A Place In The Sun: Navigating The International Property Market

Table of Contents

Researching Your Ideal International Property Location

Before you start browsing listings, thorough research is key to a successful international property investment. This involves understanding your lifestyle needs and analyzing market trends.

Understanding Your Lifestyle Needs

Your ideal location should align with your lifestyle preferences. Consider factors like:

- Climate: Do you prefer warm, sunny weather or a four-season climate?

- Culture: Are you seeking an immersive cultural experience or a more familiar environment?

- Amenities: What level of access to healthcare, transportation, schools, and other amenities is important to you?

- Proximity to loved ones: How important is it to be close to family and friends?

- Visa requirements and residency options: Research the legal requirements for long-term stays in your chosen country.

Choosing between different lifestyles is a crucial part of finding the right international property. For example:

- Coastal living vs. city living: Coastal properties often command higher prices but offer stunning views and a relaxed atmosphere. City living provides easy access to amenities and a vibrant social scene.

- Rural tranquility vs. bustling metropolis: A rural property offers peace and quiet, while a city property offers convenience and excitement.

- English-speaking regions vs. immersive cultural experiences: While English-speaking regions offer ease of communication, an immersive cultural experience can be incredibly rewarding.

Analyzing Market Trends and Investment Potential

Once you've defined your lifestyle needs, analyze the market:

- Property prices, rental yields, and capital appreciation potential: Research historical data and future projections for your chosen locations.

- Economic stability and long-term growth prospects: Look at the overall economic health and stability of the region. A robust economy usually translates into stronger property values.

- Consult with real estate professionals: Experienced agents specializing in the international property market can provide invaluable insights and guidance.

Consider these key investment factors:

- High-growth markets: These offer potentially higher returns but also carry higher risk.

- Stable investment opportunities: These may offer slower but steadier returns, minimizing risk.

- Potential for capital appreciation: Will the property increase in value over time?

- Rental income potential: Can you generate income from renting out your property?

Securing Financing for Your International Property Purchase

Securing financing for an international property purchase can be more complex than domestic transactions.

Exploring Mortgage Options

International mortgages are available, but the process differs from domestic loans:

- International mortgage providers: Research lenders offering mortgages for foreign properties and compare their rates and terms.

- Mortgage requirements: Understand the requirements, including credit score, down payment, and proof of income. These requirements can vary significantly between countries and lenders.

- Currency exchange rates: Fluctuations in currency exchange rates can impact your mortgage repayments. Factor these potential changes into your calculations.

Key considerations for international mortgages include:

- International mortgage brokers: These specialists can help you navigate the complexities of securing a foreign mortgage.

- Currency exchange risks: Hedge against currency fluctuations to mitigate potential losses.

- Mortgage pre-approval: Getting pre-approved can strengthen your offer when making an international property purchase.

- Down payment requirements: Down payments for international properties are often higher than for domestic purchases.

Alternative Financing Strategies

Mortgages aren't your only option:

- Cash purchases: A cash purchase simplifies the process and avoids interest payments but requires significant upfront capital.

- Private financing: This might be an option, but carefully assess the risks involved.

- Joint ventures: Partnering with others can reduce individual financial burdens.

Consider these points when exploring alternative financing:

- Cash purchase advantages: Avoids interest payments and simplifies the process, making you a more attractive buyer.

- Risks of private financing: Thoroughly investigate the lender and the terms of the loan agreement.

- Benefits of joint ventures: Reduces individual financial risk and can provide access to expertise.

Navigating the Legal and Regulatory Landscape of the International Property Market

The legal and regulatory aspects of international property transactions are crucial.

Understanding Local Laws and Regulations

Before you buy, understand the local laws:

- Property ownership laws: Research the specific laws governing property ownership in your target country.

- Taxation: Understand the tax implications of owning and selling property internationally.

- Restrictions on foreign buyers: Some countries impose restrictions on the amount or type of property foreign buyers can purchase.

- Engage a local lawyer: An experienced lawyer specializing in international real estate transactions is essential.

- Thorough contract review: Don't sign anything until you completely understand the terms and conditions.

Key legal and regulatory aspects include:

- Property taxes: These can vary significantly between countries and regions.

- Legal fees: Factor in legal fees associated with the purchase process.

- Closing costs: Be prepared for additional costs associated with completing the transaction.

- Due diligence: This is critical to avoid potential problems later.

Due Diligence and Property Inspection

Protect your investment with thorough due diligence:

- Property inspection: Conduct a thorough inspection to identify any potential problems.

- Professional valuation: Obtain an independent valuation of the property to ensure you're paying a fair price.

- Verify ownership and title documents: Make sure the seller has the legal right to sell the property.

Important due diligence steps include:

- Property survey: Confirm the property boundaries and size.

- Building inspection: Identify any structural or other issues.

- Title search: Verify that the seller has clear title to the property.

- Valuation report: Obtain a professional appraisal to ensure the property's value aligns with the purchase price.

Conclusion

Investing in the international property market can be a rewarding experience, offering opportunities for capital appreciation, rental income, and a fulfilling lifestyle change. However, success requires meticulous planning, thorough research, and professional guidance. By carefully considering your lifestyle needs, analyzing market trends, securing appropriate financing, and navigating the legal landscape, you can significantly increase your chances of finding your perfect "place in the sun." Remember to consult with experienced professionals specializing in the international property market throughout the entire process. Don't delay your dream—start exploring the international property market today!

Featured Posts

-

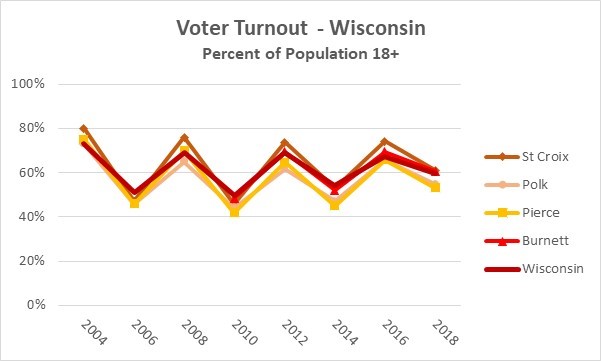

Voter Turnout In Florida And Wisconsin Implications For The Future Of Politics

May 03, 2025

Voter Turnout In Florida And Wisconsin Implications For The Future Of Politics

May 03, 2025 -

Inside Nigel Farages Press Conference My Experience

May 03, 2025

Inside Nigel Farages Press Conference My Experience

May 03, 2025 -

Land Your Dream Private Credit Job 5 Key Dos And Don Ts

May 03, 2025

Land Your Dream Private Credit Job 5 Key Dos And Don Ts

May 03, 2025 -

Rio Tinto Activist Campaign Against Dual Listing Fails

May 03, 2025

Rio Tinto Activist Campaign Against Dual Listing Fails

May 03, 2025 -

Fin De La Francafrique Declaration De Macron Depuis Le Gabon

May 03, 2025

Fin De La Francafrique Declaration De Macron Depuis Le Gabon

May 03, 2025

Latest Posts

-

Warren Buffett Denies Trump Tariff Rumours All Reports False

May 04, 2025

Warren Buffett Denies Trump Tariff Rumours All Reports False

May 04, 2025 -

1 4

May 04, 2025

1 4

May 04, 2025 -

Fleetwood Mac And The Evolution Of The Supergroup Phenomenon

May 04, 2025

Fleetwood Mac And The Evolution Of The Supergroup Phenomenon

May 04, 2025 -

Fleetwood Mac Groundbreaking Supergroup Or Popular Myth

May 04, 2025

Fleetwood Mac Groundbreaking Supergroup Or Popular Myth

May 04, 2025 -

The Case For Fleetwood Mac As The Original Supergroup

May 04, 2025

The Case For Fleetwood Mac As The Original Supergroup

May 04, 2025