trade developments for further updates on market volatility and economic forecasts. Consider diversifying your investments to mitigate risk aversion.

Featured Posts

-

Apple Stock Price Prediction One Analyst Targets 254 Is It A Buy Now

May 24, 2025

Apple Stock Price Prediction One Analyst Targets 254 Is It A Buy Now

May 24, 2025 -

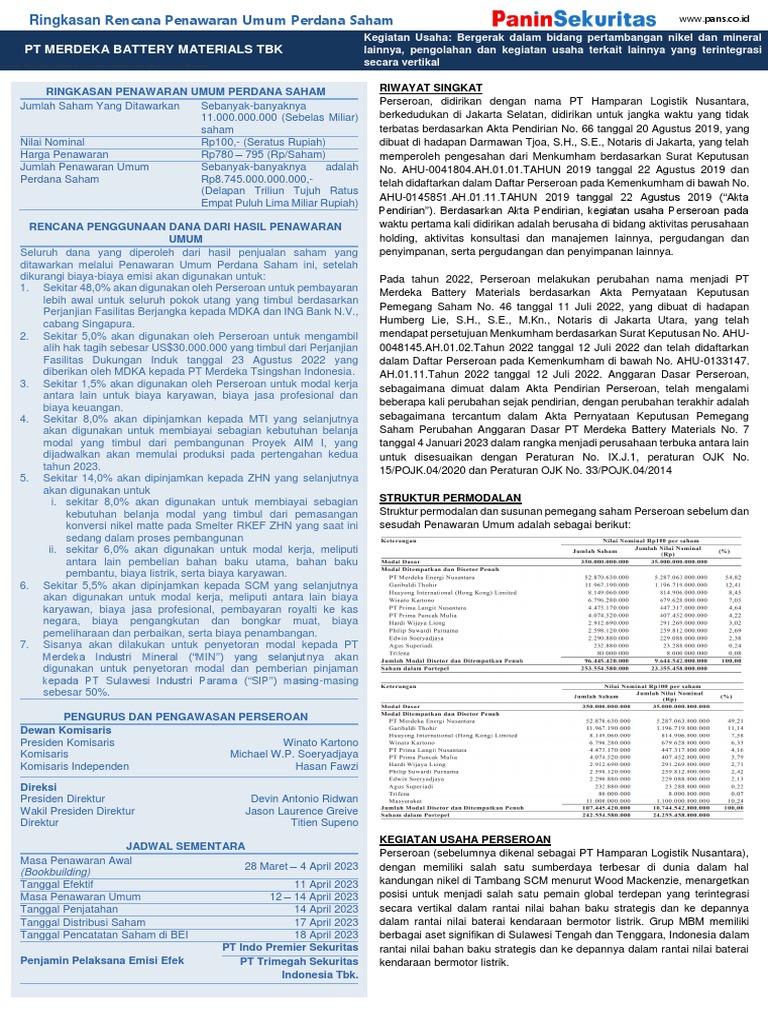

Dayamitra Telekomunikasi Mtel Dan Merdeka Battery Mbma Prospek Investasi Usai Pencatatan Msci

May 24, 2025

Dayamitra Telekomunikasi Mtel Dan Merdeka Battery Mbma Prospek Investasi Usai Pencatatan Msci

May 24, 2025 -

Bangladesh Business Event In Netherlands Expects 1 500 Attendees

May 24, 2025

Bangladesh Business Event In Netherlands Expects 1 500 Attendees

May 24, 2025 -

Eurovision Village 2025 Conchita Wurst And Jjs Joint Performance

May 24, 2025

Eurovision Village 2025 Conchita Wurst And Jjs Joint Performance

May 24, 2025 -

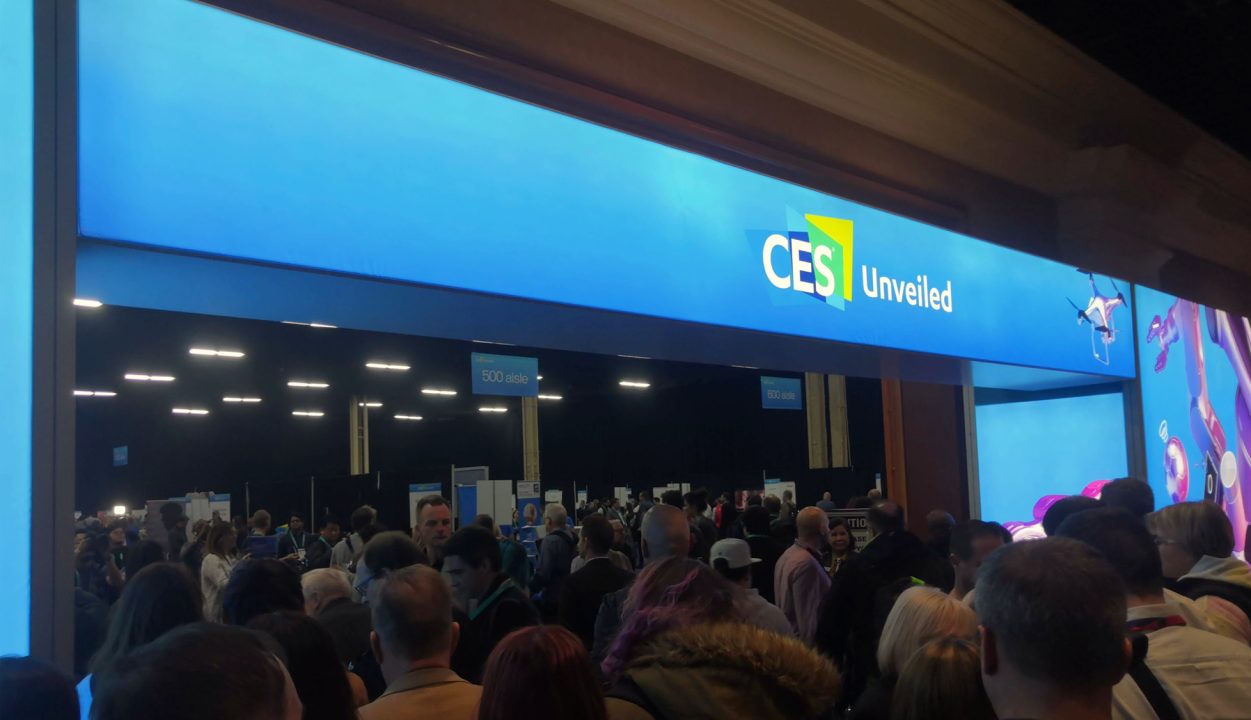

Decouvrez Les Innovations Du Ces Unveiled Europe A Amsterdam

May 24, 2025

Decouvrez Les Innovations Du Ces Unveiled Europe A Amsterdam

May 24, 2025

Latest Posts

-

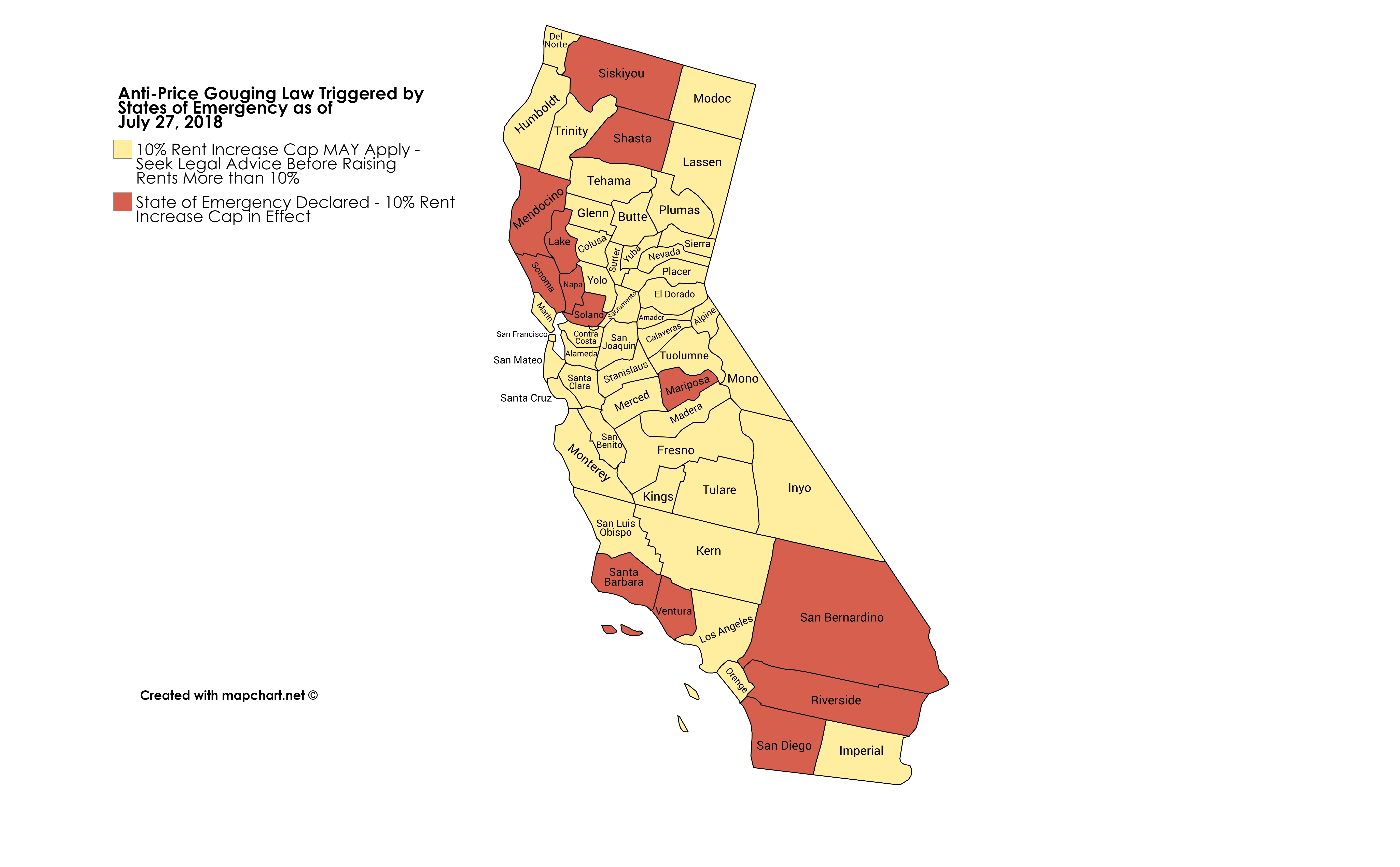

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025 -

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025 -

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025 -

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025 -

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025