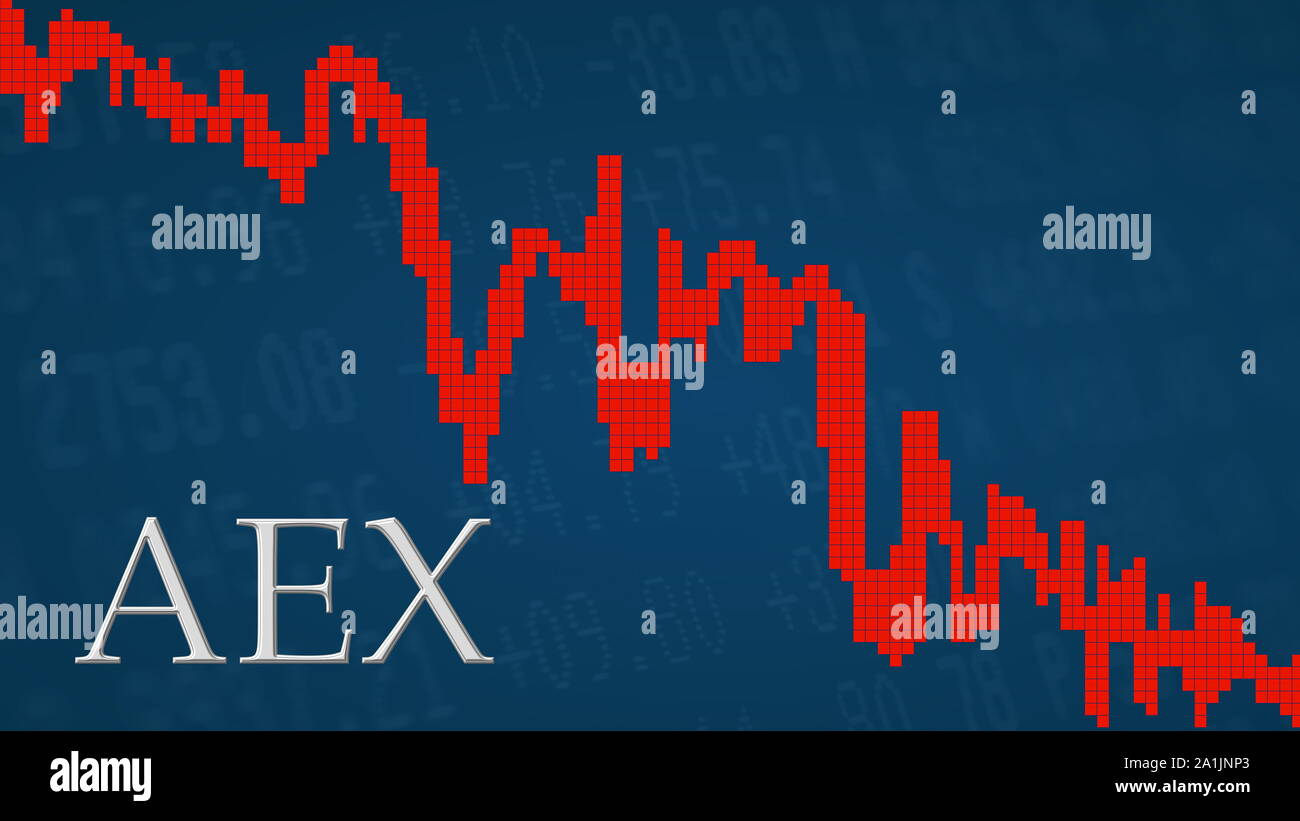

Amsterdam AEX Index Suffers Sharpest Fall In Over A Year

Table of Contents

Causes of the Amsterdam AEX Index Decline

Several interconnected factors contributed to the dramatic fall in the Amsterdam AEX Index. Understanding these causes is crucial for assessing the current market situation and predicting future trends.

Global Economic Uncertainty

The current global economic climate is characterized by significant uncertainty. Factors such as persistent inflation, aggressive interest rate hikes by central banks worldwide, and ongoing geopolitical instability have created a challenging environment for global markets, including the Amsterdam AEX Index. The weakening Euro further exacerbates the situation, impacting the competitiveness of Dutch exports and impacting the overall value of investments denominated in Euros.

- Weakening Euro: The Euro's decline against major currencies like the US dollar increases import costs and reduces the purchasing power of Dutch consumers.

- Global Recession Fears: Concerns about a potential global recession are weighing heavily on investor sentiment, leading to risk-averse behavior and sell-offs in equity markets.

- Energy Crisis Impact: The ongoing energy crisis in Europe, particularly impacting the Netherlands, adds to the economic headwinds and increases uncertainty for businesses and investors. High energy prices directly impact production costs and profitability for many companies listed on the AEX.

- Inflationary Pressures: Inflation rates remain stubbornly high in many countries, eroding consumer purchasing power and squeezing corporate profit margins. The European Central Bank's (ECB) interest rate hikes, aimed at curbing inflation, could further dampen economic growth and impact the AEX's performance. [Insert data point, e.g., "Eurozone inflation reached X% in [Month, Year], prompting the ECB to raise interest rates by Y%."]

Specific Sectoral Performance

The decline in the Amsterdam AEX Index wasn't uniform across all sectors. Some sectors were hit harder than others, reflecting specific vulnerabilities in the current market environment.

- Financials: The financial sector, including major banks like ING, experienced significant losses due to concerns about rising interest rates and potential loan defaults.

- Energy: While energy companies might benefit from high energy prices in the short term, the uncertainty surrounding future energy supplies and government regulations creates volatility.

- Technology: The tech sector, particularly companies reliant on semiconductor manufacturing like ASML, felt the impact of global supply chain disruptions and slowing global demand. [Insert data point showing percentage change for specific companies like ASML, Unilever, and ING.] [Include a chart or graph visually representing the sectoral performance.]

Investor Sentiment and Market Volatility

The sharp drop in the Amsterdam AEX Index is also a reflection of deteriorating investor sentiment and increased market volatility. Negative news cycles, fueled by global economic uncertainties and concerns about specific companies, triggered widespread sell-offs.

- Increased Market Volatility: Trading volumes surged, indicating heightened investor anxiety and frantic trading activity as investors reacted to negative news and sought to reduce their exposure to risk.

- Sell-offs: A significant sell-off in the AEX reflected a loss of confidence amongst investors.

- Impact of Negative News Cycles: Negative headlines surrounding geopolitical risks, inflationary pressures, and the energy crisis contributed to the overall pessimistic outlook and influenced investor decisions. [Insert data point on trading volume during the period.]

Consequences of the Amsterdam AEX Index Fall

The sharp decline in the Amsterdam AEX Index has significant consequences for both individual companies and the Dutch economy as a whole.

Impact on Dutch Companies

The fall in the AEX directly impacted the valuations of listed companies, leading to decreased share prices and impacting their ability to raise capital.

- Share Prices and Valuations: Companies saw their market capitalization plummet, affecting their access to financing and investment opportunities.

- Investment Plans: Many companies may be forced to postpone or cancel investment projects due to reduced access to capital.

- Potential Job Losses: Reduced profitability and investment could lead to job losses in some sectors. [Include examples of specific companies and their responses to the market downturn.]

Wider Economic Implications

The decline in the AEX reflects broader concerns about the Dutch economy. The decrease in investor confidence could negatively impact consumer spending, business investment, and overall GDP growth.

- Consumer Confidence: The market downturn could dampen consumer confidence, leading to reduced spending and slower economic growth.

- Investment: Decreased investor confidence can discourage both domestic and foreign investment, hindering economic expansion.

- Impact on Pension Funds: The fall in the AEX negatively impacts the value of pension portfolios invested in Dutch equities, potentially affecting future pension payouts. [Link the AEX performance to broader economic forecasts and predictions for GDP growth.]

Potential Future Outlook for the Amsterdam AEX Index

Predicting the future trajectory of the Amsterdam AEX Index is challenging, but analyzing analyst predictions and considering investor strategies provides some insights.

Analyst Predictions and Forecasts

Financial analysts offer diverse opinions on the AEX's future. Some predict a short-term rebound, while others foresee continued volatility or even further declines.

- Short-Term Projections: Some analysts anticipate a temporary recovery, driven by bargain hunting and positive economic news.

- Long-Term Projections: The long-term outlook depends heavily on the resolution of global economic uncertainties and the performance of key sectors within the Dutch economy. [Include quotes from reputable financial analysts, citing their sources.]

Strategies for Investors

Navigating the current market conditions requires careful consideration of risk and diversification.

- Diversification Strategies: Investors should diversify their portfolios across different asset classes to mitigate risk.

- Risk Management Techniques: Employing stop-loss orders and other risk management techniques can help limit potential losses.

- Long-Term vs. Short-Term Investment Approaches: Investors with a longer-term investment horizon may choose to ride out the market volatility, while short-term investors may adopt a more cautious approach.

Government and Regulatory Response

The Dutch government and regulatory bodies may implement measures to support the economy and stabilize the market.

- Fiscal Policies: Fiscal stimulus measures, such as tax cuts or increased government spending, could help boost economic activity.

- Monetary Policies: The ECB might adjust its monetary policy further to combat inflation and support economic growth. [Discuss potential support measures for businesses affected by the market downturn.]

Conclusion

The sharp decline in the Amsterdam AEX Index represents a significant event with far-reaching consequences for Dutch companies and the broader economy. Global economic uncertainty, specific sectoral vulnerabilities, and deteriorating investor sentiment all contributed to the dramatic fall. The consequences include decreased company valuations, reduced investment, and potential impacts on consumer confidence and GDP growth. While the future outlook remains uncertain, investors must adopt diversified strategies, employ risk management techniques, and stay informed about evolving economic conditions.

Key Takeaways: The Amsterdam AEX Index experienced its sharpest fall in over a year due to a combination of global and local factors. This event highlights the interconnectedness of global markets and the importance of monitoring economic indicators closely.

Call to Action: Stay updated on the latest developments impacting the Amsterdam AEX Index by regularly checking reputable financial news sources and monitoring key economic indicators. Understanding the dynamics of the Amsterdam AEX Index and its related markets is crucial for making sound investment decisions and navigating the complexities of the Dutch and European economies.

Featured Posts

-

Trumps Tariff Decision Euronext Amsterdam Stocks Experience 8 Growth

May 24, 2025

Trumps Tariff Decision Euronext Amsterdam Stocks Experience 8 Growth

May 24, 2025 -

Porsche Cayenne Ev 2026 Leaked Spy Shots And Speculation

May 24, 2025

Porsche Cayenne Ev 2026 Leaked Spy Shots And Speculation

May 24, 2025 -

Nasledie Nashego Pokoleniya Itogi I Perspektivy

May 24, 2025

Nasledie Nashego Pokoleniya Itogi I Perspektivy

May 24, 2025 -

Escape To The Country Balancing Rural Life With Modern Amenities

May 24, 2025

Escape To The Country Balancing Rural Life With Modern Amenities

May 24, 2025 -

Everything You Need To Know About Bbc Radio 1 Big Weekend Tickets

May 24, 2025

Everything You Need To Know About Bbc Radio 1 Big Weekend Tickets

May 24, 2025

Latest Posts

-

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025 -

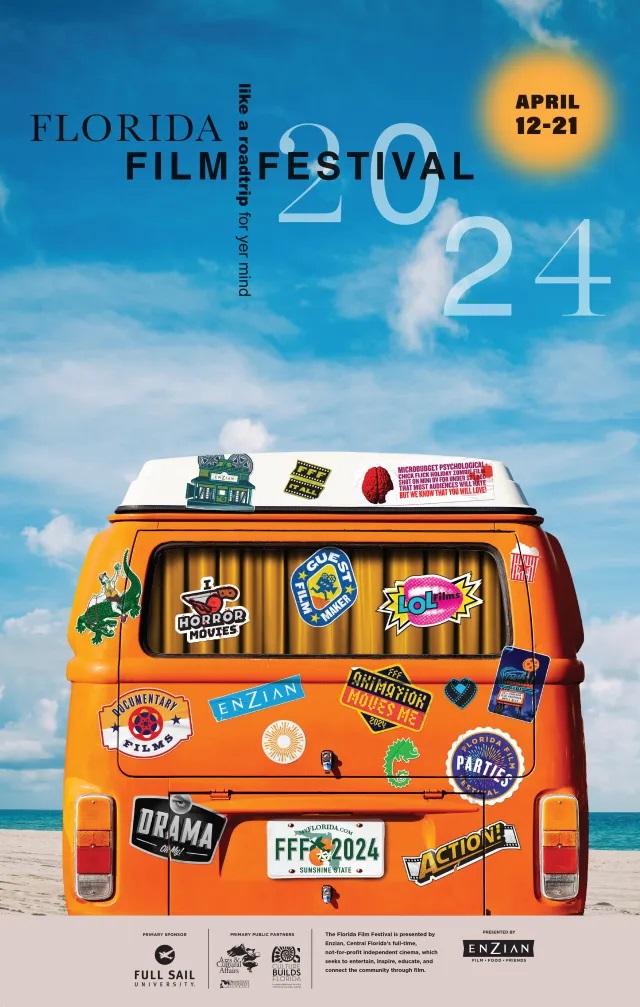

Florida Film Festival Past And Present Celebrity Appearances Featuring Mia Farrow And Christina Ricci

May 24, 2025

Florida Film Festival Past And Present Celebrity Appearances Featuring Mia Farrow And Christina Ricci

May 24, 2025 -

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025 -

Celebrities At The Florida Film Festival Mia Farrow Christina Ricci And More

May 24, 2025

Celebrities At The Florida Film Festival Mia Farrow Christina Ricci And More

May 24, 2025 -

The Farrow Warning Trump Congress And The 3 4 Month Countdown For American Democracy

May 24, 2025

The Farrow Warning Trump Congress And The 3 4 Month Countdown For American Democracy

May 24, 2025