ABN Amro: Zijn Nederlandse Huizen Betaalbaar? Een GeenStijl Analyse.

Table of Contents

H2: ABN Amro's Data on Housing Prices and Mortgages

H3: Stijgende huizenprijzen

ABN Amro's data consistently reveals a worrying trend: soaring house prices across the Netherlands. The increase isn't uniform; some regions experience more dramatic price hikes than others. Let's examine some key figures:

- Amsterdam: Average price increases of over 15% year-on-year have been reported, far outpacing income growth. This makes homeownership increasingly unattainable for many young professionals.

- Rotterdam & Utrecht: Similar, albeit slightly less dramatic, increases are observed in these major cities, further solidifying the national trend of unaffordable housing.

- Regional Variations: While major cities face the most significant challenges, smaller towns and villages also see escalating prices, albeit at a slower pace. This puts pressure on affordability across the entire country.

[Insert relevant chart/graph from ABN Amro report showing price increases in different regions].

The discrepancy between rising house prices and stagnant or slow income growth is a critical factor driving the affordability crisis. This is further exacerbated by limited housing supply, driving up demand and prices even higher.

H3: Toegankelijkheid hypotheken

ABN Amro's reports also highlight the shrinking accessibility of mortgages. Several factors contribute to this:

- Rising Interest Rates: Increased interest rates significantly increase monthly mortgage payments, making it harder for potential buyers to afford a home.

- Stricter Lending Criteria: Banks are increasingly tightening lending criteria, requiring larger down payments and stricter income verification, effectively excluding many potential homeowners.

- Government Policies: While government policies aim to support first-time buyers, their impact is often insufficient to counter the effects of rising prices and stricter lending.

H2: GeenStijl's Perspective on the Housing Crisis

H3: Kritische analyse ABN Amro rapporten

GeenStijl takes a critical stance on ABN Amro's reports, questioning whether they fully capture the severity of the situation. We see several potential areas of concern:

- Methodology: The methodology used by ABN Amro might not fully account for the impact of factors like hidden costs associated with purchasing a home or the psychological effects of the competitive market.

- Downplaying Severity: There's a suspicion that some reports might downplay the severity of the crisis, potentially due to ABN Amro's position within the financial system.

- Comparison to Previous Years: Comparing current data with previous years' reports reveals a stark and accelerating trend that needs more aggressive action.

H3: Alternatieve perspectieven

Beyond ABN Amro's data, other sources paint a similarly bleak picture. Real estate experts warn of a looming housing bubble, while government officials struggle to implement effective solutions. Several media outlets have published articles highlighting the struggles of young people trying to enter the housing market. These alternative viewpoints further emphasize the gravity of the situation.

H2: Vergelijking met andere Europese landen

Comparing the Netherlands to other European countries reveals that the affordability crisis is particularly acute. Countries like Germany or Spain, for example, offer more affordable housing options, often due to factors such as different housing policies and construction practices. Analyzing these differences provides valuable context and potential solutions.

H2: Mogelijke oplossingen

Addressing the affordability crisis requires a multi-pronged approach:

- Increased Housing Construction: A significant increase in new housing construction is crucial to alleviate the shortage.

- Government Subsidies: Targeted government subsidies for first-time buyers could help bridge the affordability gap.

- Mortgage Regulation Changes: Relaxing some of the stricter lending criteria, while maintaining responsible lending practices, could make mortgages more accessible.

- Tax Reforms: Reviewing property taxes and potentially introducing new taxes on investment properties could help curb speculative buying and stabilize the market.

3. Conclusion

ABN Amro's data, while informative, only partially captures the devastating impact of the rapidly escalating prices on betaalbare Nederlandse huizen. GeenStijl's analysis reveals a crisis of significant proportions, requiring immediate and decisive action. The combination of rising house prices, restricted mortgage access, and limited housing supply creates an unsustainable situation. The comparison with other European countries underscores the urgency for innovative solutions. Are these proposed solutions enough? Is ABN Amro painting a complete picture of the Dutch housing crisis? Share your thoughts and experiences on the affordability of Nederlandse huizen in the comments below! Let's discuss solutions to this critical issue.

Featured Posts

-

Summer Travel Airlines Anticipate Challenges And Increased Demand

May 22, 2025

Summer Travel Airlines Anticipate Challenges And Increased Demand

May 22, 2025 -

Microsoft Activision Deal Ftcs Appeal And Its Potential Impact

May 22, 2025

Microsoft Activision Deal Ftcs Appeal And Its Potential Impact

May 22, 2025 -

Aex Koersreactie Abn Amro Presteert Boven Verwachting

May 22, 2025

Aex Koersreactie Abn Amro Presteert Boven Verwachting

May 22, 2025 -

Athena Calderone Celebrates A Significant Milestone In Rome

May 22, 2025

Athena Calderone Celebrates A Significant Milestone In Rome

May 22, 2025 -

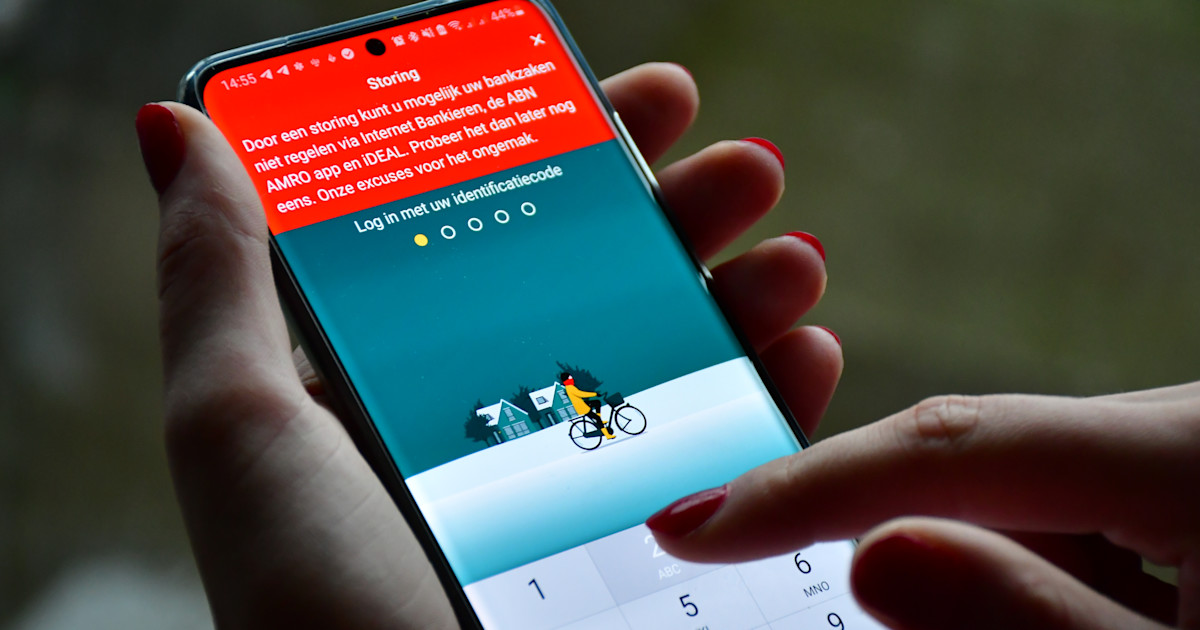

Problemen Met Online Betalingen Voor Abn Amro Opslagruimte

May 22, 2025

Problemen Met Online Betalingen Voor Abn Amro Opslagruimte

May 22, 2025

Latest Posts

-

Wyoming Otter Management A Pivotal Shift In Conservation

May 22, 2025

Wyoming Otter Management A Pivotal Shift In Conservation

May 22, 2025 -

Unexpected Zebra Mussel Discovery On Casper Boat Lift

May 22, 2025

Unexpected Zebra Mussel Discovery On Casper Boat Lift

May 22, 2025 -

Colorado Gray Wolf Dies After Relocation To Wyoming

May 22, 2025

Colorado Gray Wolf Dies After Relocation To Wyoming

May 22, 2025 -

Protecting Wyomings Otters A Pivotal Moment In Conservation

May 22, 2025

Protecting Wyomings Otters A Pivotal Moment In Conservation

May 22, 2025 -

Wyomings Second Reintroduced Colorado Gray Wolf Found Dead

May 22, 2025

Wyomings Second Reintroduced Colorado Gray Wolf Found Dead

May 22, 2025