A Call For Fiscal Responsibility: Rebuilding Canada's Economic Future Under Liberal Leadership

Table of Contents

The Current State of Canada's Finances

Analyzing the National Debt and Deficit

Canada's national debt continues to climb, impacting our ability to invest in crucial areas and hindering future economic growth. The budget deficit, the difference between government spending and revenue, remains a significant challenge.

- Current Debt Levels: According to the latest data from the Department of Finance Canada (insert citation here), the national debt stands at [insert current debt figure], representing [percentage] of GDP. This figure continues to rise, impacting our credit rating and increasing the burden of future interest payments. The impact of this high debt level on future economic growth cannot be understated.

- Deficit Projections: The government's own projections forecast a deficit of [insert projected deficit figure] for the upcoming fiscal year (insert citation here). This points to a continued need for fiscal prudence and strategic spending.

- Impact on Future Growth: High levels of national debt and consistent deficits restrict the government's ability to invest in essential infrastructure projects, education, and healthcare – all of which are crucial drivers of long-term economic growth. This unsustainable trajectory threatens to stifle innovation and economic opportunities for Canadians.

These figures have real implications for Canadian families. Higher debt levels may lead to increased taxes in the future, reduced government services, or both. Understanding the scope of this challenge is crucial for informed public discourse and effective policymaking.

Reviewing Government Spending Priorities

Government spending must be carefully reviewed and prioritized to achieve fiscal responsibility. Analyzing the allocation of funds across different sectors reveals opportunities for optimization.

- Healthcare: While healthcare is a priority, improving efficiency and reducing waste within the system is crucial. This could involve exploring innovative delivery models, improving data management, and tackling issues such as prescription drug costs.

- Education: Investment in education is paramount, but focusing on improving outcomes through targeted programs and investing in early childhood education may yield greater returns.

- Infrastructure: Infrastructure spending is vital for economic growth, but careful planning and prioritization are crucial to maximize its impact and ensure value for money.

By streamlining processes, eliminating redundancies, and focusing on high-impact investments, the government can achieve significant cost savings and improve the efficiency of public services, contributing significantly to fiscal responsibility.

Strategies for Achieving Fiscal Responsibility

Implementing Tax Reforms for Sustainable Growth

Targeted tax reforms can generate additional revenue and support sustainable growth without placing an undue burden on taxpayers.

- Closing Tax Loopholes: Identifying and closing tax loopholes exploited by corporations and high-income earners can generate significant revenue.

- Adjusting Tax Brackets: A careful review of tax brackets may be necessary to ensure fairness and equity in the tax system. However, any changes must be carefully considered to avoid discouraging investment and entrepreneurship.

These reforms must be designed to be both equitable and effective in generating sustainable revenue streams, enhancing the government's ability to address its fiscal challenges.

Investing in Infrastructure for Long-Term Prosperity

Strategic infrastructure investments stimulate economic growth and job creation.

- Transportation: Investing in efficient and sustainable transportation networks, including public transit and freight corridors, improves connectivity and facilitates trade.

- Renewable Energy: Investing in renewable energy infrastructure reduces our reliance on fossil fuels, creates jobs in the green economy, and addresses climate change.

These investments must be guided by rigorous cost-benefit analyses to maximize their return and ensure responsible allocation of public funds.

Promoting Economic Diversification and Innovation

Investing in emerging industries builds a more resilient and prosperous economy.

- Technology: Supporting the growth of the technology sector through research and development grants, tax incentives, and skills development programs fosters innovation and creates high-paying jobs.

- Clean Energy: Investing in clean energy technologies not only addresses climate change but also creates opportunities in a rapidly growing global market.

These investments bolster economic diversification and strengthen Canada's long-term competitiveness on the global stage.

The Role of the Liberal Party in Achieving Fiscal Responsibility

Evaluating the Liberal Party's Past Fiscal Policies

The Liberal Party's past economic policies have had both successes and failures, impacting the current fiscal situation. A thorough review is necessary.

- [Insert analysis of specific Liberal government policies and their impact on the national debt and deficit, citing credible sources.]

- [Discuss any instances of fiscal mismanagement and the lessons learned.]

This critical analysis is vital for shaping future policy decisions and building a more responsible fiscal framework.

Proposing Recommendations for Future Action

To achieve fiscal responsibility and improve Canada's long-term economic outlook, the Liberal government should take the following steps:

- Implement transparent and accountable budgeting practices.

- Regularly publish detailed reports on government spending and debt levels.

- Engage in open consultations with experts and stakeholders to develop comprehensive fiscal strategies.

- Focus on long-term fiscal sustainability, rather than short-term gains.

These actions are crucial for restoring public trust and ensuring responsible management of public funds.

A Renewed Call for Fiscal Responsibility

This article has highlighted the urgent need for fiscal responsibility in rebuilding Canada's economic future. The current state of our national debt and deficit demands immediate attention. The Liberal government must prioritize strategic spending, implement effective tax reforms, and invest in infrastructure and innovation to secure a prosperous future for all Canadians. We must move beyond rhetoric and demand concrete actions. Contact your elected officials, engage in public discussions, and advocate for responsible fiscal management. Let's work together to achieve fiscal sustainability and build a stronger, more secure economic future for Canada. The time for action regarding fiscal responsibility for Canada's future is now.

Featured Posts

-

Hopes Devastating News Liams Pledge To Steffy And Lunas Bold Move On The Bold And The Beautiful

Apr 24, 2025

Hopes Devastating News Liams Pledge To Steffy And Lunas Bold Move On The Bold And The Beautiful

Apr 24, 2025 -

Credit Card Spending Slowdown A New Reality For Issuers

Apr 24, 2025

Credit Card Spending Slowdown A New Reality For Issuers

Apr 24, 2025 -

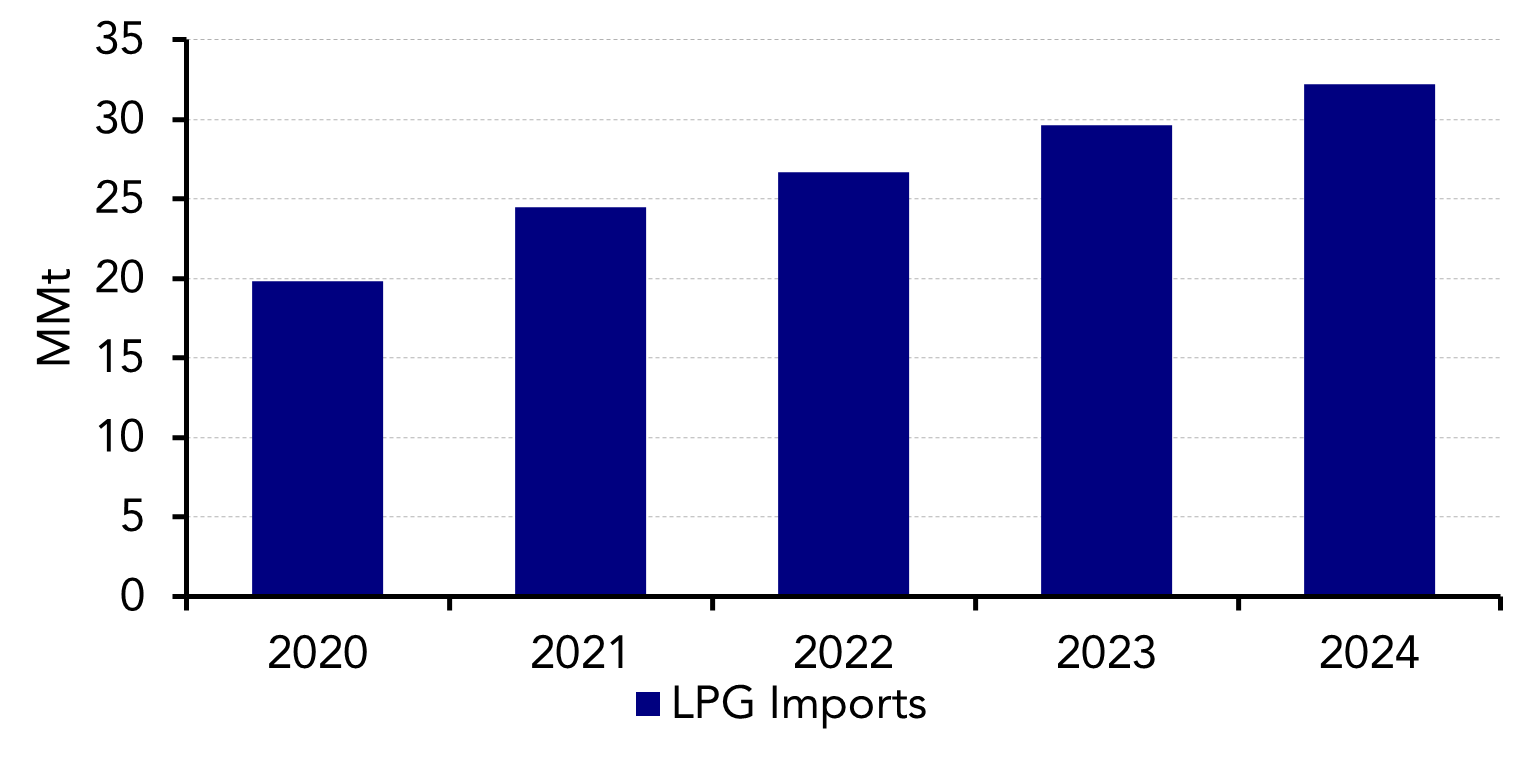

China Diversifies Lpg Imports Middle East Replaces Us Supplies Amid Tariffs

Apr 24, 2025

China Diversifies Lpg Imports Middle East Replaces Us Supplies Amid Tariffs

Apr 24, 2025 -

Jan 6 Hearing Witness Cassidy Hutchinson To Publish Memoir This Fall

Apr 24, 2025

Jan 6 Hearing Witness Cassidy Hutchinson To Publish Memoir This Fall

Apr 24, 2025 -

The Bold And The Beautiful Liams Collapse A Spoiler Filled Update On His Health

Apr 24, 2025

The Bold And The Beautiful Liams Collapse A Spoiler Filled Update On His Health

Apr 24, 2025