7-Year Prison Term For GPB Capital's David Gentile In Ponzi Case

Table of Contents

Keywords: GPB Capital, David Gentile, Ponzi scheme, prison sentence, fraud, investment fraud, SEC, financial crime, white-collar crime, 7-year sentence, due diligence, investor education

The financial world witnessed a significant development with the sentencing of David Gentile, founder of GPB Capital, to a seven-year prison term for his involvement in a massive Ponzi scheme. This case serves as a stark reminder of the devastating consequences of investment fraud and highlights the crucial role of investor education and due diligence. This article delves into the details of the GPB Capital Ponzi scheme, Gentile's role, the impact on investors, and the lessons learned.

The GPB Capital Ponzi Scheme: A Detailed Overview

GPB Capital Holdings, once a prominent private equity firm, operated under a deceptive business model that ultimately defrauded numerous investors. The company purported to invest in various sectors, including automotive dealerships and waste management businesses. However, its operations masked a classic Ponzi scheme.

Fraudulent Activities:

- Misrepresentation of assets and returns to investors: GPB Capital significantly overstated the value of its assets and promised unrealistically high returns to attract investors.

- Use of new investor funds to pay off existing investors: A hallmark of Ponzi schemes, GPB Capital used funds from new investors to pay out returns to earlier investors, creating the illusion of profitability.

- Lack of transparency and proper financial reporting: The company consistently failed to provide accurate and timely financial reports to investors, hindering their ability to assess the true state of their investments.

- Inflated valuations of assets: Independent appraisals revealed that the value of GPB Capital's assets was significantly lower than what was reported to investors.

The total amount of investor losses in the GPB Capital Ponzi scheme is estimated to be in the hundreds of millions of dollars, leaving countless investors financially devastated. Several other key figures within GPB Capital also faced charges and investigations related to the fraud.

David Gentile's Role and Conviction

David Gentile, as the founder and central figure of GPB Capital, played a crucial role in orchestrating the fraudulent activities. He was directly involved in the misrepresentation of assets, the diversion of investor funds, and the overall concealment of the scheme's true nature.

The charges against Gentile included securities fraud, wire fraud, and conspiracy to commit securities fraud. Evidence presented during the trial included internal documents, witness testimonies, and financial records that unequivocally demonstrated his participation in the scheme.

Gentile's sentencing included a seven-year prison term, significant financial fines, and an order for restitution to the defrauded investors. While his legal team attempted to mitigate the sentence, the court found his actions to be egregious and deserving of substantial punishment.

Impact on Investors and the Financial Industry

The GPB Capital Ponzi scheme had a devastating impact on numerous investors who suffered significant financial losses. Many lost their life savings, retirement funds, and other critical investments. The emotional toll on these victims is immeasurable.

This case also highlighted systemic vulnerabilities within the financial industry, raising concerns about regulatory oversight and the need for enhanced investor protections. The scandal led to increased scrutiny of private equity firms and prompted calls for stricter regulations to prevent similar schemes in the future. Several class-action lawsuits were filed by affected investors seeking compensation for their losses.

The importance of thorough due diligence before investing cannot be overstated. Investors must carefully research investment opportunities, verify the legitimacy of firms and their claims, and seek professional advice when necessary.

SEC Investigation and Prosecution

The Securities and Exchange Commission (SEC) played a pivotal role in uncovering the GPB Capital Ponzi scheme and bringing Gentile to justice. The SEC's investigation involved extensive scrutiny of GPB Capital's financial records, interviews with witnesses, and analysis of the company's investment strategies.

Their findings revealed a pattern of fraudulent activities and provided the basis for the criminal charges filed against Gentile and other individuals involved. The SEC’s successful prosecution underscores the agency’s commitment to protecting investors from fraudulent schemes and holding perpetrators accountable. Ongoing investigations related to GPB Capital and its associated entities continue to this day.

Lessons Learned and Prevention

The GPB Capital case serves as a cautionary tale, underscoring the importance of investor education and due diligence. Investors should be aware of the red flags associated with Ponzi schemes, such as:

- Unusually high returns with little or no risk.

- Difficulty in obtaining independent verification of investment performance.

- Pressure to invest quickly.

- Lack of transparency in investment operations.

Regulatory oversight and enforcement are crucial in preventing and combating investment fraud. Investors should also utilize resources provided by regulatory bodies like the SEC to learn about investment fraud prevention strategies.

To protect your investments, conduct thorough due diligence, diversify your portfolio, and be wary of promises that sound too good to be true. Seek professional financial advice before making any significant investment decisions.

Conclusion

The seven-year prison sentence handed down to David Gentile for his role in the GPB Capital Ponzi scheme sends a clear message: investment fraud will not be tolerated. This case highlights the devastating consequences of such crimes and the importance of investor protection. The lessons learned from this case should serve as a wake-up call for investors to prioritize due diligence and exercise caution when considering investment opportunities. Learning about how to avoid investment fraud and actively protecting your investments should be a top priority. Research thoroughly and learn more about identifying potential Ponzi schemes to protect yourself from becoming a victim of investment fraud like the GPB Capital Ponzi Scheme. Consult with financial advisors and utilize available resources to safeguard your financial future.

Featured Posts

-

U S Federal Reserve Maintains Rates Inflation And Unemployment Outlook

May 10, 2025

U S Federal Reserve Maintains Rates Inflation And Unemployment Outlook

May 10, 2025 -

Elon Musks Brother Kimbal His Views On Tariffs And More

May 10, 2025

Elon Musks Brother Kimbal His Views On Tariffs And More

May 10, 2025 -

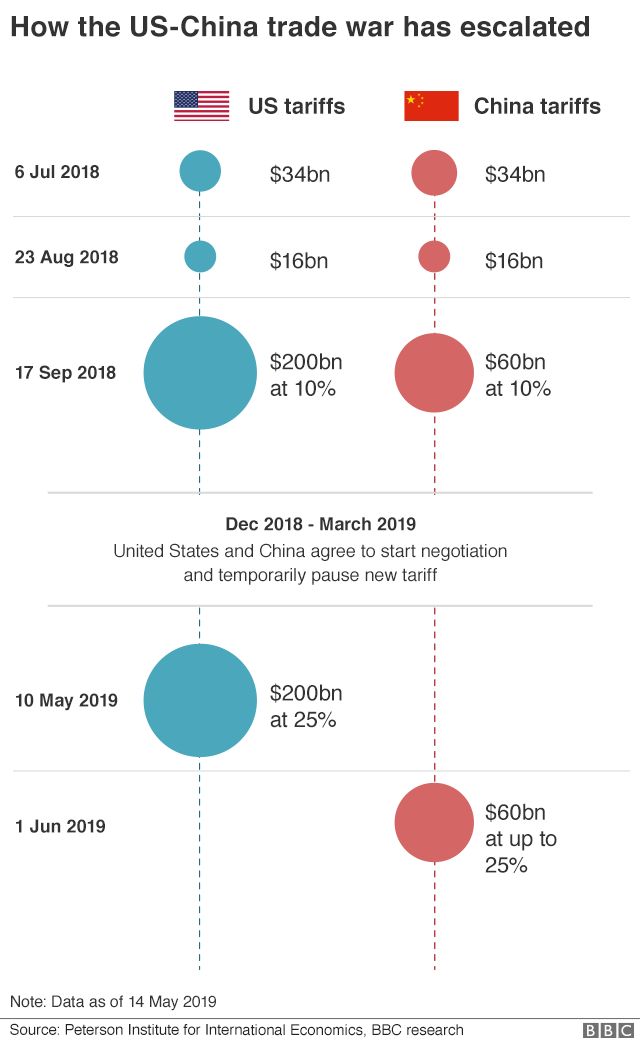

Bubble Blasters And The Ripple Effect Of Us China Trade Tensions

May 10, 2025

Bubble Blasters And The Ripple Effect Of Us China Trade Tensions

May 10, 2025 -

Following Trump Order Ihsaa Bans Transgender Girls From Sports

May 10, 2025

Following Trump Order Ihsaa Bans Transgender Girls From Sports

May 10, 2025 -

Clash On Canada Trade Tarlov Vs Pirro

May 10, 2025

Clash On Canada Trade Tarlov Vs Pirro

May 10, 2025