Alcon Acquires Village Roadshow: $417.5 Million Stalking Horse Bid Approved By Court

Table of Contents

Details of the Alcon-Village Roadshow Acquisition

The Stalking Horse Bid Explained

A stalking horse bid is essentially an initial bid in a bankruptcy sale or a distressed asset sale. It sets a baseline price, encouraging other potential buyers to enter a bidding war, ultimately driving the final price upward. For Alcon, the stalking horse bidder, this strategy offered a foothold in acquiring Village Roadshow's valuable assets.

- Key terms: Stalking horse bidder, credit bid, auction process.

- Benefits for Alcon: Secured a strategic asset at a potentially favorable price, gained a first-mover advantage, and minimized the risk of losing the acquisition to a higher bidder.

- Benefits for Village Roadshow: Provided a guaranteed minimum sale price, initiated a competitive bidding process, and ensured a more efficient and streamlined sale process.

- Risk Mitigation: While there's always a risk that a higher bid could emerge, the stalking horse bid provides a safety net for both parties involved.

The $417.5 Million Price Tag

The $417.5 million price tag represents a significant investment for Alcon. Whether it's a "good" price is subjective and depends on various factors, including Village Roadshow's assets and liabilities, the overall market conditions, and Alcon's projected return on investment (ROI). Comparing this figure to other recent entertainment acquisitions requires a thorough analysis of each deal's specifics.

- Valuation Methodology: The valuation likely considered Village Roadshow's film library, distribution rights, production infrastructure, and potential future earnings.

- Market Analysis: Current market valuations for similar entertainment companies influence the perceived fairness of the price. A decline in the entertainment market might suggest a lower valuation, while a robust market would justify a higher figure.

- Comparison to Similar Deals: Analyzing comparable acquisitions, such as Lionsgate's purchase of Starz or other recent mergers and acquisitions in the entertainment industry, provides context for assessing the price.

- Potential ROI for Alcon: Alcon's potential ROI will depend on its success in leveraging Village Roadshow's assets, managing costs, and realizing synergies between the two companies.

Court Approval and Legal Ramifications

Securing court approval was crucial for finalizing the Alcon-Village Roadshow acquisition. This process involves legal scrutiny and ensuring compliance with all relevant regulations. Any potential legal challenges could have delayed or even jeopardized the deal.

- Court proceedings: The court reviewed the terms of the acquisition, ensuring fairness and protecting the interests of Village Roadshow's creditors.

- Legal representatives: Both Alcon and Village Roadshow employed legal teams to navigate the complex legal framework surrounding the acquisition.

- Regulatory approvals needed: Depending on the jurisdictions involved, various regulatory bodies might have needed to approve the deal. Antitrust regulations, for instance, are crucial considerations in such large mergers.

- Potential future lawsuits: While the court approved the deal, the possibility of future lawsuits related to the acquisition cannot be entirely ruled out.

Implications for Alcon and Village Roadshow

Strategic Benefits for Alcon

Alcon’s acquisition of Village Roadshow is a strategic maneuver, not merely a financial transaction. Village Roadshow’s extensive film library and distribution network offer significant advantages to Alcon.

- Synergies between the two companies: Alcon can leverage Village Roadshow’s distribution channels to expand the reach of its own productions.

- Expansion into new markets: Access to Village Roadshow's international distribution network allows Alcon to tap into new markets and audiences globally.

- Diversification of Alcon's business: The acquisition diversifies Alcon's portfolio, reducing its reliance on a single revenue stream.

- Potential for increased revenue and profitability: By combining their resources and expertise, Alcon and Village Roadshow could achieve increased profitability.

Future of Village Roadshow Under Alcon Ownership

The acquisition likely signifies substantial changes for Village Roadshow. While the specifics remain to be seen, several potential alterations are expected.

- Expected changes in management: Alcon might restructure Village Roadshow's management team to align with its own corporate structure and strategic goals.

- Anticipated restructuring: Restructuring of operations could involve streamlining production processes, consolidating departments, or focusing on specific areas of business.

- Potential impact on employees: While job losses aren't guaranteed, restructuring might lead to some layoffs or personnel changes within Village Roadshow.

- Future film production plans: Alcon's acquisition could lead to changes in Village Roadshow's future film production plans, potentially focusing on projects aligned with Alcon's strategic objectives.

Impact on the Entertainment Industry

Market Consolidation and Competition

The Alcon-Village Roadshow acquisition contributes to ongoing market consolidation in the entertainment industry. This can lead to both positive and negative consequences.

- Increased market share for Alcon: The merger increases Alcon's market share and influence within the entertainment industry.

- Impact on competitors: Alcon's increased market power could put pressure on its competitors, potentially leading to further mergers or acquisitions in the sector.

- Potential for future acquisitions in the industry: This acquisition could spark a new wave of consolidation, with other major players looking to increase their market share through strategic mergers and acquisitions.

- Changes in industry dynamics: The acquisition will shift the industry dynamics, impacting competition, content creation, and distribution strategies.

Future Trends and Predictions

This acquisition reflects broader industry trends, indicating further consolidation and evolution within the entertainment sector.

- Predictions for future mergers and acquisitions: Expect continued consolidation, with smaller players merging or being acquired by larger entities to gain competitive advantage.

- The impact of streaming services: Streaming platforms continue to reshape the entertainment landscape, influencing content creation, distribution, and consumption patterns. This acquisition's impact within this evolving space remains to be seen.

- The changing landscape of the entertainment industry: The industry continues to evolve, driven by technological advancements, changing consumer preferences, and the rise of new business models.

Conclusion

The Alcon acquisition of Village Roadshow, finalized with a $417.5 million stalking horse bid and court approval, represents a landmark moment in the entertainment industry. This merger signifies a strategic shift for both companies, impacting their future operations, market positioning, and competitive landscape. The deal's implications for the broader industry are far-reaching, potentially catalyzing further consolidation and reshaping the future of film production and distribution.

Call to Action: Follow our coverage of the Alcon acquisition and stay tuned for updates on the Alcon-Village Roadshow deal as this significant merger unfolds. We'll continue to analyze the ongoing impact on the entertainment industry and provide insights into future trends.

Featured Posts

-

Video John Travolta Indulges In A Pulp Fiction Steak In Miami

Apr 24, 2025

Video John Travolta Indulges In A Pulp Fiction Steak In Miami

Apr 24, 2025 -

35 Unlimited Google Fis Latest Mobile Plan Explained

Apr 24, 2025

35 Unlimited Google Fis Latest Mobile Plan Explained

Apr 24, 2025 -

Potential Sale Of Utac Update On Chinese Buyout Firms Plans

Apr 24, 2025

Potential Sale Of Utac Update On Chinese Buyout Firms Plans

Apr 24, 2025 -

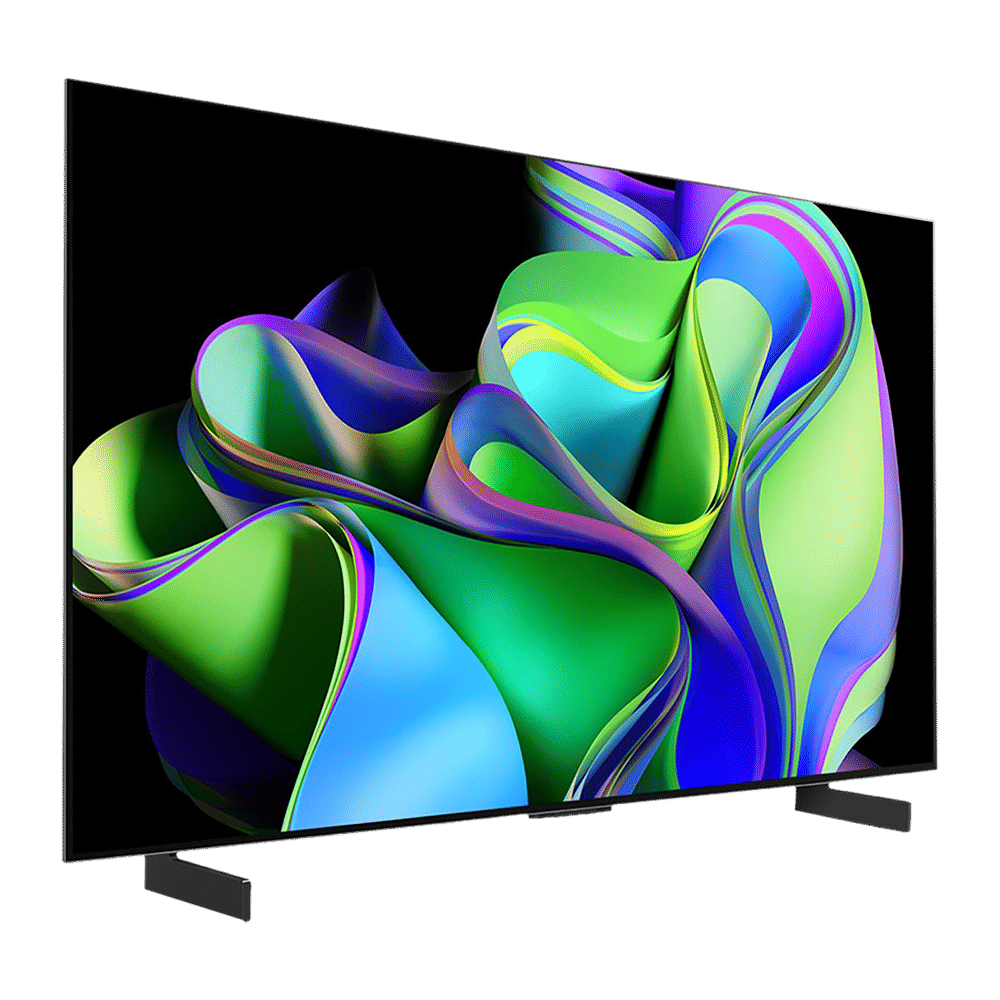

A Practical Review Of The Lg C3 77 Inch Oled Television

Apr 24, 2025

A Practical Review Of The Lg C3 77 Inch Oled Television

Apr 24, 2025 -

Trumps Immigration Policies Meet Stiff Legal Resistance

Apr 24, 2025

Trumps Immigration Policies Meet Stiff Legal Resistance

Apr 24, 2025