China Diversifies LPG Imports: Middle East Replaces US Supplies Amid Tariffs

Table of Contents

The Impact of US-China Trade Tensions on LPG Imports

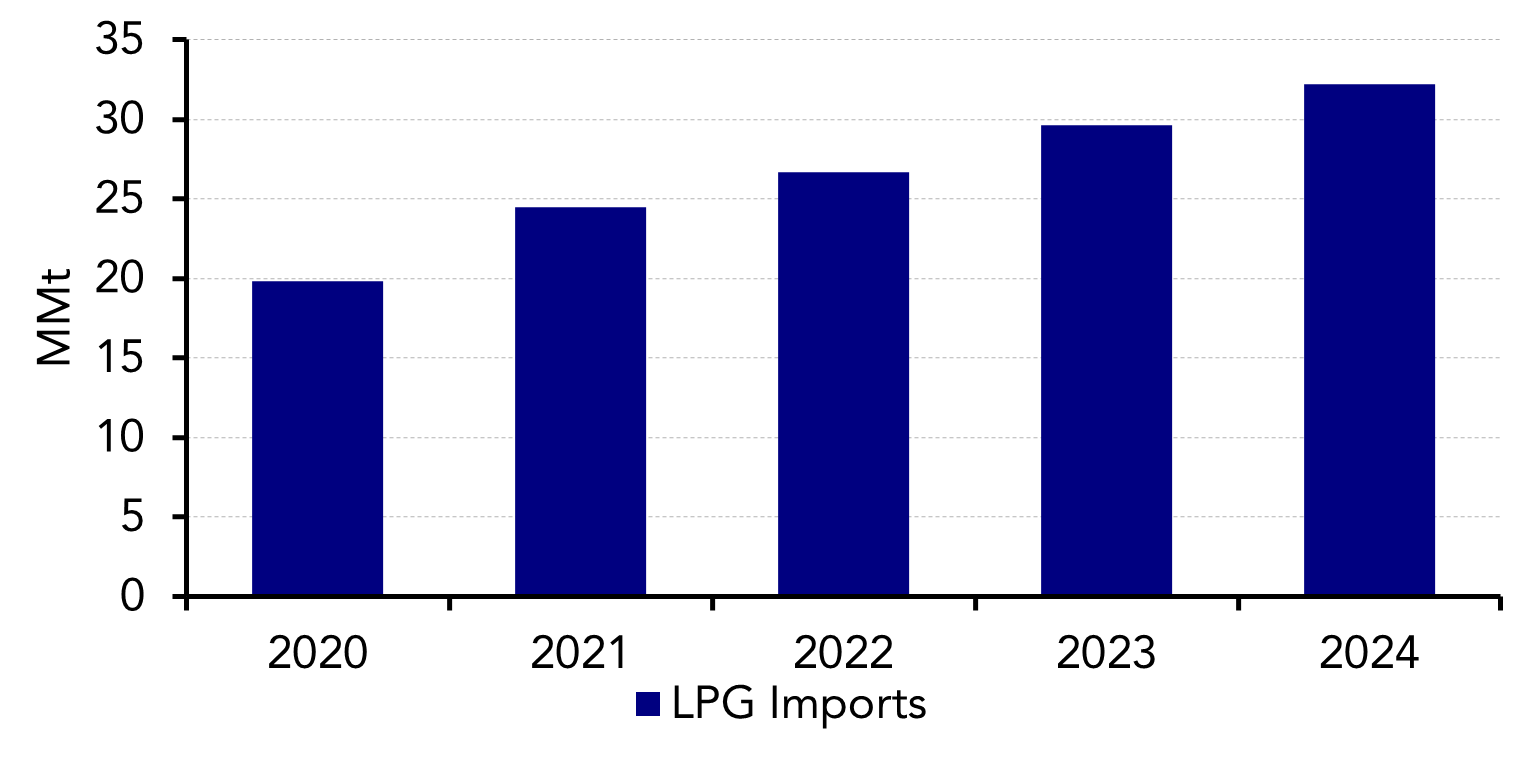

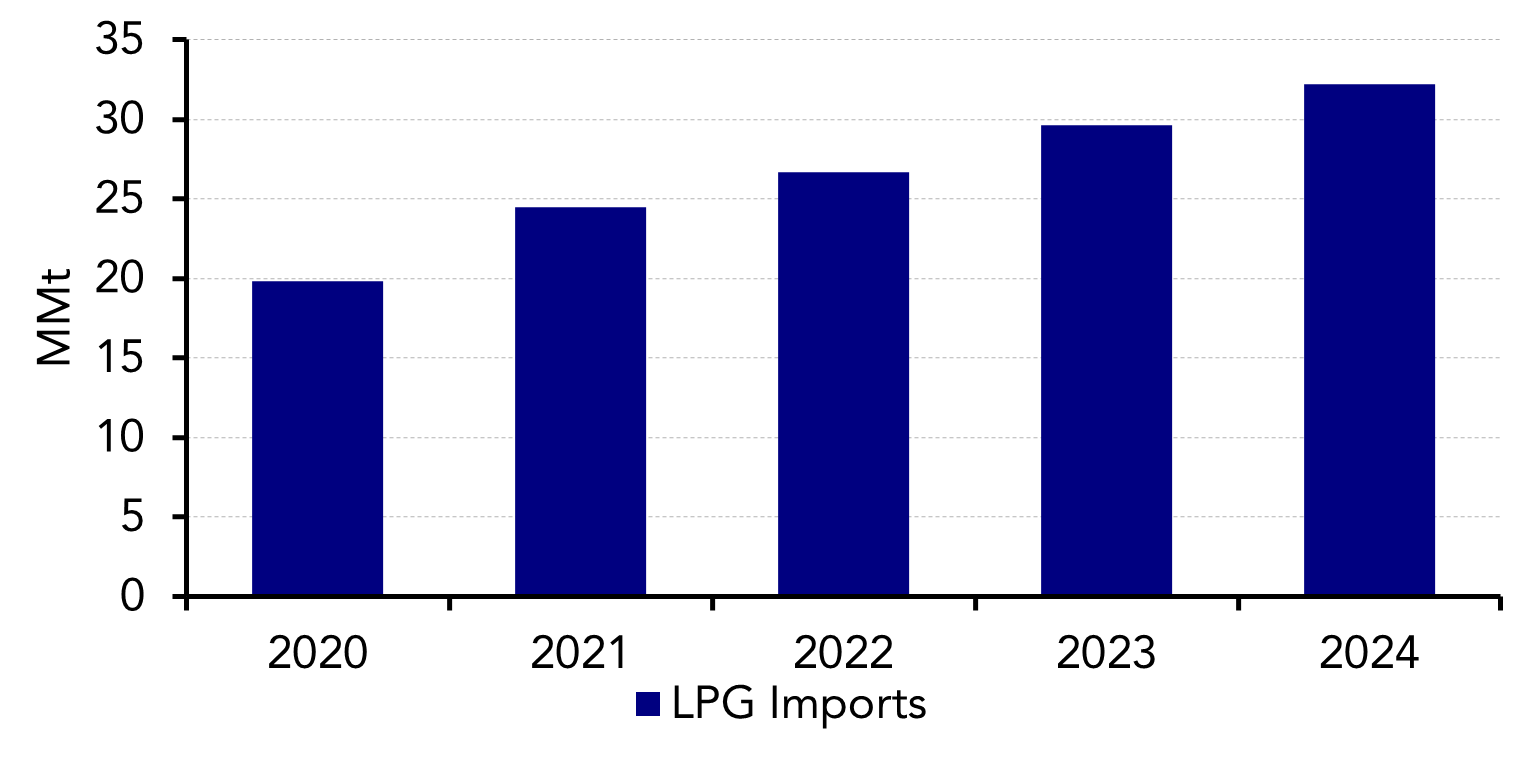

The US-China trade war significantly impacted China's LPG import strategy. Rising tariffs and retaliatory measures created instability and spurred a search for alternative suppliers.

Rising Tariffs and Their Effect

The imposition of tariffs on Chinese goods by the US, and subsequent retaliatory tariffs by China, directly affected LPG import costs.

- 2018: Tariffs of 25% were levied on various Chinese imports, impacting the price competitiveness of US LPG in the Chinese market.

- 2019: Further tariff increases led to a sharp decline in US LPG imports to China, with volumes falling by an estimated X% (insert actual statistic if available). This directly affected the cost of LPG for Chinese consumers and industries.

- Overall Impact: The escalating trade war made relying on a single major supplier, such as the US, increasingly risky for China's energy security. This instability accelerated the need for China LPG imports diversification.

Search for Alternative Suppliers

The trade war forced China to actively seek reliable alternative LPG suppliers. This presented several challenges:

- Logistical hurdles: Establishing new supply chains involves overcoming logistical complexities, including transportation costs, port infrastructure, and contract negotiations.

- Price fluctuations: Prices in alternative markets can be volatile, requiring careful risk assessment and diversification strategies.

- Geopolitical considerations: Choosing new suppliers involves navigating complex geopolitical relationships and ensuring consistent supply.

The Rise of the Middle East as a Major LPG Supplier to China

The Middle East has emerged as a crucial alternative, significantly increasing its LPG exports to China. This represents a major shift in the global LPG trade landscape and is a key aspect of China LPG imports diversification.

Increased Imports from Middle Eastern Countries

Several Middle Eastern countries have capitalized on China's need for diversified LPG supplies:

- Saudi Arabia: Has seen a substantial increase in LPG exports to China, with volumes rising by Y% (insert actual statistic if available) since the start of the trade war.

- Qatar: Similarly, Qatar has become a more significant LPG supplier to China, leveraging its substantial gas reserves and existing infrastructure.

- Other Countries: Other countries in the region have also benefited from increased demand from China, including (mention other relevant countries and data).

This increase required significant infrastructure development, including upgraded port facilities and potentially new pipelines, to handle the larger volumes of LPG being imported.

Geopolitical Implications

China's growing reliance on Middle Eastern LPG has significant geopolitical implications:

- Strengthened Energy Partnerships: This shift strengthens energy partnerships between China and Middle Eastern countries, fostering greater economic and political ties.

- Regional Influence: China's increased investment and trade in the region may increase its regional influence and strategic leverage.

- Diversified Energy Portfolio: The diversification of China's energy sources reduces reliance on any single region, enhancing its overall energy security.

Long-Term Strategies for China's LPG Security

China's long-term LPG security strategy involves a multi-pronged approach that includes boosting domestic production and forging strategic partnerships. This is further strengthening China LPG imports diversification.

Domestic LPG Production

China is investing heavily in boosting its domestic LPG production capabilities:

- Refining Capacity Expansion: Increased investment in refining capacity is aimed at producing more LPG domestically.

- Exploration for New Resources: Exploration efforts are underway to identify and develop new LPG resources within the country.

- Technological Advancements: Technological advancements in LPG production and processing are enhancing efficiency and reducing costs.

Strategic Partnerships and Investment

Beyond the Middle East, China is establishing strategic partnerships with other LPG-producing countries:

- Investment in Overseas Projects: China is investing in LPG infrastructure and production projects in various countries to secure access to stable supplies. (Give specific examples of countries and projects).

- Joint Ventures: Joint ventures with international LPG companies are being formed to leverage expertise and resources.

Conclusion

China's strategic diversification of LPG imports demonstrates a proactive approach to energy security. This shift, driven by trade tensions and a desire for stable supply chains, has significant geopolitical and economic consequences for both Asian and global energy markets. The increased reliance on Middle Eastern suppliers necessitates careful monitoring of regional stability and ongoing efforts to enhance domestic LPG production. The ongoing evolution of China LPG imports diversification is a critical factor in global energy dynamics.

Call to Action: Stay informed on the evolving landscape of China LPG imports diversification. Follow our blog for regular updates and analysis on global energy market trends and their impact on energy security in Asia and beyond.

Featured Posts

-

The Bold And The Beautiful February 20th Spoilers Steffy Liam And Finn

Apr 24, 2025

The Bold And The Beautiful February 20th Spoilers Steffy Liam And Finn

Apr 24, 2025 -

Rep Nancy Mace And Constituent Clash Tensions Rise In South Carolina

Apr 24, 2025

Rep Nancy Mace And Constituent Clash Tensions Rise In South Carolina

Apr 24, 2025 -

Nba All Star 3 Point Contest Winner Tyler Herro Skills Challenge Winners Cavaliers

Apr 24, 2025

Nba All Star 3 Point Contest Winner Tyler Herro Skills Challenge Winners Cavaliers

Apr 24, 2025 -

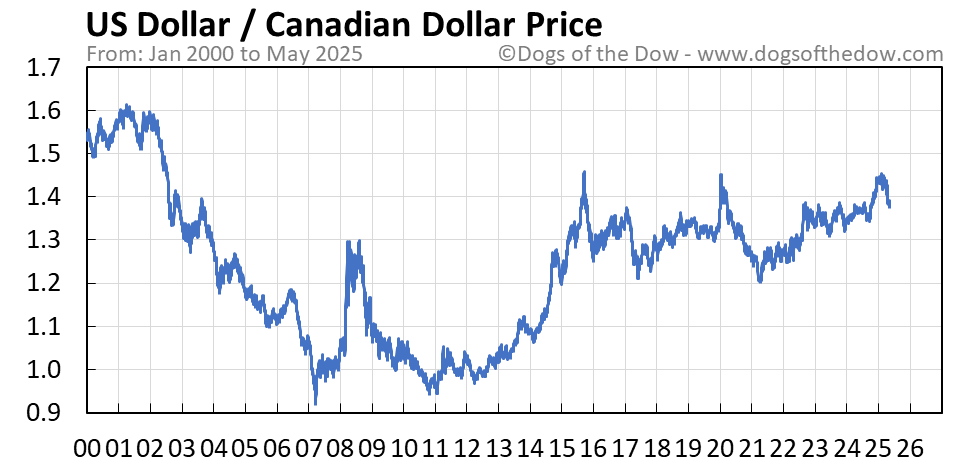

Recent Shifts In The Canadian Dollar Exchange Rate An In Depth Look

Apr 24, 2025

Recent Shifts In The Canadian Dollar Exchange Rate An In Depth Look

Apr 24, 2025 -

The Dark Side Of Disaster Betting On The Los Angeles Wildfires

Apr 24, 2025

The Dark Side Of Disaster Betting On The Los Angeles Wildfires

Apr 24, 2025